Over the last six months, Jacobs Solutions shares have sunk to $117.99, producing a disappointing 16.5% loss - worse than the S&P 500’s 8.3% drop. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Jacobs Solutions, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why you should be careful with J and a stock we'd rather own.

Why Do We Think Jacobs Solutions Will Underperform?

With a workforce of approximately 45,000 professionals tackling complex challenges from water scarcity to cybersecurity, Jacobs Solutions (NYSE:J) provides engineering, consulting, and technical services focused on infrastructure, sustainability, and advanced technology solutions.

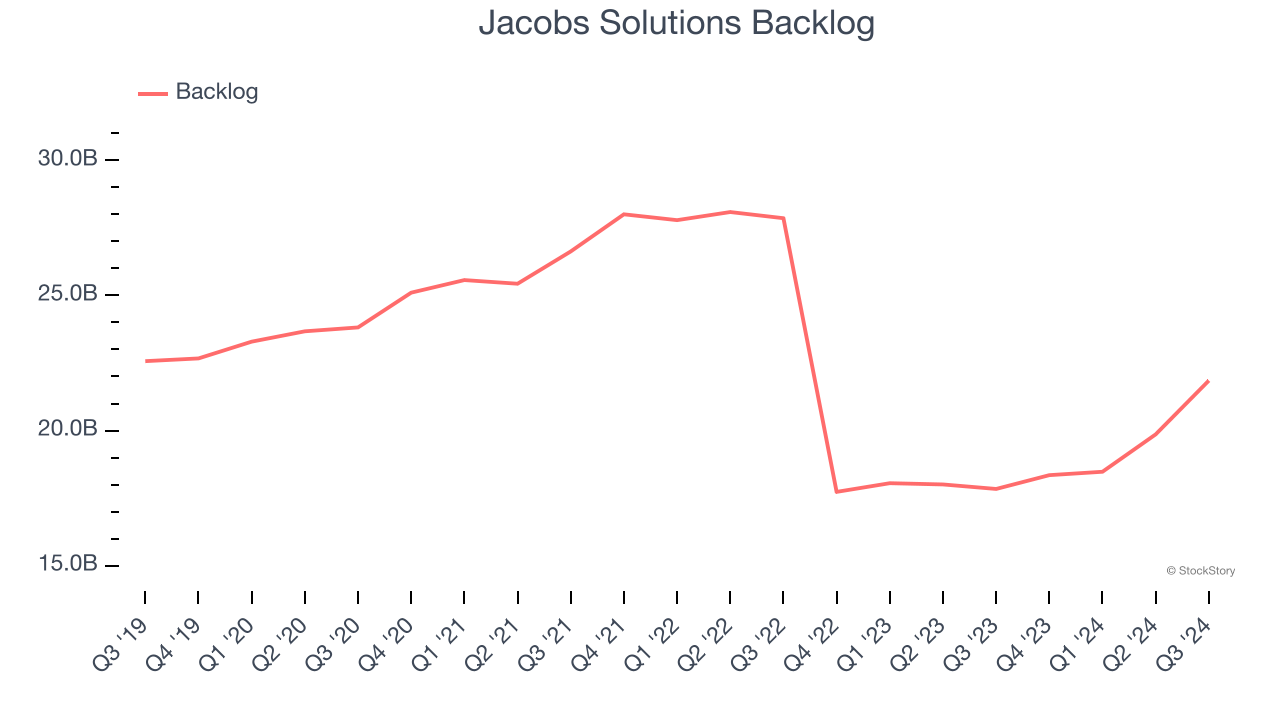

1. Backlog Declines as Orders Drop

In addition to reported revenue, backlog is a useful data point for analyzing Government & Technical Consulting companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Jacobs Solutions’s future revenue streams.

Jacobs Solutions’s backlog came in at $21.85 billion in the latest quarter, and it averaged 13.1% year-on-year declines over the last two years. This performance was underwhelming and shows the company is not winning new orders. It also suggests there may be increasing competition or market saturation.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Jacobs Solutions’s revenue to stall. Although this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

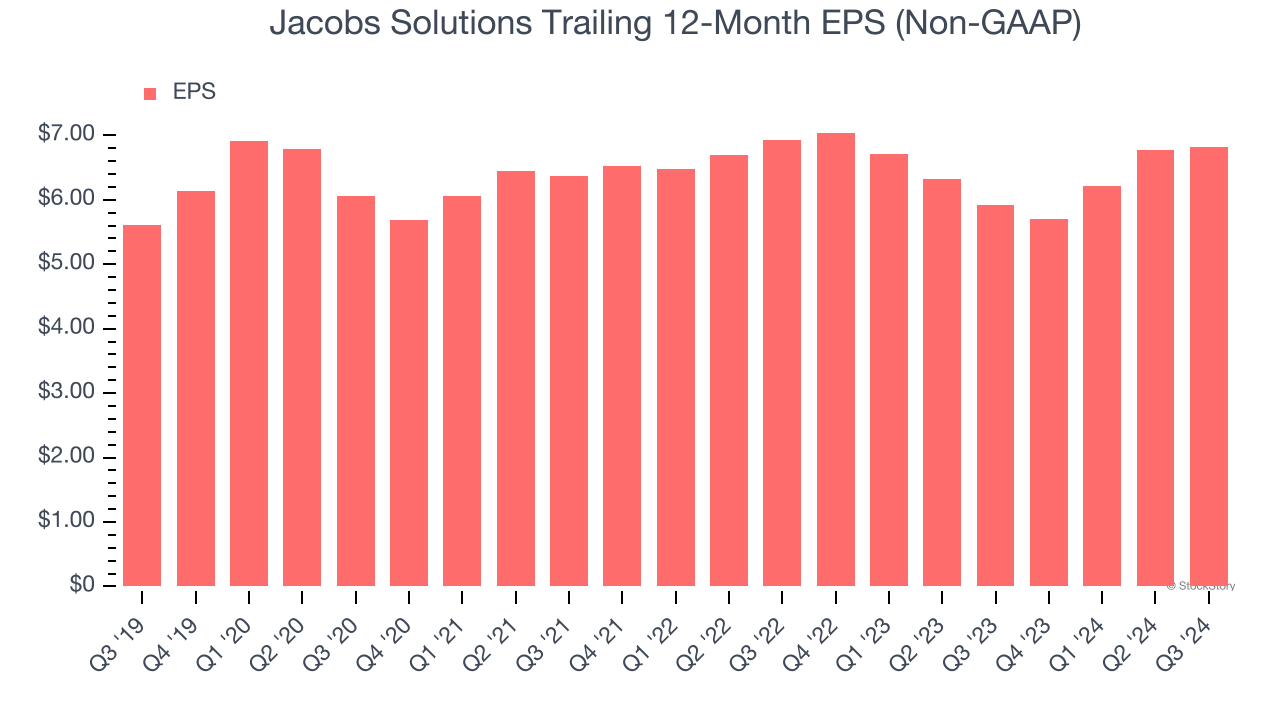

3. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Jacobs Solutions’s EPS grew at an unimpressive 4% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 2% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

Final Judgment

Jacobs Solutions falls short of our quality standards. After the recent drawdown, the stock trades at 19.6× forward price-to-earnings (or $117.99 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find better investment opportunities elsewhere. We’d suggest looking at one of our all-time favorite software stocks.

Stocks We Like More Than Jacobs Solutions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.