Water management solutions company Zurn Elkay (NYSE:ZWS) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 11.1% year on year to $455.4 million. Guidance for next quarter’s revenue was optimistic at $398.5 million at the midpoint, 2.4% above analysts’ estimates. Its non-GAAP profit of $0.43 per share was 8.6% above analysts’ consensus estimates.

Is now the time to buy Zurn Elkay? Find out by accessing our full research report, it’s free for active Edge members.

Zurn Elkay (ZWS) Q3 CY2025 Highlights:

- Revenue: $455.4 million vs analyst estimates of $442.1 million (11.1% year-on-year growth, 3% beat)

- Adjusted EPS: $0.43 vs analyst estimates of $0.40 (8.6% beat)

- Adjusted EBITDA: $122.2 million vs analyst estimates of $117 million (26.8% margin, 4.5% beat)

- Revenue Guidance for Q4 CY2025 is $398.5 million at the midpoint, above analyst estimates of $389 million

- EBITDA guidance for the full year is $438.5 million at the midpoint, above analyst estimates of $430.5 million

- Operating Margin: 17%, in line with the same quarter last year

- Free Cash Flow Margin: 20.6%, similar to the same quarter last year

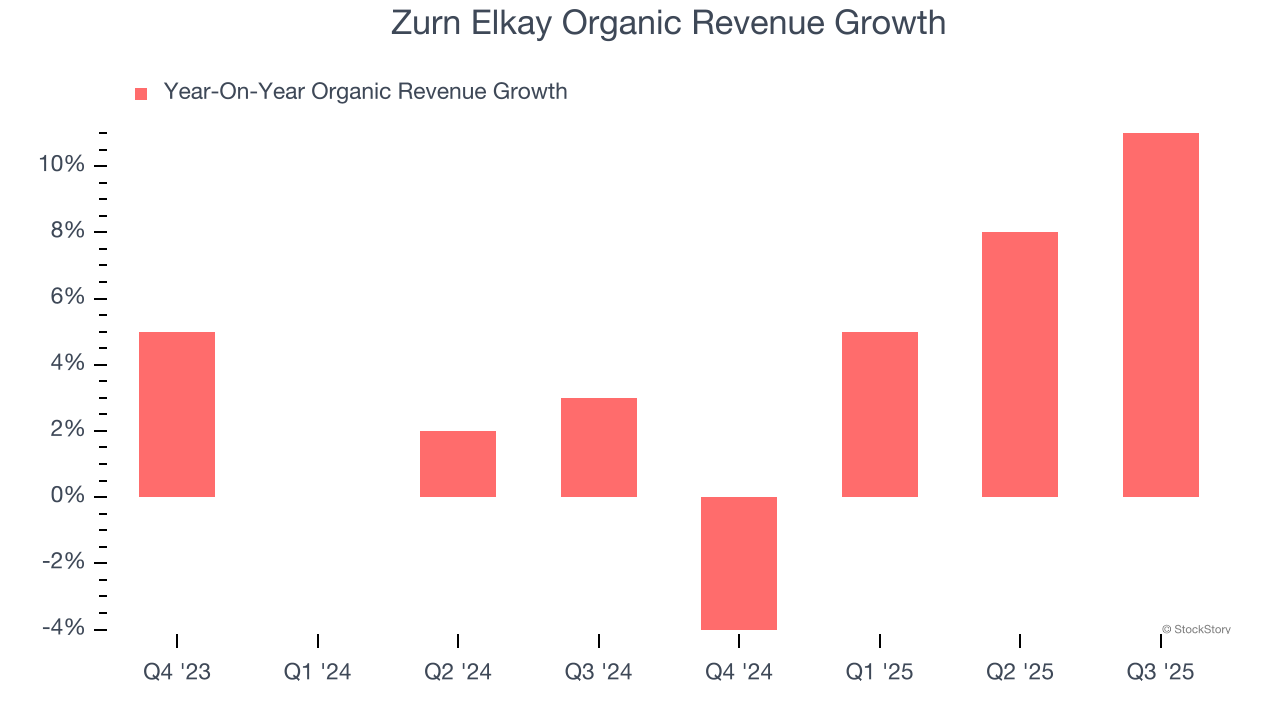

- Organic Revenue rose 11% year on year

- Market Capitalization: $7.81 billion

Todd A. Adams, Chairman and Chief Executive Officer, commented, “We delivered a solid quarter as our sales and adjusted EBITDA(1) both exceeded the guidance we provided 90 days ago and will again raise our expectations for the full year. Third quarter core sales(1) growth was 11% compared to the prior year and adjusted EBITDA margin(1) was 26.8%, an increase of 120 basis points over the prior year third quarter. Free cash flow(1) in the quarter was $94 million which reduced our leverage to a record low of 0.6x. Our exceptional cash generation and strong balance sheet have us well positioned and provides optionality to execute our balanced capital allocation approach including cultivating the right M&A opportunities and continued return of capital to shareholders. We have increased our annual dividend 22% to $0.44 per share and also increased the share repurchase authorization to $500 million.”

Company Overview

Claiming to have saved more than 30 billion gallons of water, Zurn Elkay (NYSE:ZWS) provides water management solutions to various industries.

Revenue Growth

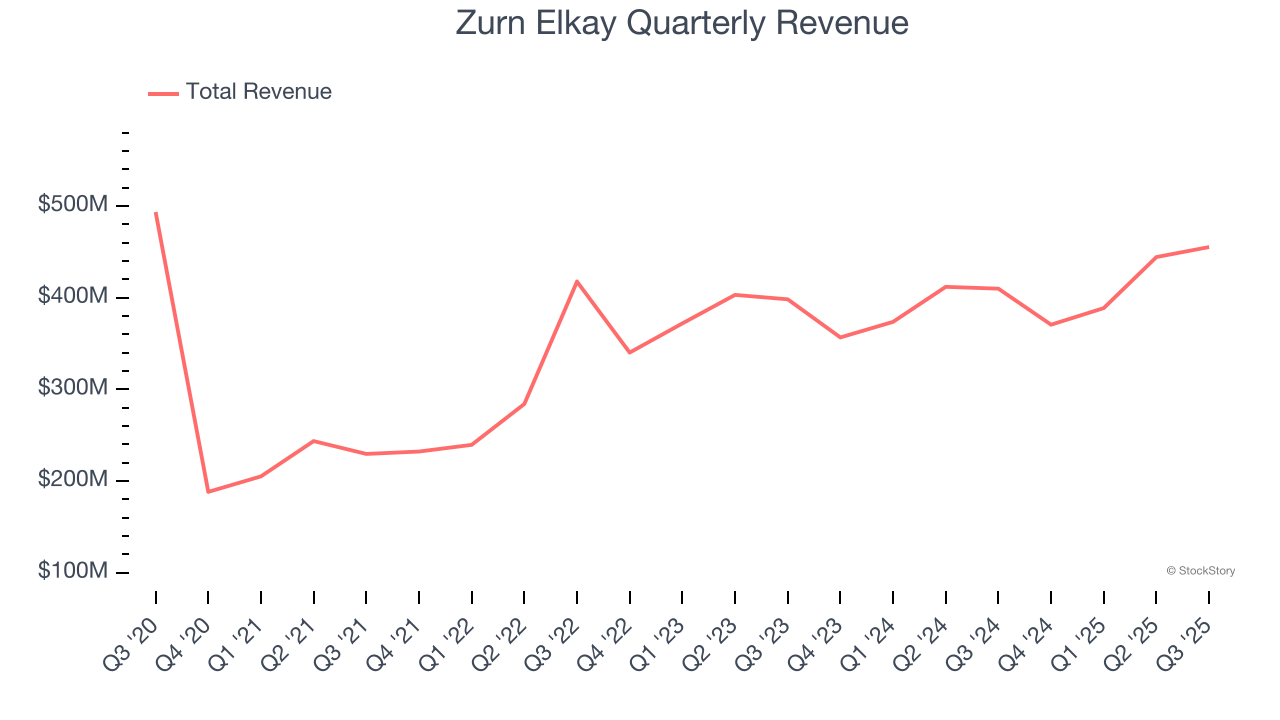

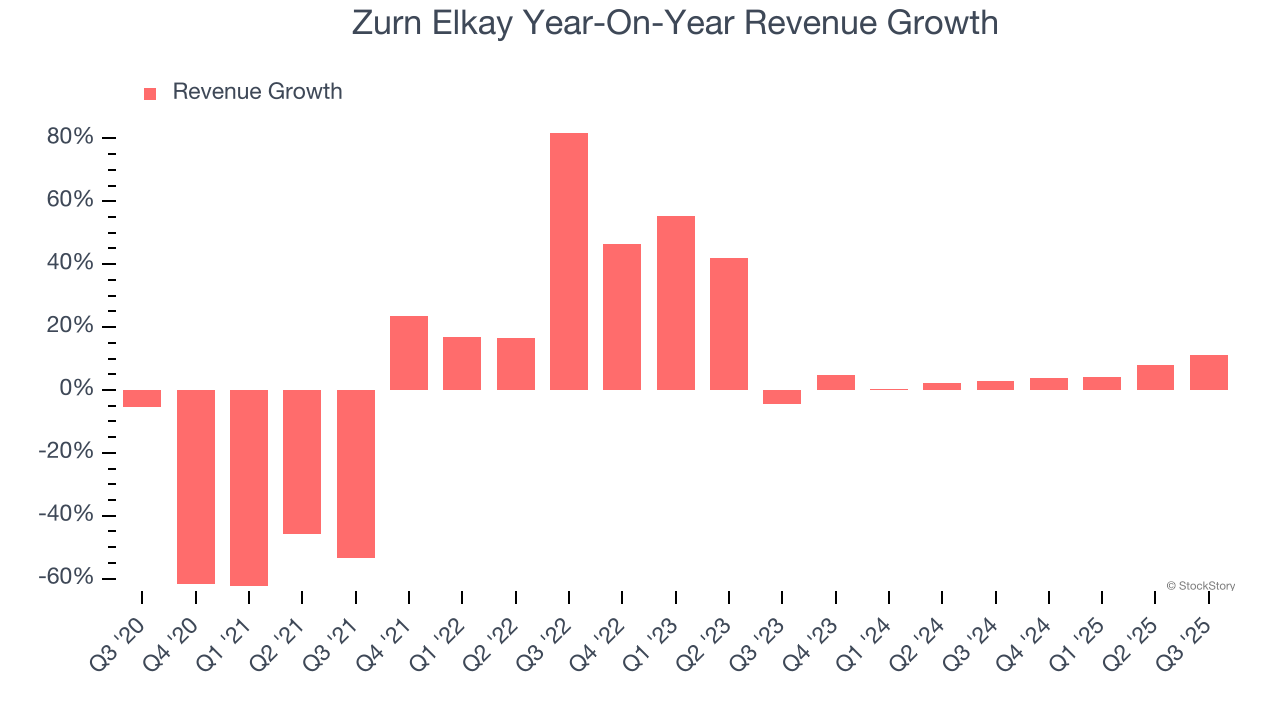

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Zurn Elkay’s demand was weak and its revenue declined by 3.5% per year. This wasn’t a great result and is a sign of lacking business quality.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Zurn Elkay’s annualized revenue growth of 4.7% over the last two years is above its five-year trend, but we were still disappointed by the results.

Zurn Elkay also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Zurn Elkay’s organic revenue averaged 3.8% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Zurn Elkay reported year-on-year revenue growth of 11.1%, and its $455.4 million of revenue exceeded Wall Street’s estimates by 3%. Company management is currently guiding for a 7.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its newer products and services will not lead to better top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

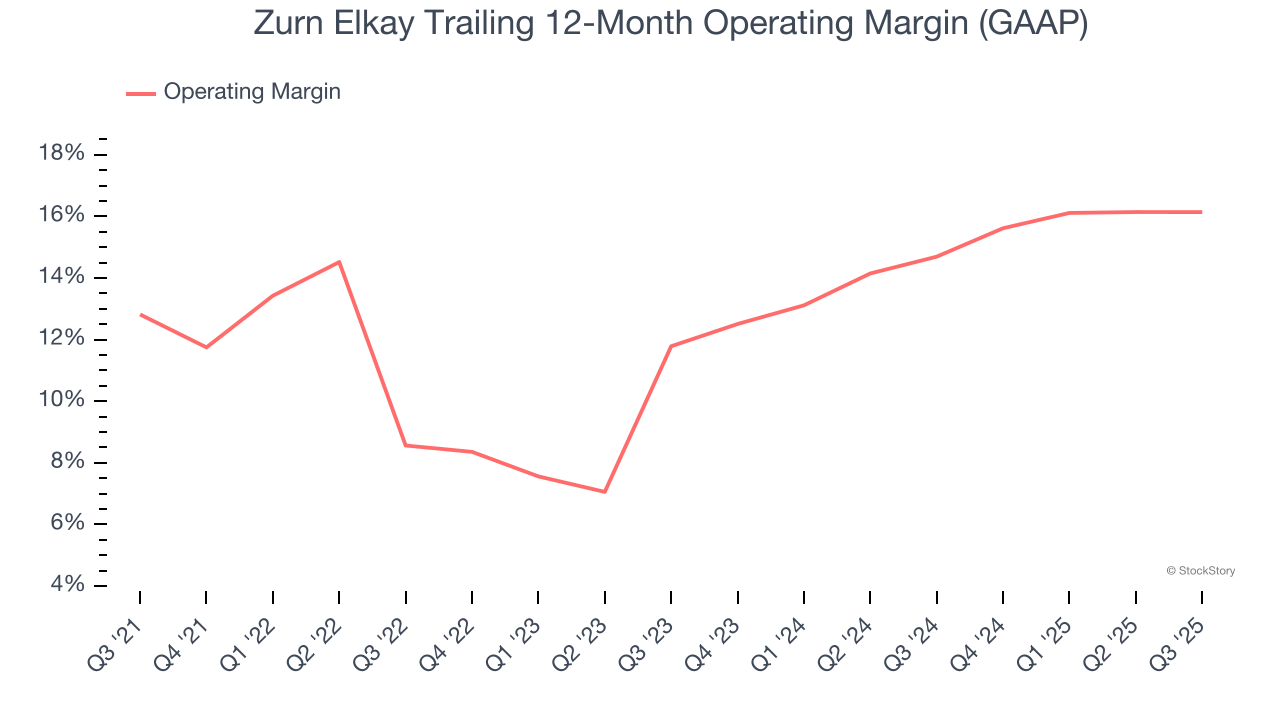

Operating Margin

Zurn Elkay has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 13.1%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Zurn Elkay’s operating margin rose by 3.3 percentage points over the last five years, showing its efficiency has improved.

This quarter, Zurn Elkay generated an operating margin profit margin of 17%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

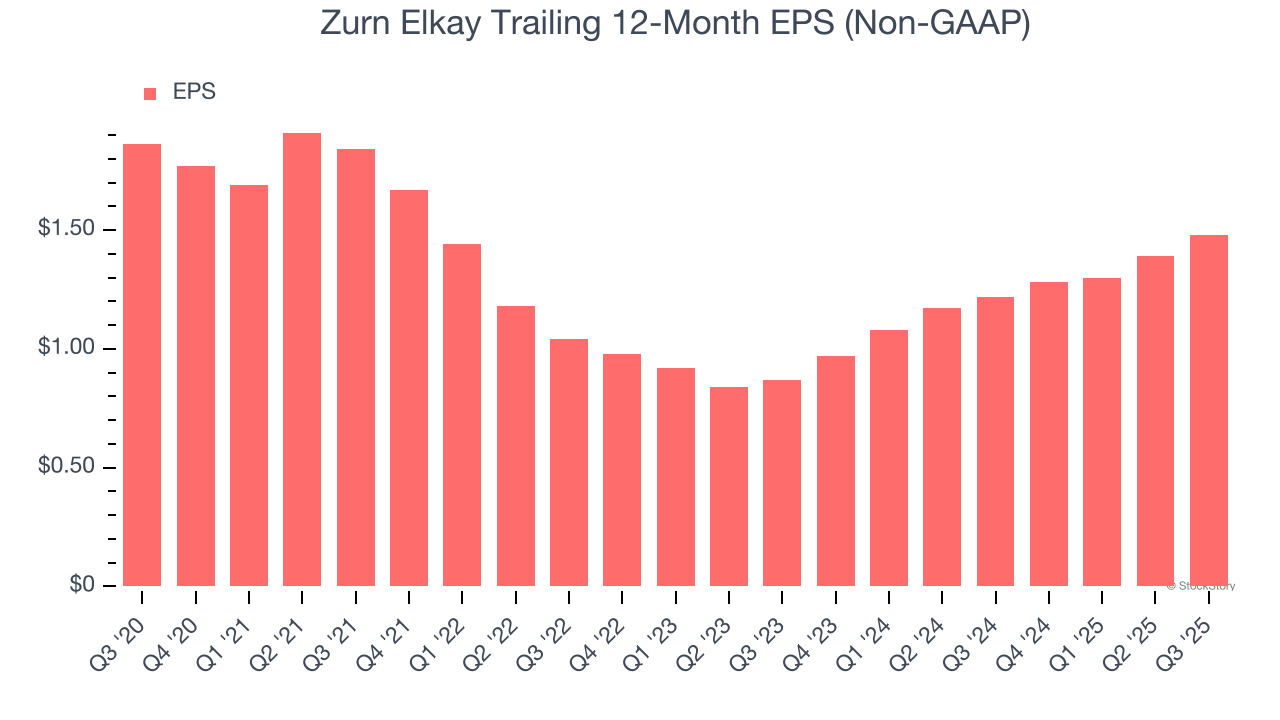

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Zurn Elkay, its EPS and revenue declined by 4.5% and 3.5% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Zurn Elkay’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Zurn Elkay’s two-year annual EPS growth of 30.4% was fantastic and topped its 4.7% two-year revenue growth.

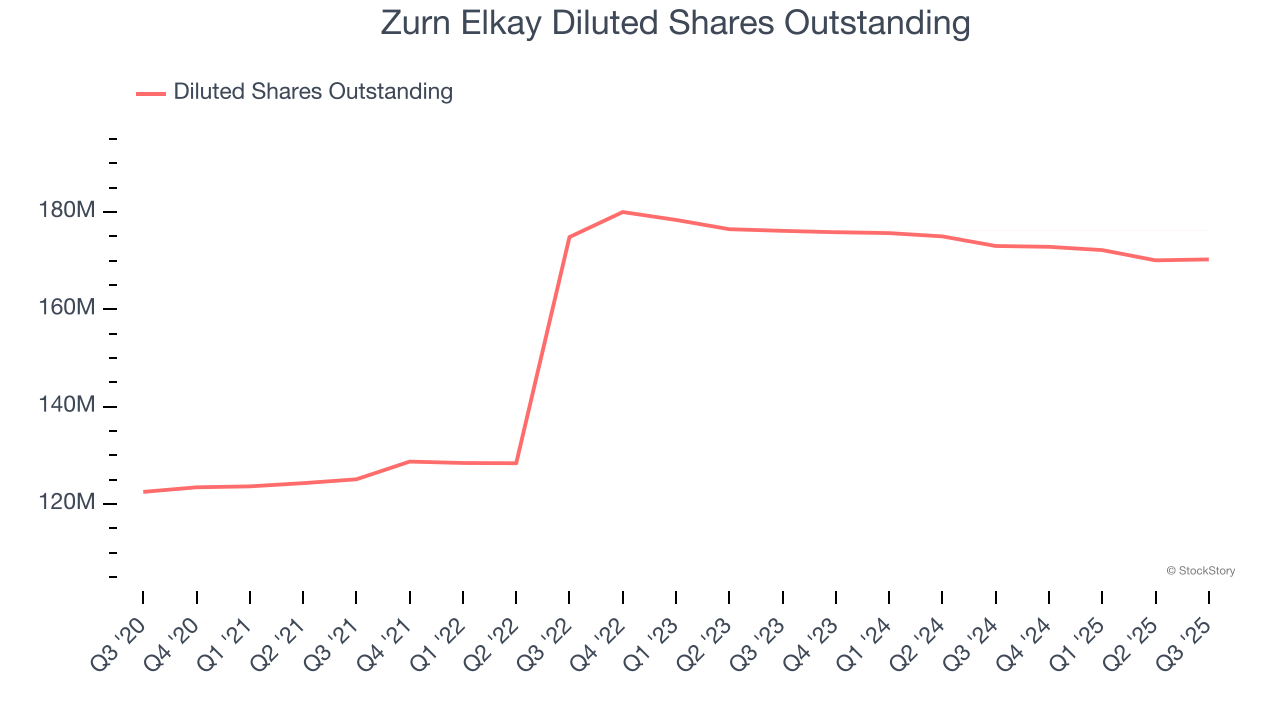

Diving into Zurn Elkay’s quality of earnings can give us a better understanding of its performance. While we mentioned earlier that Zurn Elkay’s operating margin was flat this quarter, a two-year view shows its margin has expandedwhile its share count has shrunk 3.3%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q3, Zurn Elkay reported adjusted EPS of $0.43, up from $0.34 in the same quarter last year. This print beat analysts’ estimates by 8.6%. Over the next 12 months, Wall Street expects Zurn Elkay’s full-year EPS of $1.48 to grow 4.1%.

Key Takeaways from Zurn Elkay’s Q3 Results

We enjoyed seeing Zurn Elkay beat analysts’ revenue expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 1.9% to $46.95 immediately after reporting.

Zurn Elkay had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.