Life sciences company Azenta (NASDAQ:AZTA) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, but sales fell by 4.4% year on year to $147.5 million. Its non-GAAP profit of $0.05 per share was in line with analysts’ consensus estimates.

Is now the time to buy Azenta? Find out by accessing our full research report, it’s free.

Azenta (AZTA) Q4 CY2024 Highlights:

- Revenue: $147.5 million vs analyst estimates of $146 million (4.4% year-on-year decline, 1.1% beat)

- Adjusted EPS: $0.05 vs analyst estimates of $0.06 (in line)

- Adjusted EBITDA: $13 million vs analyst estimates of $13.59 million (8.8% margin, 4.4% miss)

- Operating Margin: -7.7%, up from -10.5% in the same quarter last year

- Free Cash Flow Margin: 14.9%, up from 9.4% in the same quarter last year

- Market Capitalization: $2.37 billion

Company Overview

Founded as a small biotech firm, Azenta (NASDAQ:AZTA) provides services for life sciences research and biopharmaceutical applications such as sample management, cold chain logistics, and storage services.

Drug Development Inputs & Services

Companies specializing in drug development inputs and services play a crucial role in the pharmaceutical and biotechnology value chain. Essential support for drug discovery, preclinical testing, and manufacturing means stable demand, as pharmaceutical companies often outsource non-core functions with medium to long-term contracts. However, the business model faces high capital requirements, customer concentration, and vulnerability to shifts in biopharma R&D budgets or regulatory frameworks. Looking ahead, the industry will likely enjoy tailwinds such as increasing investment in biologics, cell and gene therapies, and advancements in precision medicine, which drive demand for sophisticated tools and services. There is a growing trend of outsourcing in drug development for nimbleness and cost efficiency, which benefits the industry. On the flip side, potential headwinds include pricing pressures as efforts to contain healthcare costs are always top of mind. An evolving regulatory backdrop could also slow innovation or client activity.

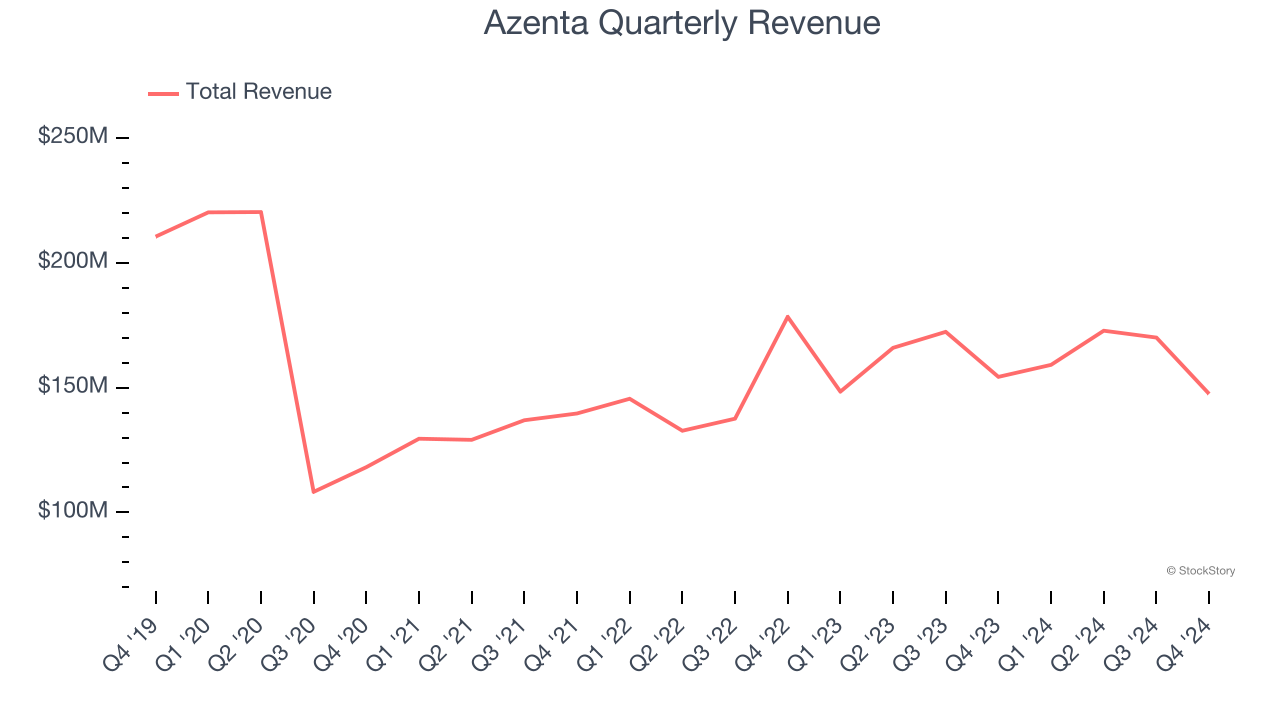

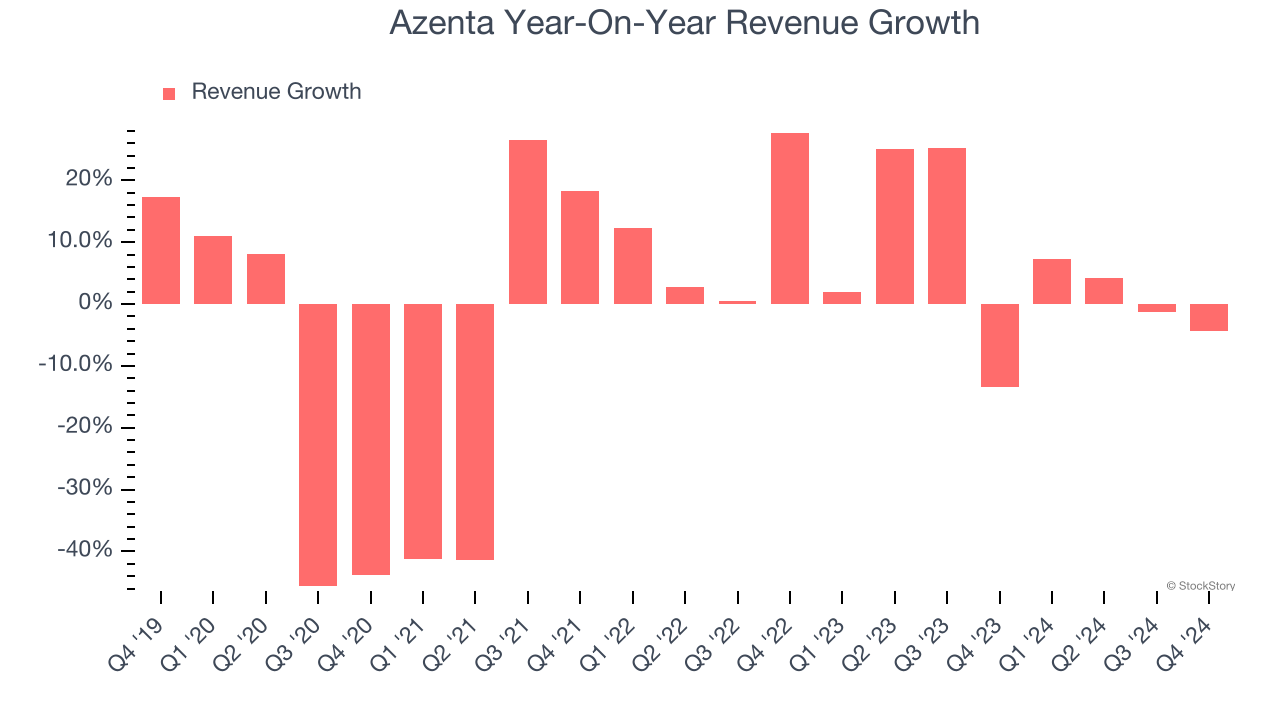

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Azenta struggled to consistently generate demand over the last five years as its sales dropped at a 4.4% annual rate. This was below our standards and signals it’s a low quality business.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Azenta’s annualized revenue growth of 4.5% over the last two years is above its five-year trend, but we were still disappointed by the results.

We can dig further into the company’s revenue dynamics by analyzing its most important segment, Sample Management. Over the last two years, Azenta’s Sample Management revenue averaged 2.8% year-on-year growth. This segment has lagged the company’s overall sales.

This quarter, Azenta’s revenue fell by 4.4% year on year to $147.5 million but beat Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to decline by 7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

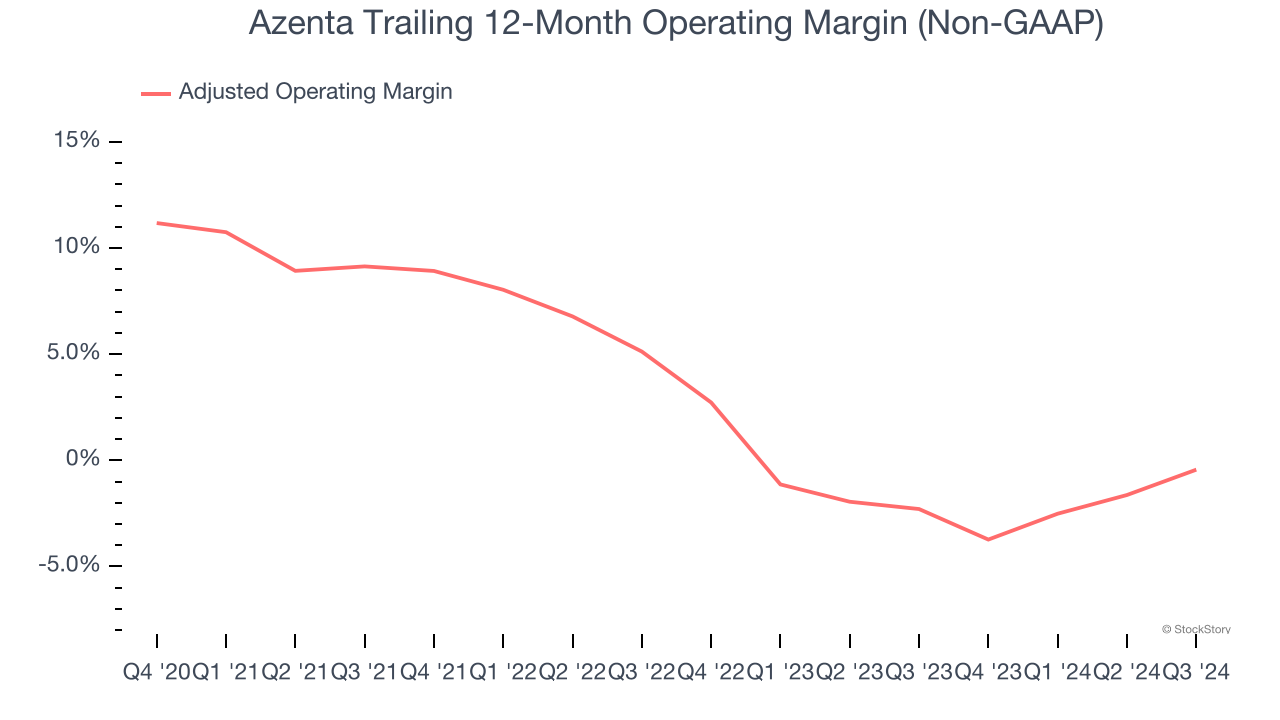

Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Azenta was profitable over the last five years but held back by its large cost base. Its average adjusted operating margin of 4.1% was weak for a healthcare business.

Analyzing the trend in its profitability, Azenta’s adjusted operating margin decreased by 10.3 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 2.7 percentage points. This performance was poor no matter how you look at it - it shows operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Azenta generated an adjusted operating profit margin of 8.8%, up 14.5 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was recently more efficient because it scaled down its expenses.

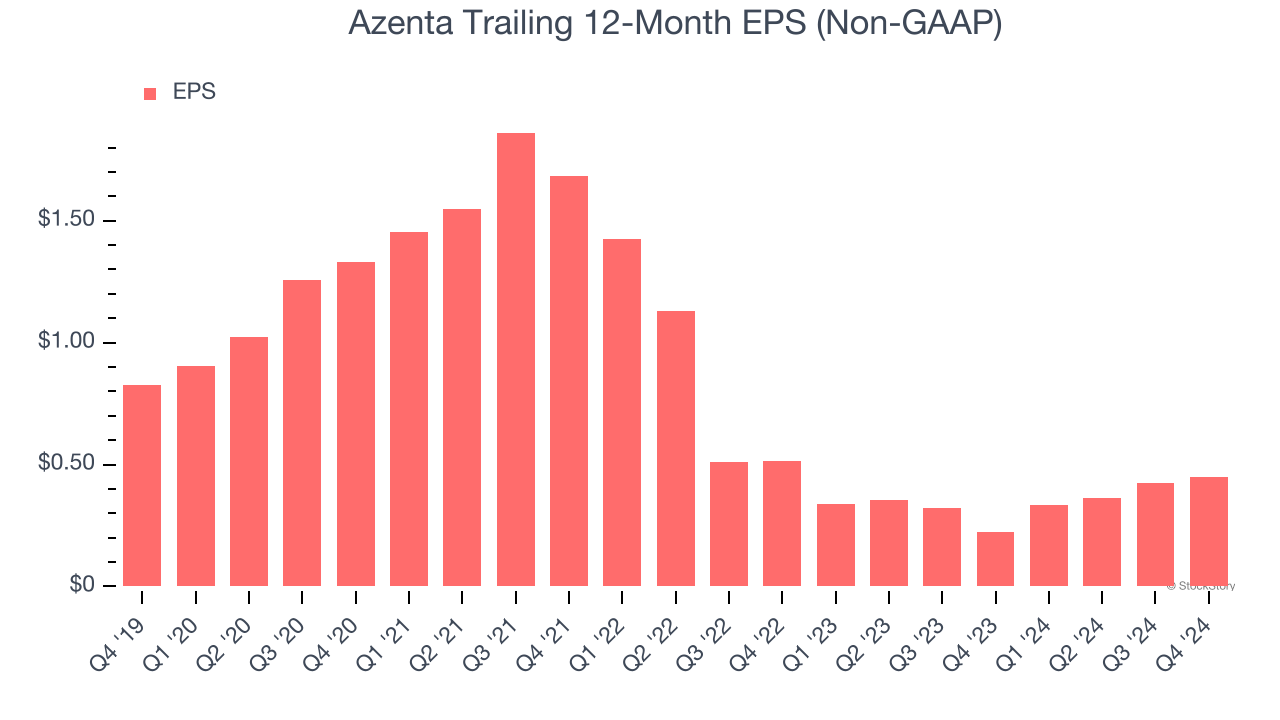

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Azenta, its EPS declined by more than its revenue over the last five years, dropping 11.5% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

We can take a deeper look into Azenta’s earnings to better understand the drivers of its performance. As we mentioned earlier, Azenta’s adjusted operating margin improved this quarter but declined by 10.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Azenta reported EPS at $0.05, up from $0.02 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Azenta’s full-year EPS of $0.45 to grow 14.7%.

Key Takeaways from Azenta’s Q4 Results

It was good to see Azenta narrowly top analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed significantly. Overall, this was a weaker quarter. The stock remained flat at $52 immediately after reporting.

Big picture, is Azenta a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.