Latest News

Industrial conglomerate Honeywell (NASDAQ:HON) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 6.4% year on year to $9.76 billion. The company’s full-year revenue guidance of $39.3 billion at the midpoint came in 0.8% below analysts’ estimates. Its non-GAAP profit of $2.59 per share was 2.1% above analysts’ consensus estimates.

Via StockStory · January 29, 2026

While Huntington Bancshares has trailed the broader market over the past year, analysts are very upbeat about its future trajectory.

Via Barchart.com · January 29, 2026

Life sciences company Thermo Fisher (NYSE:TMO) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 7.2% year on year to $12.22 billion. Its non-GAAP profit of $6.57 per share was 1.9% above analysts’ consensus estimates.

Via StockStory · January 29, 2026

Why Is CNEY Stock Rising Today?stocktwits.com

Via Stocktwits · January 29, 2026

Palantir Technologies Inc-A (NASDAQ:PLTR) Passes Strict "Little Book" Growth Stock Filterchartmill.com

Via Chartmill · January 29, 2026

Tesla’s Robotaxi Rival Waymo Faces Fresh NHTSA Probe Following Pedestrian Incident Near Schoolstocktwits.com

Via Stocktwits · January 29, 2026

META Platforms (NASDAQ:META) Passes Key Peter Lynch Investment Filterschartmill.com

Via Chartmill · January 29, 2026

Halozyme Therapeutics Inc (NASDAQ:HALO) Presents a Compelling Growth and Technical Setupchartmill.com

Via Chartmill · January 29, 2026

Realty Income has underperformed the broader market over the past year and analysts are cautious about its future stock performance.

Via Barchart.com · January 29, 2026

Although Devon Energy has underperformed the S&P 500 Index over the past year, analysts remain cautiously optimistic about its long-term prospects.

Via Barchart.com · January 29, 2026

Enpro Industries provides engineered components and materials for critical applications in global industrial and technology sectors.

Via The Motley Fool · January 29, 2026

A Tiny Float, Volatile Swings: Why Virtuix Is On Traders’ Radarstocktwits.com

Via Stocktwits · January 29, 2026

GENMAB A/S (NASDAQ:GMAB) Stands Out as a Peter Lynch-Style GARP Investmentchartmill.com

Via Chartmill · January 29, 2026

CBRE Group Inc. (NYSE:CBRE) Presents a Compelling Growth and Technical Breakout Casechartmill.com

Via Chartmill · January 29, 2026

JOBY Stock Is Falling Pre-Market — What Is Dragging The Electric Air Taxi Developer's Shares Down?stocktwits.com

Via Stocktwits · January 29, 2026

It has tons of opportunity and a solid, reliable business.

Via The Motley Fool · January 29, 2026

It might be worth buying these companies before the market notices they are undervalued.

Via The Motley Fool · January 29, 2026

Delta Air Lines has struggled to keep pace with the broader market over the past year, but analysts are highly upbeat about its future prospects.

Via Barchart.com · January 29, 2026

Caterpillar reported record Q4 revenue of $19.1 billion and adjusted earnings of $5.16 per share, beating market expectations.

Via Talk Markets · January 29, 2026

YETI HOLDINGS INC (NYSE:YETI) Stands Out as a Quality Investment with High ROIC and Strong Cash Flowchartmill.com

Via Chartmill · January 29, 2026

Via Benzinga · January 29, 2026

The commodities market continues to sizzle, with gold, silver, and copper hitting new highs as the weakening US dollar and rising geopolitical tensions drive investors toward tangible assets for protection.

Via Talk Markets · January 29, 2026

Last year's weakness is ultimately an improved entry opportunity for long-term-minded investors.

Via The Motley Fool · January 29, 2026

Overnight through early Thursday morning saw the Gold market extend its historic run.

Via Barchart.com · January 29, 2026

The market may not yet appreciate how big PayPal's new partnership could be.

Via The Motley Fool · January 29, 2026

McKesson Corp (NYSE:MCK) Fits the 'Affordable Growth' Investment Profilechartmill.com

Via Chartmill · January 29, 2026

Kiniksa Pharmaceuticals (NASDAQ:KNSA) Combines High Growth Momentum with Strong Technical Setupchartmill.com

Via Chartmill · January 29, 2026

EUR/USD treads water near 1.2000 after bouncing up from the 1.1900 area.

Via Talk Markets · January 29, 2026

Investors are dreaming of crypto riches, but are they missing something essential about XRP?

Via The Motley Fool · January 29, 2026

SoundHound AI is growing rapidly, but its stock continues to send investors on a roller-coaster ride.

Via The Motley Fool · January 29, 2026

The S&P 500 has spent the bulk of January, perhaps doing so in order to work off some of the excess that the markets have seen for the last several months.

Via Talk Markets · January 29, 2026

Crude oil price edged higher on Wednesday as weather disruptions and a weaker US dollar bolster the asset.

Via Talk Markets · January 29, 2026

Artificial intelligence (AI) software upgrades and the highly anticipated launch of the iPhone 18 are top of mind for Apple investors in 2026.

Via The Motley Fool · January 29, 2026

The U.S. Food and Drug Administration cleared its Investigational New Drug application for SER-252, a therapy to treat patients with Parkinson’s disease.

Via Stocktwits · January 29, 2026

The Trump administration has reportedly decided to abandon its plans to guarantee a minimum price for U.S. critical minerals projects amid a possible lack of congressional funding and potential market pricing complexities.

Via Benzinga · January 29, 2026

Chinese automaker Li Auto Inc. has shifted its strategy with head of self-driving now leading robotics efforts.

Via Benzinga · January 29, 2026

Palantir stock has delivered a quadruple-digit gain since its IPO.

Via The Motley Fool · January 29, 2026

Elon Musk and Vinod Khosla exchanged heated remarks on the social media platform X, with the billionaire venture capitalist accusing the Tesla Inc (NASDAQ: TSLA) CEO of promoting racism.

Via Benzinga · January 29, 2026

Major cryptocurrencies traded lower ahead of the U.S. Senate Agriculture Committee’s markup of the CLARITY Act in Washington.

Via Stocktwits · January 29, 2026

Taylor predicts AI agents will replace traditional software, despite challenges in maintaining code. Vibe coding gaining popularity.

Via Benzinga · January 29, 2026

This stock is also fast-growing, but it's less susceptible to market volatility.

Via The Motley Fool · January 29, 2026

Joby Aviation stock tanked after finalizing pricing of $1.2B in concurrent public offerings, including convertible notes and common stock.

Via Benzinga · January 29, 2026

Meta Platforms will significantly increase capital expenditures in 2026.

Via The Motley Fool · January 29, 2026

U.S. stock futures rose on Thursday following Wednesday’s mixed close. Futures of major benchmark indices were higher.

Via Benzinga · January 29, 2026

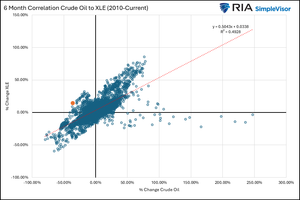

Over the last year, energy stocks have traded well despite crude oil prices languishing.

Via Talk Markets · January 29, 2026

Former hedge fund manager Jim Cramer says shares of Amazon and Uber can go even higher.

Via The Motley Fool · January 29, 2026

You're working hard for your extra money. Now make your extra money work hard for you.

Via The Motley Fool · January 29, 2026