Let’s dig into the relative performance of Anheuser-Busch (NYSE:BUD) and its peers as we unravel the now-completed Q4 beverages, alcohol, and tobacco earnings season.

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

The 16 beverages, alcohol, and tobacco stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was 0.6% below.

In light of this news, share prices of the companies have held steady as they are up 3.7% on average since the latest earnings results.

Best Q4: Anheuser-Busch (NYSE:BUD)

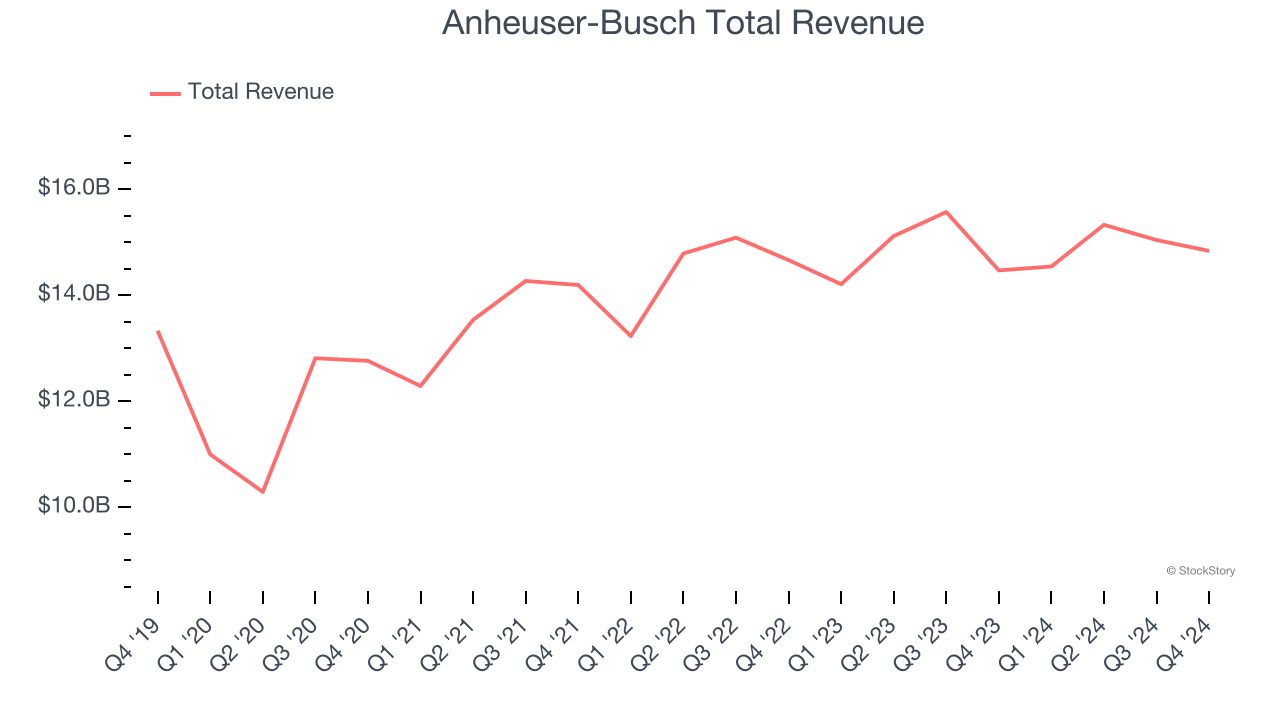

Born out of a complicated web of mergers and acquisitions, Anheuser-Busch InBev (NYSE:BUD) boasts a powerhouse beer portfolio of Budweiser, Stella Artois, Corona, and local favorites around the world.

Anheuser-Busch reported revenues of $14.84 billion, up 2.5% year on year. This print exceeded analysts’ expectations by 5.5%. Overall, it was a stunning quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Interestingly, the stock is up 18.5% since reporting and currently trades at $64.88.

Is now the time to buy Anheuser-Busch? Access our full analysis of the earnings results here, it’s free.

Celsius (NASDAQ:CELH)

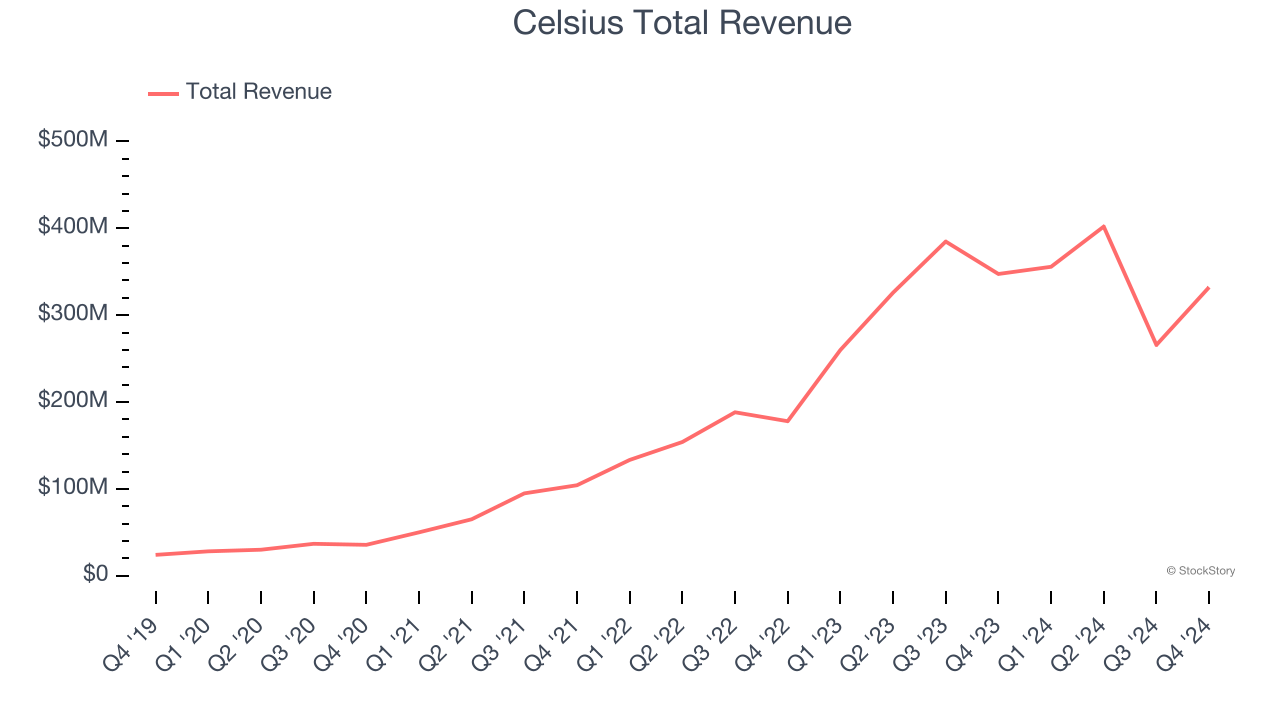

With its proprietary MetaPlus formula as the basis for key products, Celsius (NASDAQ:CELH) offers energy drinks that feature natural ingredients to help in fitness and weight management.

Celsius reported revenues of $332.2 million, down 4.4% year on year, outperforming analysts’ expectations by 2.7%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 44.7% since reporting. It currently trades at $36.91.

Is now the time to buy Celsius? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Boston Beer (NYSE:SAM)

Known for its flavorful beverages challenging the status quo, Boston Beer (NYSE:SAM) is a pioneer in craft brewing and a symbol of American innovation in the alcoholic beverage industry.

Boston Beer reported revenues of $402.3 million, up 2.2% year on year, exceeding analysts’ expectations by 2.4%. Still, it was a disappointing quarter as it posted full-year EPS guidance missing analysts’ expectations.

Interestingly, the stock is up 3.3% since the results and currently trades at $241.97.

Read our full analysis of Boston Beer’s results here.

Philip Morris (NYSE:PM)

Founded in 1847, Philip Morris International (NYSE:PM) manufactures and sells a wide range of tobacco and nicotine-containing products, including cigarettes, heated tobacco products, and oral nicotine pouches.

Philip Morris reported revenues of $9.71 billion, up 7.3% year on year. This print beat analysts’ expectations by 2.8%. It was a strong quarter as it also recorded a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ gross margin estimates.

The stock is up 23.1% since reporting and currently trades at $161.30.

Read our full, actionable report on Philip Morris here, it’s free.

Monster (NASDAQ:MNST)

Founded in 2002 as a natural soda and juice company, Monster Beverage (NASDAQ:MNST) is a pioneer of the energy drink category, and its Monster Energy brand targets a young, active demographic.

Monster reported revenues of $1.81 billion, up 4.7% year on year. This result surpassed analysts’ expectations by 0.7%. Zooming out, it was a slower quarter as it recorded a significant miss of analysts’ EBITDA estimates and a miss of analysts’ EPS estimates.

The stock is up 12.8% since reporting and currently trades at $58.56.

Read our full, actionable report on Monster here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.