Aerospace and defense company TransDigm (NYSE:TDG) will be announcing earnings results tomorrow before market open. Here’s what to expect.

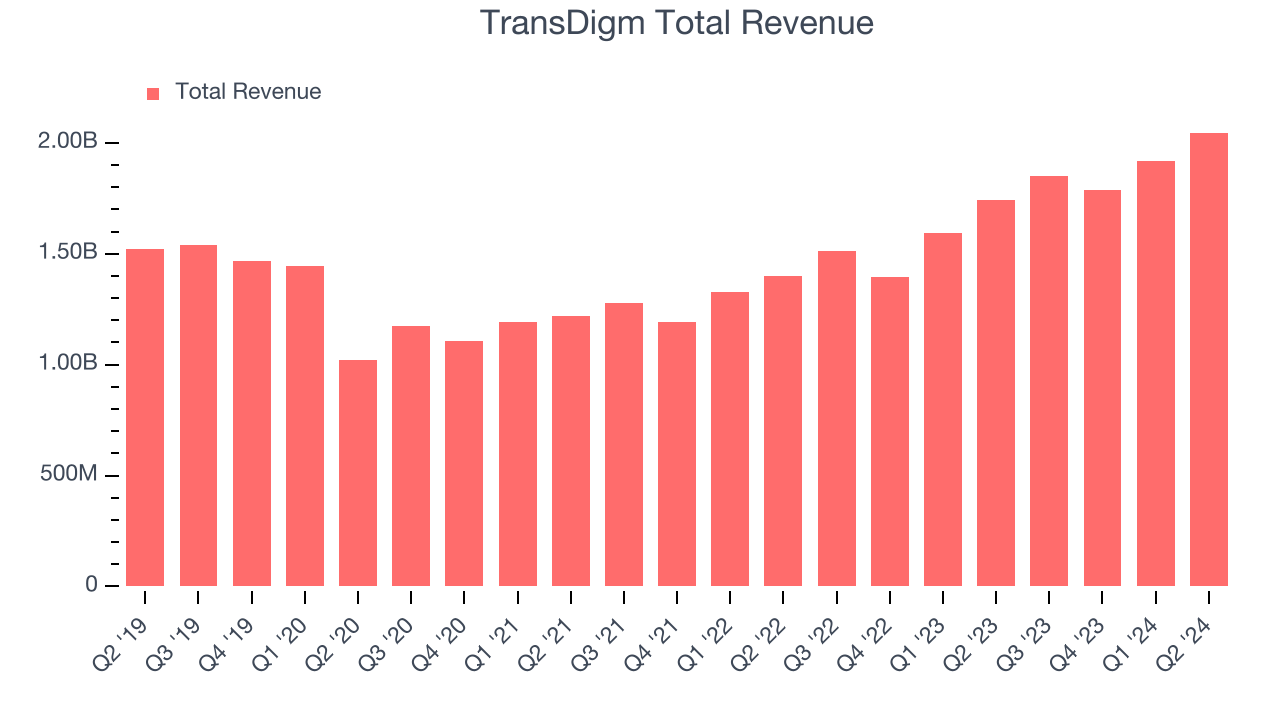

TransDigm beat analysts’ revenue expectations by 1.9% last quarter, reporting revenues of $2.05 billion, up 17.3% year on year. It was a very strong quarter for the company, with an impressive beat of analysts’ operating margin estimates and a solid beat of analysts’ organic revenue estimates.

Is TransDigm a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting TransDigm’s revenue to grow 17.3% year on year to $2.17 billion, slowing from the 22.6% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $9.31 per share.

The majority of analysts covering the company have reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. TransDigm has a history of exceeding Wall Street’s expectations, beating revenue estimates every single time over the past two years by 2.5% on average.

Looking at TransDigm’s peers in the aerospace segment, some have already reported their Q3 results, giving us a hint as to what we can expect. Curtiss-Wright delivered year-on-year revenue growth of 10.3%, beating analysts’ expectations by 5.4%, and AAR reported revenues up 20.4%, topping estimates by 2.3%. Curtiss-Wright traded down 2.3% following the results while AAR was also down 4.4%.

Read our full analysis of Curtiss-Wright’s results here and AAR’s results here.

There has been positive sentiment among investors in the aerospace segment, with share prices up 2.7% on average over the last month. TransDigm is down 2.2% during the same time and is heading into earnings with an average analyst price target of $1,485 (compared to the current share price of $1,345).

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.