Over the past six months, Corebridge Financial’s stock price fell to $27.61. Shareholders have lost 16.1% of their capital, which is disappointing considering the S&P 500 has climbed by 11.9%. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Corebridge Financial, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is Corebridge Financial Not Exciting?

Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons you should be careful with CRBG and a stock we'd rather own.

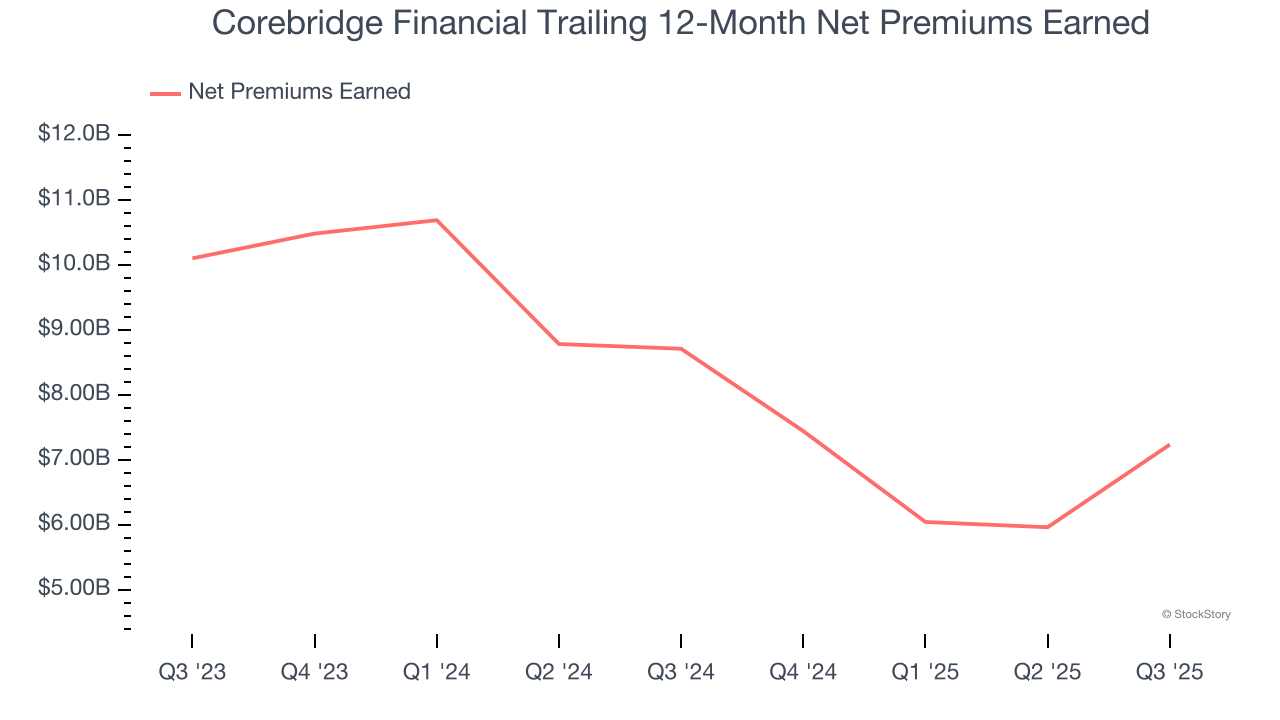

1. Declining Net Premiums Earned Reflect Weakness

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are:

- Gross premiums - what’s ceded to reinsurers as a risk mitigation and transfer strategy

Corebridge Financial’s net premiums earned has declined by 15.4% annually over the last two years, much worse than the broader insurance industry. This shows that policy underwriting underperformed its other business lines.

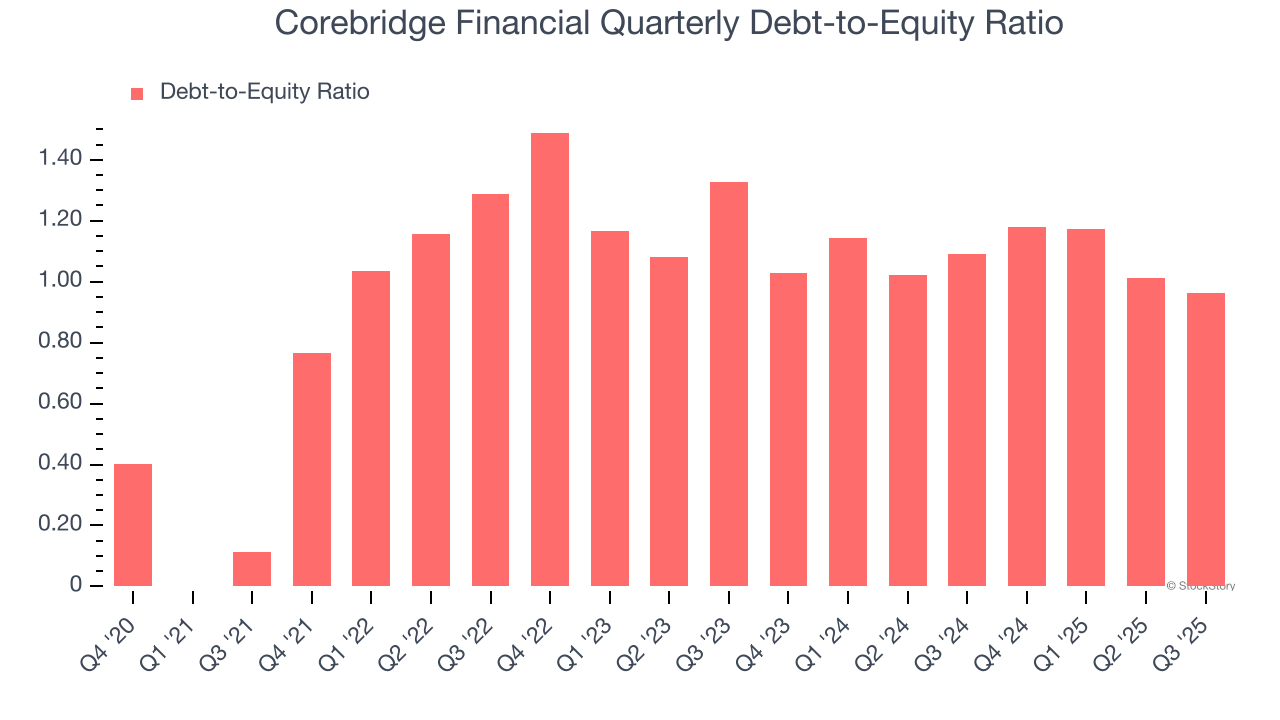

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Corebridge Financial currently has $13.06 billion of debt and $13.54 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 1.1×. We think this is dangerous - for an insurance business, anything above 1.0× raises red flags.

Final Judgment

Corebridge Financial’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 1.1× forward P/B (or $27.61 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Corebridge Financial

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.