Upwork has been treading water for the past six months, recording a small return of 4.5% while holding steady at $17.29. The stock also fell short of the S&P 500’s 11.9% gain during that period.

Is now the time to buy UPWK? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On UPWK?

Formed through the 2013 merger of Elance and oDesk, Upwork (NASDAQ:UPWK) is an online platform where businesses and independent professionals connect to get work done.

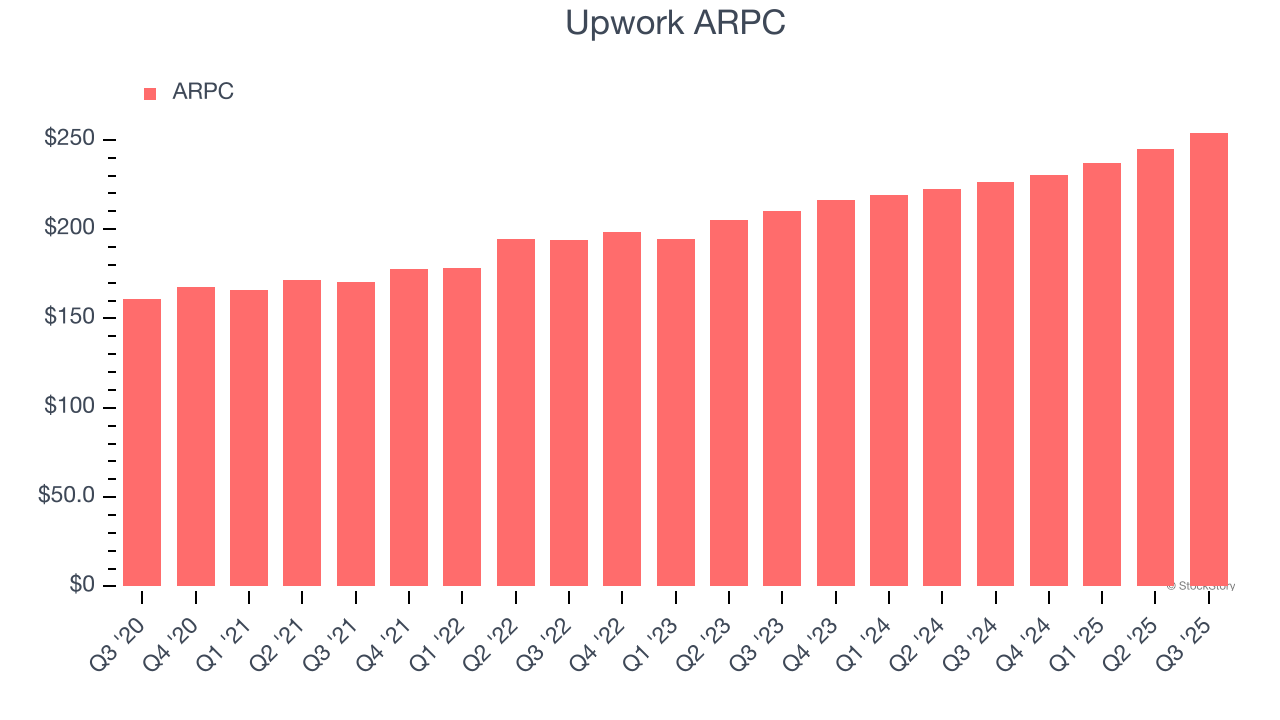

1. Eye-Popping Growth in Customer Spending

Average revenue per customer (ARPC) is a critical metric to track because it measures how much the company earns in transaction fees from each customer. This number also informs us about Upwork’s take rate, which represents its pricing leverage over the ecosystem, or "cut" from each transaction.

Upwork’s ARPC growth has been excellent over the last two years, averaging 9.4%. Although its gross services volume were flat during this time, the company’s ability to successfully increase monetization demonstrates its platform’s value for existing customers.

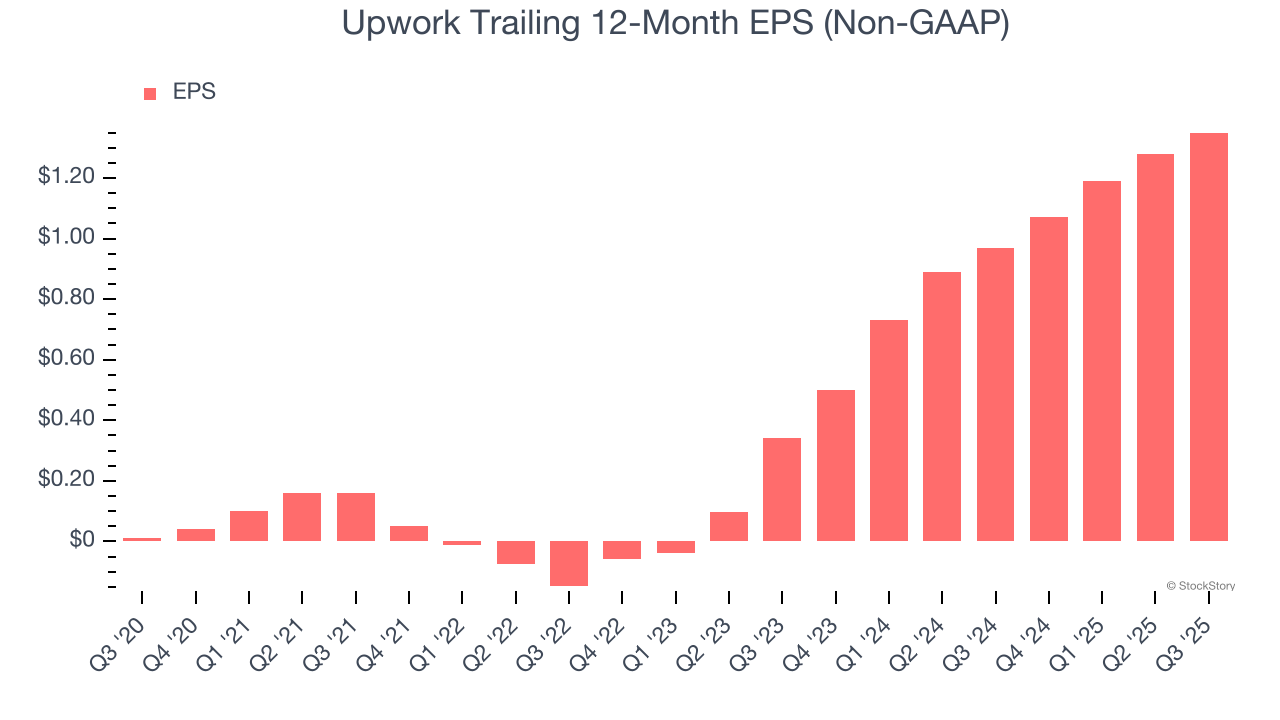

2. Outstanding Long-Term EPS Growth

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Upwork’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

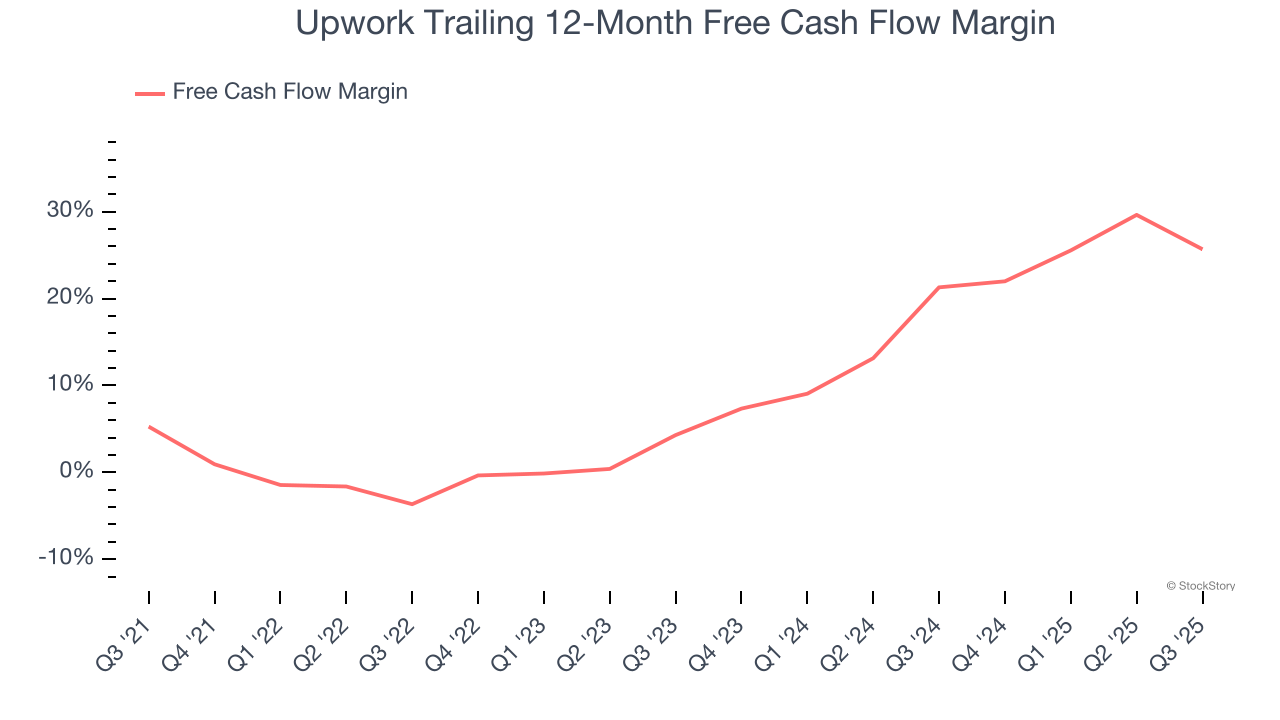

3. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Upwork’s margin expanded by 29.3 percentage points over the last few years. This is encouraging because it gives the company more optionality. Upwork’s free cash flow margin for the trailing 12 months was 25.7%.

Final Judgment

These are just a few reasons why Upwork ranks highly on our list. With its shares lagging the market recently, the stock trades at 9.7× forward EV/EBITDA (or $17.29 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than Upwork

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.