Social network Snapchat (NYSE: SNAP) reported Q4 CY2024 results exceeding the market’s revenue expectations, with sales up 14.4% year on year to $1.56 billion. Its non-GAAP profit of $0.16 per share was 13.6% above analysts’ consensus estimates.

Is now the time to buy Snap? Find out by accessing our full research report, it’s free.

Snap (SNAP) Q4 CY2024 Highlights:

- Revenue: $1.56 billion vs analyst estimates of $1.55 billion (14.4% year-on-year growth, 0.6% beat)

- Adjusted EPS: $0.16 vs analyst estimates of $0.14 (13.6% beat)

- Adjusted EBITDA: $276 million vs analyst estimates of $247.6 million (17.7% margin, 11.5% beat)

- Operating Margin: -1.7%, up from -18.3% in the same quarter last year

- Free Cash Flow Margin: 11.7%, up from 5.2% in the previous quarter

- Daily Active Users: 453 million, up 39 million year on year

- Market Capitalization: $18.73 billion

“In 2024 we made significant progress on our core priorities of growing our community and improving depth of engagement, driving top line revenue growth and diversifying our revenue sources, while building toward our long-term vision for augmented reality,” said Evan Spiegel, CEO.

Company Overview

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

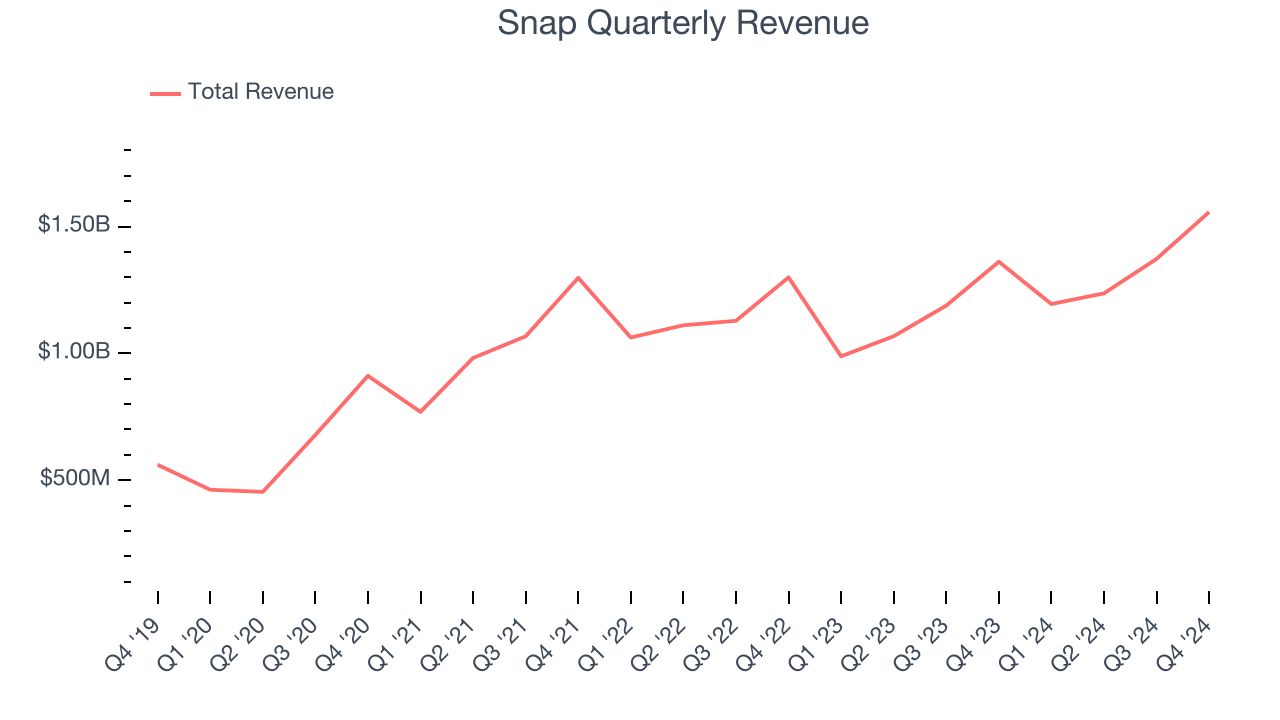

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last three years, Snap grew its sales at a mediocre 9.2% compounded annual growth rate. This was below our standard for the consumer internet sector and is a tough starting point for our analysis.

This quarter, Snap reported year-on-year revenue growth of 14.4%, and its $1.56 billion of revenue exceeded Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 12.8% over the next 12 months, an acceleration versus the last three years. This projection is above the sector average and suggests its newer products and services will catalyze better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

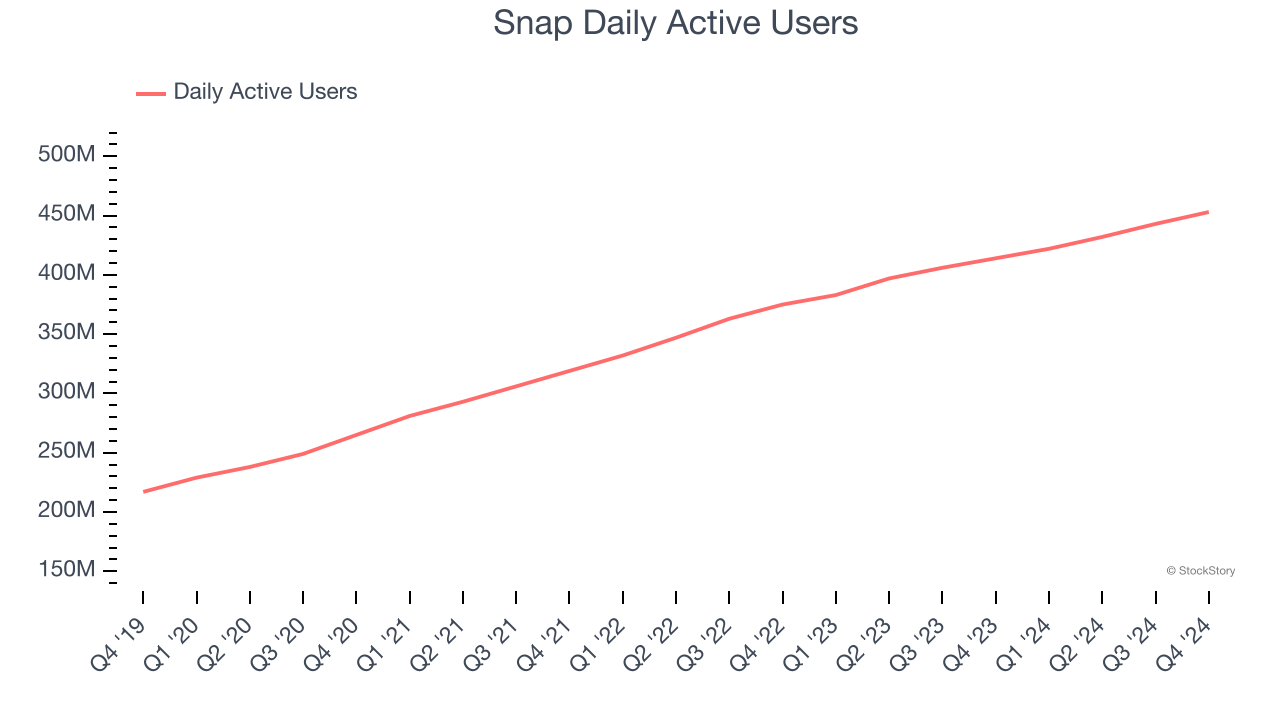

Daily Active Users

User Growth

As a social network, Snap generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Snap’s daily active users, a key performance metric for the company, increased by 11.2% annually to 453 million in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

In Q4, Snap added 39 million daily active users, leading to 9.4% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

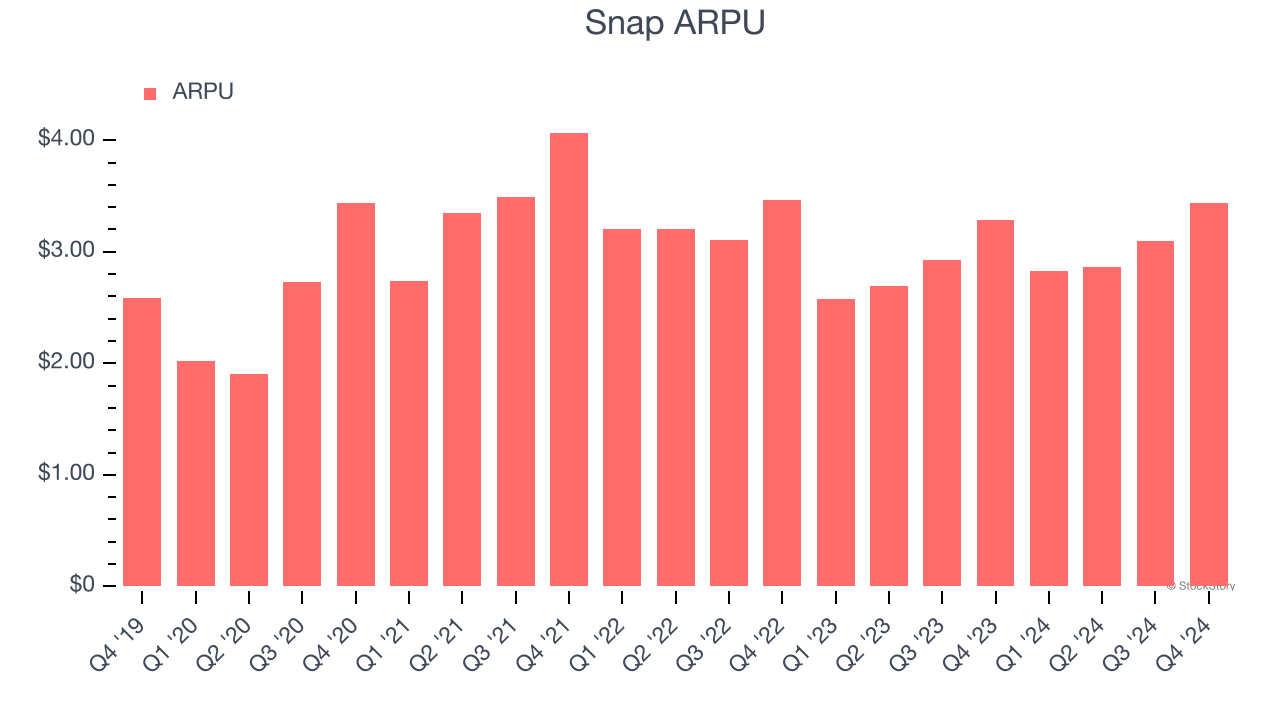

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for social networking businesses like Snap because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Snap’s audience and its ad-targeting capabilities.

Snap’s ARPU fell over the last two years, averaging 2.5% annual declines. This isn’t great, but the increase in daily active users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Snap tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

This quarter, Snap’s ARPU clocked in at $3.44. It grew by 4.5% year on year, slower than its user growth.

Key Takeaways from Snap’s Q4 Results

We were impressed by how significantly Snap blew past analysts’ EBITDA expectations this quarter. We were also glad it expanded its number of users. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 10.4% to $12.83 immediately following the results.

Snap had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.