Health care services provider Encompass Health (NYSE:EHC) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 12.7% year on year to $1.41 billion. The company expects the full year’s revenue to be around $5.85 billion, close to analysts’ estimates. Its non-GAAP profit of $1.17 per share was 14.2% above analysts’ consensus estimates.

Is now the time to buy Encompass Health? Find out by accessing our full research report, it’s free.

Encompass Health (EHC) Q4 CY2024 Highlights:

- Revenue: $1.41 billion vs analyst estimates of $1.38 billion (12.7% year-on-year growth, 1.8% beat)

- Adjusted EPS: $1.17 vs analyst estimates of $1.02 (14.2% beat)

- Adjusted EBITDA: $289.6 million vs analyst estimates of $268.2 million (20.6% margin, 8% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $5.85 billion at the midpoint, in line with analyst expectations and implying 8.9% growth (vs 11.9% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $4.81 at the midpoint, beating analyst estimates by 0.9%

- EBITDA guidance for the upcoming financial year 2025 is $1.18 billion at the midpoint, in line with analyst expectations

- Free Cash Flow Margin: 13.6%, up from 7.5% in the same quarter last year

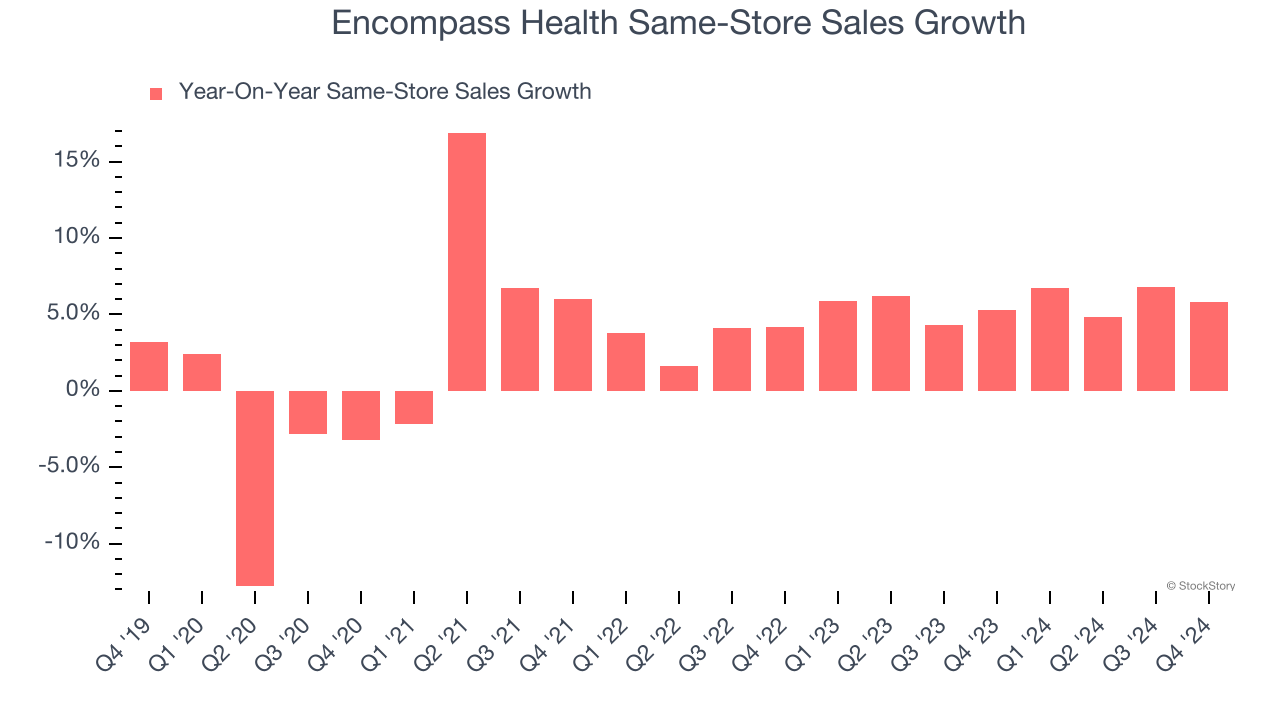

- Same-Store Sales rose 5.8% year on year, in line with the same quarter last year

- Market Capitalization: $10.3 billion

"The fourth quarter was a very strong finish to 2024," said President and Chief Executive Officer of Encompass Health Mark Tarr.

Company Overview

Founded in 1984, Encompass Health (NYSE:EHC) specializes in inpatient rehabilitation hospitals and home health care services.

Outpatient & Specialty Care

The outpatient and specialty care industry delivers targeted medical services in non-hospital settings that are often cost-effective compared to inpatient alternatives. This means that they are more desired as rising healthcare costs and ways to combat them become more and more top-of-mind. Outpatient and specialty care providers boast revenue streams that are stable due to the recurring nature of treatment for chronic conditions and long-term patient relationships. However, their reliance on government reimbursement programs like Medicare means stroke-of-the-pen risk. Additionally, scaling a network of facilities can be capital-intensive with uneven return profiles amind competition from integrated healthcare systems. Looking ahead, the industry is positioned to grow as demand for outpatient services expands, driven by aging populations, a rising prevalence of chronic diseases, and a shift toward value-based care models. Tailwinds include advancements in medical technology that support more complex procedures in outpatient settings and the increasing focus on preventive care, which can be aided by data and AI. However, headwinds such as reimbursement rate cuts, labor shortages, and the financial strain of digitization may temper growth.

Sales Growth

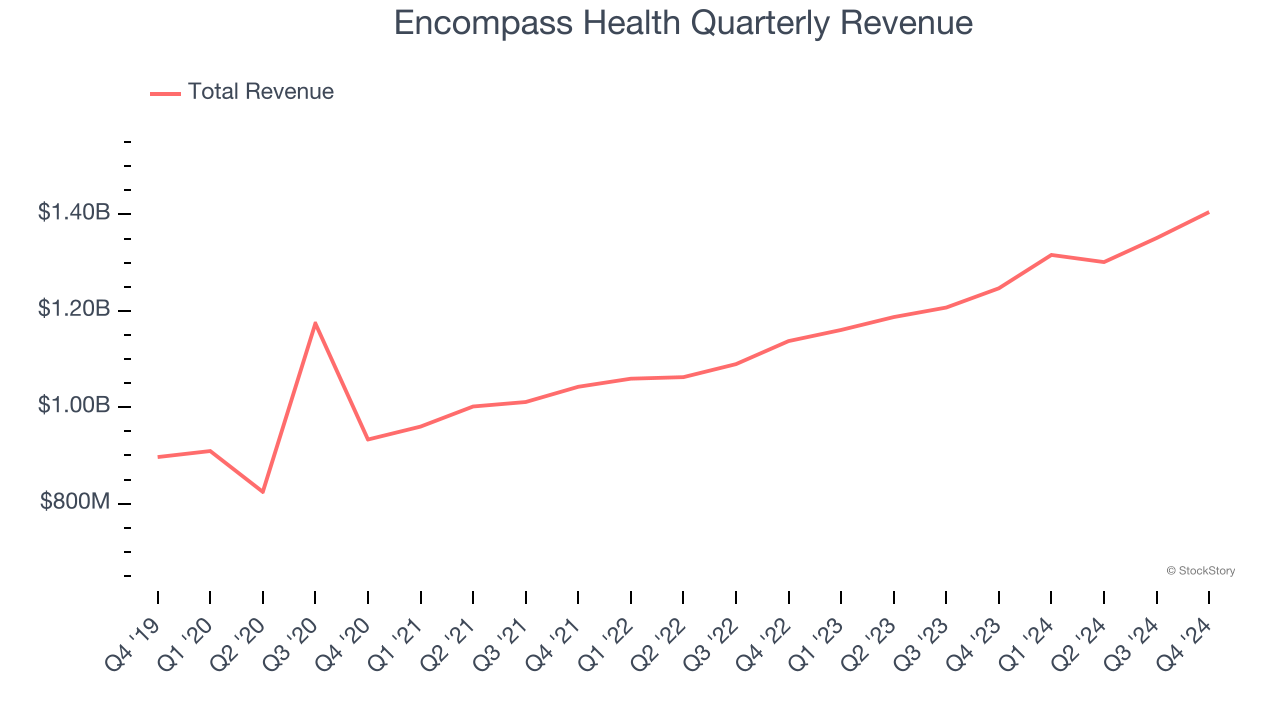

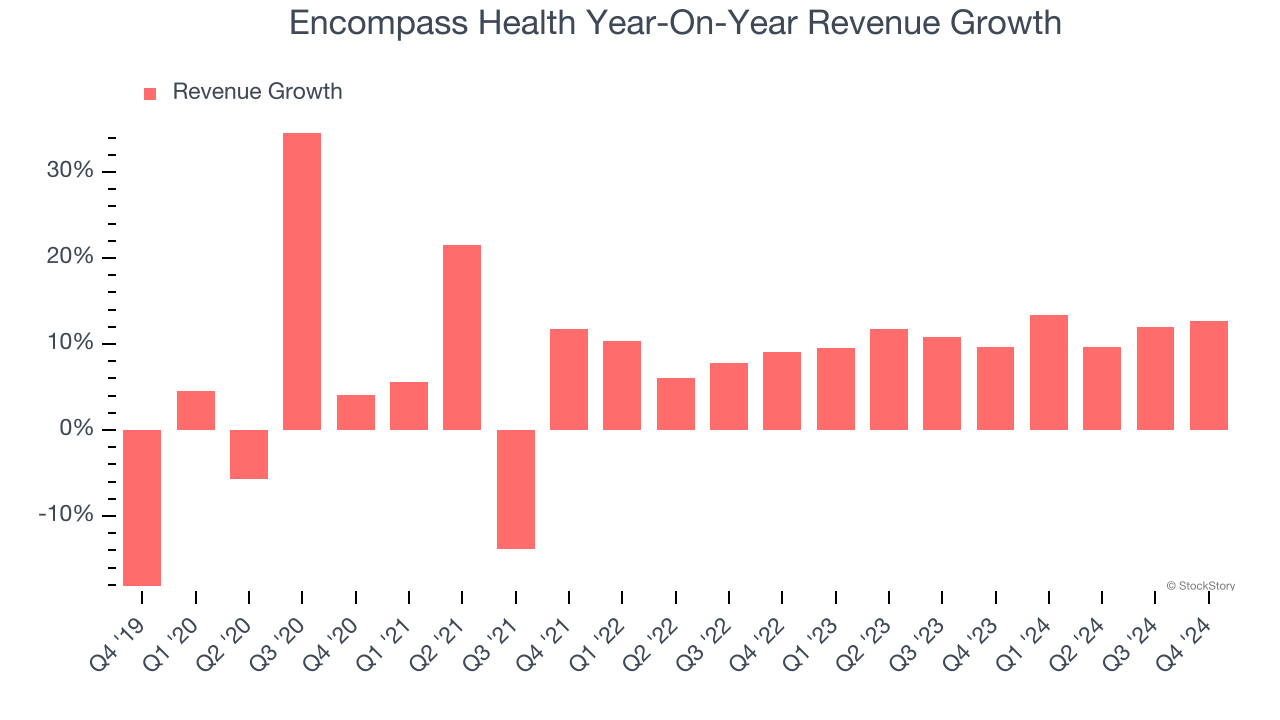

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Luckily, Encompass Health’s sales grew at a decent 8.9% compounded annual growth rate over the last five years. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Encompass Health’s annualized revenue growth of 11.2% over the last two years is above its five-year trend, suggesting some bright spots.

Encompass Health also reports same-store sales, which show how much revenue its established locations generate. Over the last two years, Encompass Health’s same-store sales averaged 5.7% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company’s top-line performance.

This quarter, Encompass Health reported year-on-year revenue growth of 12.7%, and its $1.41 billion of revenue exceeded Wall Street’s estimates by 1.8%.

Looking ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months, a slight deceleration versus the last two years. Still, this projection is noteworthy and indicates the market is factoring in success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Adjusted Operating Margin

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

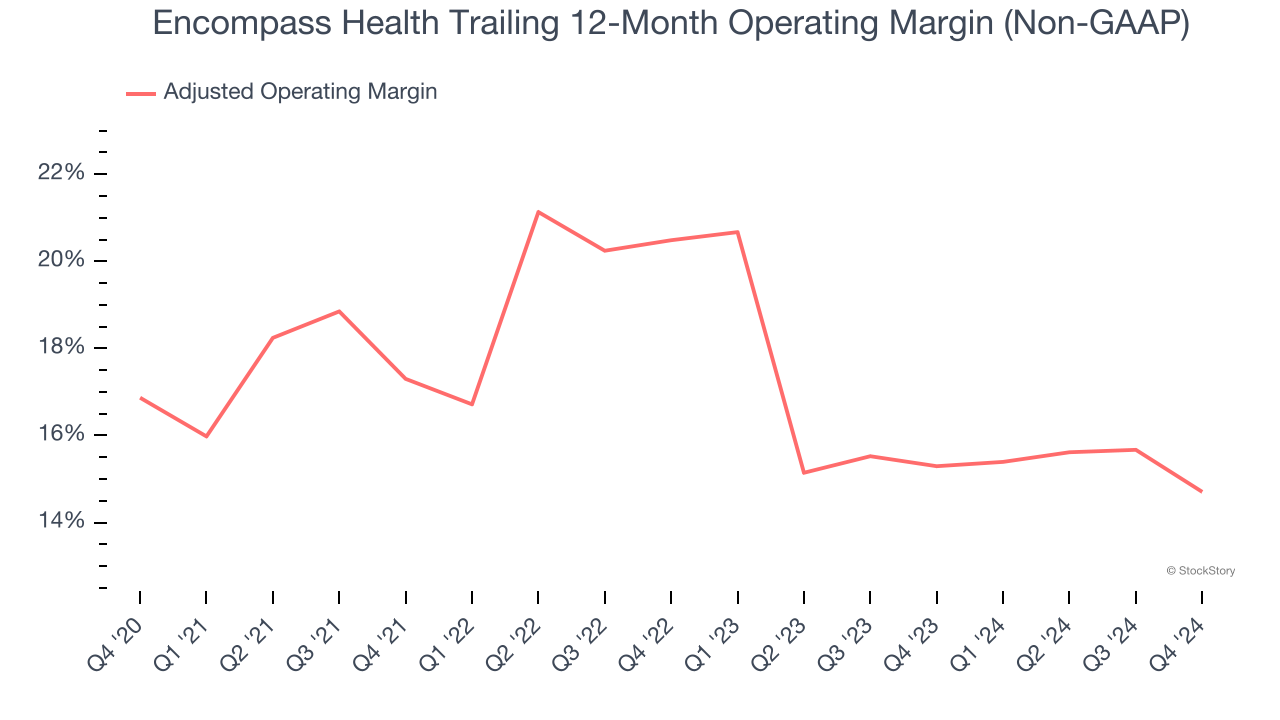

Encompass Health has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average adjusted operating margin of 16.8%.

Analyzing the trend in its profitability, Encompass Health’s adjusted operating margin decreased by 2.2 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 5.8 percentage points on a two-year basis. We’re disappointed in these results because it shows operating expenses were rising and it couldn’t pass those costs onto its customers.

In Q4, Encompass Health generated an adjusted operating profit margin of 11.4%, down 3.6 percentage points year on year. This contraction shows it was recently less efficient because its expenses grew faster than its revenue.

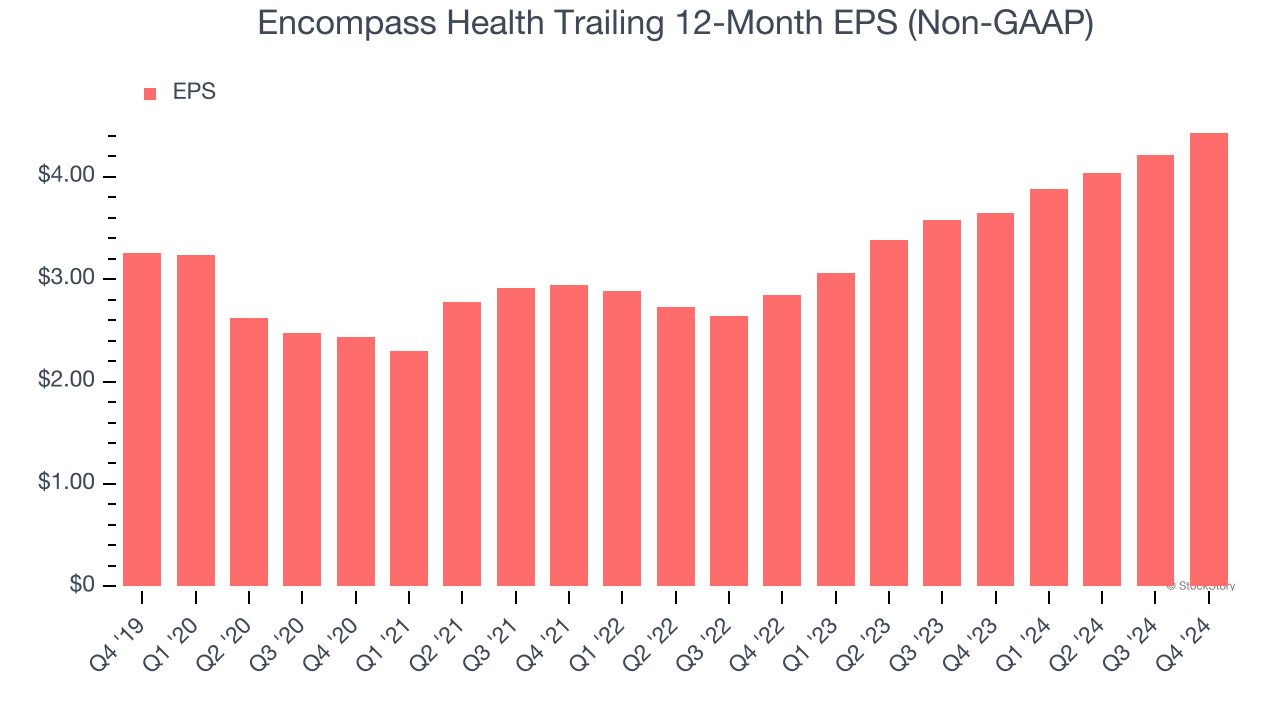

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

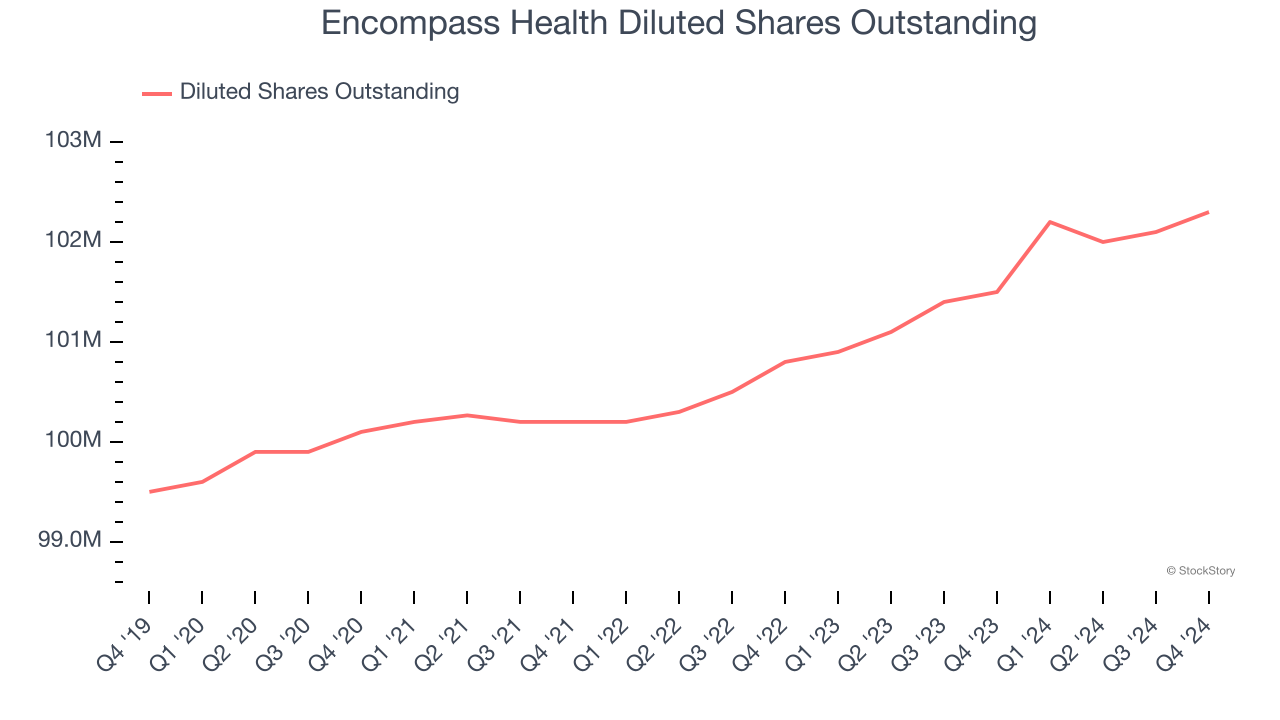

Encompass Health’s EPS grew at a decent 6.4% compounded annual growth rate over the last five years. However, this performance was lower than its 8.9% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

Diving into Encompass Health’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Encompass Health’s adjusted operating margin declined by 2.2 percentage points over the last five years. Its share count also grew by 2.8%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, Encompass Health reported EPS at $1.17, up from $0.95 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Encompass Health’s full-year EPS of $4.43 to grow 7.1%.

Key Takeaways from Encompass Health’s Q4 Results

It was encouraging to see Encompass Health beat analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also happy its full-year EPS guidance outperformed Wall Street’s estimates. Overall, this quarter had some key positives. The stock traded up 2% to $100.47 immediately following the results.

Encompass Health may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.