What a fantastic six months it’s been for JFrog. Shares of the company have skyrocketed 42%, hitting $61.19. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy FROG? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On FROG?

Named after the amphibian that continuously evolves from egg to tadpole to adult, JFrog (NASDAQ:FROG) provides a platform that helps organizations securely create, store, manage, and distribute software packages across any system.

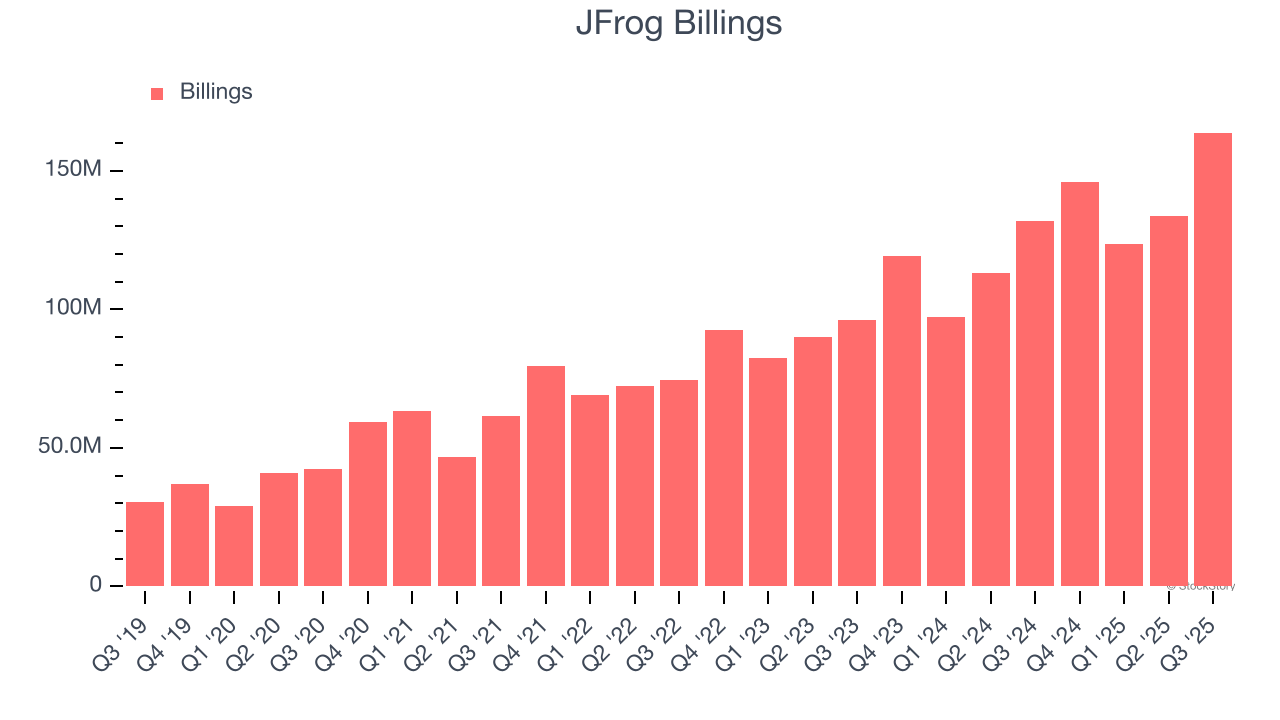

1. Billings Surge, Boosting Cash On Hand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

JFrog’s billings punched in at $163.8 million in Q3, and over the last four quarters, its year-on-year growth averaged 22.9%. This performance was impressive, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

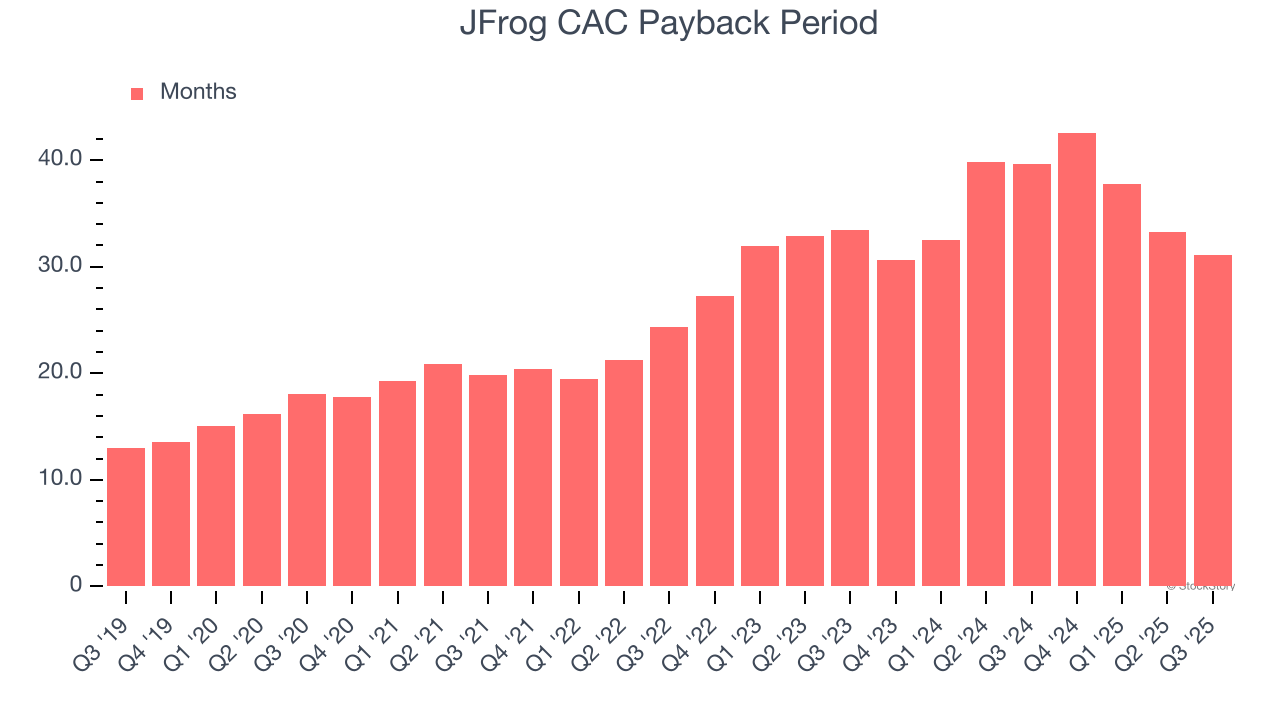

2. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

JFrog is quite efficient at acquiring new customers, and its CAC payback period checked in at 31.1 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a strong brand reputation, giving it more resources pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

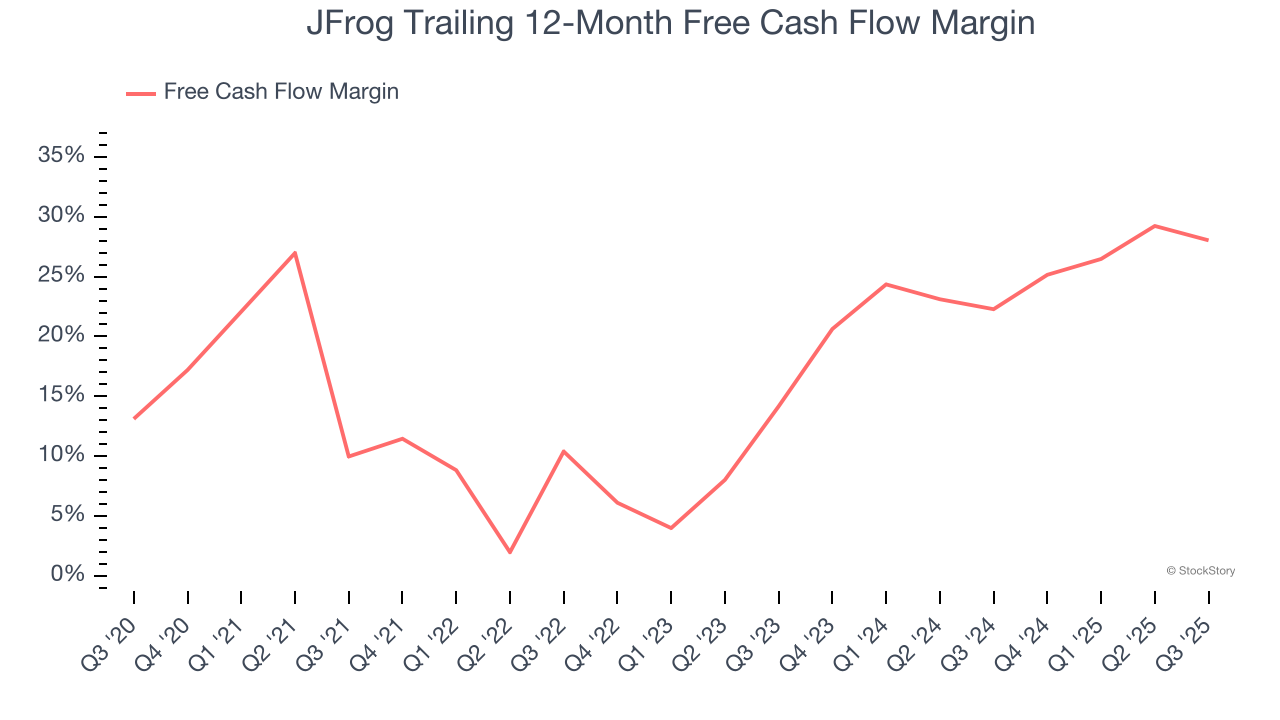

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

JFrog has shown robust cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that enable it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 28% over the last year, quite impressive for a software business. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Final Judgment

These are just a few reasons JFrog is a high-quality business worth owning, and with the recent surge, the stock trades at 11.8× forward price-to-sales (or $61.19 per share). Is now the right time to buy? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than JFrog

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.