Life sciences company Bio-Techne (NASDAQ:TECH) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 9% year on year to $297 million. Its non-GAAP profit of $0.42 per share was 9.3% above analysts’ consensus estimates.

Is now the time to buy Bio-Techne? Find out by accessing our full research report, it’s free.

Bio-Techne (TECH) Q4 CY2024 Highlights:

- Revenue: $297 million vs analyst estimates of $285.1 million (9% year-on-year growth, 4.2% beat)

- Adjusted EPS: $0.42 vs analyst estimates of $0.38 (9.3% beat)

- Adjusted EBITDA: $96.11 million vs analyst estimates of $87.93 million (32.4% margin, 9.3% beat)

- Operating Margin: 16%, up from 13.9% in the same quarter last year

- Free Cash Flow Margin: 26.1%, up from 25% in the same quarter last year

- Organic Revenue rose 9% year on year (-1.9% in the same quarter last year)

- Market Capitalization: $11.53 billion

"The Bio-Techne team once again executed at a high level and delivered strong second quarter results," said Kim Kelderman, President and Chief Executive Officer of Bio-Techne.

Company Overview

Founded in 1976, Bio-Techne (NASDAQ:TECH) develops and manufactures reagents, instruments, and services for life science research, diagnostics, and biopharmaceutical production.

Research Tools & Consumables

The life sciences subsector specializing in research tools and consumables enables scientific discoveries across academia, biotechnology, and pharmaceuticals. These firms supply a wide range of essential laboratory products, ensuring a recurring revenue stream through repeat purchases and replenishment. Their business models benefit from strong customer loyalty, a diversified product portfolio, and exposure to both the research and clinical markets. However, challenges include high R&D investment to maintain technological leadership, pricing pressures from budget-conscious institutions, and vulnerability to fluctuations in research funding cycles. Looking ahead, this subsector stands to benefit from tailwinds such as growing demand for tools supporting emerging fields like synthetic biology and personalized medicine. There is also a rise in automation and AI-driven solutions in laboratories that could create new opportunities to sell tools and consumables. Nevertheless, headwinds exist. These companies tend to be at the mercy of supply chain disruptions and sensitivity to macroeconomic conditions that impact funding for research initiatives.

Sales Growth

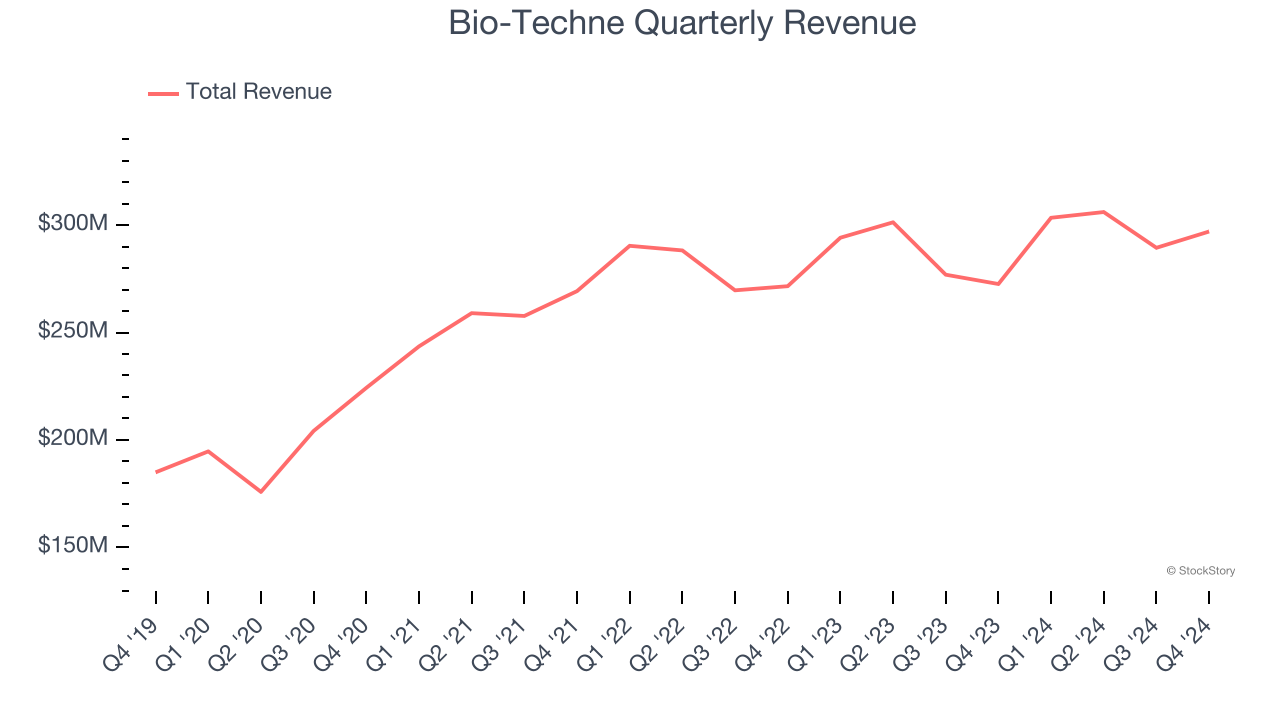

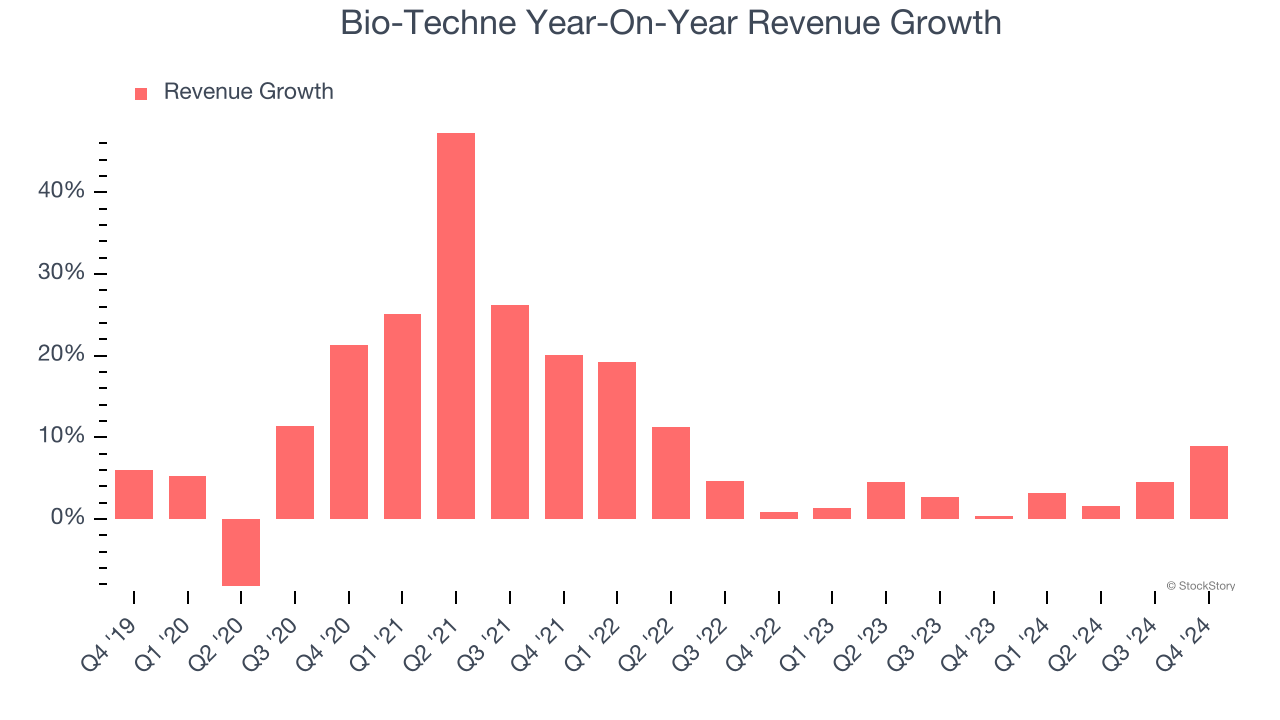

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Bio-Techne’s 9.9% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Bio-Techne’s recent history shows its demand slowed as its annualized revenue growth of 3.3% over the last two years is below its five-year trend.

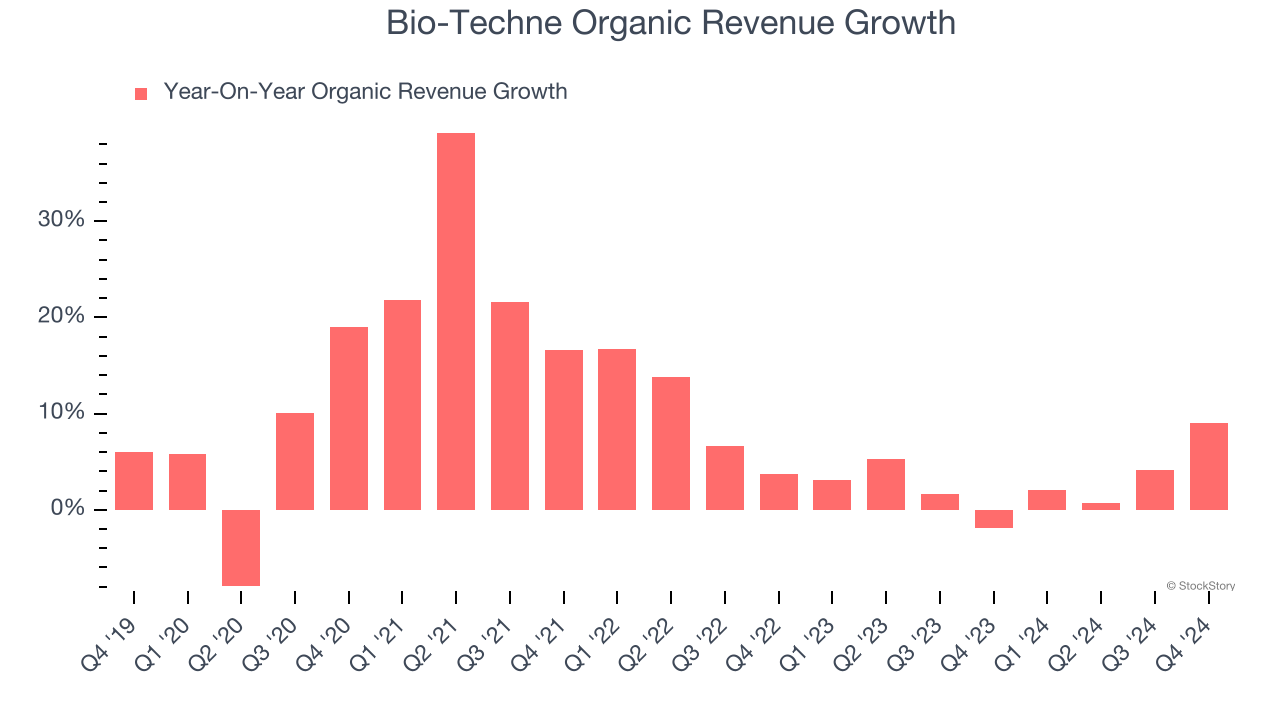

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Bio-Techne’s organic revenue averaged 3% year-on-year growth. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Bio-Techne reported year-on-year revenue growth of 9%, and its $297 million of revenue exceeded Wall Street’s estimates by 4.2%.

Looking ahead, sell-side analysts expect revenue to grow 6% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and suggests its newer products and services will fuel better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

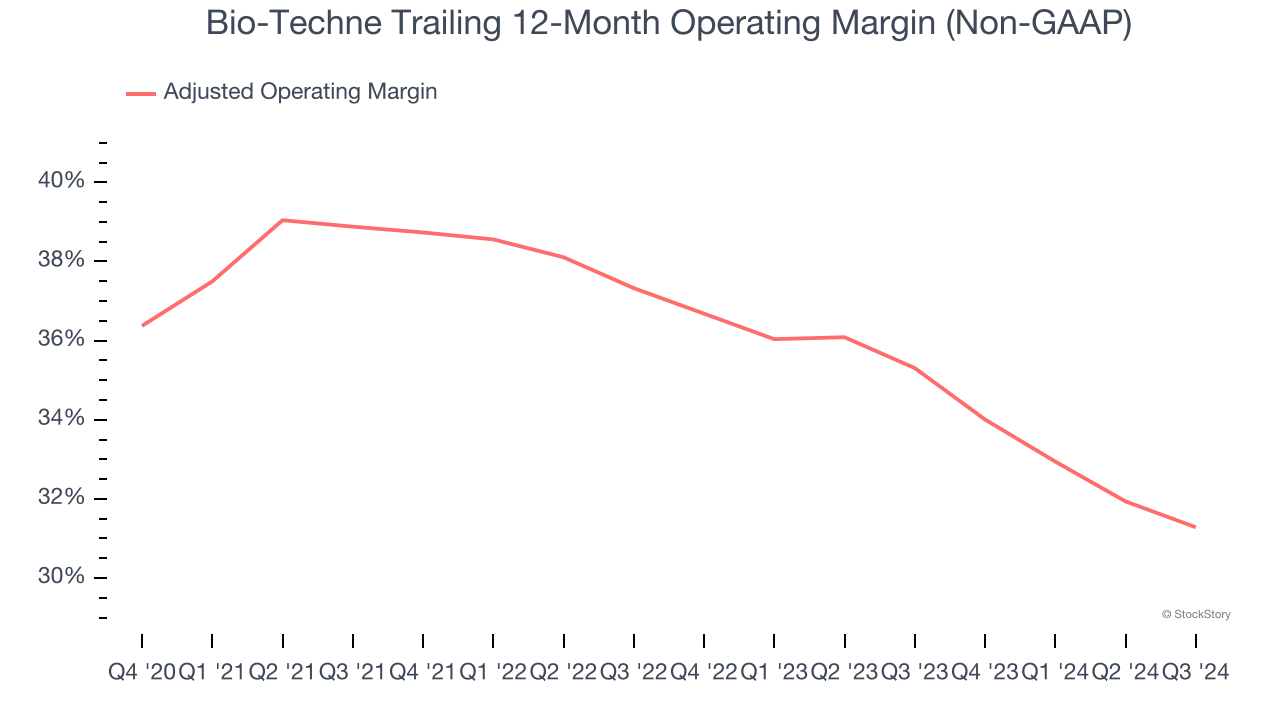

Bio-Techne has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average adjusted operating margin of 35.5%.

Analyzing the trend in its profitability, Bio-Techne’s adjusted operating margin decreased by 3.8 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 5.4 percentage points on a two-year basis. We’re disappointed in these results because it shows operating expenses were rising and it couldn’t pass those costs onto its customers.

In Q4, Bio-Techne generated an adjusted operating profit margin of 32.4%, up 2.3 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

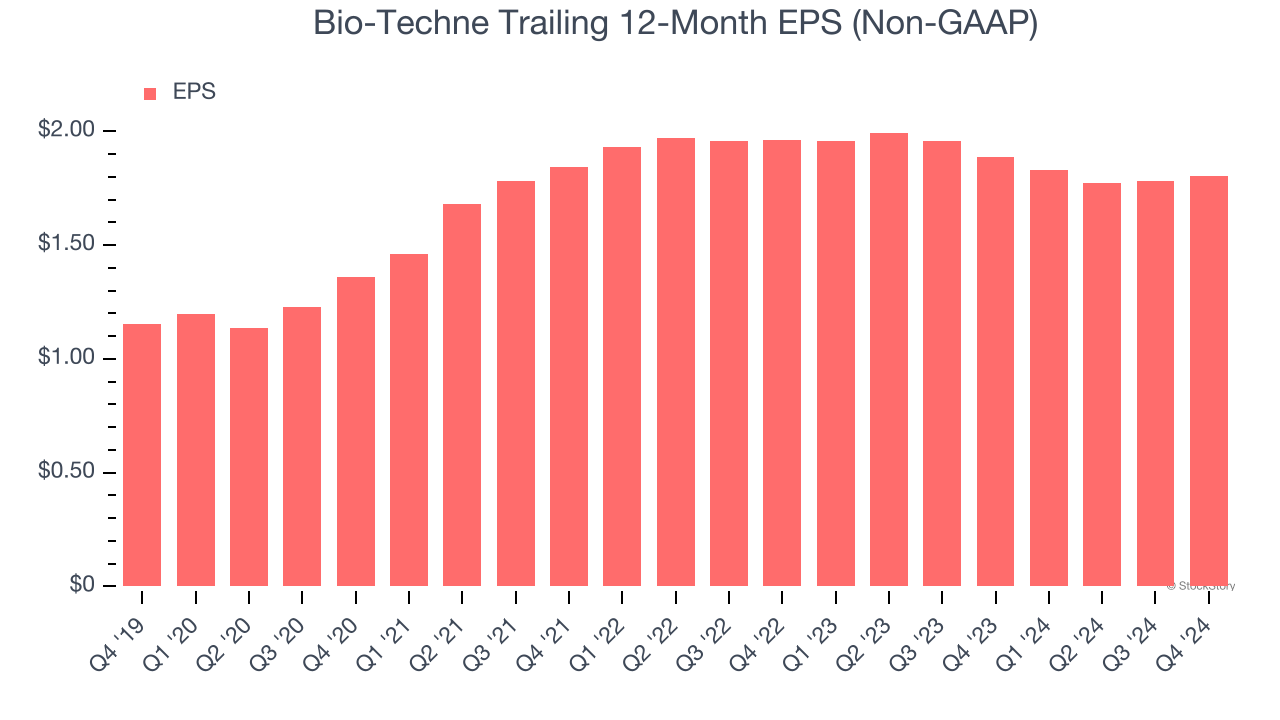

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Bio-Techne’s remarkable 9.4% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q4, Bio-Techne reported EPS at $0.42, up from $0.40 in the same quarter last year. This print beat analysts’ estimates by 9.3%. Over the next 12 months, Wall Street expects Bio-Techne’s full-year EPS of $1.81 to grow 10.4%.

Key Takeaways from Bio-Techne’s Q4 Results

We were impressed by how significantly Bio-Techne blew past analysts’ organic revenue expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 5.7% to $76.79 immediately following the results.

Bio-Techne may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.