Articles from Columbia Threadneedle Investments

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a first-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The first-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.1577% (4.63% annualized) of the Fund’s market price of $39.95 per share as of January 31, 2026.

By Columbia Threadneedle Investments · Via Business Wire · February 6, 2026

Columbia Threadneedle Investments today announced the launch of six new exchange-traded funds (ETFs), further expanding its differentiated range of actively managed and Research Enhanced strategies designed with the goal of outperforming traditional benchmarks. The additions to the firm’s lineup provide investors with targeted exposure to key segments of the equity and fixed income markets through transparent, efficient vehicles.

By Columbia Threadneedle Investments · Via Business Wire · December 15, 2025

Columbia Threadneedle Investments today announced that the Columbia Global Technology Growth Fund (CTCAX) is celebrating its 25-year anniversary. Since its inception in November 2000, the fund has delivered consistent long-term performance by investing in a globally diversified portfolio of technology companies that benefit from innovation, advancement, and disruption.

By Columbia Threadneedle Investments · Via Business Wire · November 25, 2025

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a fourth quarter distribution, that is beyond its typical quarterly managed distribution, in the total amount of $1.3280 per share of common stock (which includes the Fund’s typical quarterly $0.4625 per share distribution). A federal excise tax of 4% applies to funds that do not distribute substantially all of their annual income (including net gains) before the end of their fiscal year. The Fund’s income for the 2025 fiscal year exceeds the amounts previously distributed pursuant to the Fund’s quarterly managed distribution policy. The Fund is including this excess income – beyond the Fund’s typical quarterly distribution – in the fourth quarter distribution so that it will not incur the 4% federal excise tax in 2025.

By Columbia Threadneedle Investments · Via Business Wire · November 7, 2025

Columbia Threadneedle Investments and Long Run Partners (“Long Run”) today announced a partnership to invest in and programmatically securitize up to $1.5 billion of high-quality non-agency mortgage loans that Long Run will source. The collaboration will combine Long Run’s expertise as a leading non-agency mortgage platform with Columbia Threadneedle’s deep credit research capabilities.

By Columbia Threadneedle Investments · Via Business Wire · October 15, 2025

Columbia Threadneedle Investments today is celebrating Columbia EM Core ex-China ETF (NYSE Arca: XCEM) reaching its 10-year anniversary. Launched in 2015, XCEM was the first-ever broad-based emerging markets ETF to exclude exposure to China. Rated as a four-star fund by Morningstar, it has delivered stronger historical returns than broad emerging market benchmarks for a decade.

By Columbia Threadneedle Investments · Via Business Wire · September 26, 2025

Columbia Threadneedle Investments today announced that it has selected State Street Corporation as the service provider for a unified and outsourced global back office. State Street will provide fund accounting, administration and custody services for Columbia Threadneedle’s pooled funds, including ETFs, in the U.S. and Europe, drawing on State Street’s significant capabilities and broad industry experience.

By Columbia Threadneedle Investments · Via Business Wire · August 29, 2025

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a third-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The third-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.4871% (5.95% annualized) of the Fund’s market price of $31.10 per share as of July 31, 2025.

By Columbia Threadneedle Investments · Via Business Wire · August 8, 2025

Columbia Seligman Premium Technology Growth Fund, Inc. (the “Fund”) (NYSE: STK) today held its 15th Annual Meeting of Stockholders (the “Meeting”) in Minneapolis, Minnesota. Stockholders voted in favor of the recommendations of the Fund’s Board of Directors (the “Board”) on each of two proposals at the Meeting.

By Columbia Threadneedle Investments · Via Business Wire · June 24, 2025

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a second-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The second-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.6697% (6.68% annualized) of the Fund’s market price of $27.70 per share as of April 30, 2025.

By Columbia Threadneedle Investments · Via Business Wire · May 9, 2025

The Board of Directors (the Board) of Columbia Seligman Premium Technology Growth Fund, Inc. (the Fund) (NYSE: STK) today announced that the Fund’s 15th Annual Meeting of Stockholders will be held on June 24, 2025 (the Meeting) in Minneapolis, MN. The close of business on April 29, 2025 has been fixed by the Fund’s Board as the record date for the determination of Stockholders entitled to notice of, and to vote at, the Meeting or any postponement or adjournment thereof.

By Columbia Threadneedle Investments · Via Business Wire · March 31, 2025

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a first-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The first-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.4062% (5.62% annualized) of the Fund’s market price of $32.89 per share as of January 31, 2025.

By Columbia Threadneedle Investments · Via Business Wire · February 7, 2025

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a special fourth quarter distribution, beyond its typical quarterly managed distribution policy, in the amount of $3.2669 per share. A federal excise tax of 4% applies to funds that do not distribute substantially all of their annual income (including net gains) before the end of their fiscal year. The Fund’s income for the current fiscal year exceeds the amounts previously distributed pursuant to the Fund’s quarterly managed distribution policy. The Fund is distributing this excess income so that it will not incur the 4% federal excise tax in 2024.

By Columbia Threadneedle Investments · Via Business Wire · December 6, 2024

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a fourth-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The fourth-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.4131% (5.65% annualized) of the Fund’s market price of $32.73 per share as of October 31, 2024.

By Columbia Threadneedle Investments · Via Business Wire · November 8, 2024

Columbia Threadneedle Investments recently celebrated the five-year anniversary of its equity exchange-traded fund (ETF)—the Columbia Research Enhanced Core ETF (NYSE Arca: RECS). In the five years since its launch, RECS has attracted more than $1 billion in client assets due to consistently strong performance.

By Columbia Threadneedle Investments · Via Business Wire · October 21, 2024

Columbia Threadneedle Investments today announced the expansion of its exchange-traded fund (ETF) offerings with the launch of two actively managed, fully-transparent fixed income ETFs: the Columbia U.S. High Yield ETF (NYSE Arca: NJNK) and the Columbia Short Duration High Yield ETF (NYSE Arca: HYSD). Both ETFs draw on Columbia Threadneedle’s extensive high yield capabilities and are designed to provide investors and allocators with compelling investment options when building portfolios. Launching these strategies as ETFs addresses an increasing market demand for high current income in a low-cost, tax-efficient structure.

By Columbia Threadneedle Investments · Via Business Wire · September 12, 2024

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a third-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The third-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.3943% (5.58% annualized) of the Fund’s market price of $33.17 per share as of July 31, 2024.

By Columbia Threadneedle Investments · Via Business Wire · August 9, 2024

Columbia Seligman Premium Technology Growth Fund, Inc. (the “Fund”) (NYSE: STK) today held its 14th Annual Meeting of Stockholders (the “Meeting”) in Minneapolis, Minnesota. Stockholders voted in favor of the recommendations of the Fund’s Board of Directors (the “Board”) on each of two proposals at the Meeting.

By Columbia Threadneedle Investments · Via Business Wire · June 25, 2024

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a second-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The second-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.4929% (5.97% annualized) of the Fund’s market price of $30.98 per share as of April 30, 2024.

By Columbia Threadneedle Investments · Via Business Wire · May 3, 2024

The Board of Directors (the Board) of Columbia Seligman Premium Technology Growth Fund, Inc. (the Fund) (NYSE: STK) today announced that the Fund’s 14th Annual Meeting of Stockholders will be held on June 25, 2024 (the Meeting) in Minneapolis, MN. The close of business on April 16, 2024 has been fixed by the Fund’s Board as the record date for the determination of Stockholders entitled to notice of, and to vote at, the Meeting or any postponement or adjournment thereof.

By Columbia Threadneedle Investments · Via Business Wire · March 14, 2024

Columbia Threadneedle Investments today announced that the Columbia Ultra Short Term Bond Fund is celebrating its 20-year anniversary. Since inception, the fund has generated consistent long-term performance and provided daily NAV stability with minimal total return volatility.1

By Columbia Threadneedle Investments · Via Business Wire · March 12, 2024

Columbia Threadneedle Investments (“Columbia Threadneedle”) today announced that it has entered into a strategic investment agreement to grow its CLO platform with a consortium of investors arranged by Jefferies (“the Consortium”) that includes Columbia Threadneedle’s parent company, Ameriprise Financial.

By Columbia Threadneedle Investments · Via Business Wire · February 26, 2024

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a first-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The first-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.4270% (5.71% annualized) of the Fund’s market price of $32.41 per share as of January 31, 2024.

By Columbia Threadneedle Investments · Via Business Wire · February 9, 2024

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a special fourth quarter distribution, beyond its typical quarterly managed distribution policy, in the amount of $0.2669 per share. A federal excise tax of 4% applies to funds that do not distribute substantially all of their annual income (including net gains) before the end of their fiscal year. The Fund’s income for the current fiscal year exceeds the amounts previously distributed pursuant to the Fund’s quarterly managed distribution policy. The Fund is distributing this excess income so that it will not incur the 4% federal excise tax in 2023.

By Columbia Threadneedle Investments · Via Business Wire · December 8, 2023

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a fourth-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The fourth-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.8194% (7.28% annualized) of the Fund’s market price of $25.42 per share as of October 31, 2023.

By Columbia Threadneedle Investments · Via Business Wire · November 3, 2023

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a third-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The third-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.49% (5.96% annualized) of the Fund’s market price of $31.04 per share as of July 31, 2023.

By Columbia Threadneedle Investments · Via Business Wire · August 4, 2023

Columbia Threadneedle Investments today announced that the Columbia Seligman Technology and Information Fund (SLMCX) is celebrating its 40-year anniversary. The $9.1bn fund, which invests in technology-related stocks, has targeted long-term capital appreciation for shareholders since inception, and continues to deliver strong performance.1

By Columbia Threadneedle Investments · Via Business Wire · July 20, 2023

Columbia Seligman Premium Technology Growth Fund, Inc. (the “Fund”) (NYSE: STK) today held its 13th Annual Meeting of Stockholders (the “Meeting”) in Minneapolis, Minnesota. Stockholders voted in favor of the recommendations of the Fund’s Board of Directors (the “Board”) on each of two proposals at the Meeting.

By Columbia Threadneedle Investments · Via Business Wire · June 20, 2023

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a second-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The second-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.7238% (6.90% annualized) of the Fund’s market price of $26.83 per share as of April 30, 2023.

By Columbia Threadneedle Investments · Via Business Wire · May 5, 2023

Columbia Threadneedle Investments today announced the expansion of its exchange-traded fund (ETF) suite with the launch of the Columbia Research Enhanced Real Estate ETF (NYSE Arca: CRED). Designed for investors seeking a thoughtfully constructed and accessible way to gain exposure to the real estate sector, the strategy incorporates the firm’s research intensity and proprietary insights in real estate in a cost-effective vehicle.

By Columbia Threadneedle Investments · Via Business Wire · April 26, 2023

Columbia Threadneedle Investments today announced that the Columbia Overseas Value Fund (COSZX) is celebrating its 15-year anniversary. Since inception, the fund has generated consistent long-term performance for shareholders across market cycles.

By Columbia Threadneedle Investments · Via Business Wire · April 19, 2023

Columbia Threadneedle Investments today announced that two Columbia funds, the Columbia Dividend Income Fund and Columbia Global Technology Growth Fund, earned 2023 U.S. Refinitiv Lipper Fund Awards. The awards evaluate funds for outperformance versus peers in their respective Lipper classifications for periods ending November 30, 2022.

By Columbia Threadneedle Investments · Via Business Wire · March 27, 2023

The Board of Directors (the Board) of Columbia Seligman Premium Technology Growth Fund, Inc. (the Fund) (NYSE: STK) today announced that the Fund’s 13th Annual Meeting of Stockholders will be held on June 20, 2023 (the Meeting) in Minneapolis, MN. The close of business on April 11, 2023 has been fixed by the Fund’s Board as the record date for the determination of Stockholders entitled to notice of, and to vote at, the Meeting or any postponement or adjournment thereof.

By Columbia Threadneedle Investments · Via Business Wire · March 10, 2023

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a first-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The first-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.7225% (6.89% annualized) of the Fund’s market price of $26.85 per share as of January 31, 2023.

By Columbia Threadneedle Investments · Via Business Wire · February 3, 2023

Columbia Threadneedle Investments today announced that Melda Mergen, Global Head of Equities, has been recognized as one of the top women in asset management by DiversityQ as part of its 2022 U.S. Women in Asset Management Awards program.1 Melda was named a co-winner in the global equities category.

By Columbia Threadneedle Investments · Via Business Wire · December 7, 2022

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a special fourth quarter distribution, beyond its typical quarterly managed distribution policy, in the amount of $1.0819 per share. A federal excise tax of 4% applies to funds that do not distribute substantially all of their annual income (including net gains) before the end of their fiscal year. The Fund’s income for the current fiscal year exceeds the amounts previously distributed pursuant to the Fund’s quarterly managed distribution policy. The Fund is distributing this excess income so that it will not incur the 4% federal excise tax in 2022.

By Columbia Threadneedle Investments · Via Business Wire · December 2, 2022

Columbia Threadneedle Investments celebrated the three-year anniversary of two of its strategic beta equity exchange-traded funds (ETFs), the Columbia Research Enhanced Core ETF (NYSE Arca: RECS) and the Columbia Research Enhanced Value ETF (NYSE Arca: REVS).

By Columbia Threadneedle Investments · Via Business Wire · October 17, 2022

Columbia Threadneedle Investments announced that the Columbia Thermostat Fund has reached its 20-year anniversary. Since its inception, the fund has experienced strong long-term performance and currently ranks within the top quintile of Morningstar’s Tactical Allocation category for the 3-, 5- and 15-year periods ending September 30, 2022. Rated overall 5-stars by Morningstar,2 the Columbia Thermostat Fund is designed to provide shareholders with consistent total returns throughout various market environments.

By Columbia Threadneedle Investments · Via Business Wire · October 11, 2022

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a fourth-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The fourth-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.9944% (7.98% annualized) of the Fund’s market price of $23.19 per share as of September 30, 2022.

By Columbia Threadneedle Investments · Via Business Wire · October 7, 2022

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a third-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The third-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.507% (6.03% annualized) of the Fund’s market price of $30.69 per share as of July 31, 2022. With respect to the Fund’s second quarter distribution, note below there is a correction to the Fund’s cumulative total return (at NAV) of a share of the Fund’s common stock for the year-to-date period ended April 30, 2022.

By Columbia Threadneedle Investments · Via Business Wire · August 5, 2022

Columbia Seligman Premium Technology Growth Fund, Inc. (the “Fund”) (NYSE: STK) today held its 12th Annual Meeting of Stockholders (the “Meeting”) in Minneapolis, Minnesota. Stockholders voted in favor of the recommendations of the Fund’s Board of Directors (the “Board”) on each of two proposals at the Meeting.

By Columbia Threadneedle Investments · Via Business Wire · June 21, 2022

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a second-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The second-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.6401% (6.56% annualized) of the Fund’s market price of $28.20 per share as of April 30, 2022.

By Columbia Threadneedle Investments · Via Business Wire · May 6, 2022

Columbia Threadneedle Investments, a leading global asset manager, today announced its sponsorship of the Boston Triathlon, an event the firm has been a title sponsor of since 2016. Now in its 14th year, the Columbia Threadneedle Investments Boston Triathlon is a weekend-long event that will bring together athletes of all ages and abilities to compete in Olympic and sprint distance triathlons. Additional information on the race is available at BostonTri.com, and registration is now open.

By Columbia Threadneedle Investments · Via Business Wire · May 3, 2022

Columbia Threadneedle Investments today announced the expansion of its exchange-traded fund (ETF) offerings with the launch of its first actively managed, semi-transparent ETF, the Columbia Seligman Semiconductor and Technology ETF (NYSE Arca: SEMI). SEMI is a thematic, growth-focused technology strategy that will invest primarily in the securities of semiconductor, semiconductor equipment and related technology companies.

By Columbia Threadneedle Investments · Via Business Wire · March 30, 2022

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a first-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The first-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.3960% (5.58% annualized) of the Fund’s market price of $33.13 per share as of January 31, 2022.

By Columbia Threadneedle Investments · Via Business Wire · February 4, 2022

Columbia Threadneedle Investments today announced the selection of three innovative fintech start-ups for this year’s MassChallenge FinTech accelerator program. In working with these firms, Columbia Threadneedle, and its parent company Ameriprise Financial, hope to utilize new technologies in the areas of data analysis, data collection and automation.

By Columbia Threadneedle Investments · Via Business Wire · January 20, 2022

Columbia Threadneedle Investments today announced that the Columbia Select Mid Cap Value Fund has reached its 20-year anniversary. The five-star Morningstar-rated fund is ranked in the top quartile for the three-, five- and 10-year time periods, ending November 30, 2021. Additionally, the Columbia Select Mid Cap Value Fund received a Lipper Fund Award for its three-year performance, ending December 31, 2020. 1

By Columbia Threadneedle Investments · Via Business Wire · December 15, 2021

William Davies, Deputy Global Chief Investment Officer at Columbia Threadneedle Investments, outlines his outlook for 2022:

By Columbia Threadneedle Investments · Via Business Wire · December 7, 2021

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a special fourth quarter distribution, beyond its typical quarterly managed distribution policy, in the amount of $1.2869 per share. A federal excise tax of 4% applies to funds that do not distribute substantially all of their annual income (including net gains) before the end of their fiscal year. The Fund’s income for the current fiscal year exceeds the amounts previously distributed pursuant to the Fund’s quarterly managed distribution policy. The Fund is distributing this excess income so that it will not incur the 4% federal excise tax in 2021.

By Columbia Threadneedle Investments · Via Business Wire · December 3, 2021

Columbia Threadneedle Investments today announced that the Columbia Multi-Sector Municipal Income ETF (NYSE Arca: MUST), an innovative municipal income strategic beta ETF, reached its three-year anniversary on October 11, 2021. MUST’s consistently strong performance has earned it a five-star Overall Morningstar Rating1. The fund is also rated a Gold Medal Fund by Morningstar’s Quantitative Ratings.

By Columbia Threadneedle Investments · Via Business Wire · November 9, 2021

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a fourth-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The fourth-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.2966% (5.19% annualized) of the Fund’s market price of $35.67 per share as of October 31, 2021.

By Columbia Threadneedle Investments · Via Business Wire · November 5, 2021

Columbia Threadneedle Investments today announced that two of its institutional investment strategies were recognized as 2021 Pension Bridge Institutional Asset Management Award winners for strong performance, innovation and excellence in their respective categories. The Columbia Seligman Global Technology Strategy won Active Global Equity Strategy of the Year and the Columbia Multi-Sector Fixed Income Strategy won Active Global Fixed Income Strategy of the Year.

By Columbia Threadneedle Investments · Via Business Wire · October 11, 2021

Columbia Threadneedle Investments today announced the expansion of its strategic beta fixed income exchange-traded fund (ETF) offerings with the launch of Columbia Short Duration Bond ETF (NYSE Arca: SBND), a short-duration bond strategy focused on generating income in four segments of the debt markets. SBND tracks the firm’s proprietary Beta Advantage® Short Term Bond Index, which provides a rules-based approach to investing that is diversified and weighted toward opportunity rather than indebtedness.

By Columbia Threadneedle Investments · Via Business Wire · September 21, 2021

Columbia Threadneedle Investments today announced that Catherine Stienstra, Head of Municipal Bond Investments and Senior Portfolio Manager, has been recognized as one of the top women in asset management by Bonhill Group as part of its 2021 U.S. Women in Asset Management Awards program.1 Catherine was named a winner in the bond manager category where she was short-listed alongside nine other finalists.

By Columbia Threadneedle Investments · Via Business Wire · September 14, 2021

Columbia Threadneedle Investments today announced that the Columbia Acorn European Fund has reached its 10-year anniversary. Since its inception, the fund has outpaced its competition and is ranked as the top-performing fund of the decade in Morningstar’s Europe Stock category.

By Columbia Threadneedle Investments · Via Business Wire · September 8, 2021

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a third-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The third-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.37% (5.48% annualized) of the Fund’s market price of $33.76 per share as of July 31, 2021.

By Columbia Threadneedle Investments · Via Business Wire · August 6, 2021

Columbia Threadneedle Investments today announced that the Columbia Flexible Capital Income Fund has reached its 10-year anniversary. Since its inception a decade ago, the fund has experienced outstanding long-term performance, as evidenced by its consistent top-decile ranking among peers, according to Morningstar, for the 1-year, 3-year, 5-year, and 10-year time periods ending July 31, 2021. Additionally, the Columbia Flexible Capital Income Fund (Institutional Share Class, CFIZX) is the number one performing fund in the Allocation--30% to 50% Equity category for the 10-year period, ending July 31, 2021. Rated overall 5-stars by Morningstar, the Columbia Flexible Capital Income Fund is designed to provide shareholders with meaningful current income and long-term capital appreciation.

By Columbia Threadneedle Investments · Via Business Wire · August 4, 2021

Columbia Threadneedle Investments today announced that, as part of a planned transition, Melda Mergen, Deputy Global Head of Equities, will succeed William Davies as Global Head of Equities on October 1, 2021. As previously announced, Mr. Davies will assume the role of Global Chief Investment Officer in January 2022 when current Global CIO Colin Moore retires from the firm. Ms. Mergen will continue to report to Mr. Davies when she assumes her new role.

By Columbia Threadneedle Investments · Via Business Wire · July 15, 2021

Columbia Threadneedle Investments, a leading global asset manager, today announced the retirement of Colin Moore from Columbia Threadneedle as global chief investment officer after nearly 20 years at the firm. Consistent with the company’s long-standing succession planning, William Davies, currently EMEA CIO and global head of equities, will become global CIO upon Mr. Moore’s retirement in January 2022.

By Columbia Threadneedle Investments · Via Business Wire · June 30, 2021

Columbia Seligman Premium Technology Growth Fund, Inc. (the “Fund”) (NYSE: STK) today virtually held its 11th Annual Meeting of Stockholders (the “Meeting”). Stockholders voted in favor of the recommendations of the Fund’s Board of Directors (the “Board”) on each of two proposals at the Meeting.

By Columbia Threadneedle Investments · Via Business Wire · June 11, 2021

Today, Columbia Seligman Premium Technology Growth Fund, Inc. (NYSE: STK) (the Fund) declared a second-quarter distribution, pursuant to its managed distribution policy, in the amount of $0.4625 per share, which is equal to a quarterly rate of 2.3125% (9.25% annualized) of the $20.00 offering price in the Fund’s initial public offering in November 2009. The second-quarter distribution of $0.4625 per share is equal to a quarterly rate of 1.3704% (5.48% annualized) of the Fund’s market price of $33.75 per share as of April 30, 2021.

By Columbia Threadneedle Investments · Via Business Wire · May 7, 2021

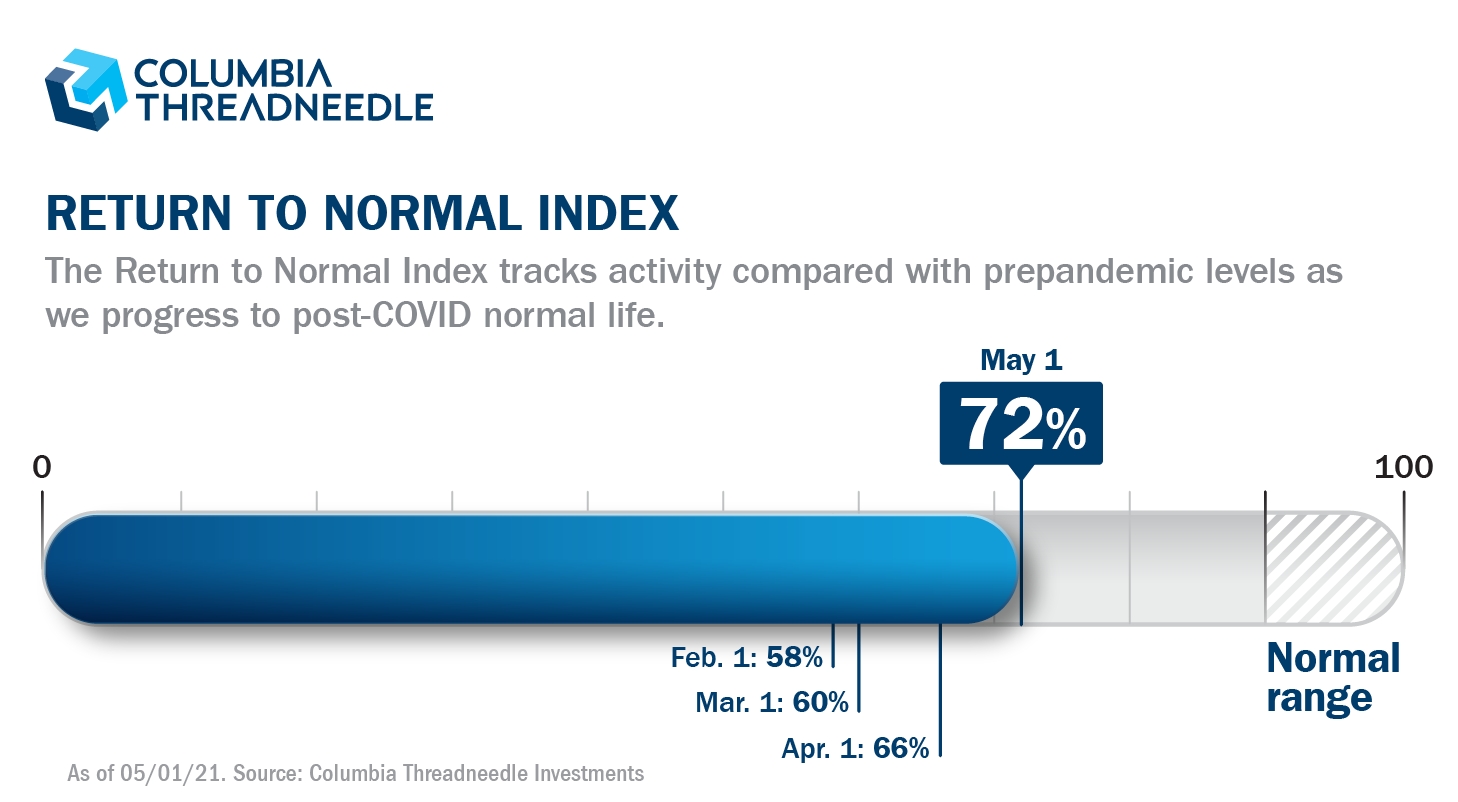

Columbia Threadneedle Investments today announced its Return to Normal Index rose to 72% as of May 1, 2021, reflecting a meaningful rise from 58% at the beginning of the year. The index tracks and measures activity data in the U.S. including travel, return to work and school, brick-and-mortar shopping and eating out, relative to pre-pandemic levels. It is constructed by the firm’s data scientists and fundamental research analysts to help augment investment decision making. Much of what’s driving this month’s data can be attributed to expanded vaccination eligibility, school re-openings, return to work, improving weather, and states lifting restrictions on activities like indoor dining.

By Columbia Threadneedle Investments · Via Business Wire · May 3, 2021

Columbia Threadneedle Investments today announced that assets in the Columbia Diversified Fixed Income Allocation ETF (NYSE Arca: DIAL), the industry’s first strategic beta multi-sector fixed income ETF, have surpassed $1 billion.

By Columbia Threadneedle Investments · Via Business Wire · April 28, 2021

Columbia Threadneedle Investments today announced that the Columbia Adaptive Retirement Series, a suite of nine risk-balanced target date funds, has reached its three-year anniversary.

By Columbia Threadneedle Investments · Via Business Wire · April 20, 2021