Latest News

Sea Limited's business has been firing on all cylinders, and there are no signs this will change.

Via The Motley Fool · January 29, 2026

Cullen Frost (CFR) Q4 2025 Earnings Transcript

Via The Motley Fool · January 29, 2026

Critical Metals stocks slides after reports that the Trump administration to drop guarantee of a price for U.S. critical mining projects

Via Benzinga · January 29, 2026

Nextpower is using its core competencies to expand its reach in the solar power market.

Via The Motley Fool · January 29, 2026

Via Benzinga · January 29, 2026

Southwest’s transition reflects a broader recalibration of its business model, as the airline seeks to move beyond its traditional no-frills approach.

Via Talk Markets · January 29, 2026

After explosive gains, leveraged rare-earth ETFs are sliding—highlighting the risks of trading geopolitics with leverage.

Via Benzinga · January 29, 2026

Nvidia will have a great 2026, but you can't go all-in on the stock.

Via The Motley Fool · January 29, 2026

March WTI crude oil (CLH26 ) on Thursday closed up +2.21 (+3.50%), and March RBOB gasoline (RBH26 ) closed up +0.0312 (+1.64%). Crude oil and gasoline prices added to this week's sharp gains on Thursday, with crude oil climbing to a 4.25-month high a...

Via Barchart.com · January 29, 2026

Blackstone Secured Lending Fund focuses on senior secured loans for private U.S. small and middle market companies.

Via The Motley Fool · January 29, 2026

March Nymex natural gas (NGH26 ) on Thursday closed up by +0.186 (+4.98%). March nat-gas prices on Thursday settled higher, but remained below Wednesday's 3-year high due to a larger-than-expected decline in weekly gas storage. The EIA reported on T...

Via Barchart.com · January 29, 2026

Bitcoin has plummeted below $84,000 as risk-off sentiment pauses the commodities rally.

Via Benzinga · January 29, 2026

AI stocks are facing stricter rules this year. That could be good for investors.

Via The Motley Fool · January 29, 2026

Via Benzinga · January 29, 2026

Via Benzinga · January 29, 2026

MSTR stock hits a 52-week low as Bitcoin drops below $84K, dragging down Strategy’s value amid broader market sell-off.

Via Talk Markets · January 29, 2026

With shares of this old-school glass pioneer soaring triple digits over the past year, can the AI-driven momentum push the stock even higher?

Via Barchart.com · January 29, 2026

Dover (DOV) Q4 2025 Earnings Call Transcript

Via The Motley Fool · January 29, 2026

Southside (SBSI) Q3 2024 Earnings Call Transcript

Via The Motley Fool · January 29, 2026

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

Tesla stock is sinking as the EV maker reported its first-ever annual revenue decline and boosted capex guidance. Here’s how you should play TSLA shares on its post-earnings decline.

Via Barchart.com · January 29, 2026

What's going on in today's session: S&P500 moverschartmill.com

Via Chartmill · January 29, 2026

Royal Caribbean had a great 2025, and its 2026 bookings are off to a record-setting pace.

Via The Motley Fool · January 29, 2026

Intel could be close to a major foundry win.

Via The Motley Fool · January 29, 2026

The cloud and database specialist got caught up in a broad AI sell-off.

Via The Motley Fool · January 29, 2026

The SaaS sector imploded today. Here's what you need to know.

Via The Motley Fool · January 29, 2026

Via Benzinga · January 29, 2026

Via Benzinga · January 29, 2026

Nvidia wins approval for a $105 million Taiwan headquarters as AI demand strengthens its partnership with TSMC, which is expanding overseas to meet global chip needs and manage geopolitical risks.

Via Benzinga · January 29, 2026

Via Benzinga · January 29, 2026

Via Benzinga · January 29, 2026

Via Benzinga · January 29, 2026

Palladium futures rose by 81.51% in 2025, settling at $1,651.40 per ounce on December 31, 2024. In late January, the price was substantially higher as the palladium rally continued.

Via Barchart.com · January 29, 2026

Ripple (CRYPTO: XRP) and Coinbase Global Inc.

Via Benzinga · January 29, 2026

Top movers in Thursday's sessionchartmill.com

Via Chartmill · January 29, 2026

Corn was higher on U.S. Dollar weakness. Trends are up due to the recent demand based rally and after production was increased in the annual report.

Via Talk Markets · January 29, 2026

While Trump's policies have added to EV firms' woes, legacy automakers like General Motors are making merry.

Via Barchart.com · January 29, 2026

Invesco BuyBack Achievers ETF tracks U.S. companies with robust share repurchase activity using a rules-based, diversified approach.

Via The Motley Fool · January 29, 2026

Gold and silver are teaching a hard lesson to a generation of investors raised on tech stocks, meme names and digital coins.

Via Benzinga · January 29, 2026

AMD’s EPYC processors are gaining traction in data centers, while its Instinct GPUs are benefiting from the accelerating AI demand.

Via Barchart.com · January 29, 2026

Demand for the memory maker's products is likely to remain strong for the foreseeable future.

Via The Motley Fool · January 29, 2026

Via MarketBeat · January 29, 2026

American Express could impact Berkshire Hathaway and several major ETFs with its Q4 earnings report Friday.

Via Benzinga · January 29, 2026

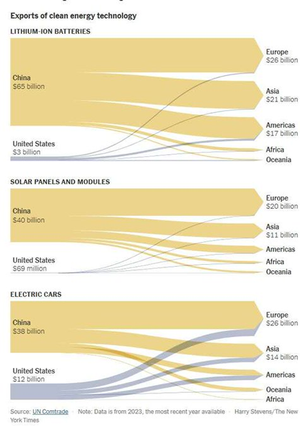

China has spent the past two decades building manufacturing capacity, subsidizing scale, automating factories, securing raw materials and investing heavily in research.

Via Talk Markets · January 29, 2026

According to a report from Reuters, the deal is backed by venture capital firms Matter Venture Partners, Kleiner Perkins, Spark Capital, Exor and GV, previously called Google Ventures.

Via Stocktwits · January 29, 2026

Southside Bancshares (SBSI) Earnings Transcript

Via The Motley Fool · January 29, 2026