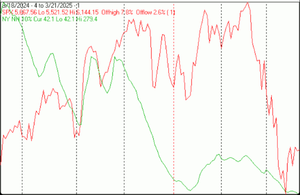

iShares 1-3 Year Treasury Bond ETF (SHY)

82.75

+0.03 (0.04%)

NASDAQ · Last Trade: Apr 20th, 12:57 PM EDT

Detailed Quote

| Previous Close | 82.72 |

|---|---|

| Open | 82.75 |

| Day's Range | 82.71 - 82.79 |

| 52 Week Range | 80.91 - 83.30 |

| Volume | 3,384,181 |

| Market Cap | - |

| Dividend & Yield | 3.276 (3.96%) |

| 1 Month Average Volume | 6,707,617 |

Chart

News & Press Releases

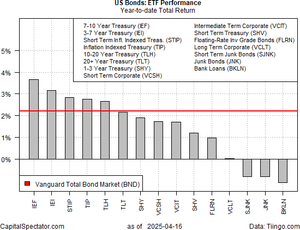

Rising US bond prices have offset the slide in US equities so far this year, but the outlook for fixed income may be more precarious than the current rear-window perspective suggests.

Via Talk Markets · April 17, 2025

The risks shot higher after the US imposed higher tariffs on its major trading partners today, led by 104% import taxes on Chinese goods.

Via Talk Markets · April 9, 2025

JPMorgan's Jasn Hunter warns S&P 500's drop below 5500 triggered recession risks.

Via Benzinga · April 7, 2025

The tariffs may still have much longer to play out.

Via Talk Markets · April 5, 2025

The central bank’s job is never easier, but in the current climate, it’s unusually tricky.

Via Talk Markets · February 25, 2025

CAD is being led lower by falling yield spreads.

Via Talk Markets · December 30, 2024

Via Talk Markets · December 19, 2024

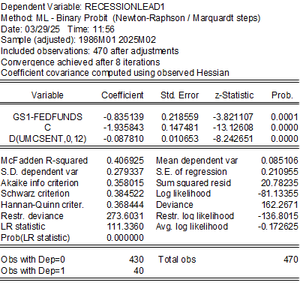

Looking at the determinants makes one understand why the estimated recession likelihood is high. That said, aside from consumption, there’s been little sign of a recession in contemporaneous, hard-data indicators.

Via Talk Markets · March 30, 2025

Many economists consider the un-inverting of the yield curve a bad sign for the economy.

Via Talk Markets · March 22, 2025

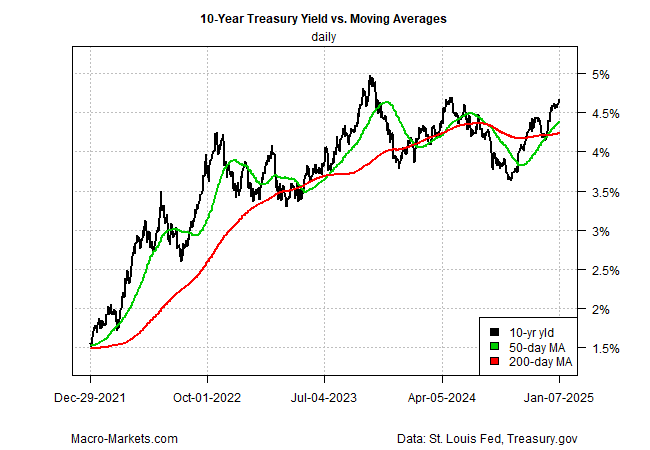

The surge in macro uncertainty related to tariffs, including the possibility of a global trade war, has complicated the Fed’s already difficult task of setting interest rates to accommodate an unknown future.

Via Talk Markets · March 19, 2025

The US stock market fell on Thursday, Mar. 13, closing 10.1% below its previous peak, a decline that many analysts define as a “correction,” which is a slide ranging from 10% to 20%.

Via Talk Markets · March 14, 2025

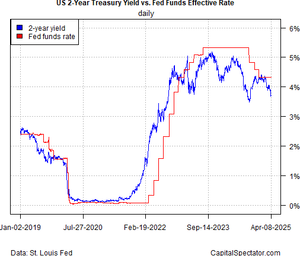

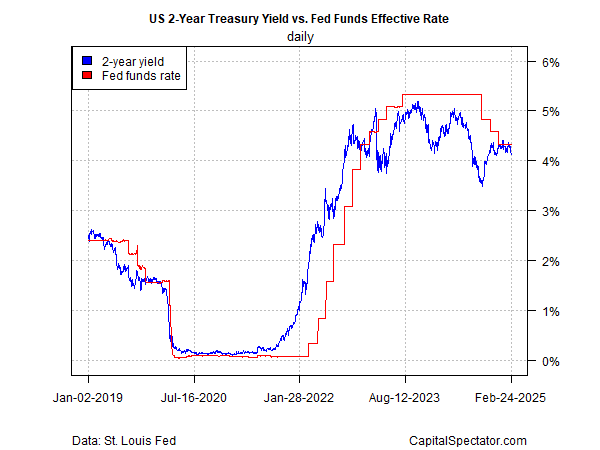

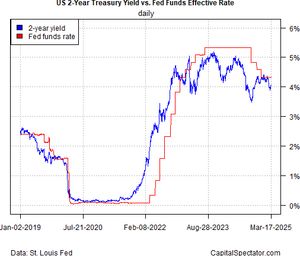

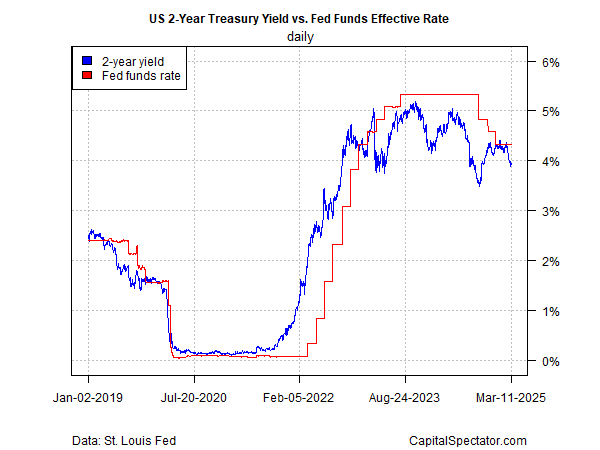

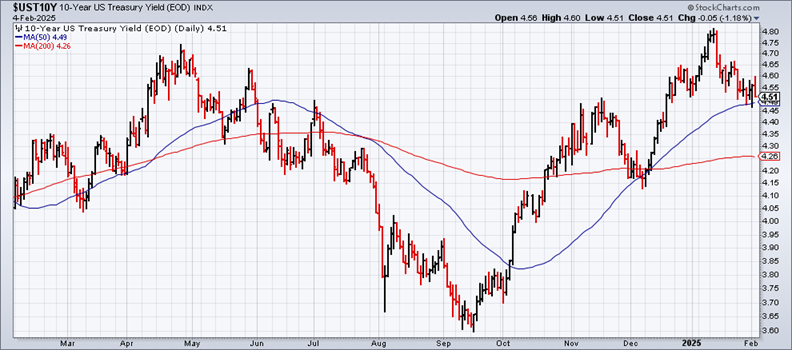

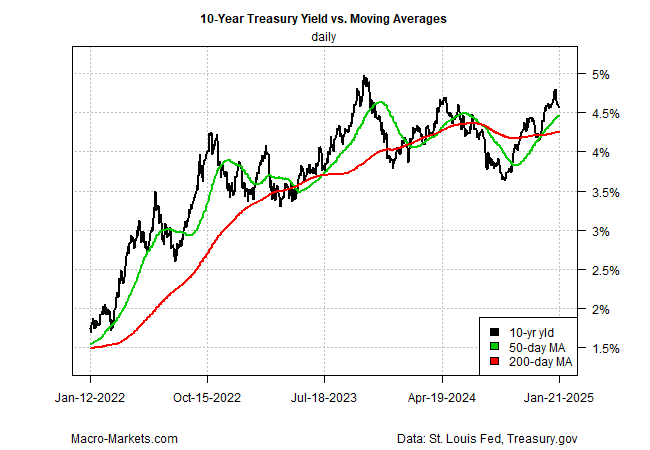

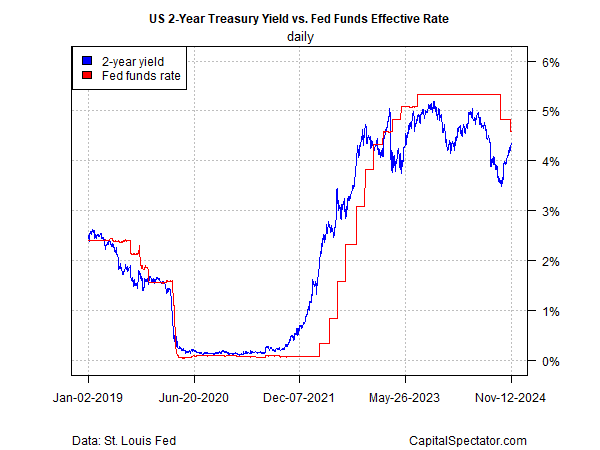

The Federal Reserve may continue to be patient before deciding on the next change in monetary policy, but the Treasury market isn’t waiting and has been rapidly adjusting to changing expectations for the economy.

Via Talk Markets · March 12, 2025

Via Talk Markets · March 2, 2025

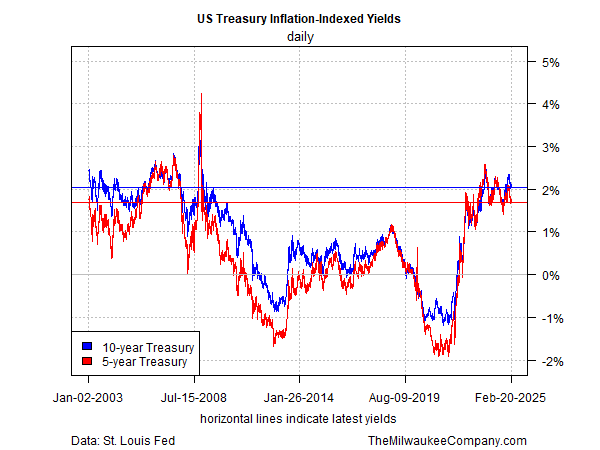

At a time of increased uncertainty about inflation, the relatively elevated real yields available in inflation-indexed Treasuries offer a partial antidote of certainty for anxious investors.

Via Talk Markets · February 21, 2025

Stocks rallied during the week as earnings reports were pretty good, with exceptions as always, and the economic news wasn’t bad either.

Via Talk Markets · February 10, 2025

Since returning to the White House last month, President Trump has outlined a wave of policy changes, plans and comments that have roiled markets and shaken expectations about the economic outlook.

Via Talk Markets · February 6, 2025

President Trump’s comments and executive orders have roiled markets and investor expectations, but from the vantage of the Treasury market a relative calm prevails.

Via Talk Markets · February 5, 2025

President Trump’s first week on the job was a good one for markets. The S&P 500 was up 1.75%, with tech stocks taking the lead as the President welcomed a group of leading technology CEOs to D.C. to announce big investments in AI.

Via Talk Markets · January 27, 2025

Treasury yields have taken a break from the sharp upswing that’s dominated trading in recent months.

Via Talk Markets · January 23, 2025

The spectre of U.S. debt ceiling debates sharpens investor focus, adding another layer of caution to Monday's international market activities while the U.S. markets are closed for the MLk holiday.

Via Talk Markets · January 20, 2025

The risk of reflation has been bubbling for several months and yesterday’s economic news on prices in the services sector fueled new concerns.

Via Talk Markets · January 8, 2025

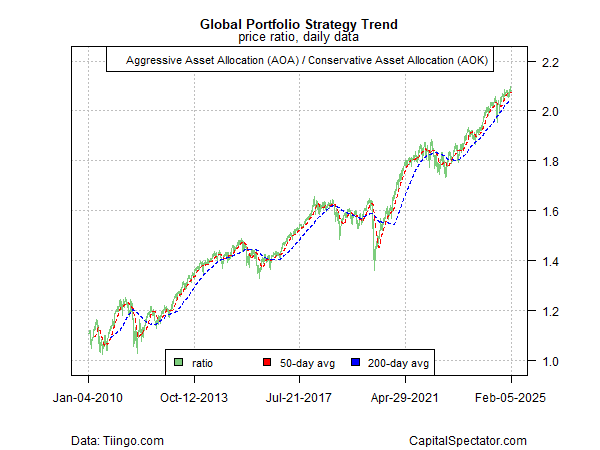

There are many reasons to question a bullish outlook at the start of the year, but the gravity-defying trend remains intact overall.

Via Talk Markets · January 6, 2025

This weekly Extreme Positions report highlights the Most Bullish and Most Bearish Positions for the speculator category. Extreme positioning in these markets can foreshadow strong moves in the underlying market.

Via Talk Markets · November 24, 2024

Fed funds futures are still leaning into expectations that the Federal Reserve will reduce its target rate next by a quarter point, but the related confidence of the forecast is slipping.

Via Talk Markets · November 13, 2024

The Fed is widely expected to cut the federal funds rate (FFR) by 25 basis points today. If we were on the Federal Open Market Committee (FOMC), we would strongly dissent in favor of a pause.

Via Talk Markets · November 13, 2024