Viper Energy, Inc. - Class A Common Stock (VNOM)

45.49

+0.00 (0.00%)

NASDAQ · Last Trade: Feb 25th, 8:41 AM EST

Viper Energy Inc-CL A (NASDAQ:VNOM) Reports In-Line Q4 2025 Results, Highlights Shareholder Returnschartmill.com

Via Chartmill · February 23, 2026

As of February 23, 2026, the energy sector’s eyes are fixed on Midland, Texas. Diamondback Energy (NASDAQ: FANG), the undisputed heavyweight champion of Permian Basin independent producers, has just released its fourth-quarter 2025 earnings. In a market defined by fluctuating crude prices and a fierce industry-wide mandate for capital discipline, Diamondback stands as a case [...]

Via Finterra · February 23, 2026

As of February 17, 2026, Texas Pacific Land Corporation (NYSE: TPL) stands as one of the most unique and profitable entities in the American energy landscape. Often described as a "land bank" or a "perpetual royalty machine," TPL has recently captured the market's attention with a significant 5.08% stock gain on February 13, 2026. This [...]

Via Finterra · February 17, 2026

Date: December 29, 2025Sector: Energy / Land & RoyaltyExchange: NYSE: TPL Introduction As of late 2025, Texas Pacific Land Corporation (NYSE: TPL) stands as one of the most unique and profitable entities in the American equity markets. Often referred to as the "Landlord of the Permian," TPL owns approximately 882,000 surface acres and 207,000 net [...]

Via PredictStreet · December 29, 2025

As of January 7, 2026, the landscape of the American energy royalty sector has been fundamentally reshaped. Following the blockbuster $4.1 billion acquisition of Sitio Royalties by Viper Energy (NASDAQ: VNOM), the combined entity has moved aggressively to streamline its portfolio, most recently punctuated by the January 6 announcement

Via MarketMinute · January 7, 2026

Shares of Viper Energy were on a tear through late last year, but the story has since soured for the stock.

Via The Motley Fool · December 29, 2025

The fund made a big cut to its Kinetik stake -- but it still didn't fully exit the position.

Via The Motley Fool · December 25, 2025

When a fund that lives and breathes energy exposure heads for the exits, it’s worth asking whether this is discipline at work or a warning flare investors shouldn’t ignore.

Via The Motley Fool · December 25, 2025

As the calendar turns toward 2026, the Exploration and Production (E&P) sector finds itself at a critical crossroads. On December 19, 2025, West Texas Intermediate (WTI) crude is trading near four-year lows, hovering between $55.70 and $56.40 per barrel. This slump, driven by a combination of robust

Via MarketMinute · December 19, 2025

Guardian Wealth bought over 133,000 shares of Viper Energy during the third quarter of 2025.

Via The Motley Fool · December 10, 2025

Via Benzinga · November 18, 2025

Oaktree Buys $145 Million in TDS Stock Amid Wireless Exit and Turnaround Strategy

Via The Motley Fool · November 14, 2025

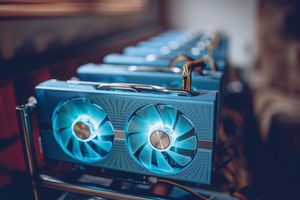

Oaktree’s New $115 Million Core Scientific Bet Tested as Stock Plunges Amid Merger Turmoil

Via The Motley Fool · November 14, 2025

What to Know About Oaktree's New $240 Million Viper Energy Stake Following Sitio Merger

Via The Motley Fool · November 14, 2025

Via Benzinga · November 10, 2025

Via Benzinga · October 7, 2025

The company wasn't quite a gusher, as investors reevaluated its prospects after an analyst's move.

Via The Motley Fool · September 3, 2025

Viper Energy (VNOM) shows strong revenue growth, high profitability, and a technical breakout setup, making it a compelling high-growth stock pick.

Via Chartmill · August 15, 2025

Viper Energy (VNOM) beats Q2 2025 earnings & revenue estimates with $297M sales and $0.41 EPS, driven by strong Permian Basin royalty interests. Stock remains flat post-release.

Via Chartmill · August 4, 2025