As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the diversified financial services industry, including Berkshire Hathaway (NYSE:BRK.A) and its peers.

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

The 11 diversified financial services stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 3.2% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 2.8% on average since the latest earnings results.

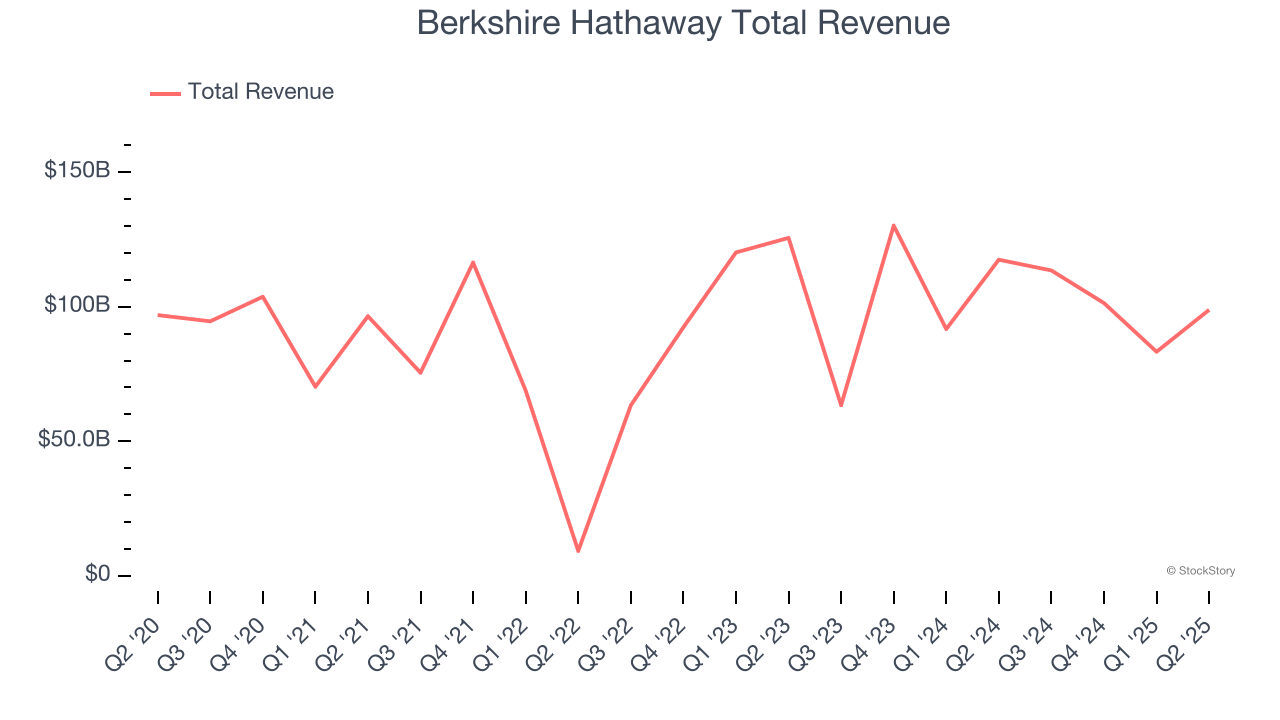

Berkshire Hathaway (NYSE:BRK.A)

Led by legendary investor Warren Buffett since 1965, transforming it from a struggling textile manufacturer into a corporate giant, Berkshire Hathaway (NYSE:BRK.A) is a diversified holding company that owns businesses across insurance, railroads, utilities, manufacturing, retail, and services sectors.

Berkshire Hathaway reported revenues of $98.88 billion, down 15.9% year on year. This print exceeded analysts’ expectations by 5.4%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ revenue estimates and a beat of analysts’ EPS estimates.

Berkshire Hathaway delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 8.1% since reporting and currently trades at $767,866.

Is now the time to buy Berkshire Hathaway? Access our full analysis of the earnings results here, it’s free for active Edge members.

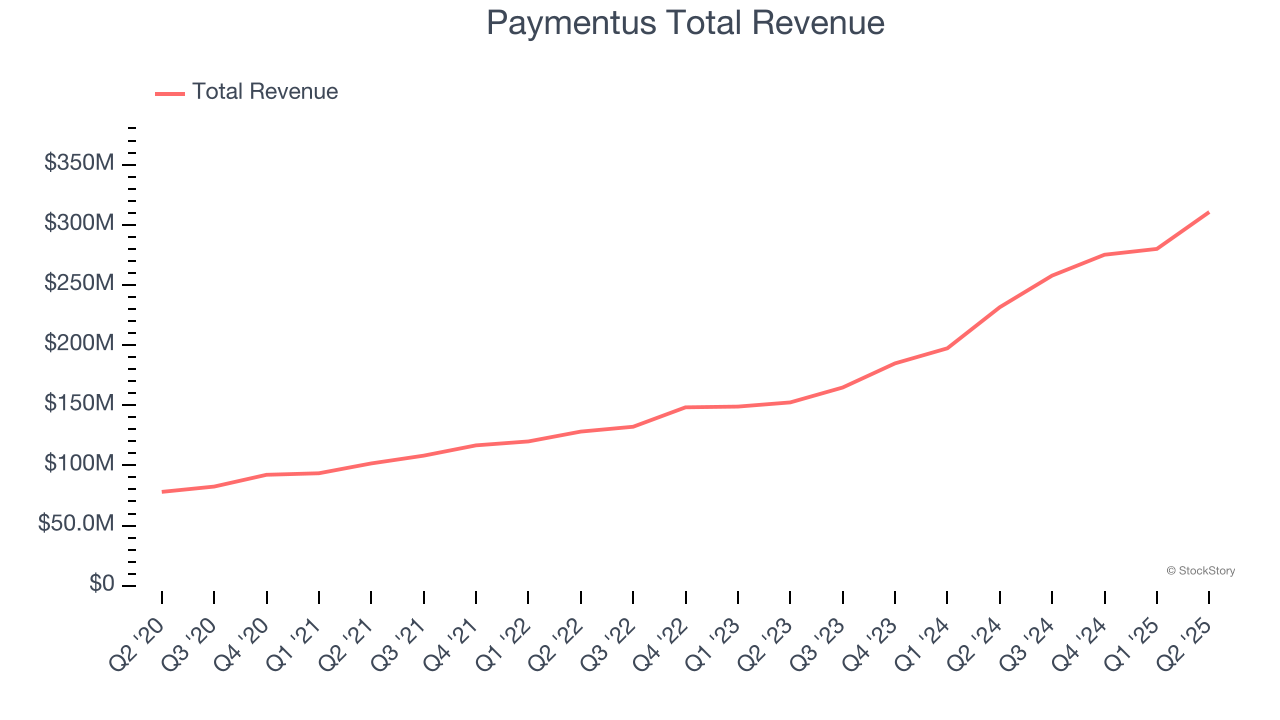

Best Q2: Paymentus (NYSE:PAY)

Founded in 2004 to simplify the complex world of bill payments, Paymentus (NYSE:PAY) provides a cloud-based platform that helps utilities, municipalities, and service providers automate billing and payment processes.

Paymentus reported revenues of $310.7 million, up 34.2% year on year, outperforming analysts’ expectations by 10.7%. The business had a stunning quarter with a solid beat of analysts’ revenue estimates and an impressive beat of analysts’ EBITDA estimates.

Paymentus delivered the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 19.5% since reporting. It currently trades at $34.20.

Is now the time to buy Paymentus? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: NCR Atleos (NYSE:NATL)

Spun off from NCR Voyix in 2023 to focus exclusively on self-service banking technology, NCR Atleos (NYSE:NATL) provides self-directed banking solutions including ATM and interactive teller machine technology, software, services, and a surcharge-free ATM network for financial institutions and retailers.

NCR Atleos reported revenues of $1.12 billion, up 4.5% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 2.4% since the results and currently trades at $36.92.

Read our full analysis of NCR Atleos’s results here.

Corpay (NYSE:CPAY)

Formerly known as FLEETCOR until its 2024 rebrand, Corpay (NYSE:CPAY) provides specialized payment solutions for businesses to manage vehicle expenses, corporate payments, and lodging costs with enhanced control and reporting capabilities.

Corpay reported revenues of $1.17 billion, up 13.9% year on year. This result topped analysts’ expectations by 0.6%. Taking a step back, it was a satisfactory quarter as it also logged full-year revenue guidance slightly topping analysts’ expectations but a miss of analysts’ EBITDA estimates.

The stock is up 12.1% since reporting and currently trades at $293.34.

Read our full, actionable report on Corpay here, it’s free for active Edge members.

NerdWallet (NASDAQ:NRDS)

Born from founder Tim Chen's frustration with the lack of transparent credit card information when helping his sister in 2009, NerdWallet (NASDAQ:NRDS) is a digital platform that provides financial guidance to help consumers and small businesses make smarter decisions about credit cards, loans, insurance, and other financial products.

NerdWallet reported revenues of $215.1 million, up 12.4% year on year. This print surpassed analysts’ expectations by 11.3%. Overall, it was an exceptional quarter as it also put up a solid beat of analysts’ revenue estimates and an impressive beat of analysts’ EBITDA estimates.

NerdWallet scored the biggest analyst estimates beat among its peers. The stock is up 25.4% since reporting and currently trades at $15.02.

Read our full, actionable report on NerdWallet here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.