EQT Corp (EQT)

62.23

+0.27 (0.44%)

NYSE · Last Trade: Mar 10th, 2:45 AM EDT

The global private equity (PE) landscape has undergone a seismic shift in the first quarter of 2026, transitioning from a period of cautious stagnation to an era of aggressive, multi-billion dollar "megadeals." According to the latest industry data, dealmaker confidence has surged to a six-year high of 86%, signaling a

Via MarketMinute · March 9, 2026

The global energy landscape fractured in spectacular fashion during February 2026, revealing a stark divergence between domestic abundance and international instability. While U.S. natural gas prices plummeted by a staggering 52% over the month, settling near $2.82/MMBtu, the rest of the energy complex moved in the opposite

Via MarketMinute · March 4, 2026

Technical Next Rise Setup Identified for EQT CORP (NYSE:EQT)chartmill.com

Via Chartmill · February 27, 2026

EQT Corp (NYSE:EQT) Combines High Growth Momentum with Bullish Technical Setupchartmill.com

Via Chartmill · February 25, 2026

The global commodity market is currently navigating a period of intense volatility as a series of short-term supply shocks clash with a looming long-term surplus. According to the World Bank’s latest Commodity Markets Outlook, the start of 2026 has been defined by a sharp reversal of the downward trend

Via MarketMinute · March 2, 2026

EQT and Hitachi could be winners from this investment pledge.

Via The Motley Fool · March 1, 2026

Energy demand from data centers continues to grow, and these two companies are well positioned to capitalize.

Via The Motley Fool · February 27, 2026

EQT CORP (NYSE:EQT) Reports Q4 2025 Earnings Beat on EPS Despite Revenue Misschartmill.com

Via Chartmill · February 17, 2026

The U.S. Energy Information Administration (EIA) released its latest weekly storage report on February 26, 2026, confirming that the massive withdrawals triggered by mid-winter Arctic blasts have left domestic natural gas inventories at their lowest late-February levels in years. While the most recent weekly draw of 52 billion cubic

Via MarketMinute · February 27, 2026

In a definitive display of operational dominance and strategic timing, Cheniere Energy (NYSE: LNG) reported a staggering fourth-quarter 2025 earnings per share of $10.68 yesterday, February 26, 2026. This figure blew past analyst expectations of roughly $3.90, marking a watershed moment for the Houston-based liquefied natural gas (LNG)

Via MarketMinute · February 27, 2026

The global natural gas market has entered a period of unprecedented structural divergence, as a "perfect storm" of climatic and industrial factors reshaped the energy landscape in early 2026. While the United States grapples with a violent upward trajectory in domestic benchmarks—highlighted by a staggering 78.4% price spike

Via MarketMinute · February 27, 2026

As of February 26, 2026, Coterra Energy Inc. (NYSE: CTRA) stands at the precipice of its most significant transformation since its inception. Once the product of a bold 2021 merger between a natural gas giant and a Permian pure-play, Coterra has spent the last five years proving the merits of a "multi-basin" strategy. Today, however, [...]

Via Finterra · February 26, 2026

The natural gas market has undergone a dramatic reversal in late February 2026, as the "weather premium" that propelled prices to historic highs just weeks ago has completely evaporated. After a period of extreme volatility, natural gas prices have surrendered to persistent negative pressure, decisively breaking below the critical $3.

Via MarketMinute · February 26, 2026

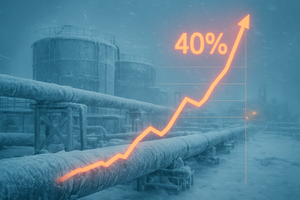

The U.S. Energy Information Administration (EIA) has sent shockwaves through the energy markets with the release of its February 2026 Short-Term Energy Outlook (STEO), significantly upwardly revising near-term natural gas price forecasts by a staggering 40%. The revision comes in the wake of "Winter Storm Fern," an aggressive Arctic

Via MarketMinute · February 25, 2026

US natural gas prices have undergone a violent transformation in early 2026, with the Henry Hub benchmark surging 78% to reach $7.82 per million British thermal units (MMBtu). This represents the highest sustained price level since the global energy crisis of late 2022, signaling a definitive end to the

Via MarketMinute · February 24, 2026

The United States energy market is reeling after a historic mid-winter "perfect storm" sent natural gas prices skyrocketing by more than 78% in the first weeks of 2026. This dramatic escalation, driven by a combination of record-breaking Arctic temperatures and structural supply constraints, has rippled through the broader economy, contributing

Via MarketMinute · February 23, 2026

The American energy landscape was sent into a tailspin in early 2026 as U.S. natural gas prices experienced a staggering 78.4% spike, a move that reverberated through global commodities and sent shockwaves across industrial and residential sectors. This unprecedented volatility was the primary driver behind a 12% surge

Via MarketMinute · February 20, 2026

In a month defined by atmospheric volatility, the U.S. natural gas market has undergone a historic convulsion. Prices on the New York Mercantile Exchange (NYMEX) recently skyrocketed, with front-month futures jumping a staggering 18.1% in a single session to settle at $7.8270 per million British thermal units

Via MarketMinute · February 19, 2026

EQT (EQT) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 18, 2026

The natural gas market faced a decisive technical breakdown today, February 17, 2026, as prices officially breached the long-held $3.20 per million British thermal units (MMBtu) support level. A combination of unseasonably warm weather forecasts and a federal storage report that failed to meet market expectations has sent the

Via MarketMinute · February 17, 2026

The United States natural gas market is currently navigating a period of extraordinary volatility, transitioning from a historic price surge in January to a rapid cooling phase as of February 11, 2026. Just weeks ago, Winter Storm Fern gripped the nation, driving spot prices to record highs and forcing the

Via MarketMinute · February 11, 2026

As of February 6, 2026, the dominant narrative on Wall Street has shifted from the virtual to the tangible. After years of dominance by Silicon Valley’s software giants, a powerful "Great Rotation" is underway, with institutional capital aggressively migrating toward the backbone of the physical economy. Investors are increasingly

Via MarketMinute · February 6, 2026

The U.S. energy market was rocked in January 2026 as natural gas prices skyrocketed by a staggering 78.4%, catapulting from a December average of $4.25 per million BTU to a peak average of $7.58. This historic surge, detailed in the latest World Bank Commodity Markets report,

Via MarketMinute · February 6, 2026

The U.S. stock market is currently witnessing a tectonic shift in capital allocation as the "AI hype cycle" of the early 2020s gives way to the "Physical Reality" of 2026. In the first five weeks of the year, a massive sector rotation has seen billions of dollars exit high-multiple

Via MarketMinute · February 5, 2026