Digital lending platform LendingClub (NYSE:LC) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 31.9% year on year to $266.2 million. Its GAAP profit of $0.37 per share was 21.7% above analysts’ consensus estimates.

Is now the time to buy LendingClub? Find out by accessing our full research report, it’s free for active Edge members.

LendingClub (LC) Q3 CY2025 Highlights:

- Revenue: $266.2 million vs analyst estimates of $256.3 million (31.9% year-on-year growth, 3.9% beat)

- Pre-tax Profit: $57.24 million (21.5% margin, 218% year-on-year growth)

- EPS (GAAP): $0.37 vs analyst estimates of $0.30 (21.7% beat)

- Market Capitalization: $1.92 billion

Company Overview

Pioneering peer-to-peer lending in the US before evolving into a digital bank, LendingClub (NYSE:LC) operates a marketplace that connects borrowers with lenders, offering personal loans, auto refinancing, and banking services.

Revenue Growth

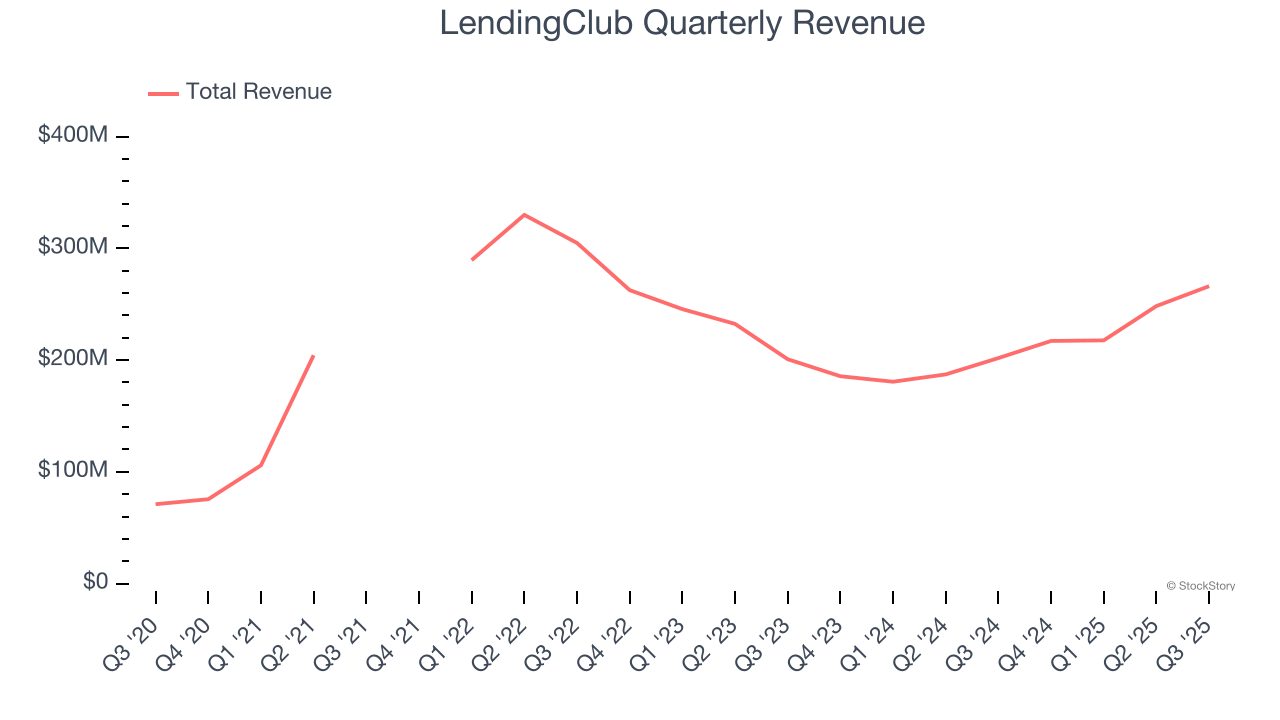

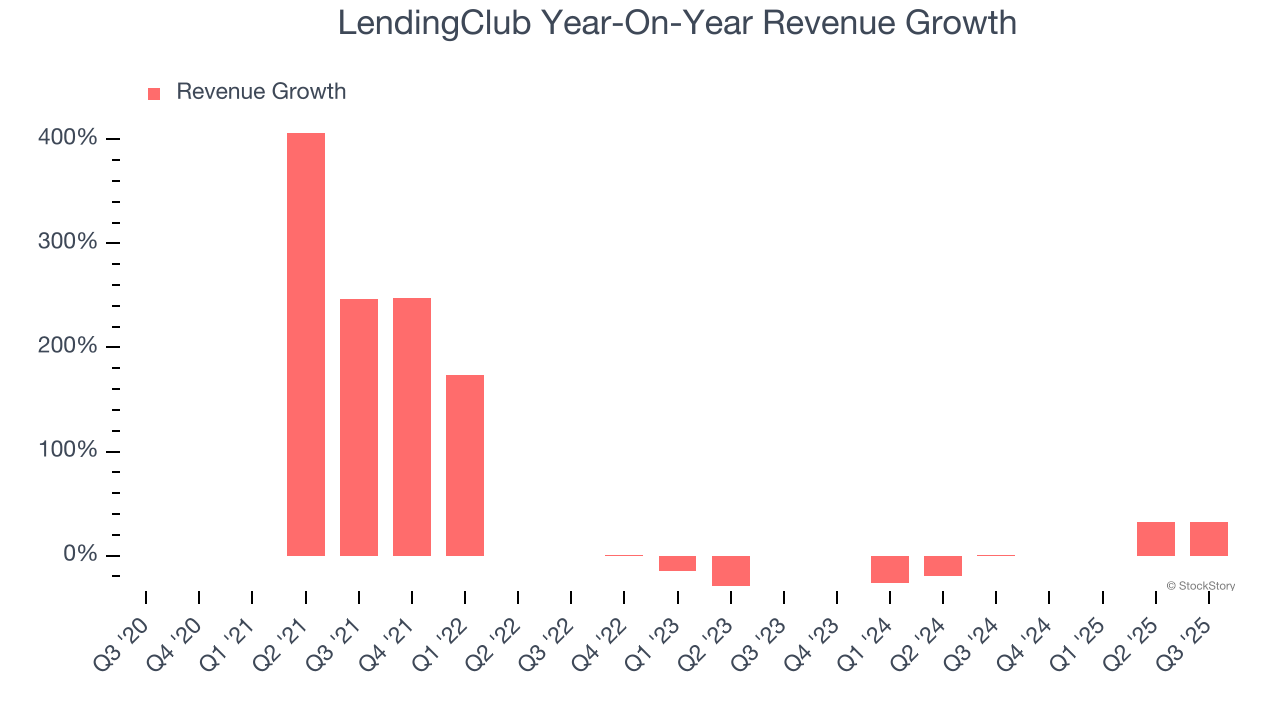

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, LendingClub’s 24.7% annualized revenue growth over the last five years was exceptional. Its growth beat the average financials company and shows its offerings resonate with customers.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. LendingClub’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, LendingClub reported wonderful year-on-year revenue growth of 31.9%, and its $266.2 million of revenue exceeded Wall Street’s estimates by 3.9%.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Key Takeaways from LendingClub’s Q3 Results

It was good to see LendingClub beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 5.4% to $17.41 immediately after reporting.

LendingClub may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.