Health insurance company Oscar Health (NYSE:OSCR) fell short of the market’s revenue expectations in Q2 CY2025, but sales rose 29% year on year to $2.86 billion. Its GAAP loss of $0.89 per share was in line with analysts’ consensus estimates.

Is now the time to buy Oscar Health? Find out by accessing our full research report, it’s free.

Oscar Health (OSCR) Q2 CY2025 Highlights:

- Revenue: $2.86 billion vs analyst estimates of $2.97 billion (29% year-on-year growth, 3.5% miss)

- EPS (GAAP): -$0.89 vs analyst estimates of -$0.88 (in line)

- Adjusted EBITDA: -$199.4 million vs analyst estimates of -$204.9 million (-7% margin, 2.7% beat)

- Operating Margin: -8%, down from 3.1% in the same quarter last year

- Free Cash Flow Margin: 17.5%, down from 22% in the same quarter last year

- Market Capitalization: $3.52 billion

“We believe the individual market has long-term upside and is the future of healthcare,” said Mark Bertolini, CEO of Oscar Health.

Company Overview

Founded in 2012 to simplify the notoriously complex American healthcare system, Oscar Health (NYSE:OSCR) is a technology-focused health insurance company that offers individual and small group health plans through its cloud-native platform.

Revenue Growth

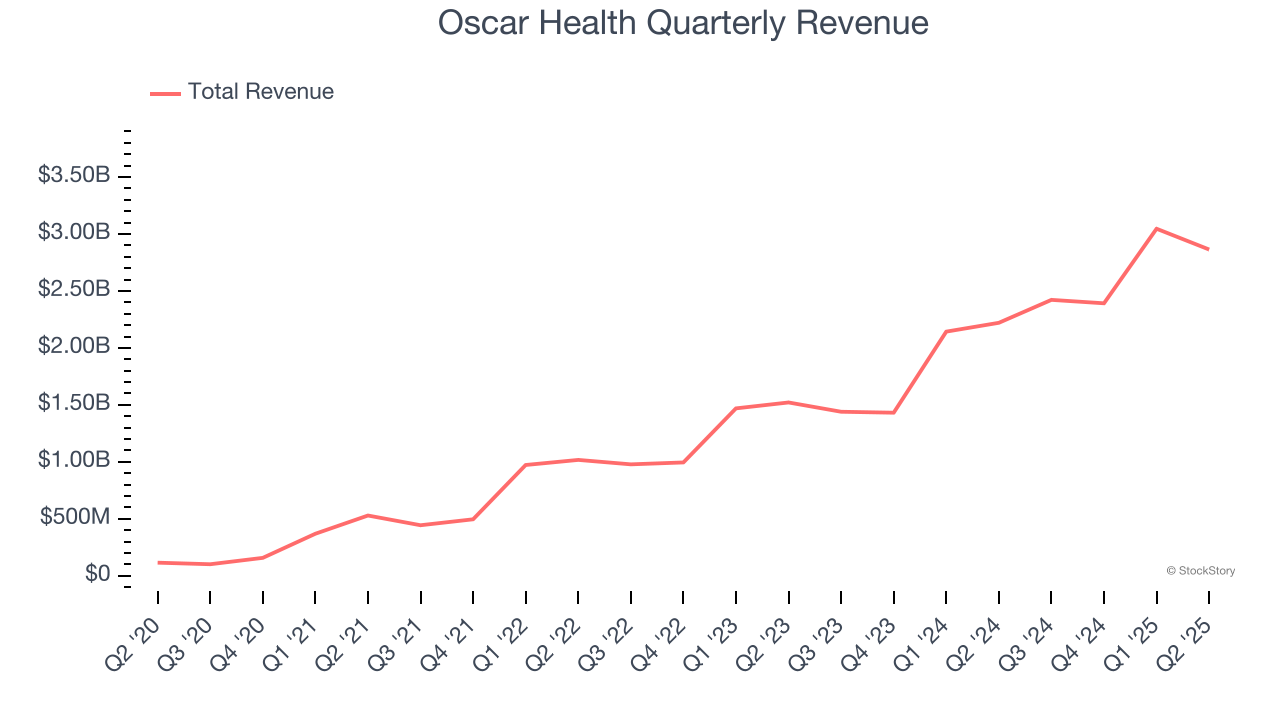

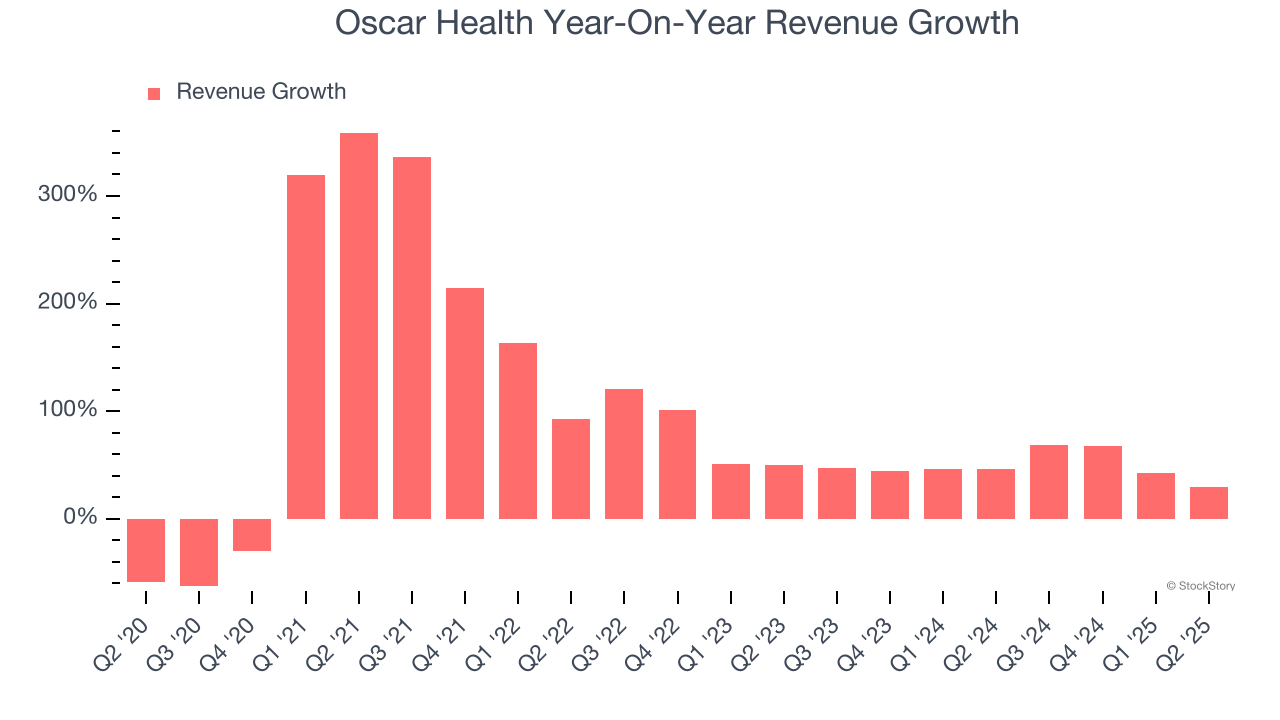

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Oscar Health’s sales grew at an incredible 72.3% compounded annual growth rate over the last five years. Its growth surpassed the average healthcare company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Oscar Health’s annualized revenue growth of 47% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Oscar Health generated an excellent 29% year-on-year revenue growth rate, but its $2.86 billion of revenue fell short of Wall Street’s high expectations.

Looking ahead, sell-side analysts expect revenue to grow 7.5% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is satisfactory given its scale and implies the market is forecasting success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

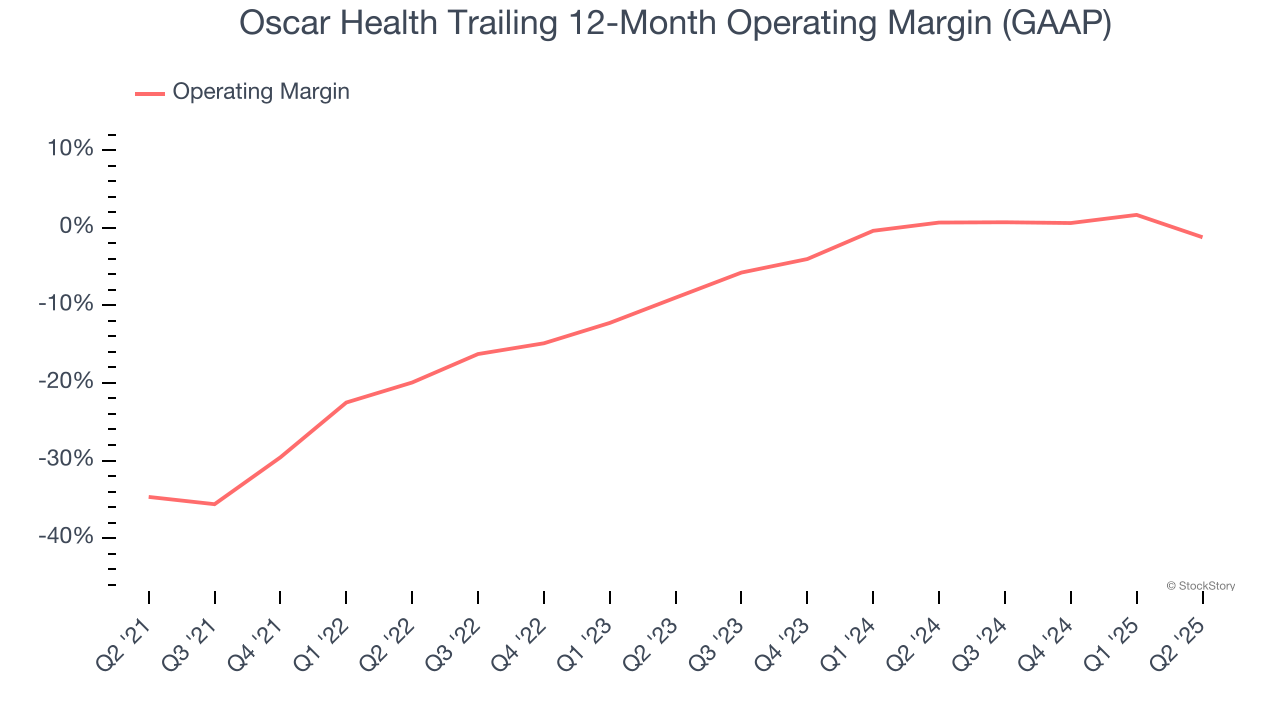

Oscar Health’s high expenses have contributed to an average operating margin of negative 5.6% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Oscar Health’s operating margin rose by 33.5 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 7.8 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

Oscar Health’s operating margin was negative 8% this quarter.

Earnings Per Share

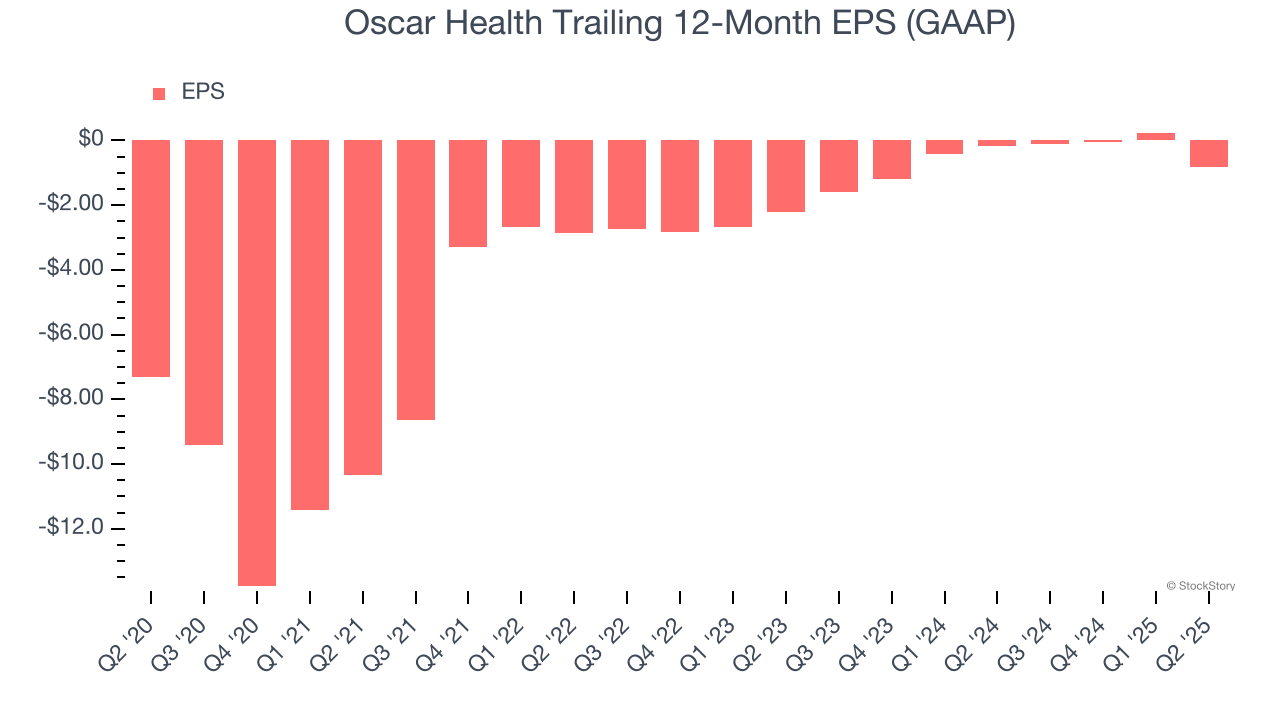

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Oscar Health’s full-year earnings are still negative, it reduced its losses and improved its EPS by 35.2% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

In Q2, Oscar Health reported EPS at negative $0.89, down from $0.18 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Oscar Health to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.83 will advance to negative $0.55.

Key Takeaways from Oscar Health’s Q2 Results

This was a mixed quarter as its revenue missed but its EBITDA beat. The stock traded up 2.3% to $14.13 immediately following the results.

So do we think Oscar Health is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.