STMicroelectronics N.V. Common Stock (STM)

29.36

+0.76 (2.66%)

NYSE · Last Trade: Jan 27th, 6:14 PM EST

Detailed Quote

| Previous Close | 28.60 |

|---|---|

| Open | 28.73 |

| Bid | 30.00 |

| Ask | 30.57 |

| Day's Range | 28.72 - 29.51 |

| 52 Week Range | 17.25 - 33.47 |

| Volume | 6,581,618 |

| Market Cap | 26.54B |

| PE Ratio (TTM) | 17.69 |

| EPS (TTM) | 1.7 |

| Dividend & Yield | 0.3600 (1.23%) |

| 1 Month Average Volume | 5,825,566 |

Chart

About STMicroelectronics N.V. Common Stock (STM)

STMicroelectronics is a global semiconductor company that designs and manufactures a wide range of integrated circuits and components for various applications across multiple industries. The company focuses on innovation in areas such as automotive, industrial, personal electronics, and the Internet of Things (IoT). With a commitment to sustainability and advanced technology, STMicroelectronics develops solutions that enhance connectivity, efficiency, and performance in electronic devices. Their extensive product portfolio includes microcontrollers, sensors, power management devices, and RF components, catering to the evolving needs of customers worldwide. Read More

News & Press Releases

As we cross into late January 2026, the electric vehicle (EV) industry has reached a pivotal inflection point that blends advanced power electronics with artificial intelligence. A newly released assessment from IDTechEx, "Power Electronics for Electric Vehicles 2026–2036," confirms that the transition to 800V architectures, powered by Silicon Carbide (SiC) semiconductors, is no longer a [...]

Via TokenRing AI · January 27, 2026

As of late January 2026, the automotive landscape has reached a definitive turning point, moving away from the charging bottlenecks and range limitations of the early 2020s. The driving force behind this transformation is the rapid, global expansion of Silicon Carbide (SiC) semiconductors. These high-performance chips have officially supplanted traditional silicon as the backbone of [...]

Via TokenRing AI · January 27, 2026

The global semiconductor landscape is witnessing a seismic shift as 2026 marks the definitive "Wide-Bandgap (WBG) Era." Driven by the insatiable power demands of AI data centers and the wholesale transition of the automotive industry toward high-voltage architectures, the market for Silicon Carbide (SiC) and Gallium Nitride (GaN) discrete devices is projected to exceed $5.3 [...]

Via TokenRing AI · January 26, 2026

As of January 23, 2026, the automotive industry has reached a pivotal tipping point in its electrification journey, driven by the explosive rise of wide-bandgap (WBG) materials. Silicon Carbide (SiC) and Gallium Nitride (GaN) have transitioned from high-end specialized components to the essential backbone of modern power electronics. This shift is not just a hardware [...]

Via TokenRing AI · January 23, 2026

In a move that signals the transition of neuromorphic computing from experimental laboratories to the global mass market, Dutch semiconductor pioneer Innatera has announced a landmark partnership with VLSI Expert to deploy its 'Pulsar' chips for engineering education. The collaboration, unveiled in early 2026, aims to equip the next generation of chip designers in India [...]

Via TokenRing AI · January 23, 2026

As of January 2026, the automotive industry has reached a decisive turning point in the electrification race. The shift toward 800-volt (800V) architectures is no longer a luxury hallmark of high-end sports cars but has become the benchmark for the next generation of mass-market electric vehicles (EVs). At the center of this tectonic shift is [...]

Via TokenRing AI · January 22, 2026

The global technology landscape is currently undergoing its most significant hardware transformation since the invention of the silicon transistor. As of January 21, 2026, the transition from traditional silicon to Wide-Bandgap (WBG) semiconductors—specifically Gallium Nitride (GaN) and Silicon Carbide (SiC)—has reached a fever pitch. This "Power Revolution" is no longer a niche upgrade; it has [...]

Via TokenRing AI · January 21, 2026

In a landmark achievement for the semiconductor industry, Wolfspeed (NYSE: WOLF) announced in January 2026 the successful production of the world’s first 300mm (12-inch) single-crystal Silicon Carbide (SiC) wafer. This breakthrough marks a definitive shift in the physics of power delivery, offering a massive leap in surface area and efficiency that was previously thought to [...]

Via TokenRing AI · January 21, 2026

As of January 19, 2026, the global semiconductor landscape is witnessing a dramatic divergence in the fortunes of the two pillars of power electronics: Silicon Carbide (SiC) and Gallium Nitride (GaN). While the SiC sector is currently weathering a painful correction cycle defined by upstream overcapacity and aggressive price wars, GaN has emerged as the [...]

Via TokenRing AI · January 19, 2026

The global transition to sustainable energy has reached a pivotal tipping point this week as the foundational hardware of the electric vehicle (EV) industry undergoes its most significant transformation in decades. On January 14, 2026, Mitsubishi Electric (OTC: MIELY) announced it would begin shipping samples of its newest trench Silicon Carbide (SiC) MOSFET bare dies [...]

Via TokenRing AI · January 19, 2026

By [Financial News Desk] Date: January 16, 2026 Introduction As the semiconductor industry emerges from the "inventory digestion" phase that defined much of 2024 and early 2025, Analog Devices, Inc. (NASDAQ: ADI) has reclaimed its position as a bellwether for the high-performance analog market. Known for its mastery of translating real-world phenomena—temperature, pressure, and sound—into [...]

Via Finterra · January 16, 2026

In a move that signals a paradigm shift for high-density computing and sustainable transport, Mitsubishi Electric Corp (TYO: 6503) has announced a major breakthrough in Wide-Bandgap (WBG) power semiconductors. On January 14, 2026, the company revealed it would begin sample shipments of its next-generation trench Silicon Carbide (SiC) MOSFET bare dies on January 21. These [...]

Via TokenRing AI · January 16, 2026

As of January 2026, the global transition to electric vehicles (EVs) has reached a pivotal milestone, driven not just by battery chemistry, but by a revolution in power electronics. The widespread adoption of Silicon Carbide (SiC) has officially ended the era of traditional silicon-based power systems in high-performance and mid-market vehicles. This shift, underpinned by [...]

Via TokenRing AI · January 13, 2026

The explosive growth of generative AI has brought the tech industry to a physical and environmental crossroads. As data center power requirements balloon from the 40-kilowatt (kW) racks of the early 2020s to the staggering 120kW-plus architectures of 2026, traditional silicon-based power conversion has finally hit its "silicon ceiling." The heat generated by silicon’s resistance [...]

Via TokenRing AI · January 13, 2026

The electric vehicle (EV) industry has reached a historic turning point this January 2026, as the "Silicon Carbide (SiC) Revolution" finally moves from luxury experimentation to mass-market reality. While traditional silicon has long been the workhorse of the electronics world, its physical limitations in high-voltage environments have created a bottleneck for EV range and charging [...]

Via TokenRing AI · January 13, 2026

As of early 2026, the automotive industry has reached a pivotal tipping point in its pursuit of silicon sovereignty. For decades, the "brains" of the modern car were dominated by proprietary instruction set architectures (ISAs), primarily controlled by global giants. However, a massive structural shift is underway as major auto manufacturers and Tier-1 suppliers aggressively [...]

Via TokenRing AI · January 13, 2026

As of January 12, 2026, the global technology landscape has reached a critical "tipping point" where traditional silicon is no longer sufficient to meet the voracious energy demands of generative AI and the performance expectations of the mass-market electric vehicle (EV) industry. The transition to Wide-Bandgap (WBG) semiconductors—specifically Gallium Nitride (GaN) and Silicon Carbide (SiC)—has [...]

Via TokenRing AI · January 12, 2026

As of January 8, 2026, the global semiconductor landscape has undergone its most radical transformation since the invention of the integrated circuit. The ambitious "reshoring" initiatives launched in the wake of the 2022 supply chain crises have reached a critical tipping point. For the first time in decades, the world’s most advanced artificial intelligence processors [...]

Via TokenRing AI · January 8, 2026

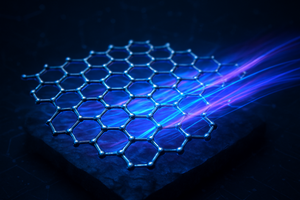

In a milestone that many physicists once deemed impossible, researchers at the Georgia Institute of Technology have successfully created the world’s first functional semiconductor made from graphene. Led by Walter de Heer, a Regents’ Professor of Physics, the team has overcome the "band gap" hurdle that has stalled graphene research for two decades. This development [...]

Via TokenRing AI · January 8, 2026

As of January 2026, the global semiconductor industry finds itself at a paradoxical crossroads. While the demand for high-performance silicon—fueled by an insatiable appetite for generative AI and autonomous systems—has the industry on a clear trajectory to reach $1 trillion in annual revenue by 2030, a critical resource is running dry: human expertise. The sector [...]

Via TokenRing AI · January 7, 2026

Date: January 7, 2026 Introduction In the high-stakes world of semiconductor manufacturing, resilience is often measured by how a company emerges from the industry’s inevitable cyclical downturns. Today, Microchip Technology (NasdaqGS: MCHP) stands at a pivotal crossroads, signaling a robust recovery following a challenging two-year inventory correction. With its recently raised Q3 2026 sales guidance, [...]

Via PredictStreet · January 7, 2026

STMicroelectronics announces timing for fourth quarter and full year 2025 earnings release and conference call

By STMicroelectronics International NV · Via GlobeNewswire · January 7, 2026

In a move that signals a tectonic shift in the semiconductor landscape, power electronics giant onsemi (NASDAQ: ON) and contract manufacturing leader GlobalFoundries (NASDAQ: GFS) have announced a strategic partnership to develop and mass-produce 650V Gallium Nitride (GaN) power devices. Announced in late December 2025, this collaboration is designed to tackle the two most pressing [...]

Via TokenRing AI · January 7, 2026

As of January 6, 2026, the semiconductor industry has officially entered the "Wide-Bandgap (WBG) Era." For decades, traditional silicon was the undisputed king of power electronics, but the dual pressures of the global electric vehicle (EV) transition and the insatiable power hunger of generative AI have pushed silicon to its physical limits. In its place, [...]

Via TokenRing AI · January 6, 2026

As of December 26, 2025, Texas Instruments Incorporated (NASDAQ: TXN) stands at a pivotal crossroads in the semiconductor industry. Long regarded as the "blue chip" of the analog world, the company has spent the last three years executing a massive, capital-intensive pivot toward domestic manufacturing and 300mm wafer supremacy. While the broader semiconductor market has [...]

Via PredictStreet · December 26, 2025