U.S. Bancorp (USB)

51.57

+0.16 (0.31%)

NYSE · Last Trade: Dec 9th, 6:50 PM EST

Ether (ETH) has recently demonstrated significant strength, experiencing an impressive 8% surge on December 2, 2025, as part of a broader rally that saw the cryptocurrency climb from $2,860 to $3,680 within the first week of December. This explosive upward movement, which included a 10% rally over four

Via MarketMinute · December 9, 2025

Shares of blockchain infrastructure company Coinbase (NASDAQ:COIN) jumped 1.8% in the afternoon session after crypto linked stocks soared as sentiment in the crypto market improved, following MicroStrategy's disclosure that it purchased an additional 10,624 bitcoins for approximately $962.7 million.

Via StockStory · December 9, 2025

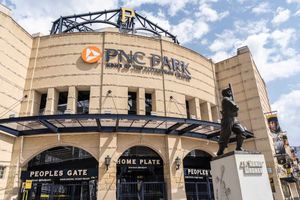

Pittsburgh, PA – December 9, 2025 – In a monumental leap bridging traditional finance with the burgeoning digital asset economy, PNC Bank (NYSE: PNC) has officially launched direct spot Bitcoin trading services for its eligible Private Bank® clients. This groundbreaking offering, powered by a strategic partnership with cryptocurrency exchange giant Coinbase (NASDAQ: COIN) and its [...]

Via BreakingCrypto · December 9, 2025

PNC Bank partnered with Coinbase to allow eligible Private Bank clients to trade Bitcoin through PNC’s platform.

Via Stocktwits · December 9, 2025

Citigroup has had a great run, which makes buying it a bit of a stretch right now.

Via The Motley Fool · December 8, 2025

Join us as we explore whether US Bancorp is a solid investment choice for the future. With a strong rating from our analysts, find out what makes this bank stand out in today's market.

Via The Motley Fool · December 4, 2025

SoFi announced a $1.5 billion stock offering and detailed plans to use the proceeds to bolster its capital position and support growth initiatives.

Via Stocktwits · December 4, 2025

The S&P 500 (^GSPC) is home to the biggest and most well-known companies in the market, making it a go-to index for investors seeking stability.

But not all large-cap stocks are created equal - some are struggling with slowing growth, declining margins, or increased competition.

Via StockStory · December 1, 2025

Investor sentiment seems to be turning away from quantum computing stocks.

Via The Motley Fool · December 1, 2025

Citigroup is a large and well-known bank, but is it worth buying while the stock is trading so close to its 52-week high?

Via The Motley Fool · December 1, 2025

While PNC Financial has lagged behind the S&P 500 Index over the past year, analysts are moderately optimistic about the stock’s prospects.

Via Barchart.com · December 1, 2025

Despite U.S. Bancorp's outperformance relative to its industry peers over the past year, Wall Street analysts maintain a cautiously optimistic outlook on the stock’s prospects.

Via Barchart.com · December 1, 2025

From high-yield pharma plays to growth-oriented compounders, these eight stocks offer something for every dividend investor.

Via The Motley Fool · November 28, 2025

U.S. Bancorp has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 13.1% to $48.90 per share while the index has gained 15.6%.

Via StockStory · November 27, 2025

Morgan Stanley, Citi and PNC will have to play catch up to popular fintech bank SoFi.

Via Talk Markets · November 25, 2025

Banks use their capital and expertise to help businesses grow while offering consumers essential financial products like mortgages and credit cards. Still, investors are uneasy as banks face challenges from credit quality concerns and potential regulatory changes.

These doubts have certainly contributed to banking stocks’ recent underperformance - over the past six months, the industry’s 9.5% gain has fallen behind the S&P 500’s 13.1% rise.

Via StockStory · November 25, 2025

The stock fell 14.6% over the last week, logging the seventh consecutive week of declines.

Via Stocktwits · November 24, 2025

This diversified fintech still has plenty of upside potential.

Via The Motley Fool · November 22, 2025

A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official boosted hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to markets amid concerns over high valuations, particularly in AI-related stocks.

Via StockStory · November 21, 2025

Thrivent converts two mutual funds into small- and mid-cap value ETFs, offering active stock picking in a more tax-efficient structure.

Via Benzinga · November 20, 2025

North Dakota's vital rural economy finds itself in a precarious position as of November 2025, grappling with a "perfect storm" of interconnected challenges: extreme commodity volatility, persistent export hurdles, and a perplexing farmland paradox. This confluence of factors is creating a complex landscape for farmers and energy producers alike, threatening

Via MarketMinute · November 20, 2025

The company has been making strides in real-world use cases.

Via The Motley Fool · November 18, 2025

A major U.S. bank is demonstrating that quantum computing has practical applications.

Via The Motley Fool · November 17, 2025

Andreas Halvorsen of Viking Global Investors' portfolio Q3 changes included exits from Amazon, Nvidia and Qualcomm.

Via Benzinga · November 17, 2025

Citigroup has had a strong performance during the past year, but that has significantly altered the value proposition for investors.

Via The Motley Fool · November 17, 2025