Aerospace and defense company General Dynamics (NYSE:GD) reported Q4 CY2024 results exceeding the market’s revenue expectations, with sales up 14.3% year on year to $13.34 billion. Its GAAP profit of $4.15 per share was 2.4% above analysts’ consensus estimates.

Is now the time to buy General Dynamics? Find out by accessing our full research report, it’s free.

General Dynamics (GD) Q4 CY2024 Highlights:

- Revenue: $13.34 billion vs analyst estimates of $12.9 billion (14.3% year-on-year growth, 3.4% beat)

- EPS (GAAP): $4.15 vs analyst estimates of $4.05 (2.4% beat)

- Operating Margin: 10.7%, in line with the same quarter last year

- Free Cash Flow Margin: 13.5%, up from 7.6% in the same quarter last year

- Backlog: $90.6 billion vs analyst estimates of $81.8 billion (10.8% beat)

- Market Capitalization: $72.08 billion

"We had a solid fourth quarter, capping off a year that saw steady growth in revenue and earnings across all four segments," said Phebe N. Novakovic, chairman and chief executive officer.

Company Overview

Creator of the famous M1 Abrahms tank, General Dynamics (NYSE:GD) develops aerospace, marine systems, combat systems, and information technology products.

Defense Contractors

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

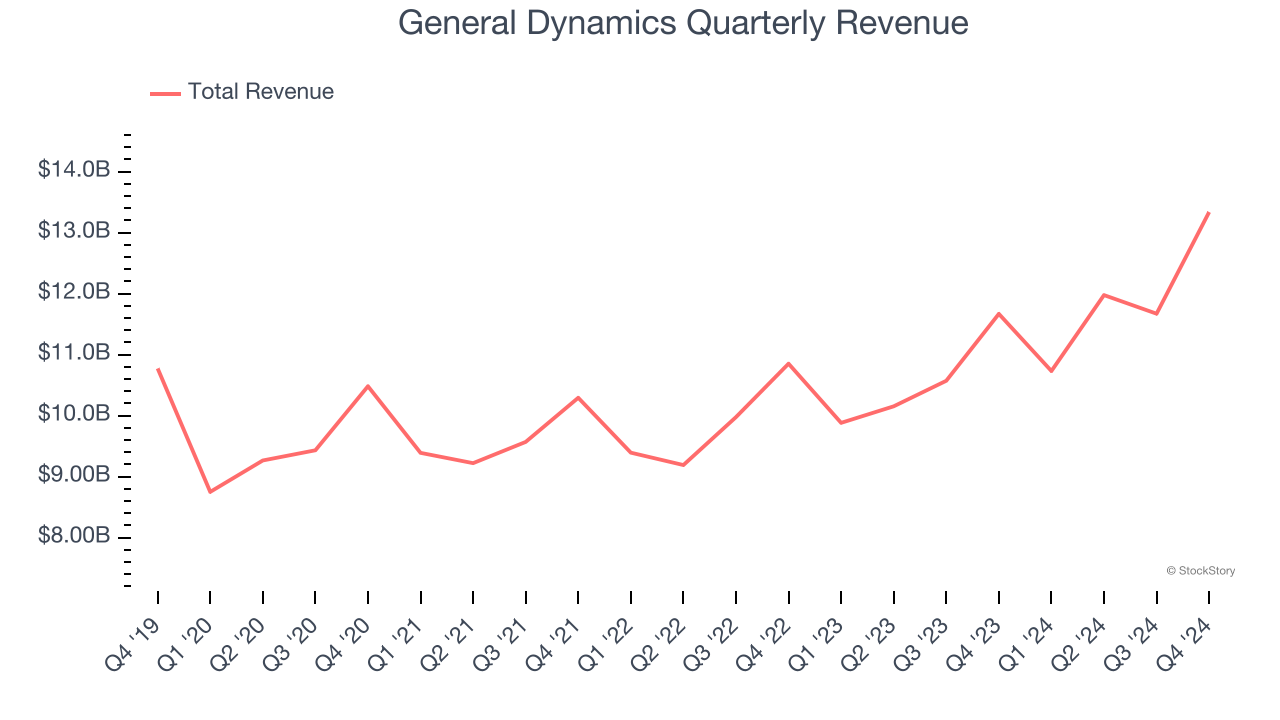

Sales Growth

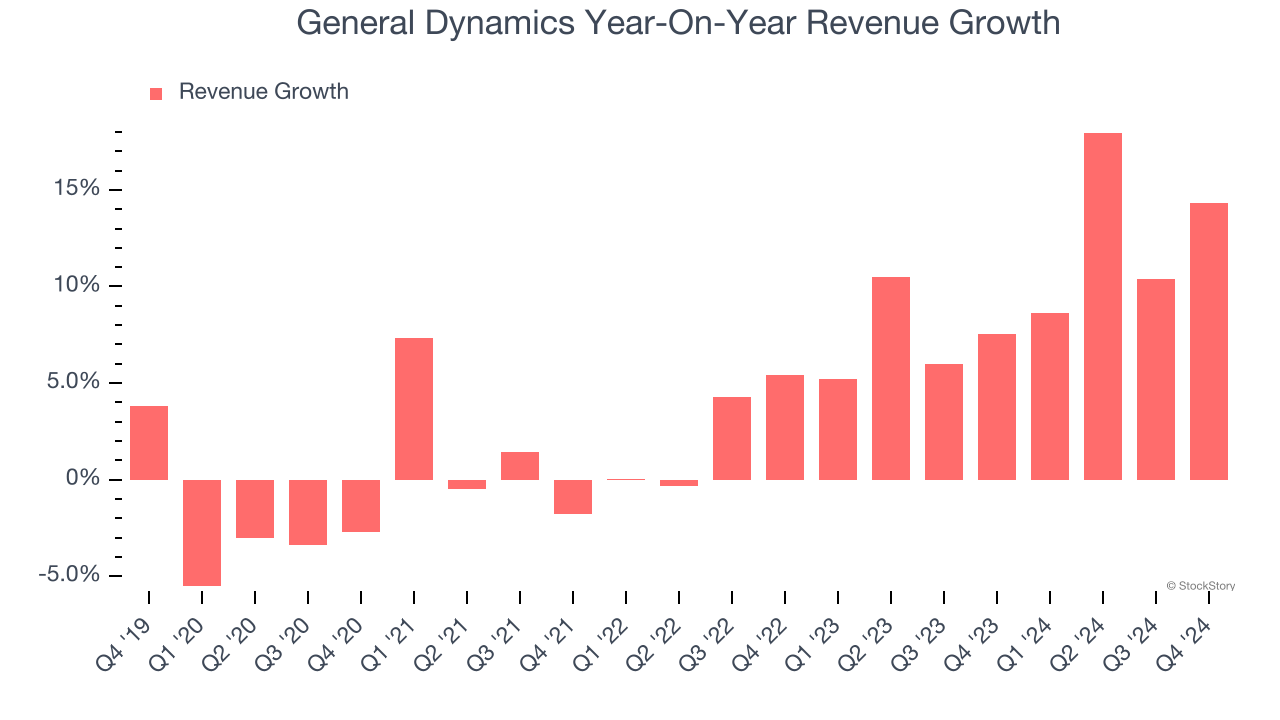

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, General Dynamics’s sales grew at a sluggish 3.9% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. General Dynamics’s annualized revenue growth of 10% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, General Dynamics reported year-on-year revenue growth of 14.3%, and its $13.34 billion of revenue exceeded Wall Street’s estimates by 3.4%.

Looking ahead, sell-side analysts expect revenue to grow 5.4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

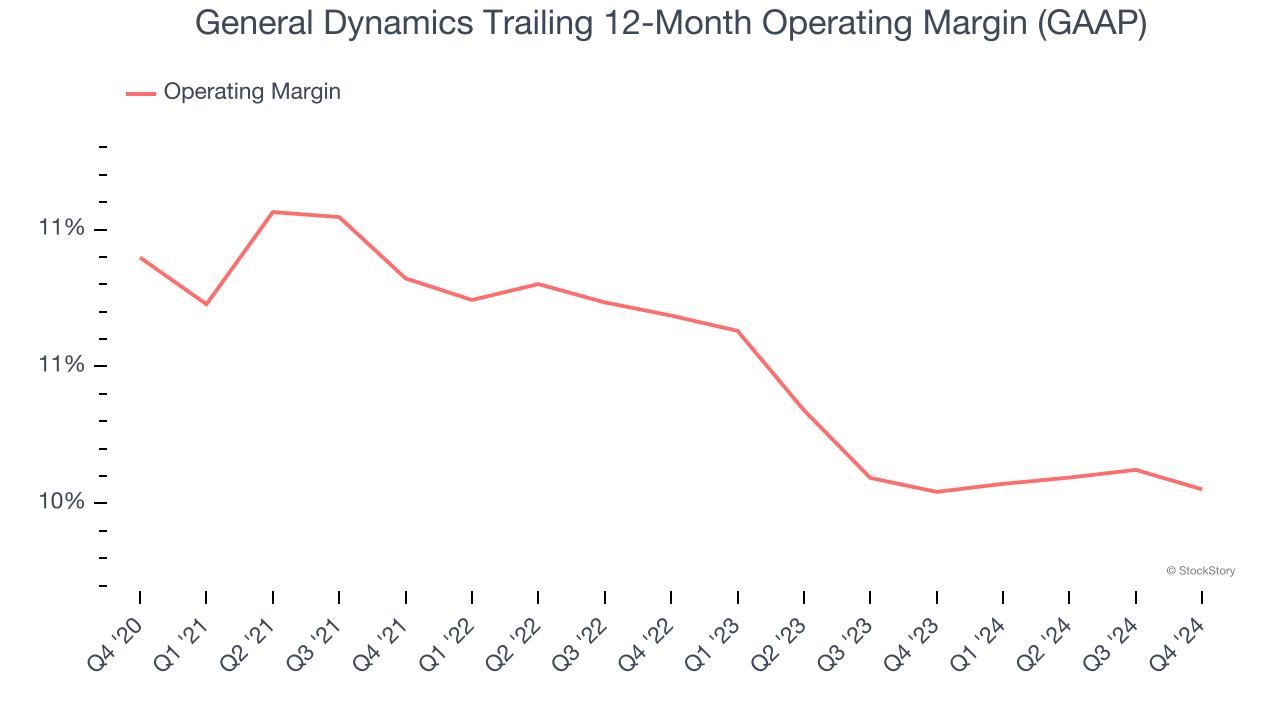

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

General Dynamics has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.5%.

Analyzing the trend in its profitability, General Dynamics’s operating margin might have seen some fluctuations but has generally stayed the same over the last five years, highlighting the long-term consistency of its business.

This quarter, General Dynamics generated an operating profit margin of 10.7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

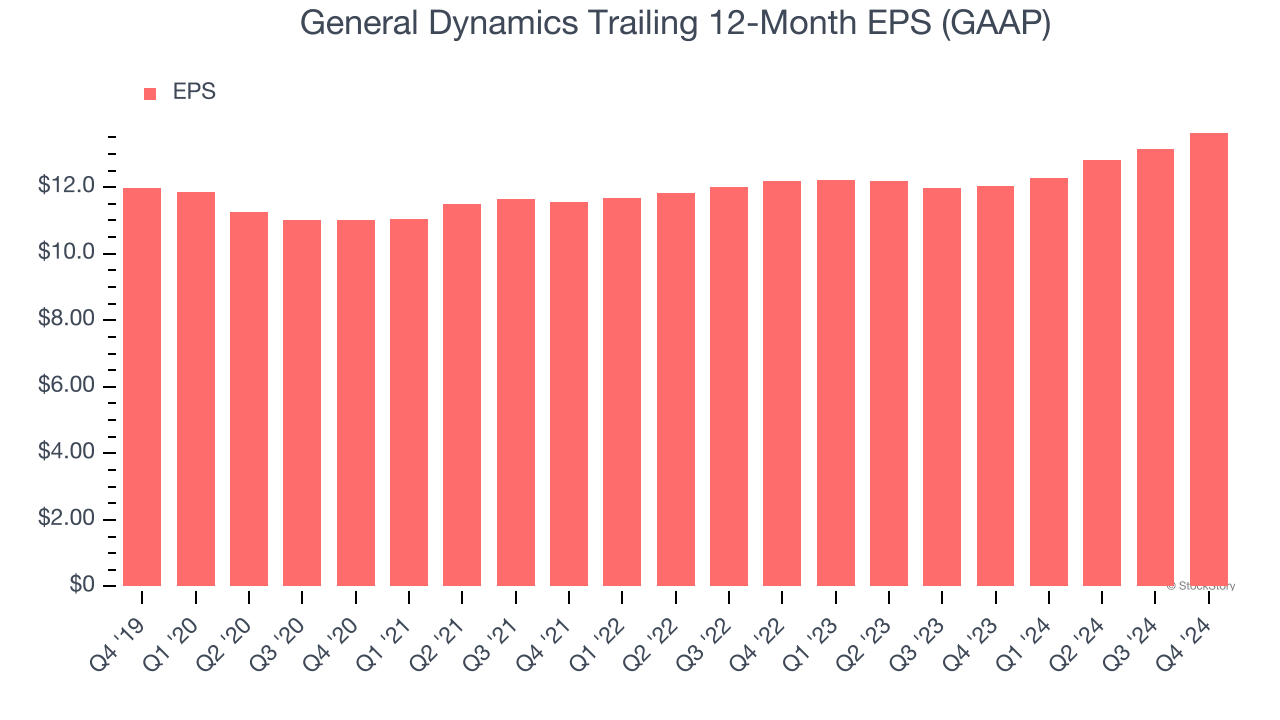

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

General Dynamics’s EPS grew at a weak 2.6% compounded annual growth rate over the last five years, lower than its 3.9% annualized revenue growth. However, its operating margin didn’t change during this timeframe, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For General Dynamics, its two-year annual EPS growth of 5.8% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.

In Q4, General Dynamics reported EPS at $4.15, up from $3.64 in the same quarter last year. This print beat analysts’ estimates by 2.4%. Over the next 12 months, Wall Street expects General Dynamics’s full-year EPS of $13.64 to grow 16.1%.

Key Takeaways from General Dynamics’s Q4 Results

We enjoyed seeing General Dynamics exceed analysts’ revenue expectations this quarter. Backlog at the end of the quarter also came in higher than expectations. Zooming out, we think this was a solid quarter. However, shares traded down 1.7% to $257.89 immediately following the results. This could be the result of the market's continued worries about businesses tied to the government and to defense contracts under the new Trump administration. Specifically, President Trump's DOGE initiatives could upend spend with General Dynamics and peers.

So do we think General Dynamics is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.