Steel wire manufacturer Insteel (NYSE:IIIN) reported Q1 CY2025 results beating Wall Street’s revenue expectations, with sales up 26.1% year on year to $160.7 million. Its GAAP profit of $0.52 per share was 92.6% above analysts’ consensus estimates.

Is now the time to buy Insteel? Find out by accessing our full research report, it’s free.

Insteel (IIIN) Q1 CY2025 Highlights:

- Revenue: $160.7 million vs analyst estimates of $149.9 million (26.1% year-on-year growth, 7.2% beat)

- EPS (GAAP): $0.52 vs analyst estimates of $0.27 (92.6% beat)

- Adjusted EBITDA: $19.68 million vs analyst estimates of $12.51 million (12.2% margin, 57.2% beat)

- Operating Margin: 8.5%, up from 6.2% in the same quarter last year

- Free Cash Flow was -$5.54 million compared to -$580,000 in the same quarter last year

- Market Capitalization: $519.2 million

Company Overview

Growing from a small wire manufacturer to one of the largest in the U.S., Insteel (NYSE:IIIN) provides steel wire reinforcing products for concrete.

Commercial Building Products

Commercial building products companies, which often serve more complicated projects, can supplement their core business with higher-margin installation and consulting services revenues. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of commercial building products companies.

Sales Growth

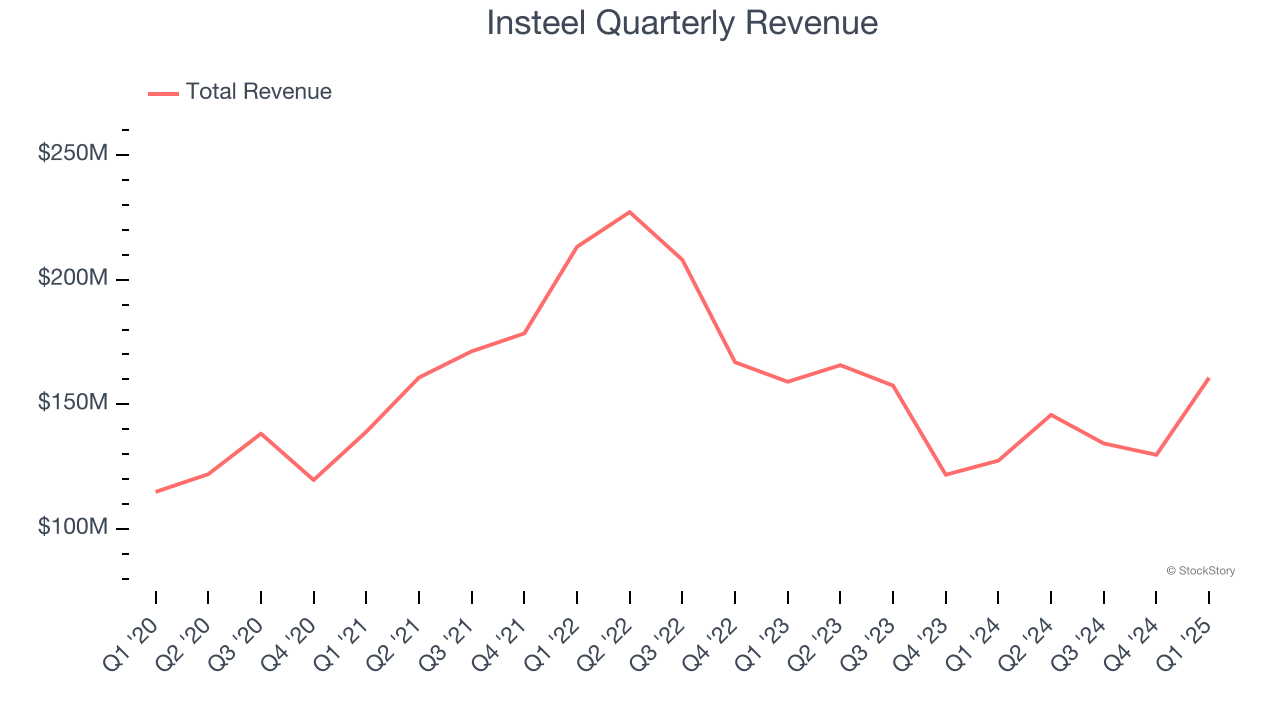

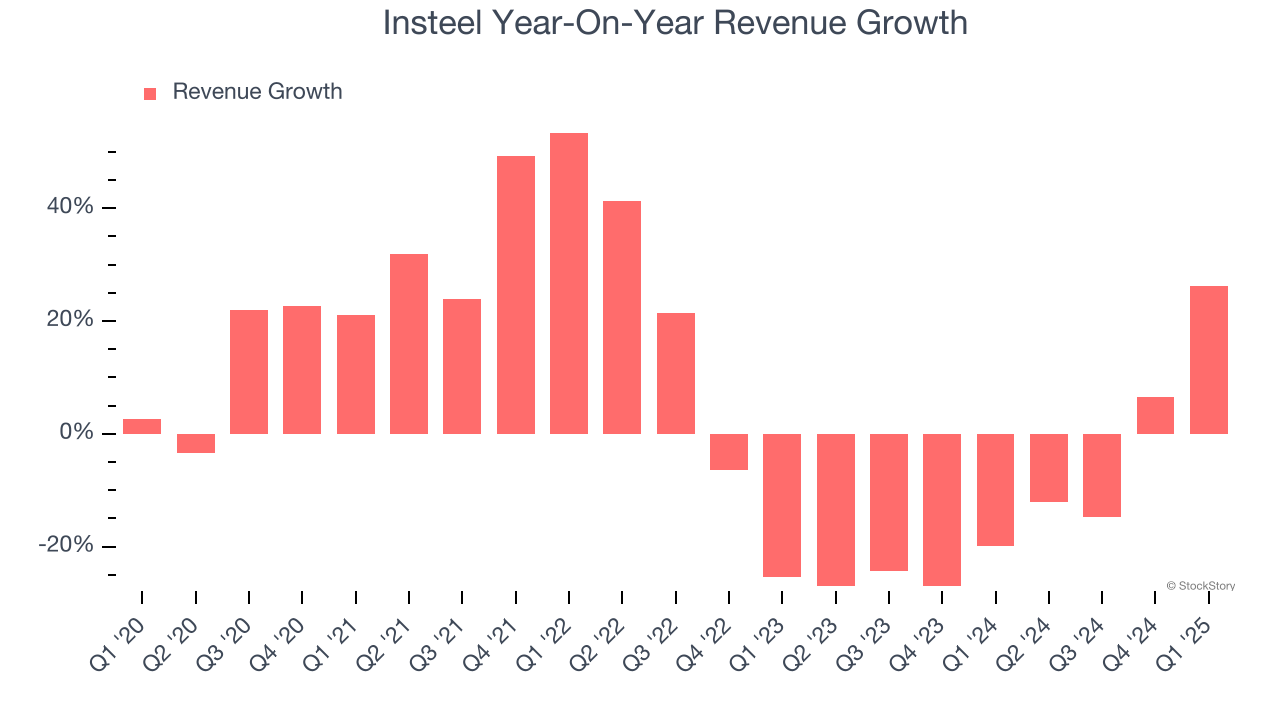

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Insteel grew its sales at a tepid 4.8% compounded annual growth rate. This was below our standard for the industrials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Insteel’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 13.4% annually. Insteel isn’t alone in its struggles as the Commercial Building Products industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Insteel reported robust year-on-year revenue growth of 26.1%, and its $160.7 million of revenue topped Wall Street estimates by 7.2%.

Looking ahead, sell-side analysts expect revenue to grow 12.9% over the next 12 months, an improvement versus the last two years. This projection is healthy and implies its newer products and services will fuel better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

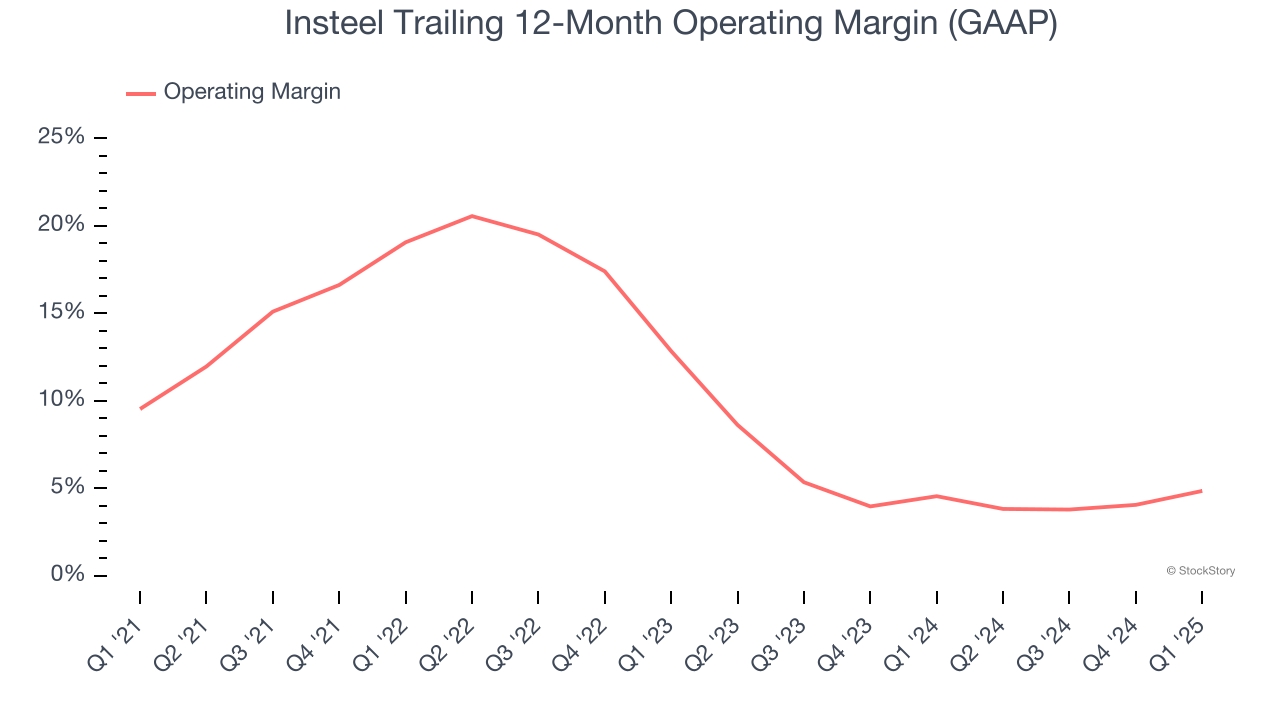

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Insteel has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.8%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Insteel’s operating margin decreased by 4.7 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q1, Insteel generated an operating profit margin of 8.5%, up 2.4 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Earnings Per Share

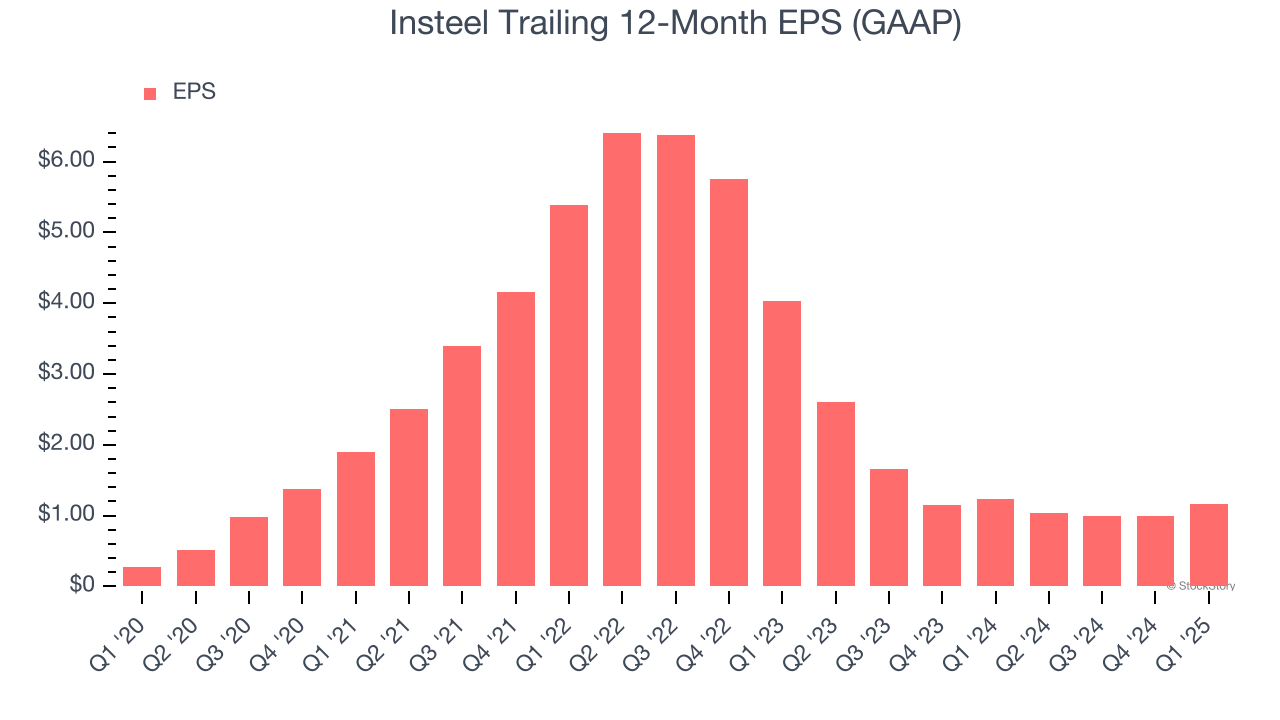

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Insteel’s EPS grew at an astounding 32.9% compounded annual growth rate over the last five years, higher than its 4.8% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t expand and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Insteel, its two-year annual EPS declines of 46.3% mark a reversal from its (seemingly) healthy five-year trend. We hope Insteel can return to earnings growth in the future.

In Q1, Insteel reported EPS at $0.52, up from $0.35 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Insteel’s full-year EPS of $1.16 to grow 69%.

Key Takeaways from Insteel’s Q1 Results

We were impressed by how significantly Insteel blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 4.9% to $28 immediately following the results.

Indeed, Insteel had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.