Articles from Natixis Investment Managers

After three consecutive years of double-digit returns on most indexes, almost 8 in 10 (79%) U.S. institutional investors say that markets are due for a correction in 2026, according to survey findings published today by Natixis Investment Managers (Natixis IM). On average, U.S. institutional investors assign a 49% probability of a 10 - 20% market correction in 2026, and a 20% probability of a market correction deeper than 20%.

By Natixis Investment Managers · Via Business Wire · November 19, 2025

Natixis Investment Managers (Natixis IM) announced the launch of the sixth edition of its flagship program, The Students Challenge. This virtual portfolio management competition – open to students from universities and business schools worldwide, including master’s-level students in Europe and final-year undergraduates elsewhere – has established itself as a driver of international talent and a stepping stone to a career in asset management.

By Natixis Investment Managers · Via Business Wire · November 5, 2025

Natixis Investment Managers (Natixis IM) today announced the US recipients of its 2025 Global Equal Opportunities Advancement Scholarship. Four students from the Boston area have each been awarded a $5,000 renewable scholarship to support their college tuition and expenses, along with internship and mentoring opportunities at Natixis IM. The scholarship program is part of Natixis IM’s ongoing commitment to attract, inspire and develop future leaders within the financial services industry.

By Natixis Investment Managers · Via Business Wire · October 16, 2025

Gateway Investment Advisers (“Gateway”), a pioneer in options-based investment strategies and affiliate of Natixis Investment Managers (“Natixis IM”), today announced the successful closing of its previously announced acquisition of the business of Belmont Capital Group (“Belmont”), a Los Angeles-based provider of customized, options-based separately managed account (SMA) strategies.

By Natixis Investment Managers · Via Business Wire · September 10, 2025

The United States inched up in the rankings to 21st best country for retirees according to this year’s Global Retirement Index (GRI) from Natixis Investment Managers (Natixis IM). Strengthening financial conditions and longer life expectancy in the United States helped offset the effects of a cooling labor market and a decline in happiness scores. At the same time, optimism among Americans is on the rise: just 21% now say it will take a “miracle” to retire. Still, 69% believe the world feels unstable and worry about the impact on their finances.

By Natixis Investment Managers · Via Business Wire · September 9, 2025

Natixis Investment Managers (Natixis IM) is proud to announce its multi-year sponsorship of two renowned para-athletic sprinters Femita Ayanbeku from the US and Dimitri Jozwicki from France. Natixis IM began its sponsorships with Ayanbeku and Dimitri in 2023 and 2022, respectively. Through these global partnerships, Natixis IM aims to celebrate with employees, clients, and the community the values of perseverance, resilience, and commitment to excellence embodied by Ayanbeku and Jozwicki. Natixis IM will also collaborate with its charitable partners to create opportunities for the para-athletes to share their experiences, further extending the impact of their inspirational stories.

By Natixis Investment Managers · Via Business Wire · July 22, 2025

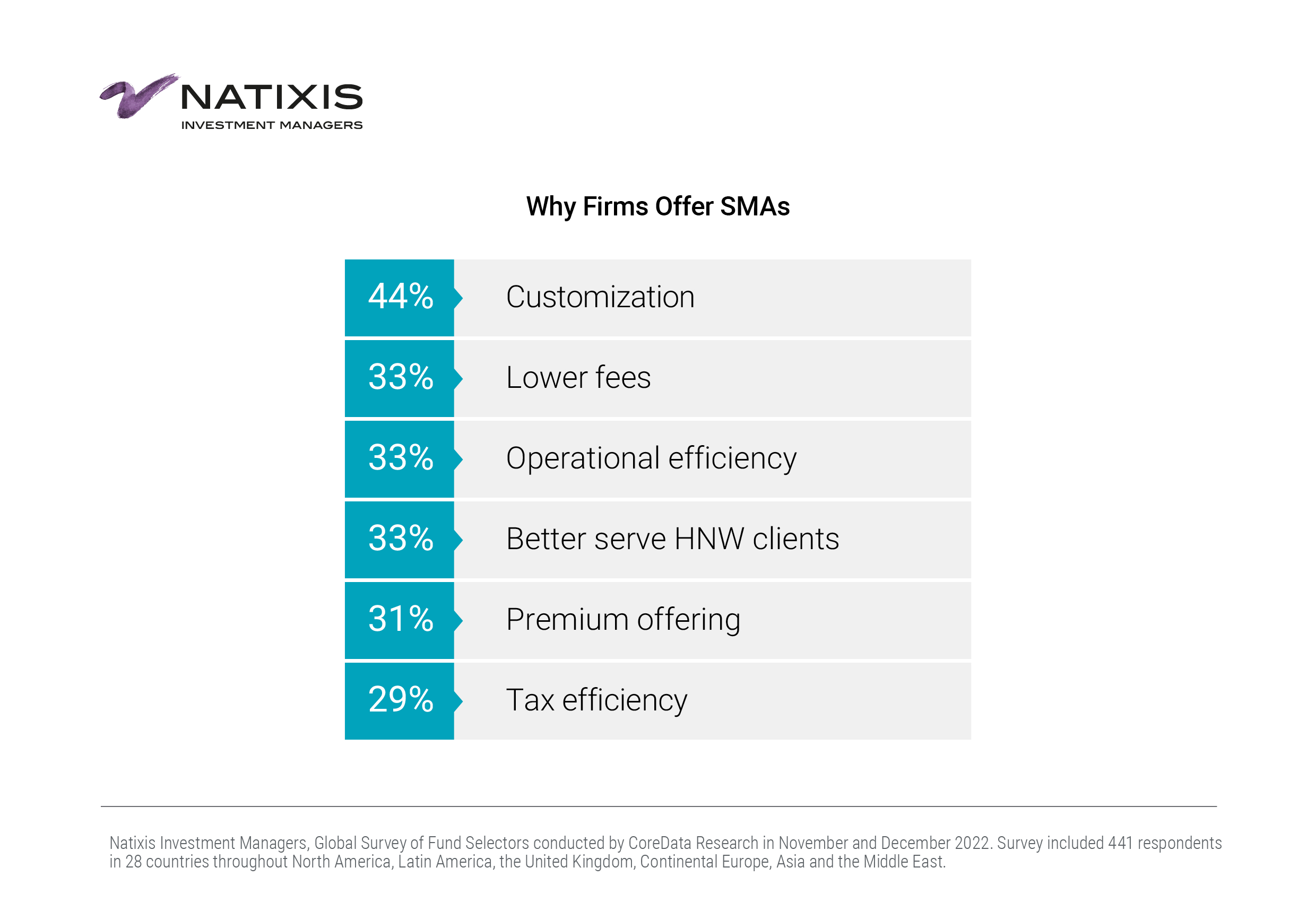

Gateway Investment Advisers (Gateway), a pioneer in options-based investment strategies and affiliate of Natixis Investment Managers (Natixis IM), today announced it has agreed to acquire the business of Belmont Capital Group (Belmont), a Los Angeles-based provider of customized, options-based separately managed account (SMA) strategies. The acquisition reinforces Gateway’s commitment to SMAs, one of the fastest-growing product segments in the US financial services industry.

By Natixis Investment Managers · Via Business Wire · July 16, 2025

While shifting trade policies have driven concerns of volatility, ongoing inflation, and a “less exceptional” U.S., a survey of strategists across the Natixis Investment Managers group and its affiliates highlights that they are finding opportunities across global markets.

By Natixis Investment Managers · Via Business Wire · June 25, 2025

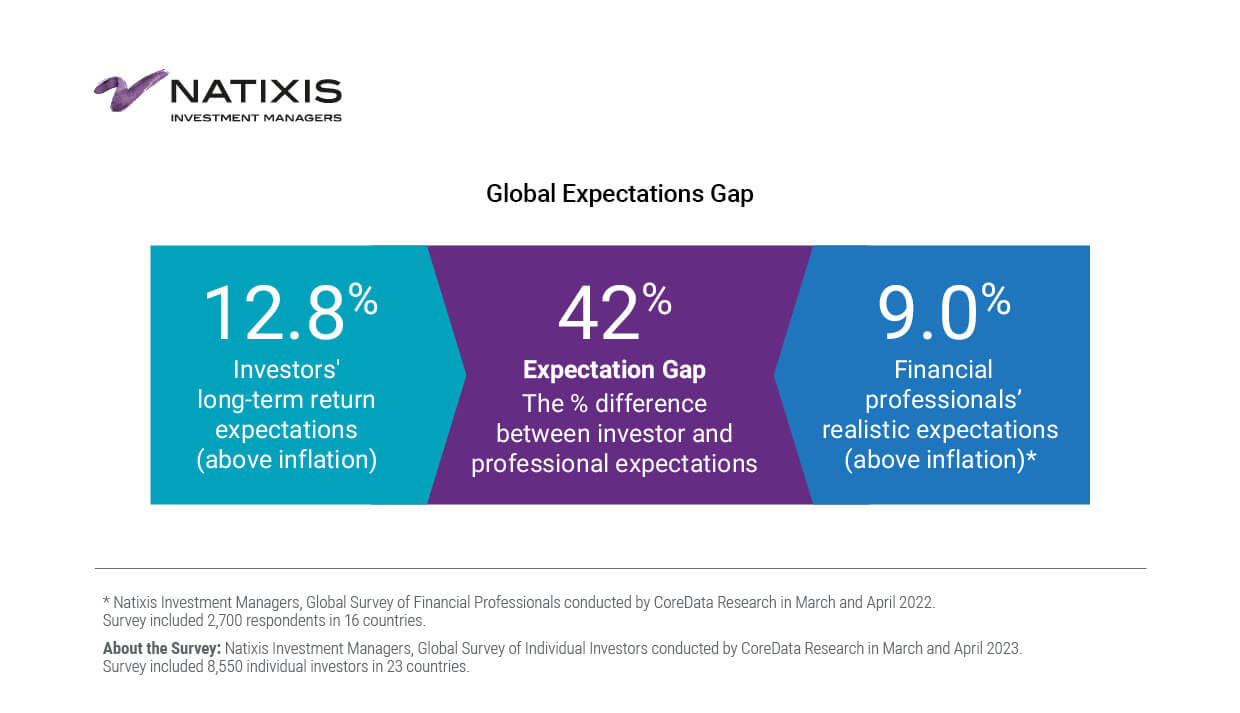

After years of strong returns fueled by low rates and tech growth, 69% of investors now feel the world is unstable and worry about their finances, according to the 2025 Natixis Investment Managers (“Natixis IM”) Survey. Inflation, global conflict and policy uncertainty tapered U.S. investors’ return expectations from 15.6% in 2023 to 12.6% in 2025.

By Natixis Investment Managers · Via Business Wire · June 10, 2025

Nearly six in 10 (59%) professional fund selectors from major U.S. wealth management firms cite high valuations and inflation as their top portfolio risk concerns in 2025, according to survey findings released today by Natixis Investment Managers (Natixis IM). These concerns topped a wide-ranging list of political, economic, technological and business challenges.

By Natixis Investment Managers · Via Business Wire · March 25, 2025

Natixis Investment Managers today announced that funds managed by several of its affiliate investment management firms – Loomis, Sayles & Company; Harris | Oakmark; and Natixis Advisors – earned 2025 LSEG Lipper Fund Awards for the US. The funds were recognized for achieving consistently strong risk-adjusted performance relative to their peers for the period ending November 30, 2024. LSEG announced award and certificate recipients on March 13, 2025, which included the following from the Natixis Investment Managers mutual fund family:

By Natixis Investment Managers · Via Business Wire · March 14, 2025

During 2024, the US economic backdrop shifted as inflation eased, the labor market cooled and the Fed began bringing down interest rates. The new year ushers in a new administration with policy changes on the horizon. Despite uncertainty about what those changes ultimately look like and how they may affect the economy, the market’s mood is optimistic based on expectations of continued growth bolstered by resilient consumer consumption.

By Natixis Investment Managers · Via Business Wire · January 8, 2025

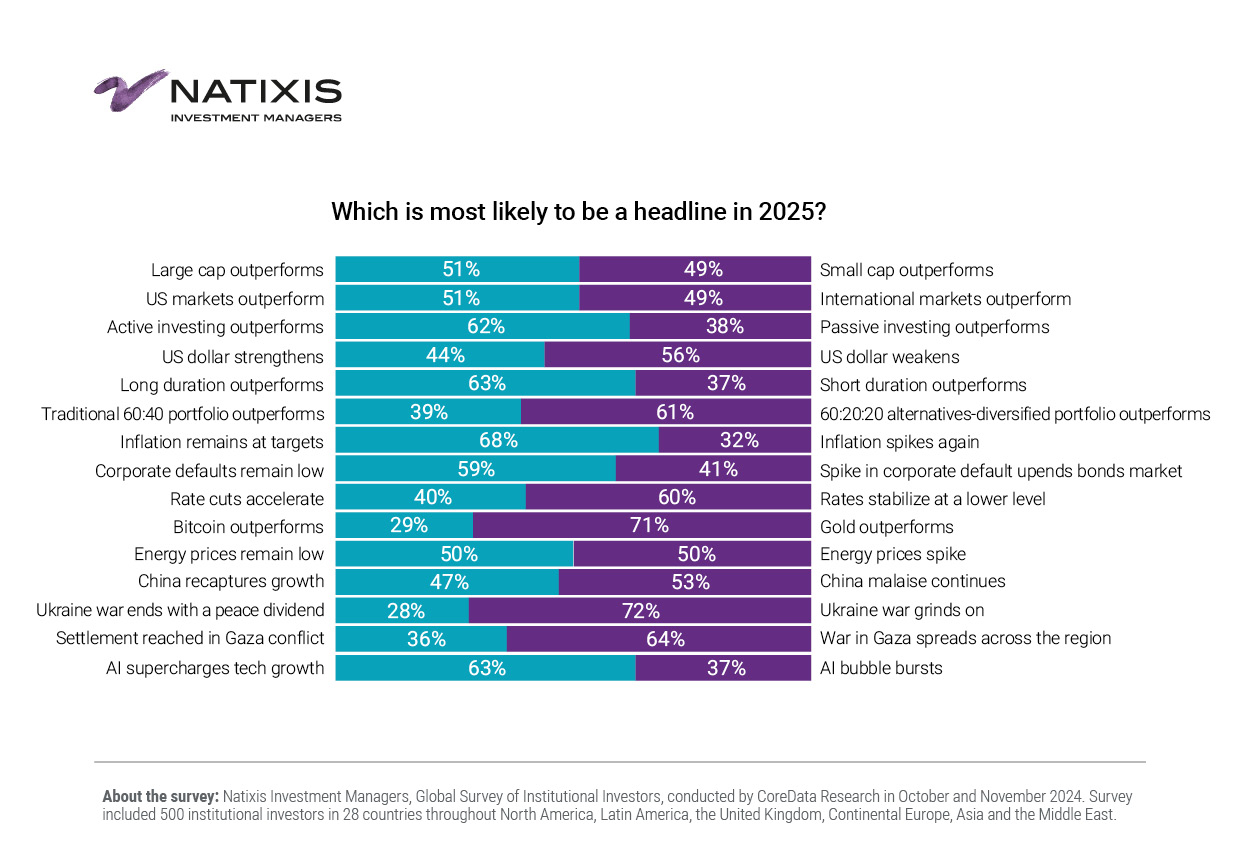

Institutional investors are heading into the new year with the expectation that 2024’s positive market conditions will continue, but they are keeping their eyes on a wide range of economic threats, according to new survey findings published today by Natixis Investment Managers (Natixis IM).

By Natixis Investment Managers · Via Business Wire · December 4, 2024

Natixis Investment Managers (Natixis IM) is pleased to announce the launch of the fifth edition of The Students Challenge for the 2024/25 academic year. Registration is now open, inviting applications from business schools, engineering schools, and universities worldwide. Eligible participants must be in their final year of an undergraduate degree or currently pursuing a master’s degree, with a strong interest in finance.

By Natixis Investment Managers · Via Business Wire · November 7, 2024

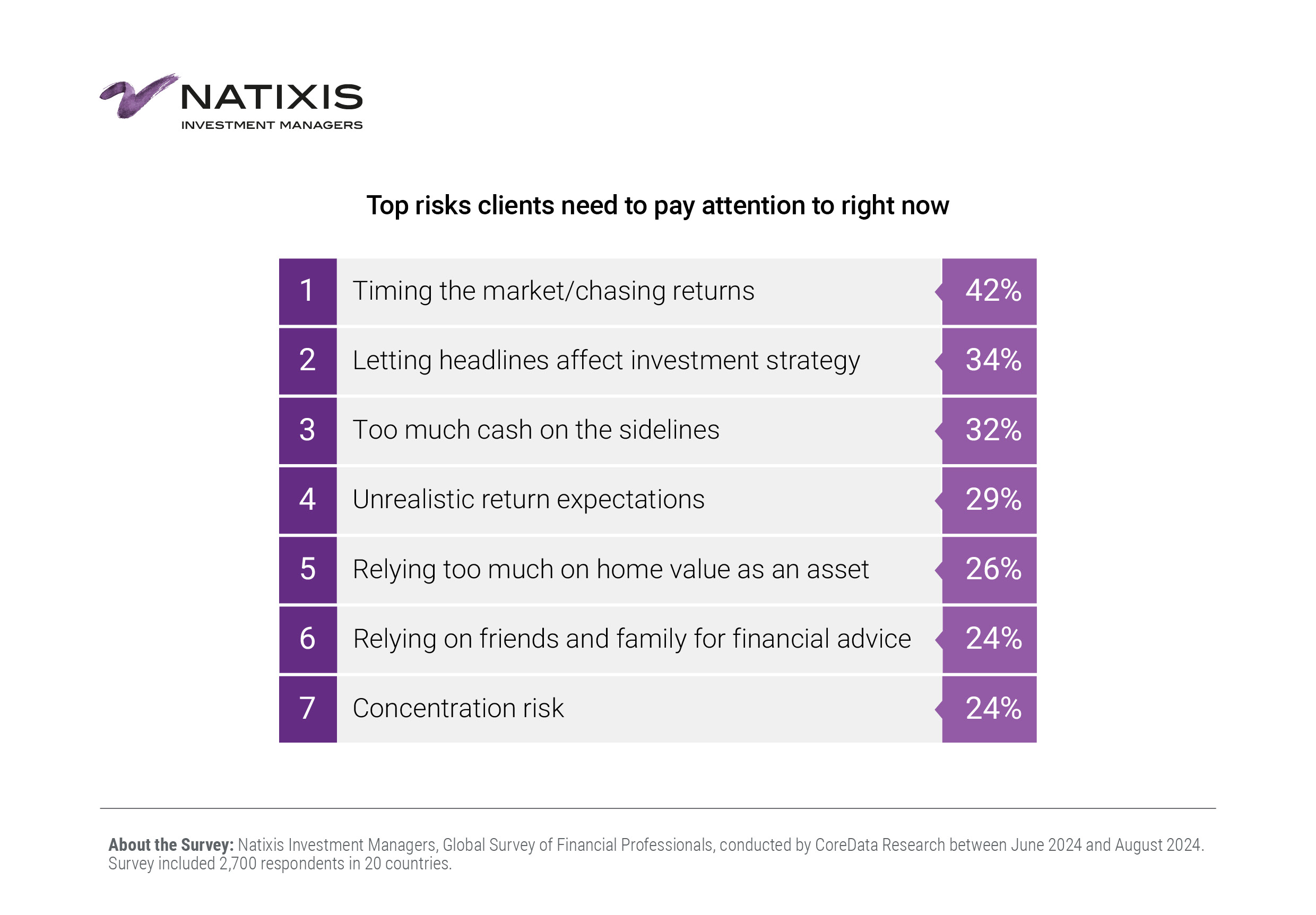

Financial advisors are navigating short-term economic risks and long-term demographic challenges as they look to add assets and clients to ensure the longevity of their businesses, according to findings from Natixis Investment Managers (IM) 2024 Survey of Financial Professionals, published today.

By Natixis Investment Managers · Via Business Wire · October 16, 2024

Natixis Investment Managers (Natixis IM) and Gateway Investment Advisers, LLC (Gateway) celebrate the 10-year anniversary of the Gateway Equity Call Premium Fund (GCPYX, or the Fund), a low volatility equity mutual fund that offers investors a portfolio that is highly correlated to the S&P 500® Index with a lower risk profile and reduced drawdowns. The Fund is among the $9.4 billion in assets managed by Gateway, a Cincinnati-based registered investment adviser and affiliate of Natixis IM, which has more than $1.3 trillion assets under management (AUM) globally.

By Natixis Investment Managers · Via Business Wire · October 10, 2024

Gateway Investment Advisers, LLC (Gateway), a registered investment adviser and affiliate of Natixis Investment Managers, today announced the appointment of Julie M. Schmuelling, CPA, to the role of President. Schmuelling had been the firm’s Chief Operating Officer and Vice President. Michael T. Buckius, CFA®,1 who became President of Gateway in March 2021, retains the title of CEO as well as Chief Investment Officer and portfolio manager.

By Natixis Investment Managers · Via Business Wire · October 1, 2024

Natixis Investment Managers (Natixis IM) announced today that it will liquidate and close the Natixis Loomis Sayles Short Duration Income ETF (NYSE: LSST). The decision was made by the Board of Trustees of the Natixis ETF Trust on the recommendation of the Fund’s adviser, Natixis Advisors, LLC.

By Natixis Investment Managers · Via Business Wire · September 12, 2024

Retirement conditions remain steady this year, following improvements in retirement security across nearly all developed countries last year, according to the latest Global Retirement Index from Natixis Investment Managers (Natixis IM). The top performers in Natixis IM’s annual Global Retirement Index (GRI) have delivered more consistent rankings across all sub-indices, showing a stabilizing global retirement outlook. The list of countries that rank in the top 10 of the index has remained the same for two consecutive years. However, individuals are feeling the pressure as more come to the realization that they are on their own when it comes to funding income later in life.

By Natixis Investment Managers · Via Business Wire · September 10, 2024

With inflation easing, and fears of a global recession behind us, the first half of 2024 (H1) experienced a positive start to the year. But even so, nearly 7 in 10 (67%) strategists across Natixis Investment Managers and its affiliates believe markets may be too optimistic as they head into an uncertain second half of 2024 (H2).

By Natixis Investment Managers · Via Business Wire · July 30, 2024

Natixis Investment Managers (Natixis IM) and Gateway Investment Advisers, LLC (Gateway), a pioneer in options-based investment strategies, today announced that the Natixis Gateway Quality Income ETF (GQI) has recently surpassed $100 million in assets. The ETF was launched on December 13, 2023, and has generated a return of 11.43% since inception through June 30, 2024.

By Natixis Investment Managers · Via Business Wire · July 17, 2024

Eric Liu, co-portfolio manager of the Oakmark International and Oakmark Global Select Funds and a senior investment analyst at Harris Associates L.P., adviser to the Oakmark Funds and an affiliate of Natixis Investment Managers, has been appointed co-portfolio manager of the Oakmark Global Fund.

By Natixis Investment Managers · Via Business Wire · July 1, 2024

Natixis Investment Managers (Natixis IM) today welcomed the US recipients of its Global Equal Opportunities Advancement Scholarship for 2024. Four Boston-area students who have each been awarded a $5,000 renewable scholarship to apply to college tuition and expenses, along with internship and mentoring opportunities at Natixis IM, joined David Giunta, CEO for the US at Natixis IM, and other Natixis IM employees to celebrate their scholarships and discuss the various career opportunities within finance. The Natixis Investment Managers Global Equal Opportunities Advancement Scholarship program supports Natixis IM’s broader efforts to increase the number of people from diverse backgrounds at the firm and within the financial services industry by attracting, inspiring and developing individuals that might not otherwise be exposed to the financial industry or consider careers in financial services. To date, more than 20 students have been granted scholarships through Natixis IM’s global program.

By Natixis Investment Managers · Via Business Wire · June 24, 2024

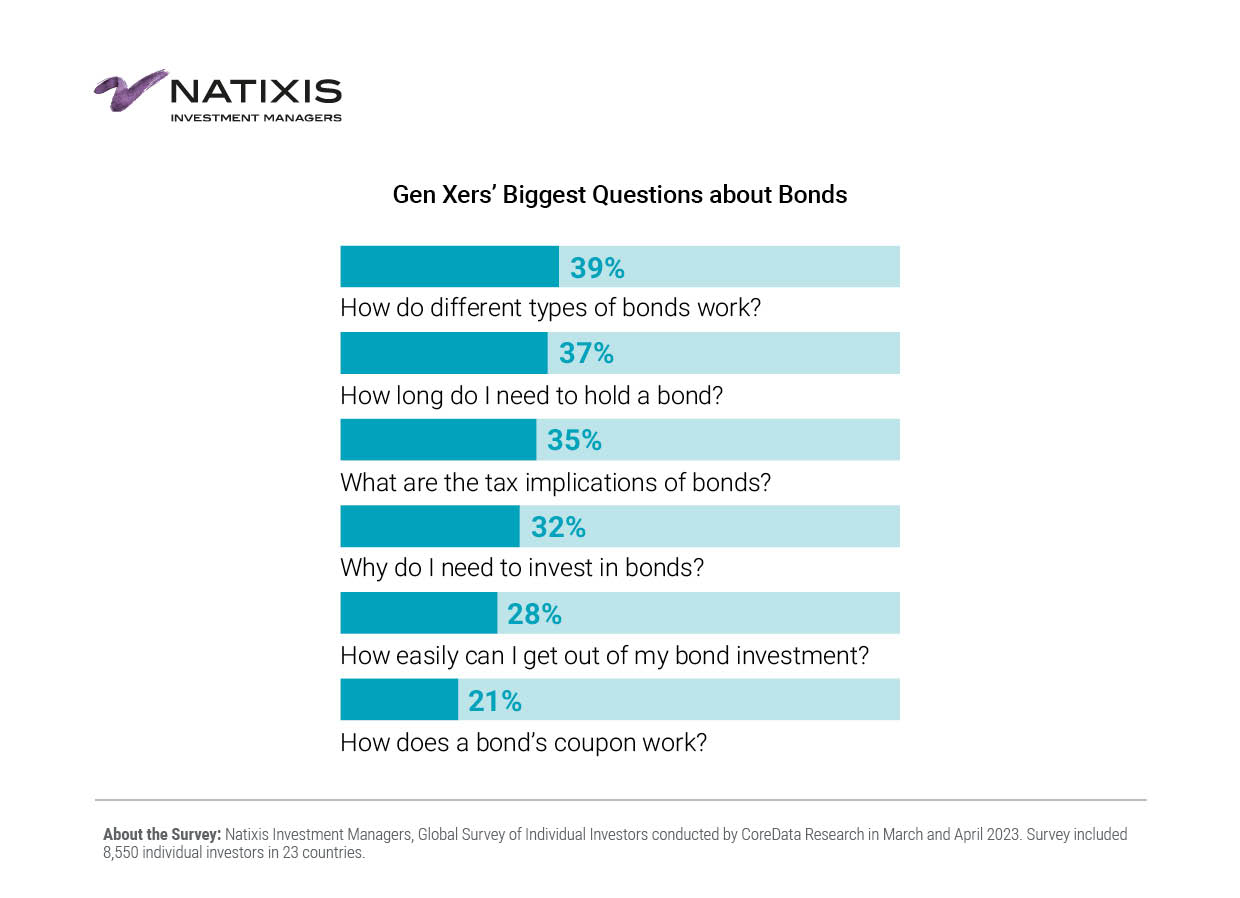

Perpetually stuck between older, more popular Baby Boomers and younger, more precocious Millennials, Generation X has been overlooked for most of the 21st Century. The oldest Generation Xers (born between 1965 and 1980) will turn 59 ½ this June and can begin withdrawing their retirement savings without penalty. According to new survey findings released today by Natixis Investment Managers (Natixis IM), nearly half (44%) of American Gen Xers report that it will take a “miracle” to be able to retire securely. While the majority of American Gen Xers do plan to retire someday, nearly a quarter (24%) say they will not retire.

By Natixis Investment Managers · Via Business Wire · June 18, 2024

Natixis Investment Managers (Natixis IM) announced today that it will liquidate and close the Natixis Vaughan Nelson Mid Cap ETF (NYSE: VNMC). The decision was made by the Board of Trustees of the Natixis ETF Trust II on the recommendation of the Fund’s adviser, Natixis Advisors, LLC.

By Natixis Investment Managers · Via Business Wire · June 12, 2024

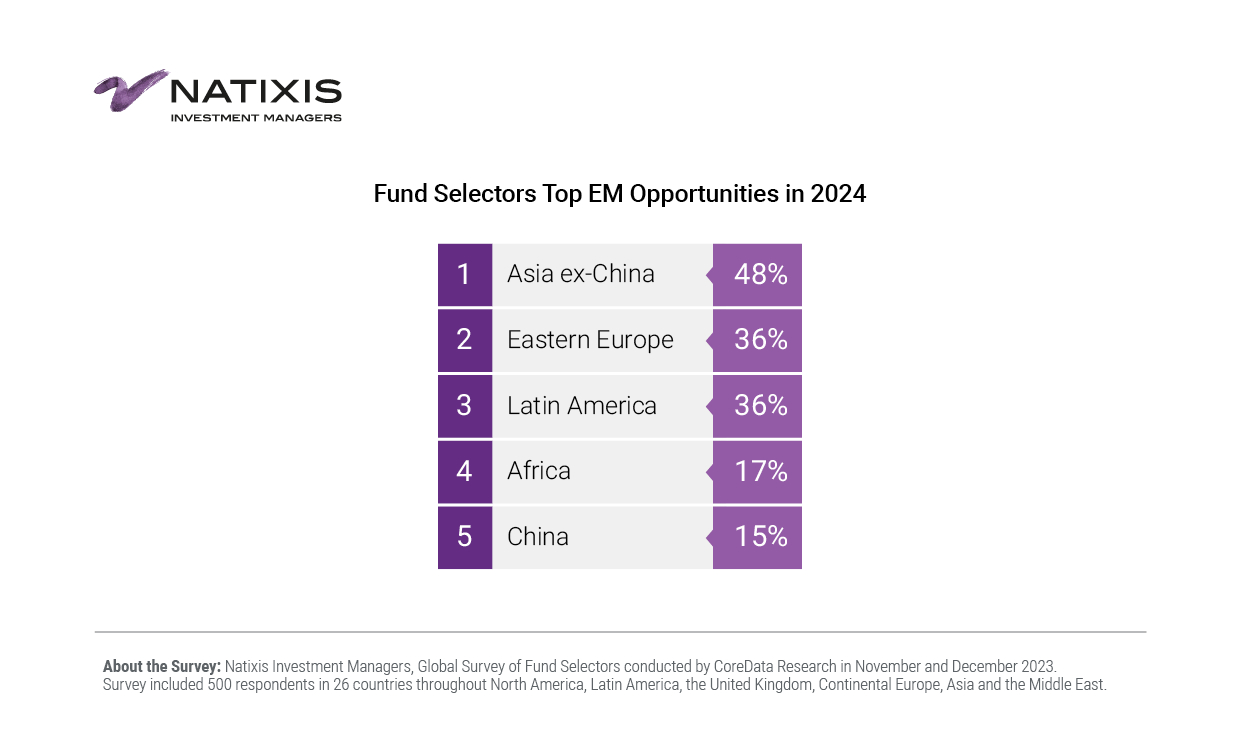

Nearly seven out of ten (69%) professional fund selectors from some of the largest US wealth management firms agree that active fund management will be essential to investment outperformance in 2024, according to new survey findings released today by Natixis Investment Managers (Natixis IM). This comes after 58% report that the actively managed funds on their platforms outperformed their benchmarks last year, and 65% expect the markets to continue favoring active management.

By Natixis Investment Managers · Via Business Wire · February 6, 2024

Natixis Investment Managers (Natixis IM) today announced its sponsorship of elite US amputee sprinter Femita Ayanbeku. Boston-native Ayanbeku, who represented the United States in the 2016 and 2020 Paralympic Games and won a bronze medal in the 2019 World Para Athletic Championships, is training for the opportunity to once again represent the United States at the highest level of para-athletic competitions in 2024. Through the sponsorship, Natixis IM hopes to inspire employees, clients and the community by highlighting Ayanbeku’s hard work, dedication, determination, and positivity as we follow her dream of earning the top accolade in her discipline. An active community advocate, Ayanbeku also will partner with Natixis IM to share her inspirational story with the firm’s charitable partners.

By Natixis Investment Managers · Via Business Wire · January 19, 2024

Flexstone Partners (Flexstone), an affiliated investment manager of Natixis Investment Managers, managing more than $10 billion in assets focused on lower, middle market buyouts, growth equity, and emerging managers in the US, Europe, and Asia, today appointed Samira Boussem as Managing Director & Head of Sustainability.

By Natixis Investment Managers · Via Business Wire · January 11, 2024

In 2023, a bull market in stocks surprised while bonds saw an uptick in performance during the fourth quarter. As 2023 ended, the impending recession never appeared, and inflation eased.

By Natixis Investment Managers · Via Business Wire · January 10, 2024

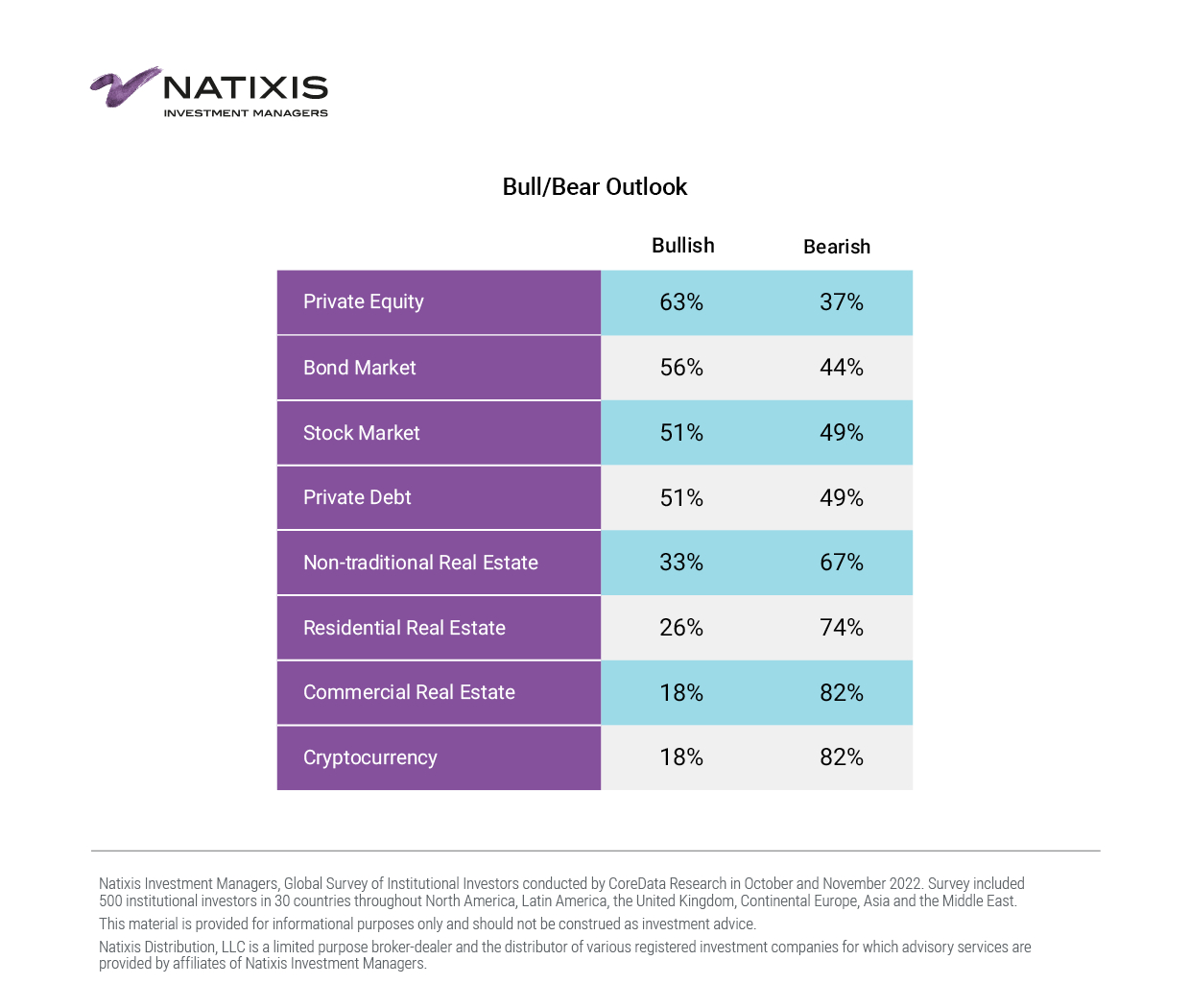

Institutional investors are decidedly bullish on just three areas of the market next year – bonds, private equity, and private debt – in a global economy that at least half of institutions see teetering on the verge of recession, according to Natixis Investment Managers’ (Natixis IM) survey of the world’s largest institutional investors.

By Natixis Investment Managers · Via Business Wire · December 6, 2023

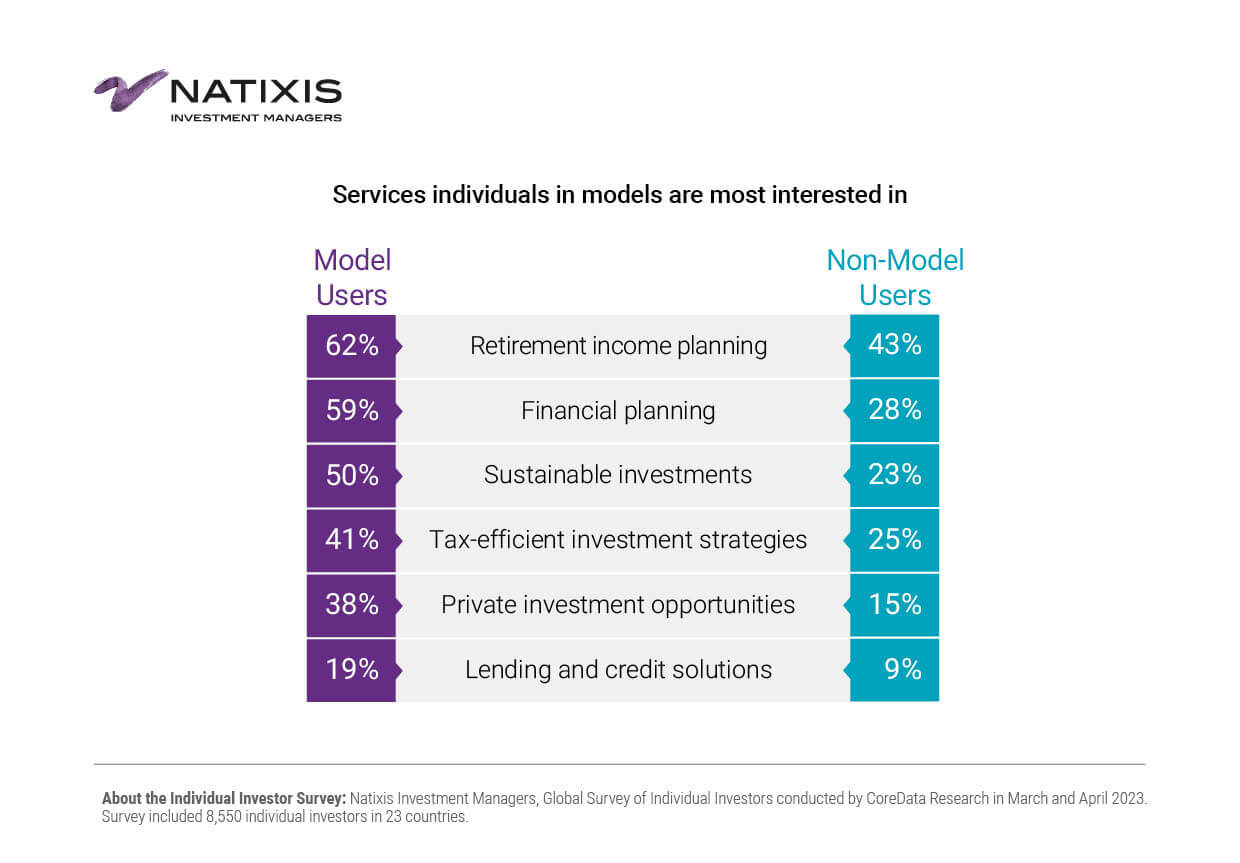

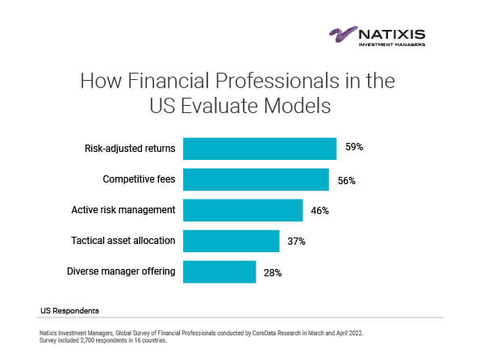

After recent bouts of volatility and inflation, just one in three Americans feels confident about the state of their finances right now. Yet those invested in model portfolios are nearly two times more likely to express confidence (45%) than non-model users (24%), according to new survey findings published today by Natixis Investment Managers (Natixis IM).

By Natixis Investment Managers · Via Business Wire · October 26, 2023

Natixis Investment Managers (Natixis IM) and Vaughan Nelson Investment Management (Vaughan Nelson), announce the three-year anniversary of the Natixis Vaughan Nelson Select ETF (VNSE), an active, high-conviction U.S. stock ETF. The ETF is among the $15.1 billion managed by Vaughan Nelson, a Houston-based affiliate of Natixis IM, which has more than $1.2 trillion of assets under management (AUM) globally.

By Natixis Investment Managers · Via Business Wire · October 17, 2023

For the first time in ten years, nearly all developed countries in Natixis Investment Managers’ Global Retirement Index (GRI), including the United States, received a higher overall score for retirement security over the prior year. The annual index, released today, shows improved economic conditions, mainly the result of employment growth, wage gains, and interest rates. Yet Natixis Investment Managers’ (Natixis IM) research reveals that optimism at the macro level is not being felt in the everyday lives of retirees and working Americans.

By Natixis Investment Managers · Via Business Wire · September 13, 2023

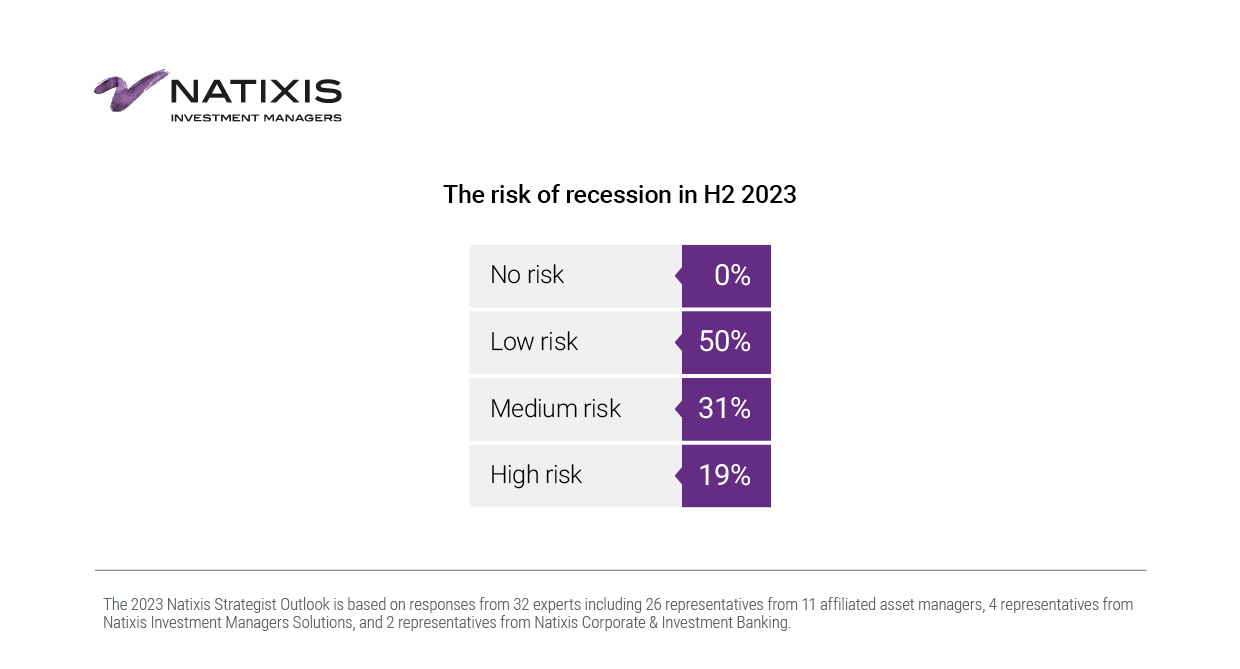

After a robust start to the year with inflation easing, some stock markets reaching double digit returns, and bond yields reaching 15-year highs, economists and investment strategists are feeling more confident that recession risk is receding in H2 2023, according to a survey by Natixis Investment Managers conducted at the end of June 2023.

By Natixis Investment Managers · Via Business Wire · July 25, 2023

Americans remain blithely bullish on the markets and have high investment return expectations almost as if 2022 never happened, finds the 2023 Natixis Investment Managers Survey of Individual Investors, published today. While 86% of respondents say last year was a wake-up call, reminding them that the stock market can go down, investors still expect average annual returns of 15.6% above inflation over the long term, or around 20% given the current inflation rate. However, the findings suggest that shifting economic and market drivers could trigger investors’ worst fears and shed light on critical gaps in their investment knowledge particularly about rates, risk, and the pros and cons of passive investing.

By Natixis Investment Managers · Via Business Wire · June 21, 2023

Natixis Investment Managers (Natixis IM) announced today that it will liquidate and close the Natixis U.S. Equity Opportunities Exchange Traded Fund (NYSE: EQOP). The decision was made by the Board of Trustees of the Natixis ETF Trust II on the recommendation of the Fund’s adviser, Natixis Advisors, LLC.

By Natixis Investment Managers · Via Business Wire · June 8, 2023

Natixis Investment Managers (Natixis IM) today announced the US recipients of its Global Equal Opportunities Advancement Scholarship for 2023. Four Boston-area students have each been awarded a $5,000 renewable scholarship to apply to college tuition and expenses, along with internship and mentoring opportunities at Natixis IM. The Natixis Investment Managers Global Equal Opportunities Advancement Scholarship program supports Natixis IM’s broader efforts to increase diversity at the firm and within the financial services industry by attracting, inspiring and developing underrepresented groups to consider careers in financial services.

By Natixis Investment Managers · Via Business Wire · June 5, 2023

Mirova, an affiliate of Natixis Investment Managers dedicated to sustainable finance, along with Robeco and a group of 11 financial players launch a call for expressions of interest (CEI) to develop a global database of avoided emissions factors and associated company-level avoided emissions.

By Natixis Investment Managers · Via Business Wire · May 16, 2023

After 10 interest rate hikes over the past year, and with the federal funds target rate at a 15-year high, 86% of financial advisors agree that bond yields are back. In fact, 89% say this is the best yield opportunity they have seen in years, with 69% also saying this is the best return opportunity for bonds since before the global financial crisis, according to a new fixed income pulse survey of 350 US-based financial advisors who manage $1.7 billion in client assets, conducted by Natixis Investment Managers and Loomis Sayles.

By Natixis Investment Managers · Via Business Wire · May 3, 2023

Flexstone Partners has closed another vintage of its small- and middle-market private equity co-investment funds, a significant step for Flexstone flagship investment strategy, despite challenging global markets. A leading asset manager with over US$10 billion assets under management (AUM)2, Flexstone Partners specializes in small and mid-market global private assets and is an affiliate of Natixis Investment Managers, which has more than $1.1 trillion AUM3.

By Natixis Investment Managers · Via Business Wire · April 19, 2023

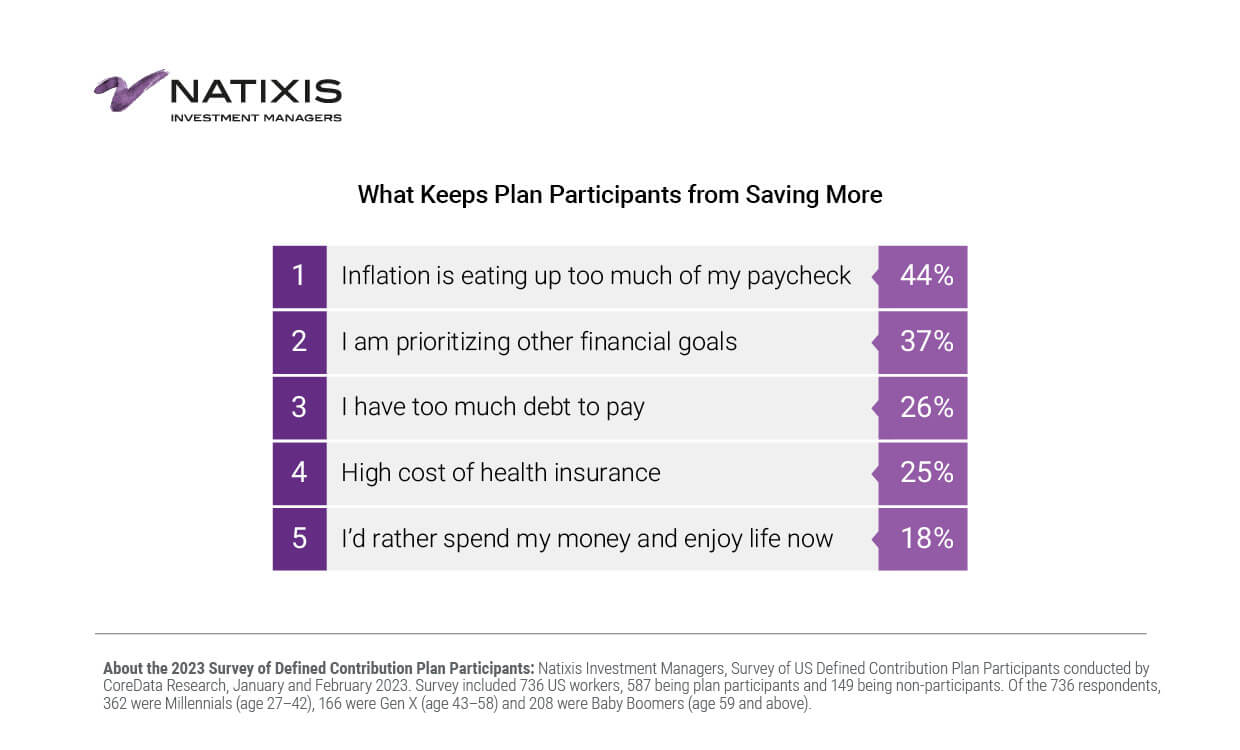

If the key to a financially secure retirement is to save big and start early, millennials are doing a lot right, in part because of provisions in retirement plan design, such as automatic enrollment of new employees, to help more American workers reach their retirement goals. A new survey by Natixis Investment Managers (Natixis IM) found that millennials started saving for retirement 11 years earlier in life than baby boomers did, and they are contributing a whopping 16% of their annual salaries toward it, on average.

By Natixis Investment Managers · Via Business Wire · April 18, 2023

Natixis Investment Managers today announced that funds managed by several of its affiliate investment management firms earned 2023 Refinitiv Lipper Fund Awards for the US. Funds managed by WCM Investment Management; AlphaSimplex Group; Loomis, Sayles & Company; and Harris Associates were recognized for achieving consistently strong risk-adjusted performance relative to their peers for the period ending November 30, 2022. Refinitiv announced award and certificate recipients on March 23, 2023, including the following from the Natixis Investment Managers mutual fund family:

By Natixis Investment Managers · Via Business Wire · March 29, 2023

Eight out of ten (84%) top investment professionals believe the US economy already is in or will be in a recession this year, and 51% think the markets are underestimating how long it will last, according to survey findings published today by Natixis Investment Managers (Natixis IM). They see a policy error by the Federal Reserve as the biggest potential threat to the US economy. Yet their outlook for the markets is surprisingly optimistic, with a mostly bullish forecast for stocks (63%) and bonds (54%) in a year when actively managed investments are expected to shine.

By Natixis Investment Managers · Via Business Wire · February 14, 2023

In 2022, things got ugly for both the equity and fixed income markets. As inflation grew and interest rates rose in response to monetary policy tightening, stocks registered their worst year since 2008 and bonds failed in their role as diversifiers in traditional 60/40 portfolios. As a result, investors faced disappointing returns from mainstay investment portfolios.

By Natixis Investment Managers · Via Business Wire · January 11, 2023

Natixis Investment Managers (Natixis IM) celebrated its tenth year partnering with the John Winthrop Elementary School in Dorchester, Massachusetts, during the firm’s annual “Frosty’s Friends” holiday gift-giving event. Launched in 2012, the partnership between Natixis IM and Winthrop School was designed to provide direct, sustained impact and bolster the school’s efforts to enhance student education and improve learning environments through technology upgrades, facilities improvements, and special volunteer programs. Boston Public Schools Superintendent Mary Skipper joined Natixis IM employees for the milestone festivities that took place on Friday, December 16, at the school.

By Natixis Investment Managers · Via Business Wire · December 16, 2022

Institutional investors enter 2023 with a somber view of the economy and mixed outlook for the markets on expectations of even higher interest rates, inflation and volatility, according to new survey findings published today by Natixis Investment Managers (Natixis IM). The vast majority (85%) believe the economy is or will be in a recession next year, which 54% think is necessary to get inflation under control. However, most (65%) institutions think the bigger risk ahead is stagflation, or a period of negative GDP growth with entrenched inflation and spiralling unemployment. Given the stakes, institutions believe a central bank policy error is one of the biggest threats to the economy, second only to war.

By Natixis Investment Managers · Via Business Wire · December 7, 2022

Natixis Investment Managers Solutions is celebrating the 20-year anniversary of its AIA S&P 500® direct indexing strategy. Launched in November 2002, Active Index Advisors Strategies – the direct indexing business of Natixis Investment Managers Solutions – has grown from $4 million in assets under management (AUM) to nearly $8 billion today, and the flagship AIA S&P 500® strategy has tracked its benchmark index to within 12 basis points annualized since inception, outperforming on an after-tax basis by over 370 basis points on an average annualized basis.

By Natixis Investment Managers · Via Business Wire · November 10, 2022

Vaughan Nelson Investment Management (Vaughan Nelson), a registered investment adviser and affiliate of Natixis Investment Managers (Natixis IM), today announced that Stephen A. Davis will retire on March 31, 2023. Davis has been a member of Vaughan Nelson’s investment team since 2010 and co-manager of the Vaughan Nelson Small Cap Value Fund (NEJYX) since 2019.

By Natixis Investment Managers · Via Business Wire · October 21, 2022

2022 is proving a difficult year for many to retire. Americans have suffered steep losses in their 401(k)s and other retirement vehicles this year, calling into question underlying assumptions about saving, spending and investing. Even before the turmoil of this year, high net worth individuals (HNWIs) were concerned about their ability to retire securely. Data on U.S. investors with $1 million in investable assets from a survey conducted by Natixis Investment Managers (IM) suggests that wealthier individuals are preoccupied with their eventual ability to retire comfortably, even with $1 million or more in assets.

By Natixis Investment Managers · Via Business Wire · October 18, 2022

The United States slipped one spot to No. 18 out of 44 developed countries in the Natixis Investment Managers 2022 Global Retirement Index (GRI). The annual index, which marks its 10th anniversary this year, shows erosion in key factors affecting the financial security and material wellbeing of US retirees. In a year on track to be one of the worst on record to retire, the market downturn and sharp increase in food, gas, housing, and medications have hit retirees particularly hard. New market risks, namely inflation, low but rising interest rates, and ongoing volatility, will make it harder for retirees to make up for lost ground and calls for new thinking about retirement planning by savers.

By Natixis Investment Managers · Via Business Wire · September 13, 2022

After six months of navigating rising rates, inflation and geopolitical tensions, recession fears are on the rise for 2022, casting a long shadow over prospects for global economies and markets in the second half of the year. Results of a mid-year survey of 34 market strategists, portfolio managers, research analysts and economists at Natixis Investment Managers and 15 of its affiliated investment managers, as well as Natixis Corporate and Investment Banking, show that nearly a quarter (24%) believe a recession is inevitable in the second half of 2022, while 64% believe it is a distinct possibility. Nine in ten believe central bank policy will be the biggest market driver over the next six months.

By Natixis Investment Managers · Via Business Wire · July 20, 2022

Natixis Investment Managers (Natixis IM) today announced the US recipients of the Global Equal Opportunities Advancement Scholarship for 2022. Four local students have each been awarded $5,000 renewable scholarships to apply to college tuition and expenses, along with internship and mentoring opportunities at Natixis IM. Launched in 2020, the Global Equal Opportunities Advancement scholarship program supports Natixis IM’s broader efforts to increase diversity at the firm and within the financial services industry by attracting, inspiring and developing underrepresented groups to consider careers in financial services.

By Natixis Investment Managers · Via Business Wire · July 12, 2022

Natixis Investment Managers (Natixis IM) and Vaughan Nelson Investment Management (Vaughan Nelson), today celebrated the 10-year anniversary of the Vaughan Nelson Select Fund (VNSYX), an active, high-conviction equity mutual fund. The Fund is among the $14.7 billion managed by Vaughan Nelson, a Houston-based affiliate of Natixis IM, which has more than $1.3 trillion of assets under management (AUM) globally.

By Natixis Investment Managers · Via Business Wire · June 29, 2022

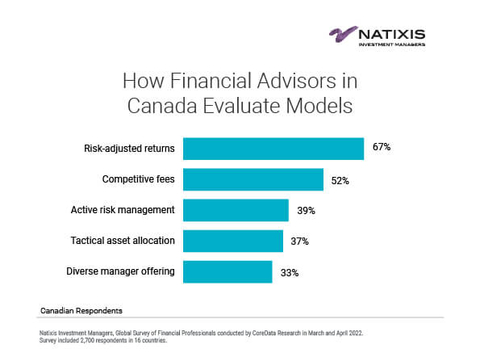

Financial advisors in Canada expect the markets to remain volatile in the second half of 2022, but they predict the S&P/TSX Composite Index to return 5.4% for the year and for the S&P 5002 to gain 4.2%, according to new survey findings published today by Natixis Investment Managers (Natixis IM). Their outlook for the U.S. stock market is decidedly bullish considering the steep losses year to date and triple dose of reality for investors – a simultaneous double-digit correction in stock and bond prices and the biggest rise in inflation in four decades.

By Natixis Investment Managers · Via Business Wire · June 28, 2022

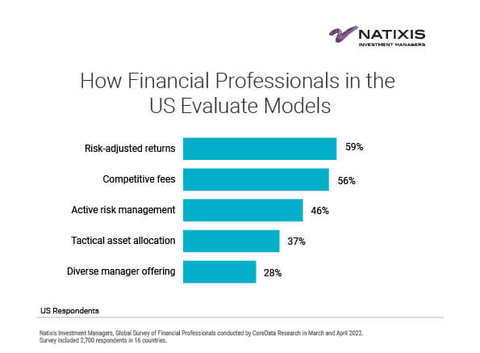

Financial advisors expect the markets to remain volatile in the second half of 2022, but they predict the S&P 5002 will ultimately post a gain of 4.4% for the year, according to new survey findings published today by Natixis Investment Managers (Natixis IM). Their outlook is decidedly bullish considering the staggering market losses year to date and a triple dose of reality for U.S. investors – a simultaneous double-digit correction in stock and bond prices and the biggest rise in inflation in four decades.

By Natixis Investment Managers · Via Business Wire · June 28, 2022

Financial advisors are looking to increase client assets under management (AUM) by 10% (median) this year, and with little of that likely to come from market performance, they are counting primarily on new assets from new clients to grow their business, according to findings from Natixis Investment Managers (IM) 2022 Survey of Financial Professionals, published today.

By Natixis Investment Managers · Via Business Wire · June 28, 2022

Natixis Investment Managers (Natixis IM) announced that Jim Cove, Senior Vice President in US Marketing and leader of the firm’s All Equals LGBTQ+ employee resource group (ERG) in the US, was recognized among LGBT Great’s first Top 100 Gamechangers. Individuals were recognized by LGBT Great for their consistent involvement in diversity, equity and inclusion work, and for inspiring others to bring awareness, respect and acceptance to members of the LGBT+ community within the finance industry.

By Natixis Investment Managers · Via Business Wire · June 6, 2022

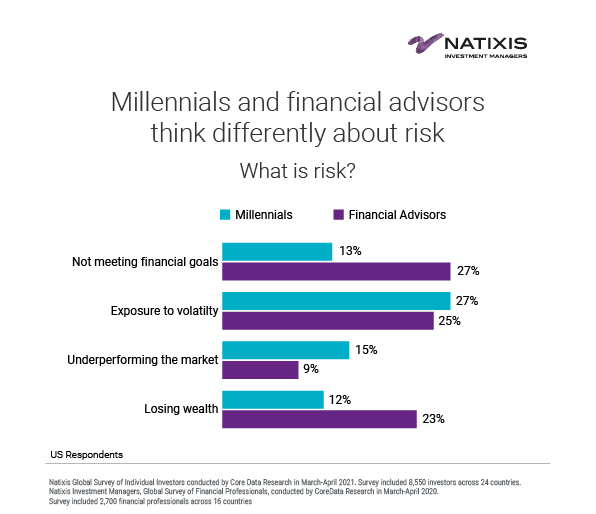

Millennials have grown up, and it turns out they are the financially disciplined, focused and responsible adults in the room, according to new survey findings published today by Natixis Investment Managers (Natixis IM). The oldest members of the generation born between 1981 and 1996 are now in their 40s, and they are entering their peak earning years with financial means and maturity that should bode well for them and an unexpected ally in their success: Financial advisors.

By Natixis Investment Managers · Via Business Wire · May 4, 2022

Natixis Investment Managers (Natixis IM) one of the world’s largest asset managers with €1,199.4 billion in AUM, has hired Mabrouk Chetouane as Head of Global Market Strategy, Solutions, International.

By Natixis Investment Managers · Via Business Wire · February 15, 2022

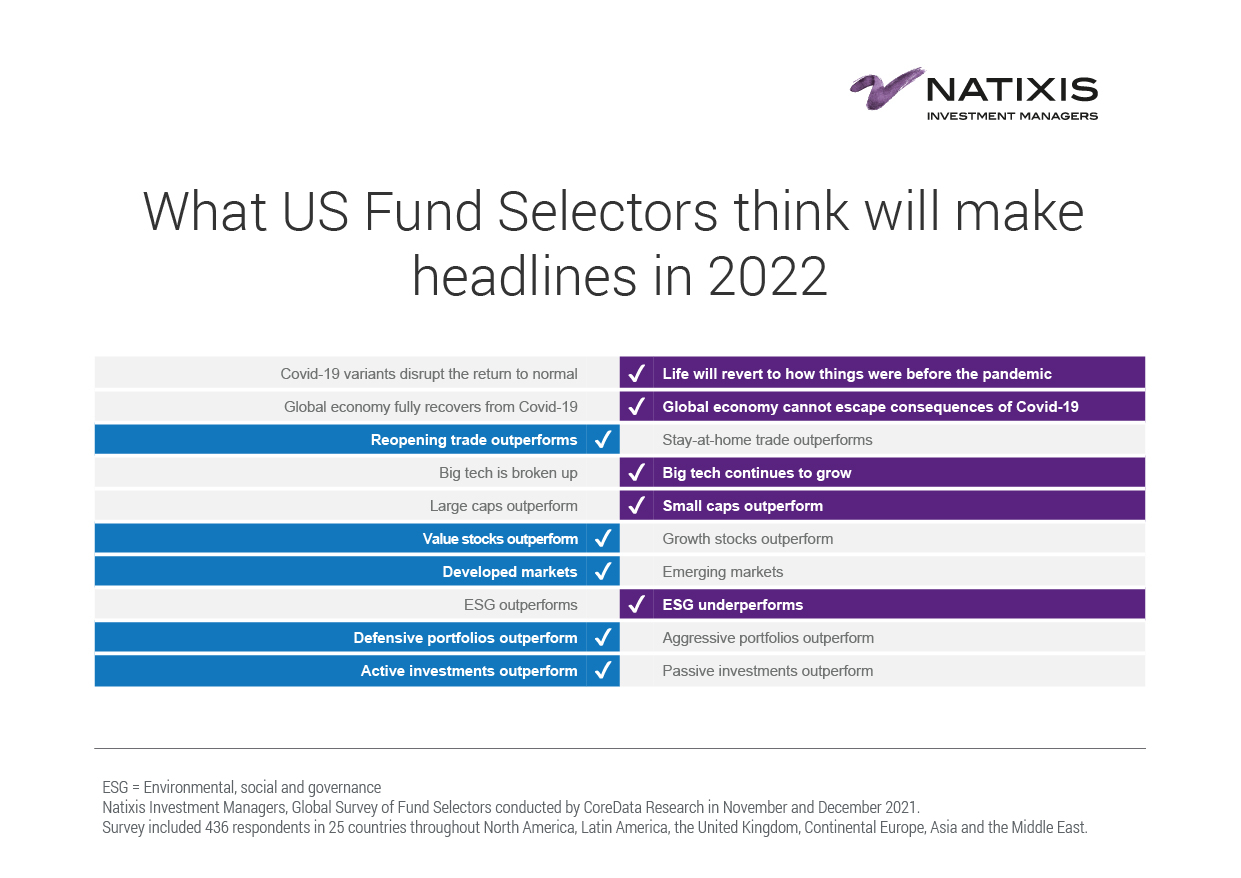

Eighty percent of the investment professionals responsible for fund selection and portfolio construction at leading US wealth management firms, private banks and wirehouses say that investors have taken on too much portfolio risk in a rate environment that has distorted stock values and decimated bond yields, according to new survey findings released today by Natixis Investment Managers. Sentiment from fund selectors reflects a shift in the market forces that drove stocks to record highs last year and now call for portfolio repositioning as the Federal Reserve starts raising rates, markets begin to normalize and the world learns to live with COVID.

By Natixis Investment Managers · Via Business Wire · February 8, 2022

Natixis Investment Managers (Natixis IM) today announced it has named Ron Taylor as an Executive Vice President and Head of Diversity, Equity and Inclusion (DEI) in the US, based in Boston. In this role, Taylor leads Natixis IM’s US DEI initiatives and also serves as a resource for Natixis IM’s affiliates in the region to support their DEI efforts. He reports to David Giunta, CEO of Natixis Investment Managers in the US, and was appointed to the US Executive Committee.

By Natixis Investment Managers · Via Business Wire · January 13, 2022

After closing out a third straight year of double-digit returns, the stock market’s continued rise has stalled out on investor concerns about potential monetary policy changes as inflationary pressures and COVID variants roil the economy’s nascent recovery. As a result, equity investors remain wary while income-seeking investors continue to search for yield.

By Natixis Investment Managers · Via Business Wire · January 13, 2022

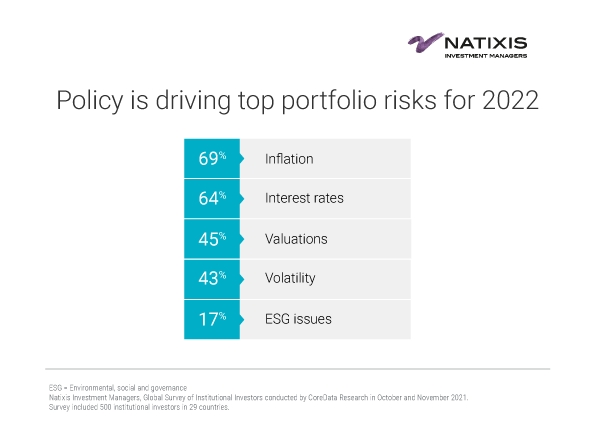

Institutional investors are heading confidently into 2022, armed with tactical allocation moves to counter their expectation of rising rates, lingering inflation and higher stock and bond market volatility, according to survey findings published today by Natixis Investment Managers (Natixis IM). Despite the threat of supply chain disruptions and ongoing COVID-19 concerns, institutional investors see plenty of growth potential in a market they say is driven and distorted by fiscal and monetary policies and which could spell trouble for unprepared individual investors.

By Natixis Investment Managers · Via Business Wire · December 8, 2021

Natixis Investment Managers (Natixis IM) today announced it is joining The Equity Collective, a new multi-year collaboration launched by Morgan Stanley designed to educate, empower and develop the next generation of diverse leaders in the finance industry. The program aligns with Natixis IM’s long-standing commitment to support its local communities and reinforces its broader efforts to increase diversity in the financial services industry.

By Natixis Investment Managers · Via Business Wire · November 23, 2021

Natixis Investment Managers (Natixis IM) today announced that Liana Magner has joined the firm as an Executive Vice President and Head of Retirement and Institutional in the US. She is a member of the US Executive Committee and reports to David Giunta, CEO of Natixis Investment Managers in the US. She joins the firm today and is based in Boston.

By Natixis Investment Managers · Via Business Wire · November 15, 2021

A majority (60%) of investors around the world reject the idea that companies are responsible only for creating value for shareholders, according to a survey of more than 8550 individual investors in 24 countries by Natixis Investment Managers (Natixis IM). The findings show that investors also expect accountability from companies for their impact on the environment and society, and they want to see more action from policymakers and the private sector, including fund managers.

By Natixis Investment Managers · Via Business Wire · November 9, 2021

Canada slipped two spots to No. 10 among developed nations in the 2021 Global Retirement Index (GRI), Natixis Investment Managers (Natixis IM) annual snapshot of the relative financial security of retirees in 44 countries. The ninth annual index shows that many Canadians feel that their retirement dreams are slipping away, notably as a result of the macro-economic consequences of the COVID-19 pandemic including increased government debt, rising inflation and persistently low interest rates. Savers are shouldering a growing share of the responsibility for funding their retirement and are increasingly looking to the private sector and financial advisors for help.

By Natixis Investment Managers · Via Business Wire · November 2, 2021

Natixis Investment Managers (Natixis IM) was recognized as a Diversity Champion in the InvestmentNews 2021 Excellence in Diversity, Equity and Inclusion Awards during the fourth annual summit and awards program that took place in New York on September 21, 2021. The recognition program aims to tell the story of firms and individuals using their success, leadership skills and willingness to implement and advocate for diversity and inclusion within the financial advisory industry.

By Natixis Investment Managers · Via Business Wire · October 4, 2021

The United States slipped one spot to No. 17 among developed nations in the 2021 Global Retirement Index (GRI), released today by Natixis Investment Managers (Natixis IM). The ninth annual index, a snapshot of the relative financial security of retirees in 44 countries, shows that many Americans feel that their retirement dreams are slipping away, notably as a result of the macro-economic consequences of the COVID-19 pandemic including increased government debt, rising inflation and persistently low interest rates. Savers are shouldering a growing share of the responsibility for funding their retirement and are increasingly looking to the private sector and financial advisors for help.

By Natixis Investment Managers · Via Business Wire · September 14, 2021

Natixis Investment Managers (Natixis) today announced that it has unified several sub-branded businesses related to direct indexing, overlay, and multi-asset portfolios along with its consulting business under a single division called “Natixis Investment Managers Solutions.” The combined business has $45 billion in assets under administration1 and will be led by co-heads Curt Overway and Marina Gross.

By Natixis Investment Managers · Via Business Wire · August 4, 2021

Natixis Investment Managers (Natixis IM) one of the world’s largest asset managers with €1,152.8* billion in AUM, has appointed Nathalie Wallace as Global Head of Sustainable Investing.

By Natixis Investment Managers · Via Business Wire · August 2, 2021

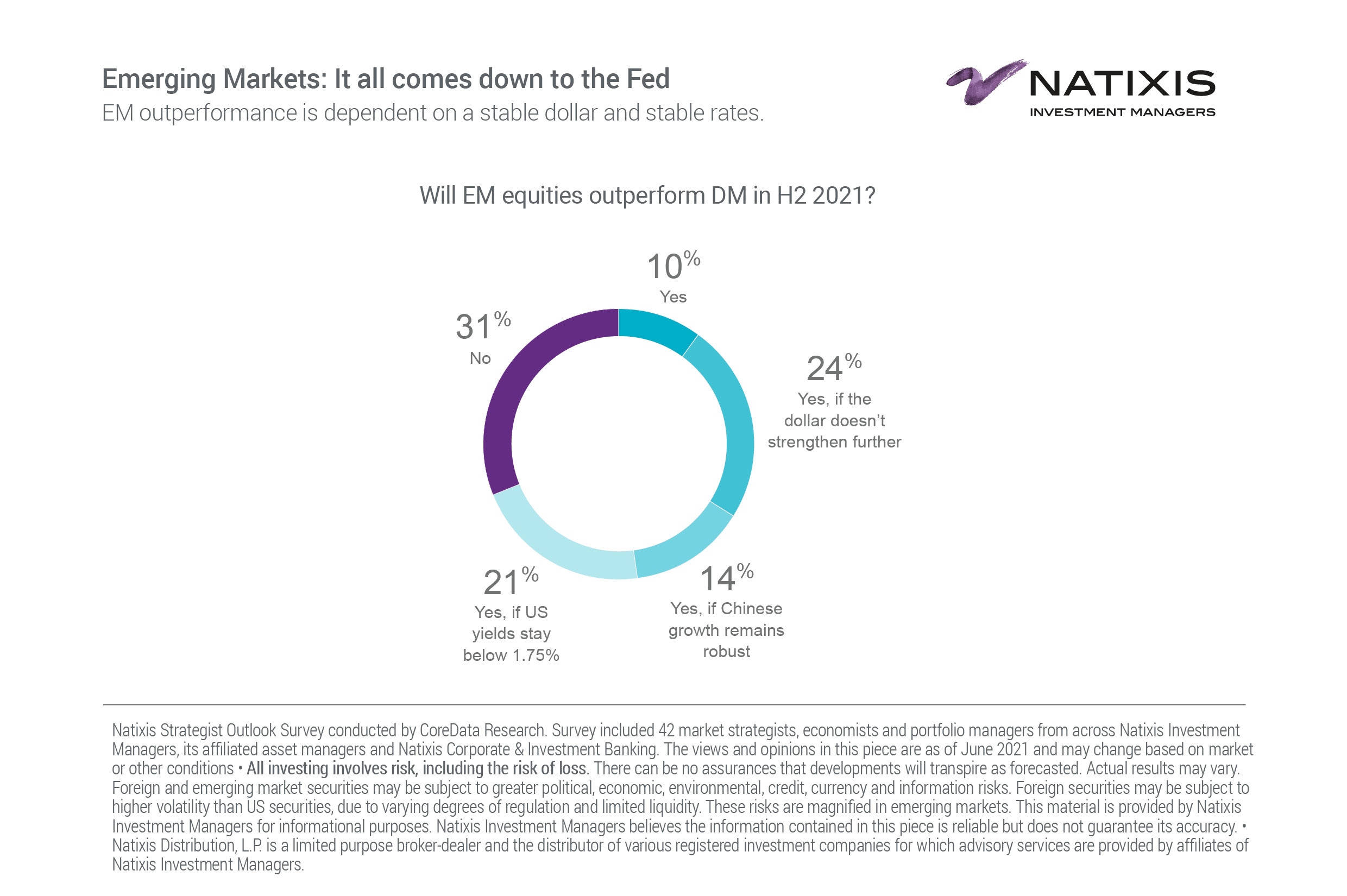

Results of a mid-year survey of 42 portfolio managers, strategists and economists representing Natixis Investment Managers (Natixis), 16 of its affiliated asset managers, and Natixis Corporate and Investment Banking show that even as the market considers the first real dose of inflation in 13 years, complacency may actually be the biggest risk facing investors.

By Natixis Investment Managers · Via Business Wire · July 20, 2021

Natixis Investment Managers (Natixis) today announced that it is partnering with the National Association of Plan Advisors (NAPA) on the launch of NAPA’s new certificate program designed to educate retirement plan advisors on how to evaluate investments in Environmental, Social, and Governance (ESG). Over the past few years, more and more investment professionals are incorporating ESG data into their investment process, and plan participants are showing a strong preference for choices that are sustainable, responsible or ESG driven. In fact, according to the Natixis 2019 Defined Contribution Plan Survey, 61% of retirement plan participants say ESG investments would make them more likely to contribute to their plan.

By Natixis Investment Managers · Via Business Wire · July 14, 2021

Natixis Investment Managers (Natixis) today announced that it is the Global Advisor and main sponsor of the Bloomberg Sustainable Business Summit, which will be held on July 13-14, 2021. The Bloomberg Sustainable Business Summit is a global series focused on bridging the gap between business leaders acting on their sustainability goals and investors incorporating Environmental, Social, and Governance (ESG) in their decision making process. This year’s Summit will be held as a two-day virtual event, with sessions that cross time zones, bringing together global voices from business, finance and government, to focus on the risks and opportunities for corporate executives and forward-thinking investors in a 21st-century economy.

By Natixis Investment Managers · Via Business Wire · July 13, 2021

Natixis Investment Managers (Natixis) is pleased to announce the first recipients of a global scholarship and development program focused on expanding the pipeline of diverse candidates within the financial services industry. Two high school graduates will receive up to $10,000 annually toward college tuition and expenses, along with internship opportunities and mentoring at Natixis. The Boston-based scholarships are the first awarded under Natixis’ global scholarship program, which is part of a broader strategic initiative to promote diversity at the firm and within the financial services industry.

By Natixis Investment Managers · Via Business Wire · July 1, 2021