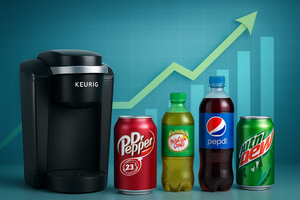

Keurig Dr Pepper Inc. - Common Stock (KDP)

29.53

+0.47 (1.62%)

NASDAQ · Last Trade: Dec 10th, 5:40 PM EST

Keurig Dr Pepper (NASDAQ: KDP) announced today, December 9, 2025, that its Board of Directors has declared a regular quarterly cash dividend of $0.23 per share of common stock. This move underscores the company's commitment to returning value to shareholders and signals robust financial health amidst a dynamic consumer

Via MarketMinute · December 9, 2025

As the trading day of December 9, 2025, draws to a close, beverage giant Coca-Cola (NYSE: KO) finds itself in the spotlight not for effervescent gains, but for a more subdued performance, positioning it as a bottom mover in today's market. Despite a generally optimistic outlook from many analysts, underlying

Via MarketMinute · December 9, 2025

An underperforming beverages business and an eventually slowing snacks division have put PepsiCo in the spotlight this year, with Elliott Investment Management asking the company to course-correct.

Via Stocktwits · December 9, 2025

Trump’s Food Tariff Cut Likely To Trim Import Costs For Hershey, Dr. Pepper, Vita Coco, Analyst Saysstocktwits.com

Via Stocktwits · November 16, 2025

Why did Denny's stock soar nearly 60% in November? Here's what Denny's investors and restaurant guests need to know.

Via The Motley Fool · December 2, 2025

As tariffs rattle coffee markets and CEO overhauls reshape strategy, food giants are selling premium café brands while others bulk up through billion-dollar deals.

Via Stocktwits · December 2, 2025

Value investing has created more billionaires than any other strategy, like Warren Buffett, who built his fortune by purchasing wonderful businesses at reasonable prices.

But these hidden gems are few and far between - many stocks that appear cheap often stay that way because they face structural issues.

Via StockStory · November 20, 2025

Low-volatility stocks may offer stability, but that often comes at the cost of slower growth and the upside potential of more dynamic companies.

Via StockStory · November 14, 2025

Sao Paulo, Brazil – November 13, 2025 – The global coffee market is currently experiencing significant turbulence, with coffee futures on the rise due to a severe and prolonged drought in Brazil, the world's largest coffee producer. This climatic challenge, coupled with other market dynamics, is having immediate and far-reaching implications for

Via MarketMinute · November 13, 2025

Via MarketBeat · November 12, 2025

The snack and beverage supplier is being sold.

Via The Motley Fool · November 10, 2025

What a New CEO Means for GXO Logisticsfool.com

GXO is looking to set up for a new stage of growth.

Via The Motley Fool · November 10, 2025

Regarded as defensive investments, consumer staples stocks are generally safe bets in choppy markets. The flip side is that they frequently fall behind growth industries when times are good,

and this perception became a reality over the past six months as the sector was down 8.9% while the S&P 500 was up 15.3%.

Via StockStory · November 9, 2025

Keurig Dr Pepper’s third quarter was marked by robust revenue expansion and a strong market response, with management attributing the outperformance to continued momentum across its core beverage and coffee businesses. CEO Tim Cofer highlighted that “net sales accelerated in Q3,” driven by solid gains in both U.S. Refreshment Beverages and international markets, as well as successful pricing actions in the coffee segment. Additionally, the company maintained its operating margins despite inflationary pressures, signaling operational discipline amid a dynamic macroeconomic backdrop. Management’s focus on brand building, innovation, and productivity initiatives supported both top-line and bottom-line growth, even as input costs and tariffs increased.

Via StockStory · November 3, 2025

October 28, 2025 – The global commodity markets are currently presenting a starkly divergent picture for two of the world's most consumed agricultural staples: sugar and coffee. While sugar prices have experienced a significant downturn, driven by robust global supplies and evolving demand patterns, coffee prices have defied earlier expectations of

Via MarketMinute · October 28, 2025

Via Benzinga · October 28, 2025

Via MarketBeat · October 28, 2025

The Fear & Greed Index showed lower fear, Dow surged 300 pts., US & China had successful trade talks, markets cheered.

Via Benzinga · October 28, 2025

Beverage company Keurig Dr Pepper (NASDAQ:KDP) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 10.7% year on year to $4.31 billion. Its non-GAAP profit of $0.54 per share was in line with analysts’ consensus estimates.

Via StockStory · October 28, 2025

Today's market activity saw Keurig Dr Pepper (NASDAQ: KDP) emerge as a significant mover, though without explicit gains, suggesting a day marked by considerable volatility or a potential downturn. In the intricate dance of financial markets, a stock can be a "mover" not just through upward surges but also through

Via MarketMinute · October 27, 2025

Shares of beverage company Keurig Dr Pepper (NASDAQ:KDP)

jumped 7.3% in the afternoon session after the company reported third-quarter revenue that surpassed Wall Street's expectations. The beverage giant's sales grew 10.7% year on year to $4.31 billion, beating the consensus estimate. A key driver behind the strong performance was a significant 6.4% jump in sales volumes, an acceleration from previous periods, indicating robust consumer demand for its products. While the company's adjusted earnings per share of $0.54 met analyst forecasts, the market reacted positively to the strong top-line growth and accelerating demand, signaling confidence in the company's performance.

Via StockStory · October 27, 2025

Investor optimism drives the S&P 500 to new records while Qualcomm steals the spotlight with an 11% surge after unveiling new AI chips.

Via Chartmill · October 27, 2025

Wondering what's happening in today's session for the S&P500 index? Stay informed with the top movers within the S&P500 index on Monday.

Via Chartmill · October 27, 2025

Keurig Dr Pepper delivered strong third-quarter results and raised its revenue guidance. But investors still seem unconvinced that the company's $18 billion coffee gambit is a good move.

Via The Motley Fool · October 27, 2025