Since October 2024, ADP has been in a holding pattern, posting a small return of 2.6% while floating around $298.35. However, the stock is beating the S&P 500’s 8.4% decline during that period.

Is there still a buying opportunity in ADP, or does the price properly account for its business quality and fundamentals? Find out in our full research report, it’s free.

Why Does ADP Stock Spark Debate?

Processing one out of every six paychecks in the United States, ADP (NASDAQ:ADP) provides cloud-based human capital management solutions that help businesses manage payroll, benefits, talent acquisition, and HR administration.

Two Positive Attributes:

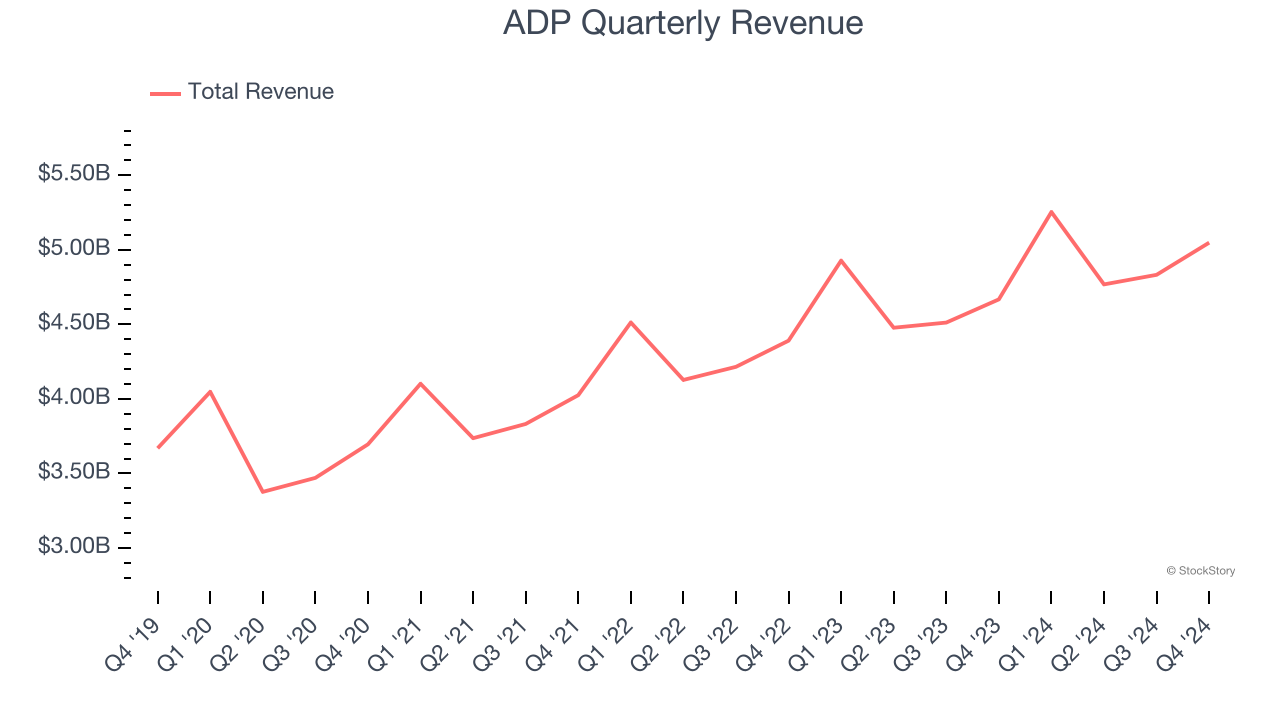

1. Long-Term Revenue Growth Shows Momentum

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, ADP’s sales grew at a decent 6.6% compounded annual growth rate over the last five years. Its growth was slightly above the average business services company and shows its offerings resonate with customers.

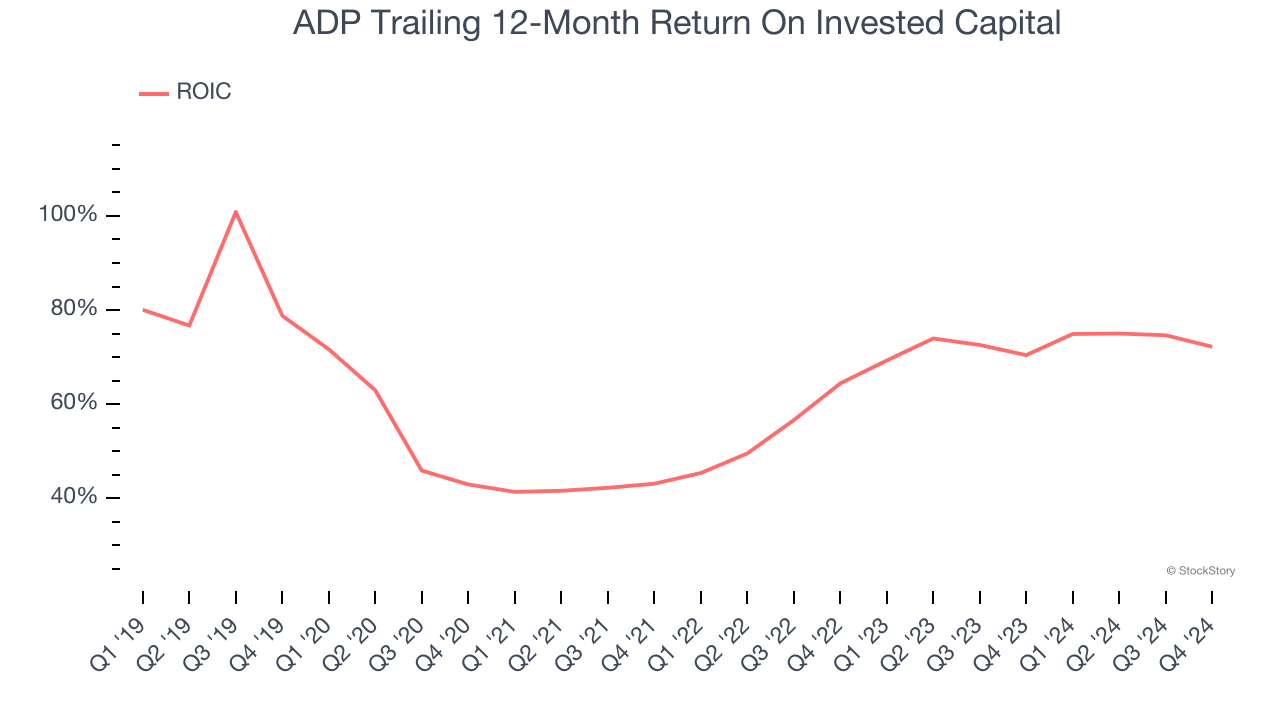

2. New Investments Bear Fruit as ROIC Jumps

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. ADP’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

One Reason to be Careful:

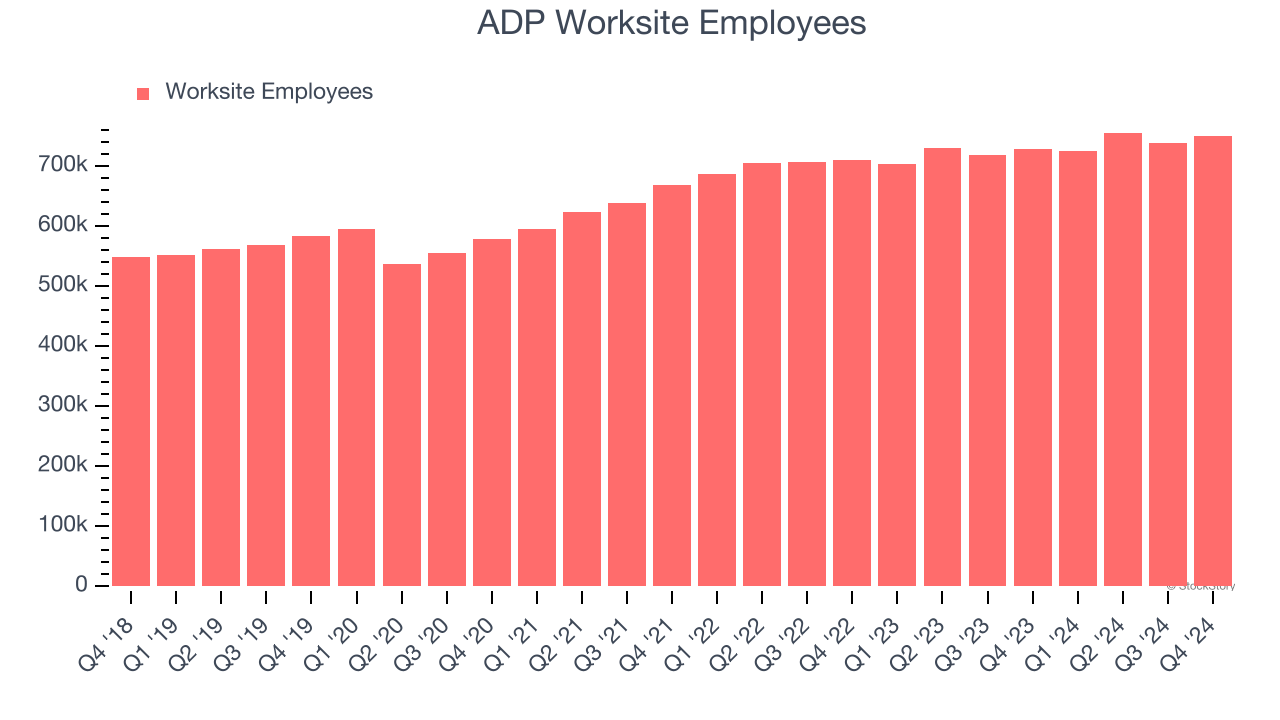

Weak Growth in Worksite Employees Points to Soft Demand

Revenue growth can be broken down into changes in price and volume (for companies like ADP, our preferred volume metric is worksite employees). While both are important, the latter is the most critical to analyze because prices have a ceiling.

ADP’s worksite employees came in at 751,000 in the latest quarter, and over the last two years, averaged 2.8% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

Final Judgment

ADP has huge potential even though it has some open questions, and with its recent outperformance in a weaker market environment, the stock trades at 28.8× forward price-to-earnings (or $298.35 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than ADP

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.