Global entertainment and media company Disney (NYSE:DIS) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 4.8% year on year to $24.69 billion. Its non-GAAP profit of $1.76 per share was 22.9% above analysts’ consensus estimates.

Is now the time to buy Disney? Find out by accessing our full research report, it’s free.

Disney (DIS) Q4 CY2024 Highlights:

- Revenue: $24.69 billion vs analyst estimates of $24.63 billion (4.8% year-on-year growth, in line)

- Adjusted EPS: $1.76 vs analyst estimates of $1.43 (22.9% beat)

- Disney+ subscribers decline 1%, warns of another “modest decline” in subscribers next quarter

- Adjusted EBITDA: $6.24 billion vs analyst estimates of $4.96 billion (25.3% margin, 25.9% beat)

- Operating Margin: 20.5%, up from 13.2% in the same quarter last year

- Free Cash Flow Margin: 3%, similar to the same quarter last year

- Market Capitalization: $204.9 billion

“Our results this quarter demonstrate Disney’s creative and financial strength as we advanced the strategic initiatives set in motion over the past two years,” said Robert A. Iger, Chief Executive Officer, The Walt Disney Company.

Company Overview

Founded by brothers Walt and Roy, Disney (NYSE:DIS) is a multinational entertainment conglomerate, renowned for its theme parks, movies, television networks, and merchandise.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

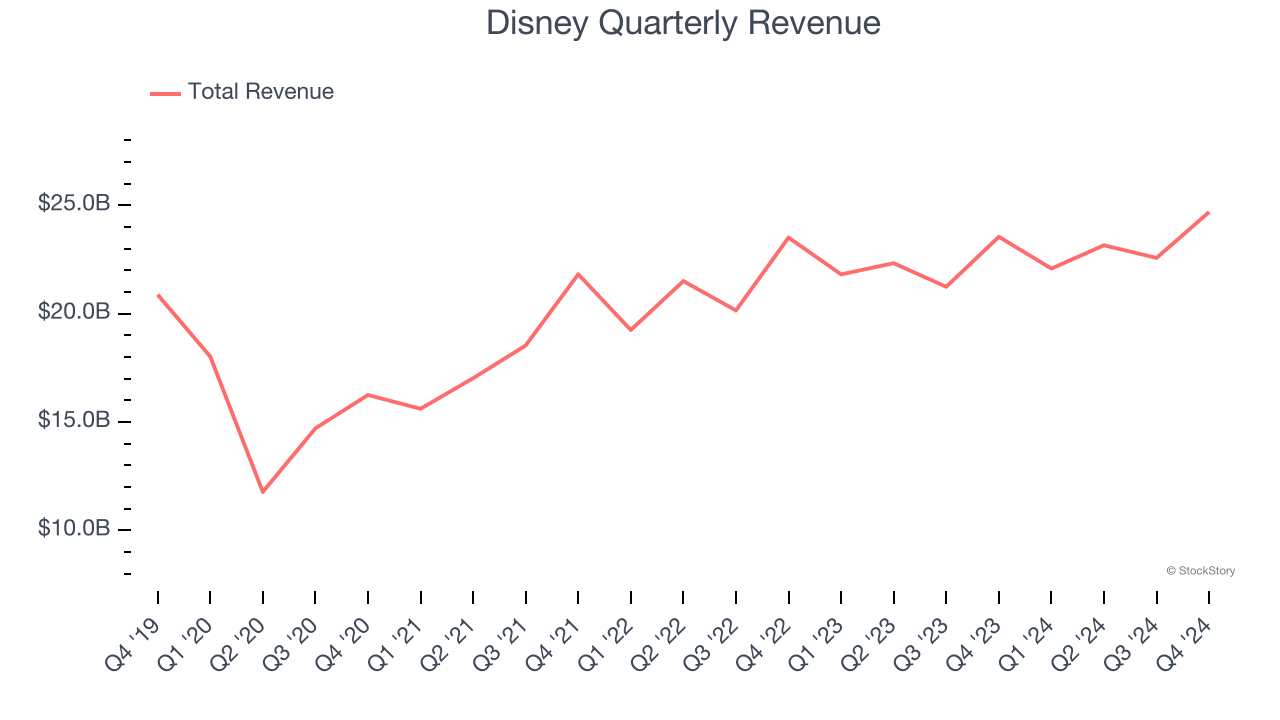

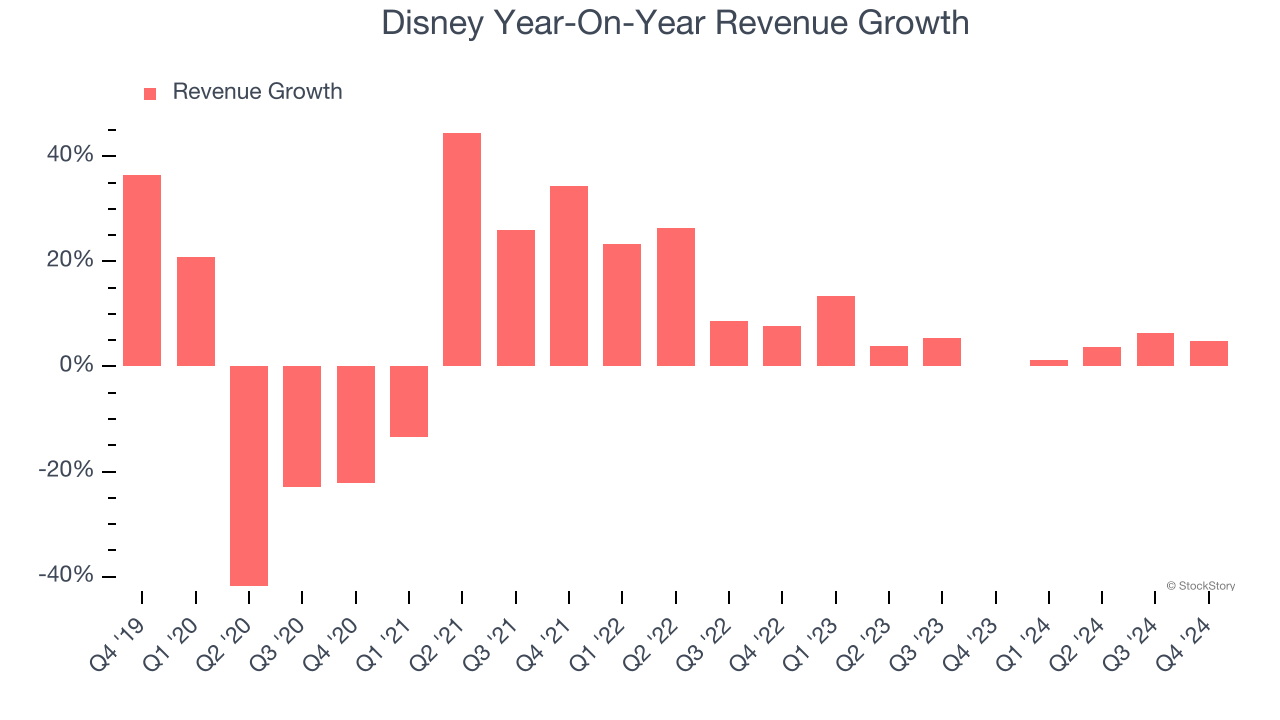

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Disney’s 4.2% annualized revenue growth over the last five years was sluggish. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Disney’s annualized revenue growth of 4.7% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

Disney also breaks out the revenue for its three most important segments: Entertainment, Sports, and Experiences, which are 44%, 19.6%, and 38.1% of revenue. Over the last two years, Disney’s revenues in all three segments increased. Its Entertainment revenue (movies, Disney+) averaged year-on-year growth of 2.9% while its Sports (ESPN, SEC Network) and Experiences (theme parks) revenues averaged 1.1% and 8.3%.

This quarter, Disney grew its revenue by 4.8% year on year, and its $24.69 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

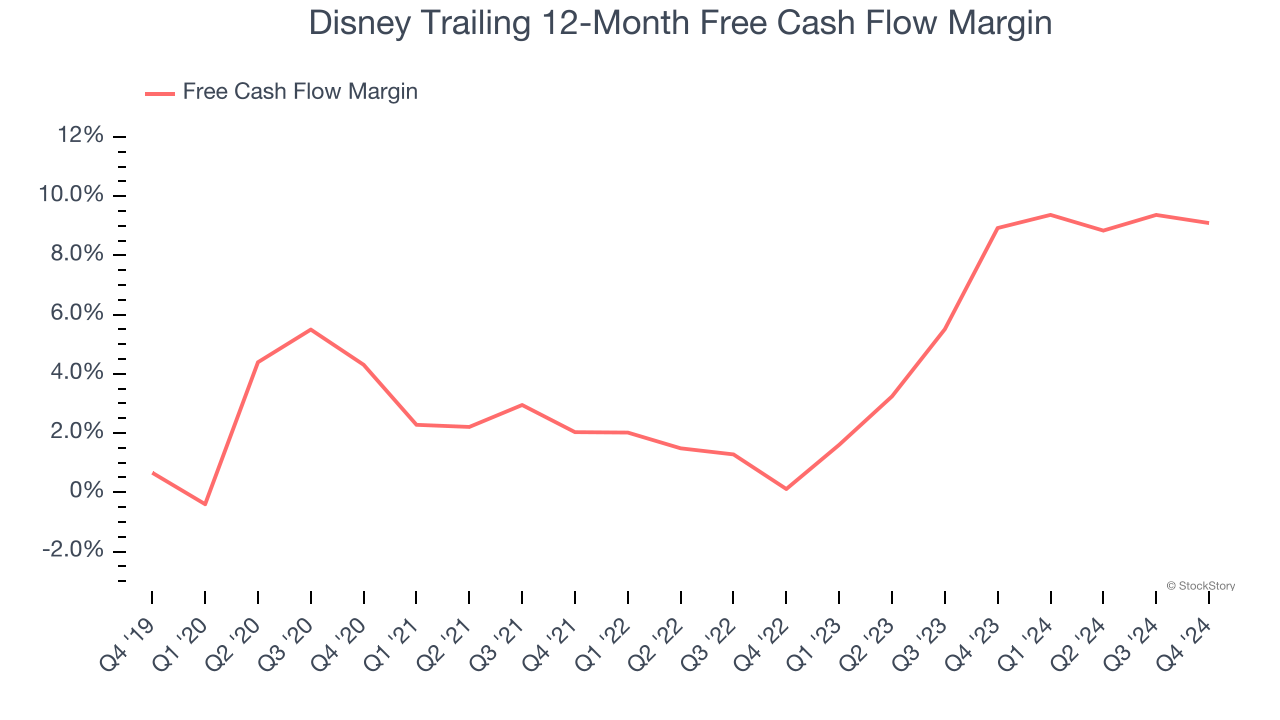

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Disney has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9%, subpar for a consumer discretionary business.

Disney’s free cash flow clocked in at $739 million in Q4, equivalent to a 3% margin. This cash profitability was in line with the comparable period last year but below its two-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Disney’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 9.1% for the last 12 months will decrease to 6.5%.

Key Takeaways from Disney’s Q4 Results

We were impressed by how significantly Disney blew past analysts’ EPS expectations this quarter. On the other hand, there was a decline in all-important Disney+ subscribers, and the company warned of another modest decline next quarter. Zooming out, we think this quarter was mixed. The stock traded up 2.4% to $116 immediately after reporting.

Disney put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.