Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Watsco (NYSE:WSO) and the best and worst performers in the infrastructure distributors industry.

Focusing on narrow product categories that can lead to economies of scale, infrastructure distributors sell essential goods that often enjoy more predictable revenue streams. For example, the ongoing inspection, maintenance, and replacement of pipes and water pumps are critical to a functioning society, rendering them non-discretionary. Lately, innovation to address trends like water conservation has driven incremental sales. But like the broader industrials sector, infrastructure distributors are also at the whim of economic cycles as external factors like interest rates can greatly impact commercial and residential construction projects that drive demand for infrastructure products.

The 4 infrastructure distributors stocks we track reported a slower Q3. As a group, revenues were in line with analysts’ consensus estimates.

Thankfully, share prices of the companies have been resilient as they are up 9.7% on average since the latest earnings results.

Weakest Q3: Watsco (NYSE:WSO)

Originally a manufacturing company, Watsco (NYSE:WSO) today only distributes air conditioning, heating, and refrigeration equipment, as well as related parts and supplies.

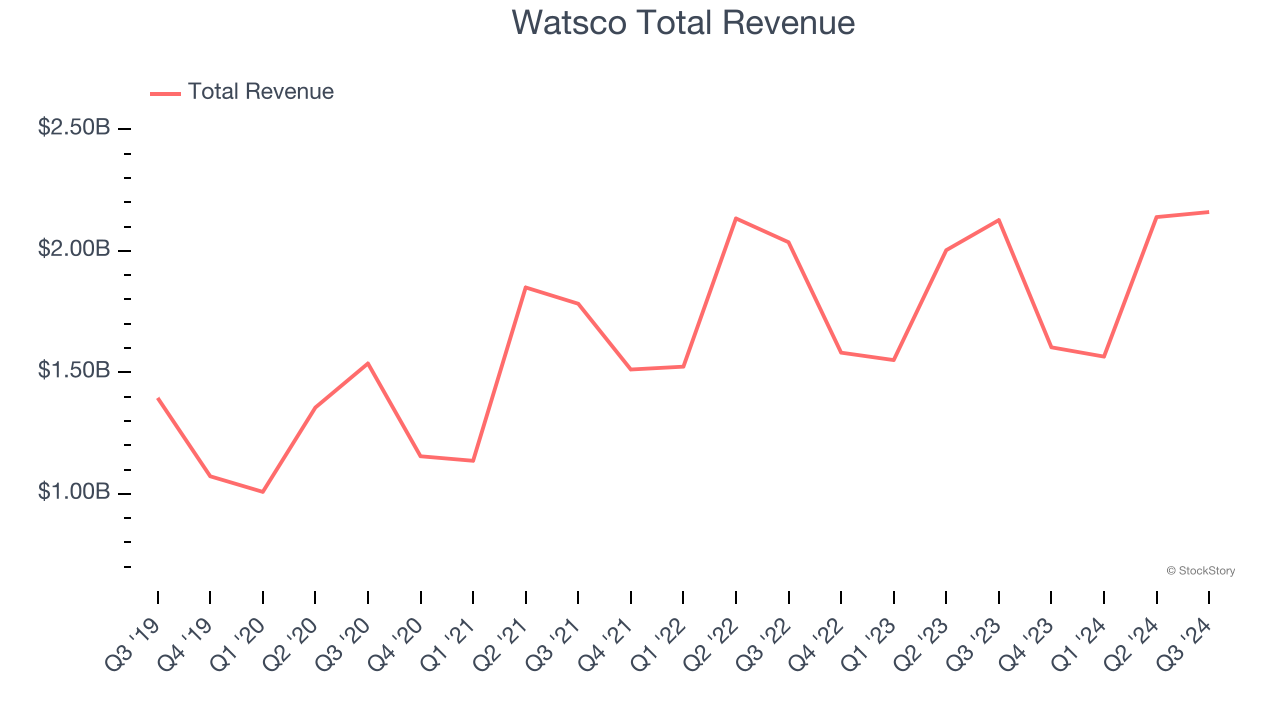

Watsco reported revenues of $2.16 billion, up 1.6% year on year. This print fell short of analysts’ expectations by 4.3%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

Albert H. Nahmad, Chairman and CEO commented: “During the third quarter, Watsco achieved record sales and net income, produced strong cash flow and made further strides to improve operating efficiency across its network. We believe the market environment for HVAC products stabilized this year, and we look forward to helping our customers navigate next year’s regulatory transition toward the new A2L systems. This regulatory change will ultimately impact approximately 60% of our sales and offers our contractor customers the opportunity to upgrade older HVAC systems with new products that are both more energy-efficient and environmentally-friendly.”

Watsco delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 1.3% since reporting and currently trades at $478.38.

Read our full report on Watsco here, it’s free.

Best Q3: Core & Main (NYSE:CNM)

Formerly a division of industrial distributor HD Supply, Core & Main (NYSE:CNM) is a provider of water, wastewater, and fire protection products and services.

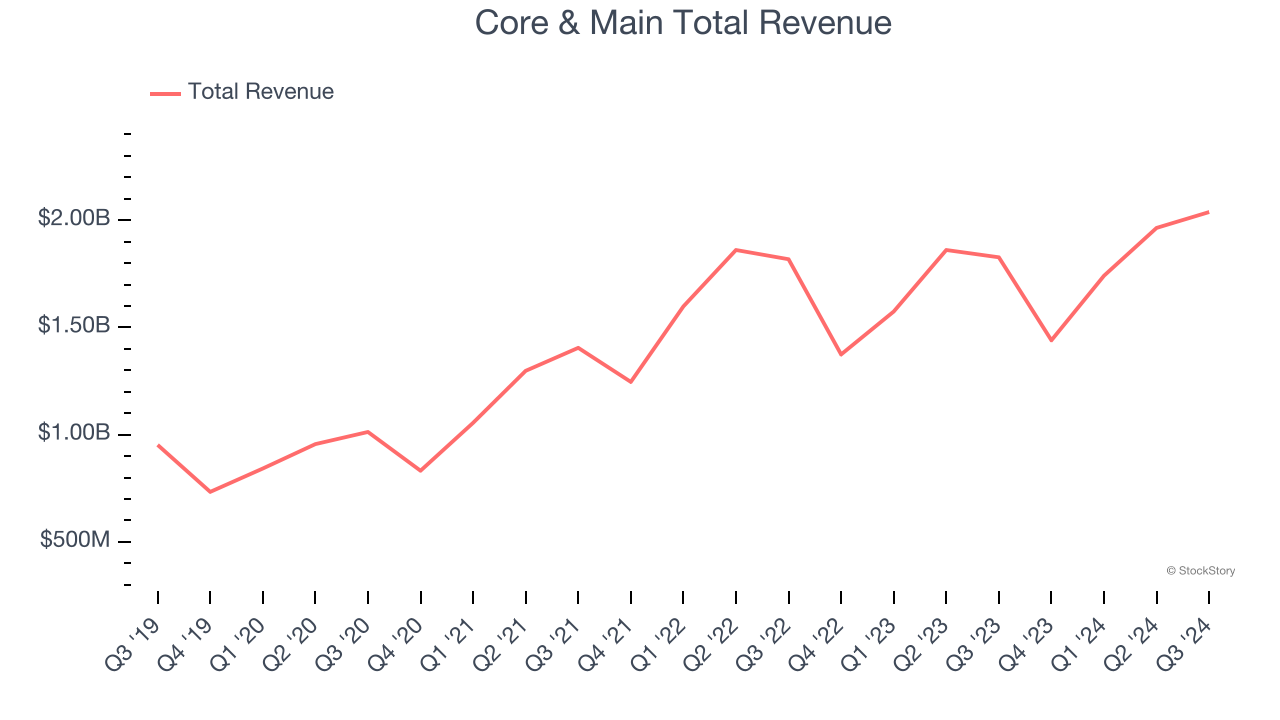

Core & Main reported revenues of $2.04 billion, up 11.5% year on year, outperforming analysts’ expectations by 2.9%. The business had an exceptional quarter with a solid beat of analysts’ organic revenue and operating income estimates.

Core & Main delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 17.8% since reporting. It currently trades at $56.88.

Is now the time to buy Core & Main? Access our full analysis of the earnings results here, it’s free.

DistributionNOW (NYSE:DNOW)

Spun off from National Oilwell Varco, DistributionNOW (NYSE:DNOW) provides distribution and supply chain solutions for the energy and industrial end markets.

DistributionNOW reported revenues of $606 million, up 3.1% year on year, falling short of analysts’ expectations by 0.5%. It was a slower quarter as it posted a miss of analysts’ EBITDA and EPS estimates.

Interestingly, the stock is up 8.4% since the results and currently trades at $14.91.

Read our full analysis of DistributionNOW’s results here.

MRC Global (NYSE:MRC)

Producing bomb casings and tracks for vehicles during WWII, MRC (NYSE:MRC) offers pipes, valves, and fitting products for various industries.

MRC Global reported revenues of $797 million, down 10.2% year on year. This number was in line with analysts’ expectations. More broadly, it was a mixed quarter as it also logged an impressive beat of analysts’ EPS estimates but a significant miss of analysts’ adjusted operating income estimates.

MRC Global had the slowest revenue growth among its peers. The stock is up 14% since reporting and currently trades at $14.38.

Read our full, actionable report on MRC Global here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.