Humana Inc. (HUM) is a major health-insurance and managed-care company that offers a broad range of medical and specialty insurance products across the United States. Headquartered in Louisville, Kentucky, Humana operates through two primary business segments: Insurance and CenterWell, providing services such as Medicare and Medicaid plans, supplemental benefit plans, pharmacy benefit management, senior-centered primary-care services, home health, hospice, and more. The market cap of Humana is around $30.9 billion.

Companies valued at $10 billion or more are generally tagged as “large-cap” stocks, and Humana fits this criterion perfectly as the company distinguishes itself as one of the largest health insurance providers. It is particularly strong in the Medicare Advantage market and has a significant national footprint.

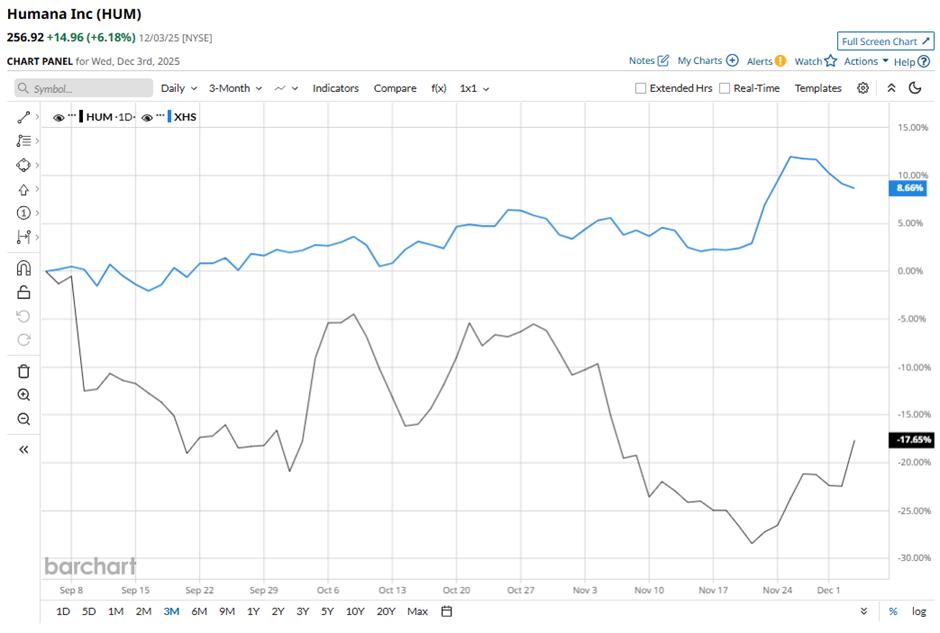

However, HUM is trading 18.5% below its 52-week high of $315.35, which it hit on Sept. 5. The stock has declined 17.7% over the past three months, lagging behind the broader SPDR S&P Health Care Services ETF (XHS), which has gained 9.1% over the same period.

In the longer term, HUM is up 1.3% on a YTD basis, significantly lagging behind XHS’s 19.7% gains. The stock has declined 11.8% over the past 52 weeks, considerably underperforming XHS’s 11.2% returns over the same time frame.

To confirm the bearish price trend, HUM has largely traded below the 200-day moving average over the past year, except for some periods of trading above the line in recent months. The stock is trading well below the 50-day and 200-day moving averages since the beginning of last month.

HUM has demonstrated a weak performance primarily due to ongoing challenges in its Medicare Advantage business. The most significant factor was a substantial downgrade in the quality ratings (Star Ratings) for several of its major MA plans. Additionally, the company has faced higher-than-anticipated medical costs (evident in a rising benefit ratio), which has pressured profit margins.

For Q3 2025 (reported on Nov. 5), while sales rose 11.1% year-over-year (YoY) to $32.7 billion, profits weakened as rising medical utilization pushed the adjusted benefit ratio up to 91.1%. Non-GAAP EPS fell 22.1% YoY to $3.24. Humana also continues to face Medicare Advantage pressures, with expected membership losses of 425K for the year. The company reaffirmed its 2025 benefit ratio and adjusted EPS guidance of $17, but its lowered GAAP EPS outlook to $12.26. The stock has plunged 6% on Nov. 5 and 5.2% on the following day.

Meanwhile, HUM has outpaced its rival Cigna Group’s (CI) 18.1% decline over the past 52 weeks and 2.1% drop on a YTD basis.

The stock has a consensus rating of “Moderate Buy” from the 27 analysts in coverage, and the mean price target of $283.67 suggests a premium of 10.4% to its current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart