PayPal Holdings, Inc. - Common Stock (PYPL)

46.38

+0.75 (1.64%)

NASDAQ · Last Trade: Mar 4th, 1:40 AM EST

Detailed Quote

| Previous Close | 45.63 |

|---|---|

| Open | 44.73 |

| Bid | 46.26 |

| Ask | 46.35 |

| Day's Range | 44.66 - 46.96 |

| 52 Week Range | 38.46 - 79.50 |

| Volume | 22,406,521 |

| Market Cap | 42.67B |

| PE Ratio (TTM) | 8.573 |

| EPS (TTM) | 5.4 |

| Dividend & Yield | 0.1400 (0.30%) |

| 1 Month Average Volume | 38,177,328 |

Chart

About PayPal Holdings, Inc. - Common Stock (PYPL)

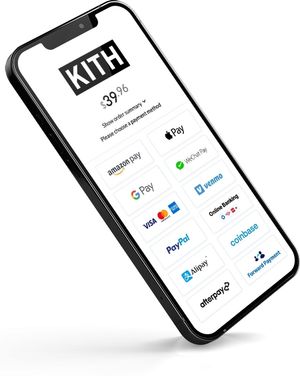

PayPal Holdings is a leading digital payments platform that enables individuals and businesses to make and receive payments electronically. The company provides a secure and convenient way to conduct transactions online and through mobile devices, allowing users to link their bank accounts, credit cards, and debit cards to their PayPal accounts. With a focus on enhancing the user experience, PayPal offers a range of services including online money transfers, payment processing for e-commerce, and digital wallet solutions, empowering users to manage their finances and engage in global commerce seamlessly. Read More

News & Press Releases

He also accused the banks of “trying to undercut” the GENIUS Act and coming in the way of the U.S. becoming “the crypto capital of the world.”

Via Stocktwits · March 3, 2026

PROOFCORE . PUBG: Battlegrounds is a very popular game today. It’s an online multiplayer battle royale that many adventure players love. The gameplay is familiar to those who love playing this type of game.

Via Get News · March 3, 2026

What Happened? Shares of enterprise workflow automation company ServiceNow (NYSE:NOW) jumped 4.2% in the afternoon session after investors appeared to buy th...

Via StockStory · March 3, 2026

What Happened? Shares of cloud security platform Zscaler (NASDAQ:ZS) jumped 4.7% in the afternoon session after investors appeared to buy the dip amid height...

Via StockStory · March 3, 2026

What Happened? Shares of global professional services company Accenture (NYSE:ACN) jumped 2% in the afternoon session after it agreed to acquire Ookla, a glo...

Via StockStory · March 3, 2026

What Happened? Shares of cybersecurity software provider Rapid7 (NASDAQ:RPD) jumped 7.6% in the afternoon session after the stock appeared to rebound followi...

Via StockStory · March 3, 2026

What Happened? Shares of genetic testing company Myriad Genetics (NASDAQ:MYGN) jumped 5.9% in the afternoon session after the company announced the launch of...

Via StockStory · March 3, 2026

NEW YORK, March 03, 2026 (GLOBE NEWSWIRE) --

By The Rosen Law Firm PA · Via GlobeNewswire · March 3, 2026

What Happened? Shares of IT distribution giant Ingram Micro (NYSE:INGM) jumped 16.3% in the afternoon session after the company reported decent fourth-quarte...

Via StockStory · March 3, 2026

What Happened? Shares of cruise ship company Carnival (NYSE:CCL) fell 4.2% in the afternoon session after rising geopolitical tensions in the Middle East spa...

Via StockStory · March 3, 2026

NEW YORK, March 03, 2026 (GLOBE NEWSWIRE) -- Pomerantz LLP announces that a class action lawsuit has been filed against PayPal Holdings, Inc. (“PayPal” or the “Company”) (NASDAQ: PYPL). Such investors are advised to contact Danielle Peyton at newaction@pomlaw.com or 646-581-9980, (or 888.4-POMLAW), toll-free, Ext. 7980. Those who inquire by e-mail are encouraged to include their mailing address, telephone number, and the number of shares purchased.

By Pomerantz LLP · Via GlobeNewswire · March 3, 2026

BERLIN, March 3, 2026 — At the ITB Berlin travel trade show today, Sabre Corporation (NASDAQ: SABR) officially pulled the curtain back on what analysts are calling a "once-in-a-generation" transformation. The company, long known as a pillar of the legacy Global Distribution System (GDS) industry, declared its multi-year migration to a

Via MarketMinute · March 3, 2026

In the rapidly evolving landscape of enterprise technology, few companies have commanded as much intrigue, controversy, and market enthusiasm as Palantir Technologies Inc. (NYSE: PLTR). Once dismissed as a "black box" government contractor shrouded in secrecy, Palantir has reinvented itself as the foundational operating system for the modern AI-driven enterprise. As of today, March 3, [...]

Via Finterra · March 3, 2026

LOS ANGELES, March 03, 2026 (GLOBE NEWSWIRE) -- The Schall Law Firm, a national shareholder rights litigation firm, reminds investors of a class action lawsuit against PayPal Holdings, Inc. (“PayPal” or “the Company”) (NASDAQ: PYPL) for violations of §§10(b) and 20(a) of the Securities Exchange Act of 1934 and Rule 10b-5 promulgated thereunder by the U.S. Securities and Exchange Commission.

By Schall Law · Via GlobeNewswire · March 3, 2026

NEW YORK, March 03, 2026 (GLOBE NEWSWIRE) -- Bernstein Liebhard LLP announces that a shareholder has filed a securities class action lawsuit on behalf of investors (the “Class”) who purchased or acquired the common stock of PayPal Holdings, Inc. (“PayPal” or the “Company”) (NASDAQ: PYPL) between February 25, 2025 and February 2, 2026, inclusive.

By Bernstein Liebhard LLP · Via GlobeNewswire · March 3, 2026

The CLARITY Act missed its March 1 deadline, with no updates on when the next round of talks are scheduled to happen or if another deadline has been put in place.

Via Stocktwits · March 3, 2026

Financial providers use their expertise in capital allocation and risk assessment to help facilitate economic growth while offering consumers and businesses essential financial services. But worries about economic uncertainty and potential market volatility have kept sentiment in check,

and over the past six months, the industry has tumbled by 7.1%. This drawdown is a noticeable divergence from the S&P 500’s 6.6% return.

Via StockStory · March 2, 2026

Over the past six months, Mattel’s shares (currently trading at $16.62) have posted a disappointing 8.8% loss, well below the S&P 500’s 6.6% gain. This was p...

Via StockStory · March 2, 2026

Don't underestimate the rebound potential of these bargain stocks.

Via The Motley Fool · March 2, 2026

Shares of edge cloud platform Fastly (NYSE:FSLY) jumped 7.4% in the afternoon session after RBC Capital raised its price target on the stock to $20 from $12 as investor meetings with management provided reassurance about the company's improving execution.

Via StockStory · March 2, 2026

The market is buzzing with rumors of companies interested in buying Paypal. We look into whether there's fire behind the smoke.

Via The Motley Fool · March 2, 2026

Why does the shortest month of the year sometimes feel like the longest?

Via The Motley Fool · March 2, 2026

Shares of PayPal Holdings, Inc. (NASDAQ: PYPL) surged by more than 10% in early trading on March 2, 2026, as the market reacted to a dual-threat of major corporate developments. The rally followed the official first day of Enrique Lores as the company’s new President and CEO, a transition

Via MarketMinute · March 2, 2026

New York - SensePass announced it has been named the Best Payment Orchestration Platform in 2026, recognizing its leadership in enterprise payment infrastructure and high-volume global commerce.

Via AB Newswire · March 2, 2026

PayPal Holdings has underperformed the Dow over the past year, and analysts remain cautious about the stock’s outlook.

Via Barchart.com · March 2, 2026