American motorcycle manufacturing company Harley-Davidson (NYSE:HOG) missed Wall Street’s revenue expectations in Q4 CY2024, with sales falling 34.7% year on year to $688 million. Its GAAP loss of $0.93 per share was 41.6% below analysts’ consensus estimates.

Is now the time to buy Harley-Davidson? Find out by accessing our full research report, it’s free.

Harley-Davidson (HOG) Q4 CY2024 Highlights:

- Revenue: $688 million vs analyst estimates of $714.6 million (34.7% year-on-year decline, 3.7% miss)

- EPS (GAAP): -$0.93 vs analyst expectations of -$0.66 (41.6% miss)

- Operating Margin: -28.1%, down from -2% in the same quarter last year

- Free Cash Flow was $77.04 million, up from -$20.38 million in the same quarter last year

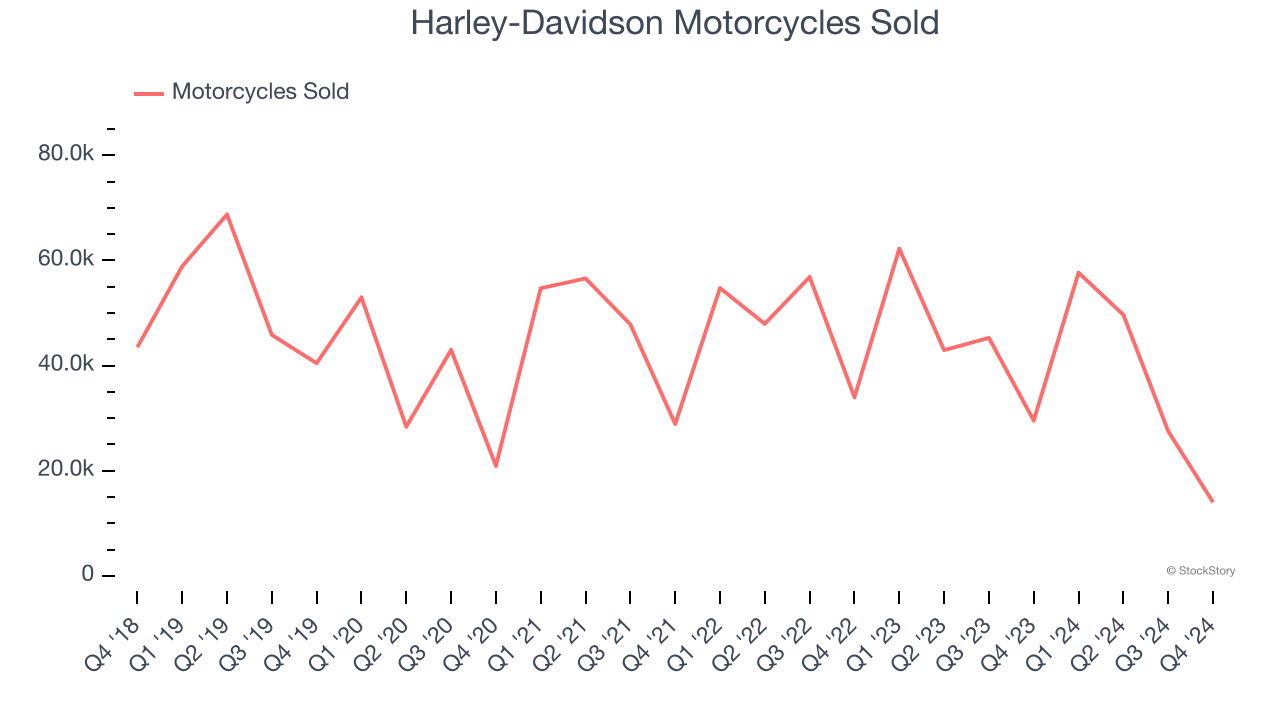

- Motorcycles Sold: 14,000, down 15,544 year on year

- Market Capitalization: $3.41 billion

Company Overview

Founded in 1903, Harley-Davidson (NYSE:HOG) is an American motorcycle manufacturer known for its heavyweight motorcycles designed for cruising on highways.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Sales Growth

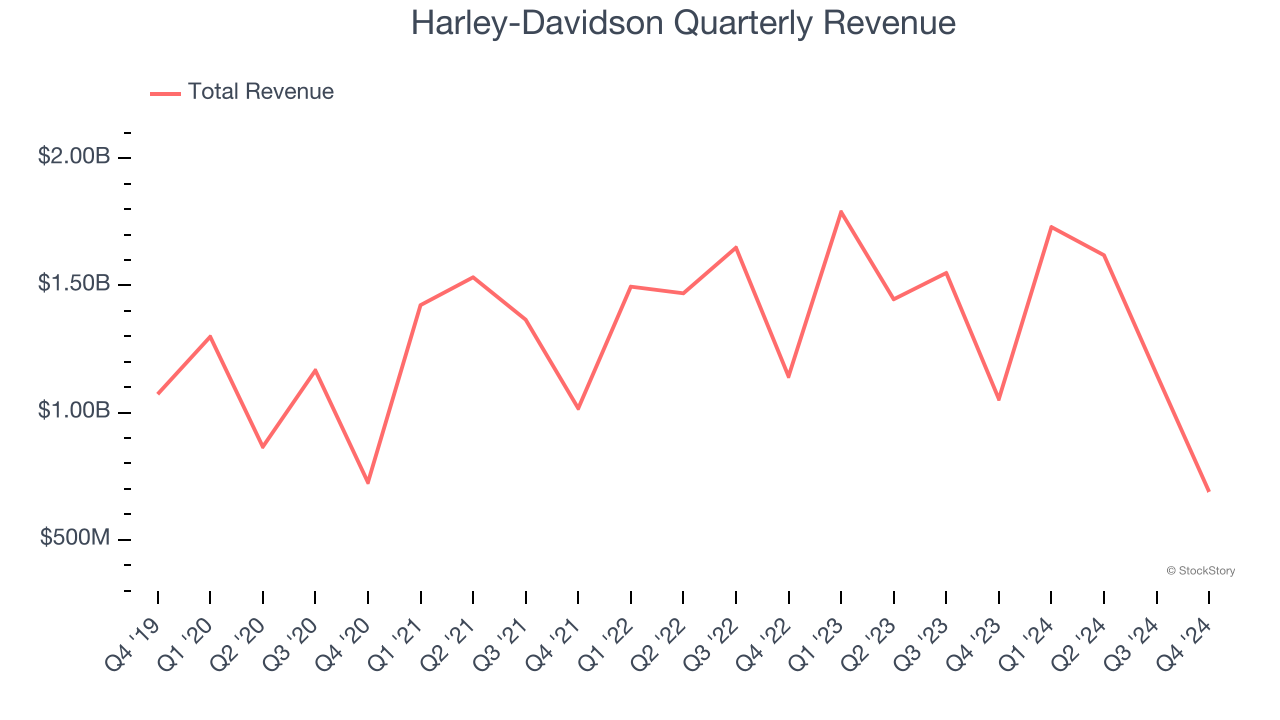

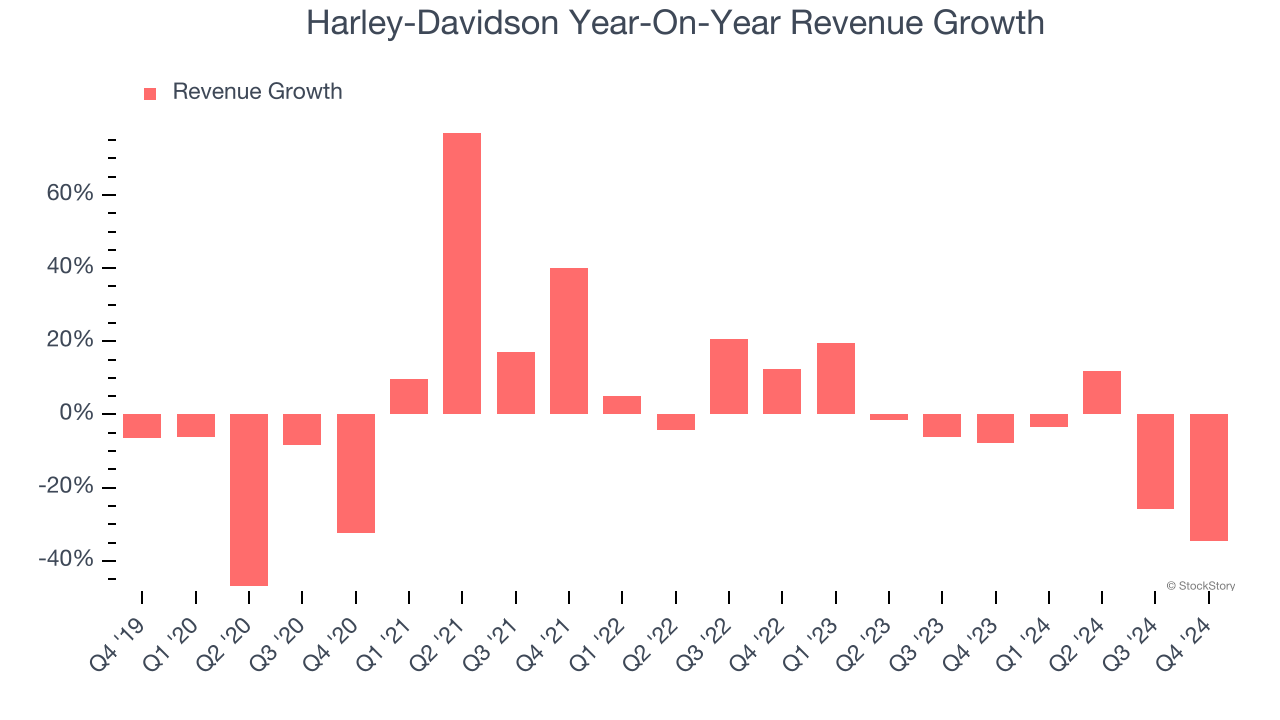

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Harley-Davidson struggled to consistently increase demand as its $5.19 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of lacking business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Harley-Davidson’s recent history shows its demand has stayed suppressed as its revenue has declined by 5.1% annually over the last two years.

We can dig further into the company’s revenue dynamics by analyzing its number of motorcycles sold, which reached 14,000 in the latest quarter. Over the last two years, Harley-Davidson’s motorcycles sold averaged 14.2% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Harley-Davidson missed Wall Street’s estimates and reported a rather uninspiring 34.7% year-on-year revenue decline, generating $688 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

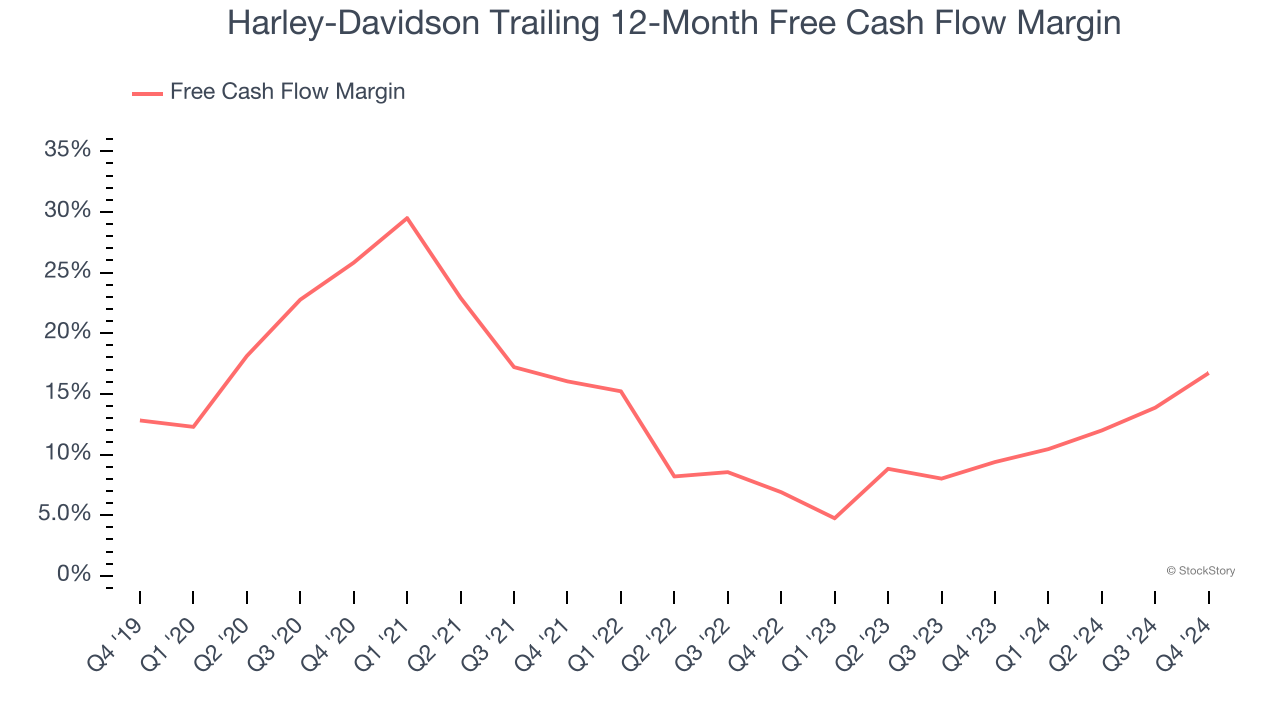

Harley-Davidson has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.8% over the last two years, slightly better than the broader consumer discretionary sector.

Harley-Davidson’s free cash flow clocked in at $77.04 million in Q4, equivalent to a 11.2% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

Over the next year, analysts predict Harley-Davidson’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 16.7% for the last 12 months will decrease to 12%.

Key Takeaways from Harley-Davidson’s Q4 Results

We struggled to find many positives in these results as its number of motorcycles sold and EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 4.1% to $25.73 immediately following the results.

Harley-Davidson may have had a tough quarter, but does that actually create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.