Wireless technology manufacturer Qualcomm (QCOM) recorded its seventh straight trading session of losses on Jan. 20. While it ended the day up 1.5% on Jan. 21, the stock is still down in the past week. This follows a downgrade by Mizuho analysts to “Neutral.”

Mizuho analysts cited increasing pressure in the mobile handset market. Smartphone sales are expected to decline this year as chip costs weigh on consumer demand. Mizuho analysts pointed out that China is increasingly insourcing components. This is said to essentially affect Qualcomm’s core business.

Another headwind comes from Apple's (AAPL) decision to move its modem business away from Qualcomm. Apple has advanced its proprietary 5G modem tech, and Apple devices now integrate its C1-series custom modems instead of Qualcomm components.

Although Qualcomm pledged to supply Snapdragon modems to Apple through 2026, industry observers anticipate a sharp decline in their partnership thereafter as Apple's in-house solutions expand across its products. Therefore, one key objective of Qualcomm has been to reduce its dependence on Apple.

On the other hand, Qualcomm’s Automotive and Internet of Things businesses are experiencing robust demand. At CES, the company showcased its robotics technologies, ranging from industrial AMRs to advanced full-size humanoids. Qualcomm is in discussions with Kuka Robotics for its next-gen robotics solutions.

Moreover, the company is launching its new artificial intelligence (AI) chips, AI200 and AI250, which might enable it to challenge semiconductor giants. Late last year, the company acquired Alphawave IP Group ahead of schedule to accelerate the company’s venture into the data center space.

Against the backdrop of these conflicting developments, should you buy the dip in Qualcomm?

About Qualcomm Stock

Qualcomm, based in San Diego, California, is a pioneer in wireless technology and semiconductors. It develops chips, software, and services that drive mobile communications worldwide. Core operations include Snapdragon processors for smartphones, automotive systems, and IoT devices.

The San Diego headquarters fuels engineering, product innovation, and sales efforts to enhance networks and connected tech. This foundation powers intelligent solutions in mobiles, vehicles, smart homes, and emerging edge computing. The company has a market capitalization of $167 billion.

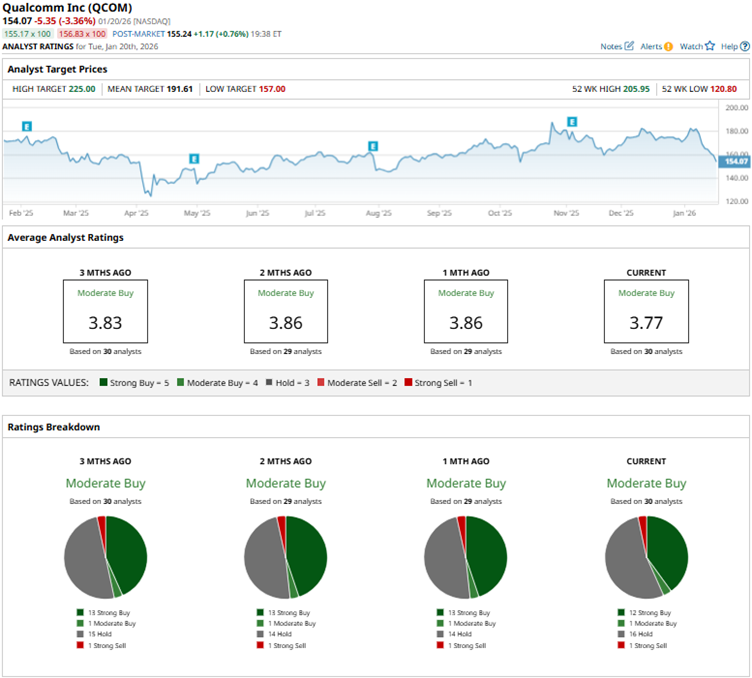

Over the past 52 weeks, Qualcomm’s stock has declined about 7%, while it has been down marginally over the past six months. It had reached a 52-week high of $205.95 in October 2025 but is down significantly from that level.

Qualcomm’s stock is trading at a lower valuation than its peers. Its price-to-non-GAAP-earnings of 13.25x is lower than the industry average of 24.97x.

Qualcomm’s Q4 Results Were Better Than Expected

On Nov. 5, 2025, Qualcomm reported its fourth-quarter and fiscal 2025 results (period ended Sept. 28, 2025). The company’s revenues increased by 10% year-over-year (YOY) to $11.27 billion, surpassing the $10.79 billion that Wall Street analysts had expected. For fiscal 2025, its revenues increased 14% compared to the prior year to $44.28 billion.

Its Qualcomm CDMA Technologies (QCT) revenues increased 13% YOY to $9.82 billion. Fiscal 2025 QCT revenues increased 16% annually to $38.37 billion, while non-Apple QCT revenues grew by 18% YOY.

On the profitability front, Qualcomm’s GAAP-based results were affected by the new U.S. tax legislation in the One Big Beautiful Bill Act. On a non-GAAP basis, the company’s Q4 earnings per share (EPS) grew by 12% YOY to $3.00, above the $2.88 analysts’ estimate.

Wall Street analysts have a mixed view about Qualcomm’s bottom-line trajectory. For the first quarter of fiscal 2026, its EPS is expected to drop by 2.8% YOY to $2.78. For fiscal 2026, EPS is expected to decline by 2.9% to $9.78. On the other hand, for fiscal 2027, the company’s EPS is projected to increase by 2.6% annually to $10.03.

What Do Analysts Think About Qualcomm’s Stock?

Recently, Wall Street analysts have shown differing views on Qualcomm’s stock. Apart from the Mizuho downgrade, RBC Capital analyst Srini Pajjuri initiated coverage of the stock with a “Sector Perform” rating and a $180 price target. The research firm noted that Qualcomm is struggling due to sluggish smartphone growth and Apple’s in-house modem. Although the firm acknowledged Qualcomm’s AI accelerator product announcement, it also noted that meaningful revenue might take some time to materialize.

In November 2025, analysts at Piper Sandler maintained an “Overweight” rating on the stock, while raising the price target from $175 to $200. Analysts cited strong results and Qualcomm’s traction in the Android ecosystem. Rosenblatt analyst Kevin Cassidy maintained a “Buy” rating and a Street-high $225 price target, signaling confidence in the stock’s trajectory. On the other hand, in the same month, Wells Fargo analyst Aaron Rakers maintained an “Underweight” rating, while raising the price target from $140 to $165.

Qualcomm has long been a popular name on Wall Street, with analysts awarding it a consensus “Moderate Buy” rating overall. Of the 30 analysts rating the stock, 12 analysts have given it a “Strong Buy” rating, one analyst rated it “Moderate Buy,” 16 analysts are taking the middle-of-the-road approach with a “Hold” rating, while one recommended “Strong Sell.”

The consensus price target of about $192 suggests potential upside from current levels.

Key Takeaways

While the Mizuho downgrade has rattled Qualcomm’s stock, analysts’ outlook remains moderately positive. Moreover, the company’s Snapdragon chipsets still enjoy robust demand in the Android ecosystem, while the company advances its AI ambitions and automotive and IoT businesses. Therefore, the stock might still be worth investing in.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The ‘Trump Effect’ Makes Intel’s Earnings Report Tonight Very Special. Why You Should Brace for a Double-Digit Move in INTC Stock.

- As SoFi Stock Drops Below $30, Is it a Buy Ahead of Q4 Earnings?

- AMD Stock Outperformed Nvidia. Is It Still a Buy?

- Dear Boeing Stock Fans, Mark Your Calendars for January 27