Let’s dig into the relative performance of Blue Bird (NASDAQ:BLBD) and its peers as we unravel the now-completed Q3 heavy transportation equipment earnings season.

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

The 12 heavy transportation equipment stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 1.4%.

In light of this news, share prices of the companies have held steady as they are up 1.7% on average since the latest earnings results.

Blue Bird (NASDAQ:BLBD)

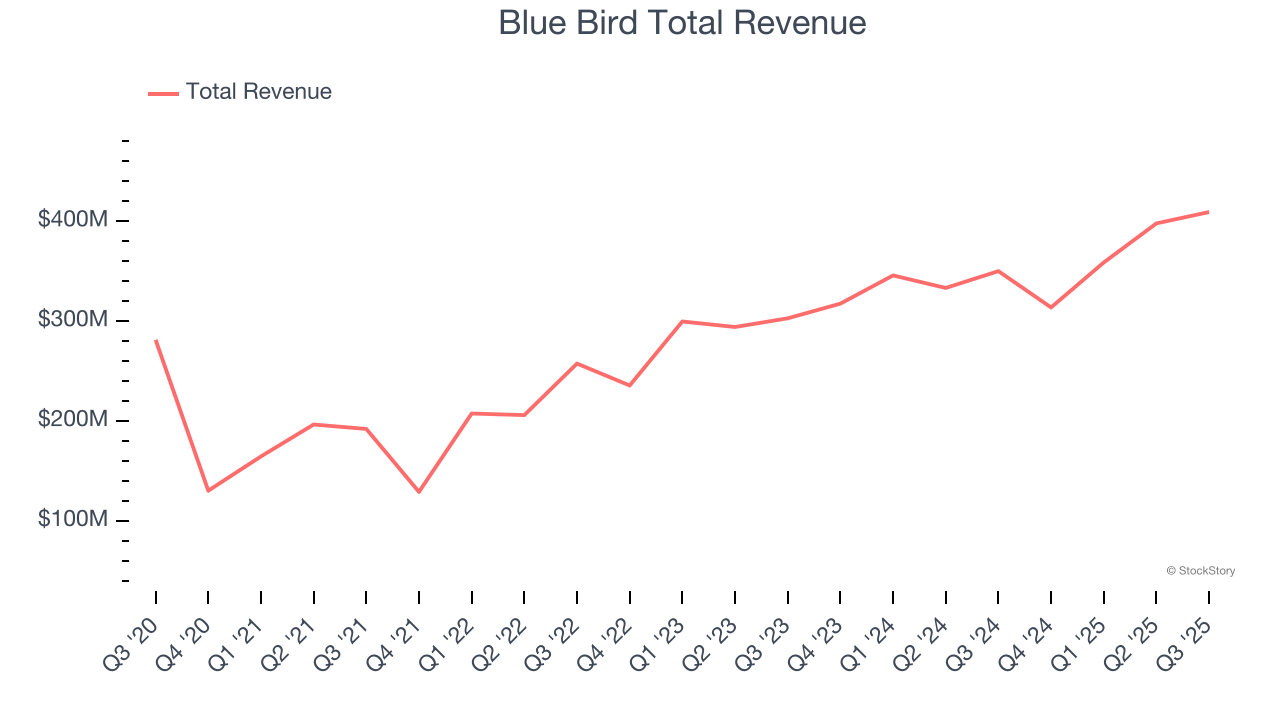

With around a century of experience, Blue Bird (NASDAQ:BLBD) is a manufacturer of school buses and complementary parts.

Blue Bird reported revenues of $409.4 million, up 16.9% year on year. This print exceeded analysts’ expectations by 7.7%. Overall, it was a very strong quarter for the company with a beat of analysts’ EPS and EBITDA estimates.

“I am incredibly proud of our team in delivering another outstanding result, achieving a new all-time record revenue and profit for the quarter and year,” said John Wyskiel, President & CEO of Blue Bird Corporation.

Blue Bird pulled off the biggest analyst estimates beat of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 6.5% since reporting and currently trades at $51.28.

Best Q3: Cummins (NYSE:CMI)

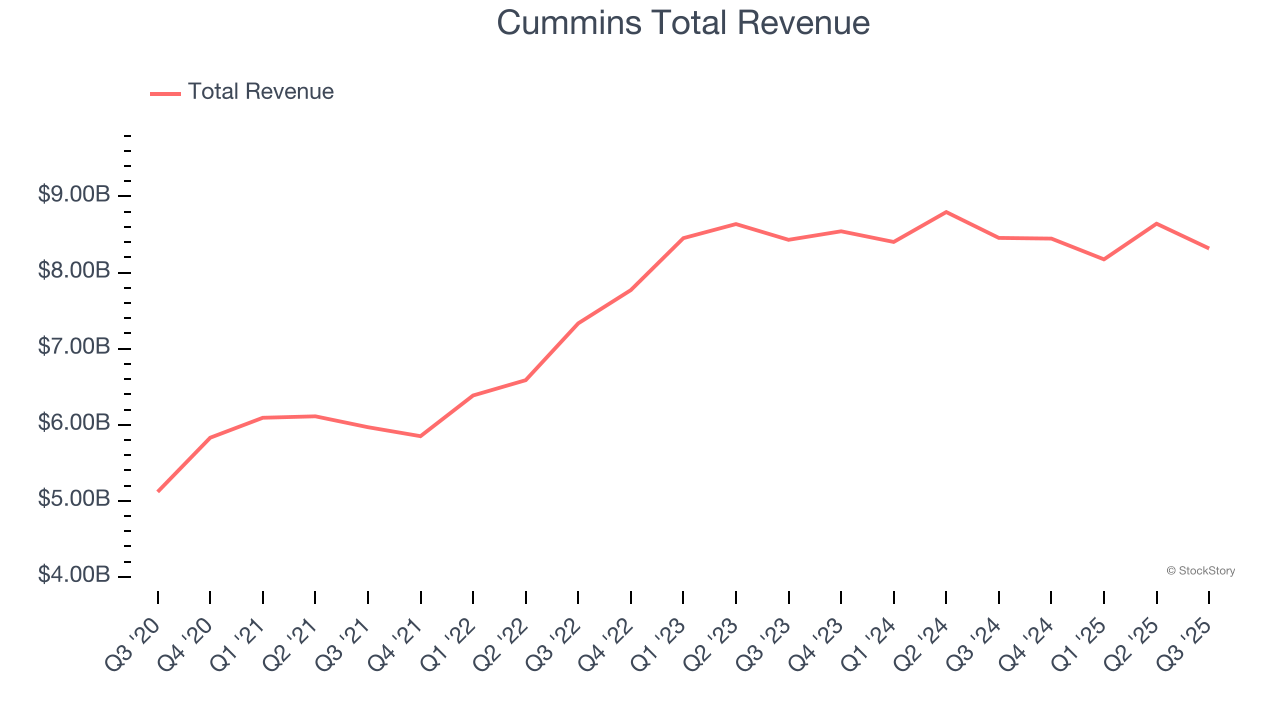

With more than half of the heavy-duty truck market using its engines at one point, Cummins (NYSE:CMI) offers engines and power systems.

Cummins reported revenues of $8.32 billion, down 1.6% year on year, outperforming analysts’ expectations by 5%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA and revenue estimates.

The market seems happy with the results as the stock is up 12.7% since reporting. It currently trades at $495.

Is now the time to buy Cummins? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Wabash (NYSE:WNC)

With its first trailer reportedly built on two sawhorses, Wabash (NYSE:WNC) offers semi trailers, liquid transportation containers, truck bodies, and equipment for moving goods.

Wabash reported revenues of $381.6 million, down 17.8% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations and full-year EPS guidance missing analysts’ expectations significantly.

Wabash delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 2.8% since the results and currently trades at $8.55.

Read our full analysis of Wabash’s results here.

Wabtec (NYSE:WAB)

Also known as Wabtec, Westinghouse Air Brake Technologies (NYSE:WAB) provides equipment, systems, and related software for the railway industry.

Wabtec reported revenues of $2.89 billion, up 8.4% year on year. This number was in line with analysts’ expectations. Zooming out, it was a mixed quarter as it also produced an impressive beat of analysts’ adjusted operating income estimates but a miss of analysts’ organic revenue estimates.

The stock is up 4.1% since reporting and currently trades at $206.09.

Read our full, actionable report on Wabtec here, it’s free for active Edge members.

Allison Transmission (NYSE:ALSN)

Helping build race cars at one point, Allison Transmission (NYSE:ALSN) offers transmissions to original equipment manufacturers and fleet operators.

Allison Transmission reported revenues of $693 million, down 15.9% year on year. This print came in 8.5% below analysts' expectations. Overall, it was a disappointing quarter as it also recorded a miss of analysts’ Service and Support revenue estimates and a miss of analysts’ International On-Highway revenue estimates.

The stock is up 7.7% since reporting and currently trades at $87.86.

Read our full, actionable report on Allison Transmission here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.