Even though Hope Bancorp (currently trading at $10.75 per share) has gained 6.5% over the last six months, it has lagged the S&P 500’s 14.1% return during that period. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Hope Bancorp, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Do We Think Hope Bancorp Will Underperform?

We're cautious about Hope Bancorp. Here are three reasons why HOPE doesn't excite us and a stock we'd rather own.

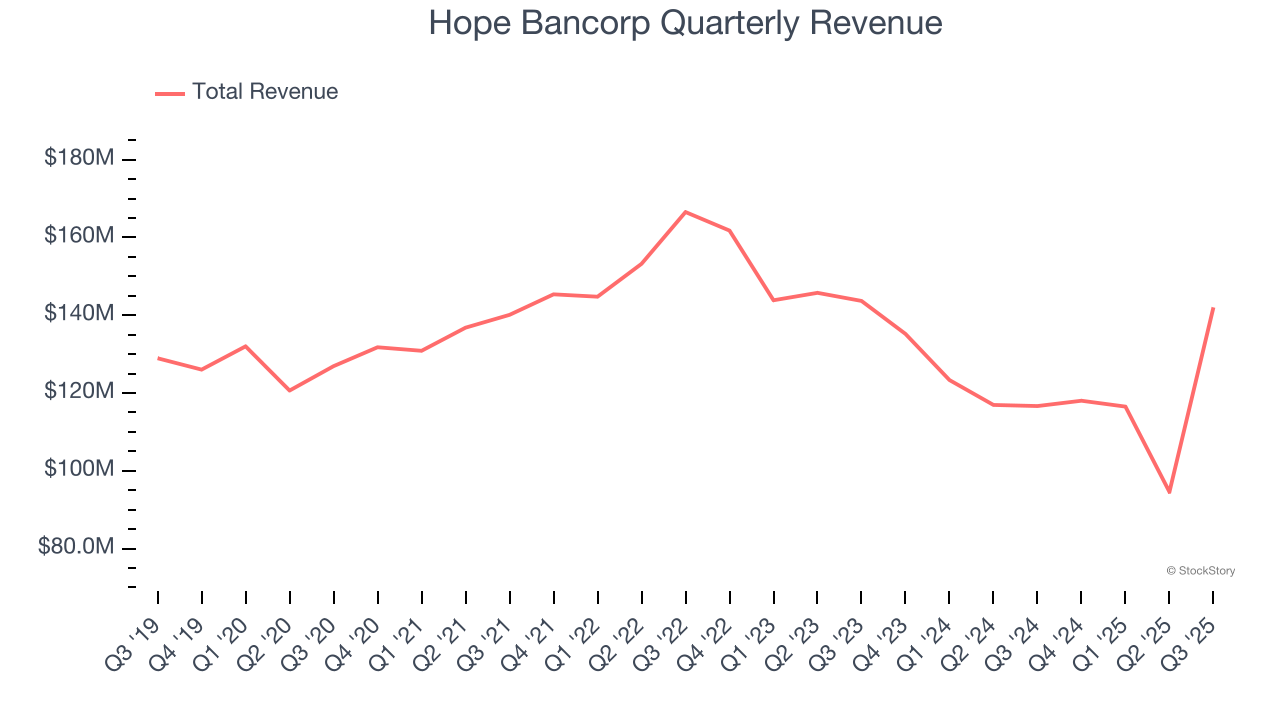

1. Revenue Spiraling Downwards

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions.

Hope Bancorp struggled to consistently generate demand over the last five years as its revenue dropped at a 1.4% annual rate. This was below our standards and signals it’s a low quality business.

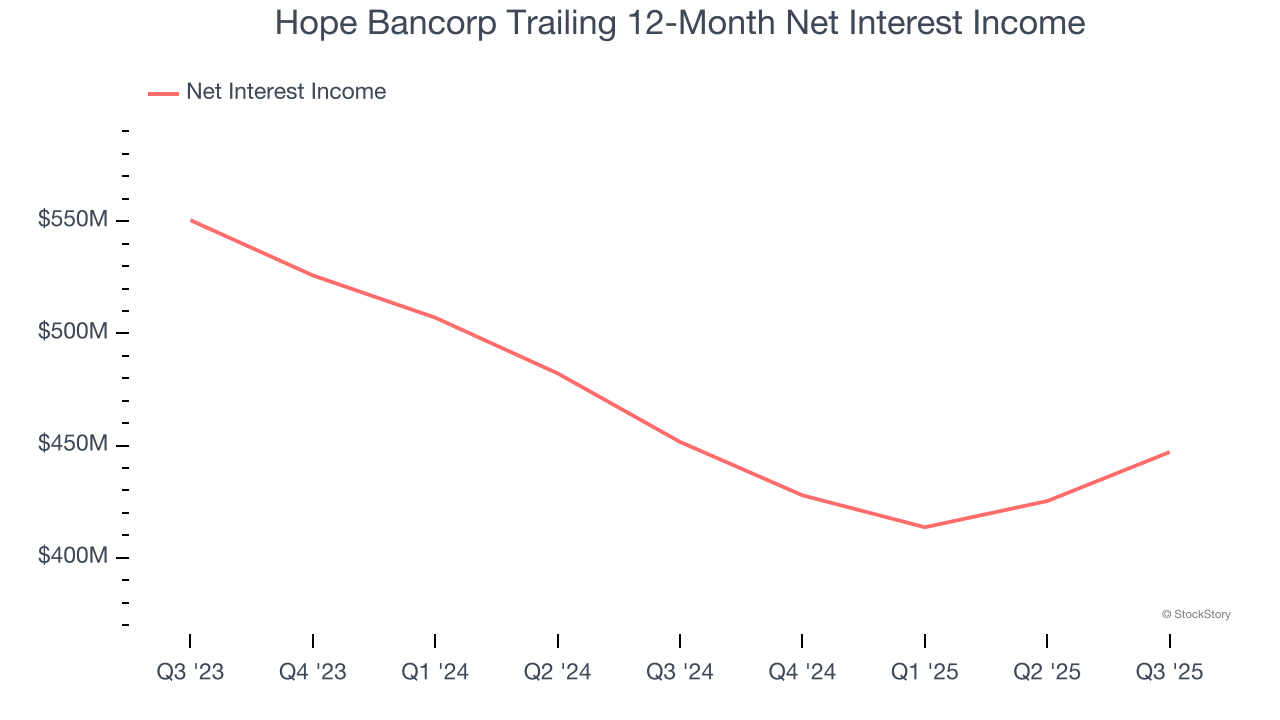

2. Net Interest Income Hits a Plateau

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

Hope Bancorp’s net interest income was flat over the last five years, much worse than the broader banking industry and in line with its total revenue.

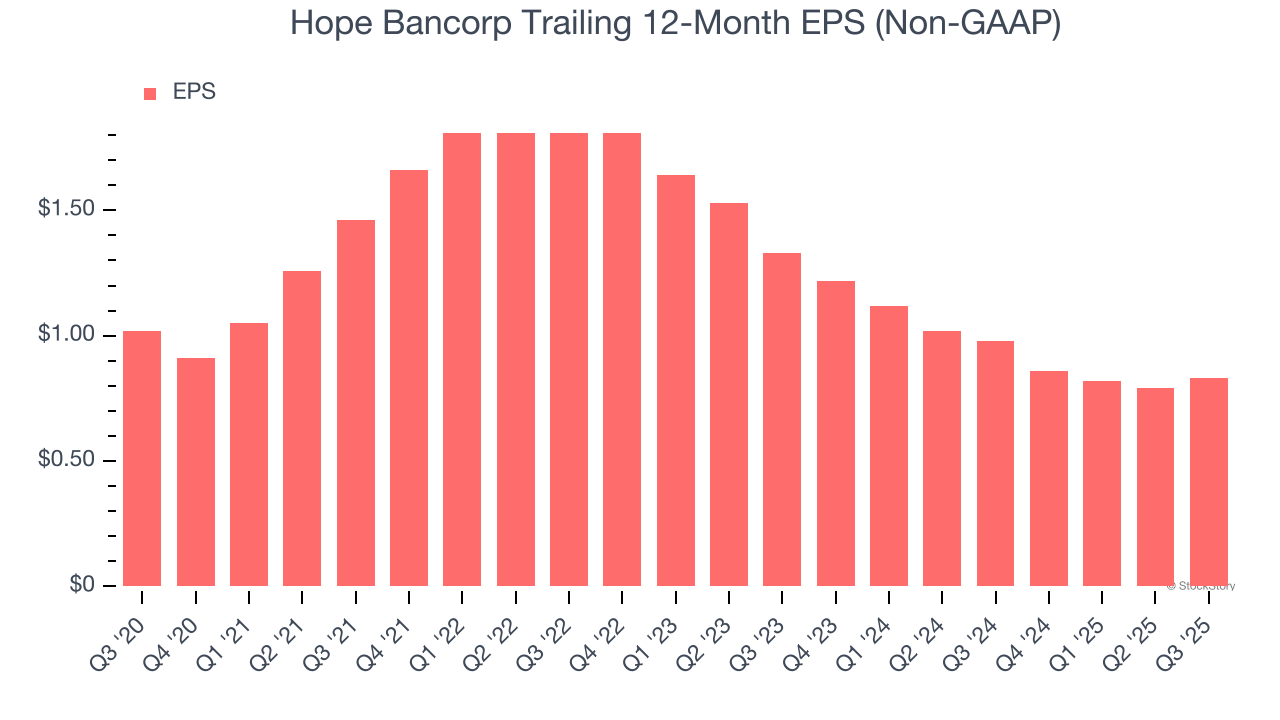

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Hope Bancorp, its EPS declined by 4% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

We cheer for all companies supporting the economy, but in the case of Hope Bancorp, we’ll be cheering from the sidelines. With its shares lagging the market recently, the stock trades at 0.6× forward P/B (or $10.75 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. We’d suggest looking at one of our all-time favorite software stocks.

Stocks We Like More Than Hope Bancorp

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.