Intel (INTC) stock has rallied significantly heading into the company’s earnings release on Jan. 22, but a senior Citi analyst Atif Malik believes it will push higher still in 2026.

According to Barchart, the semiconductor behemoth is expected to lose $0.02 a share in its fiscal Q4, roughly unchanged from the same quarter last year.

Still, Malik raised his rating on the company this week to “Neutral.” His upgrade is significant given Intel stock is already up more than 160% versus its 52-week low.

Why Is Citi Keeping Bullish on Intel Stock?

In his research note, Atif Malik recommended that investors focus on the long-term story in INTC stock instead of near-term earnings volatility.

Importantly, recent reports suggest Taiwan Semiconductor (TSM) has recently told Nvidia (NVDA) and Broadcom (AVGO) that it’s facing a capacity crunch.

This – according to the Citi analyst – is a “unique window of opportunity” for Intel to secure major foundry customers and remove a lingering overhang from its stock.

Additionally, Intel has done a great job in right-sizing the business and improving its balance sheet, which may add to the bullish momentum moving forward.

Where Options Data Suggests INTC Shares Are Headed

For Intel shares, options data is largely skewed to the upside as well. Derivatives contracts expiring mid-April currently have the upper price set at about $56, according to Barchart.

In the near-term (through the end of next week) also, the implied move is 7.73%, which means the semiconductor stock could be trading at north of $50 by as soon as Jan. 23.

Historically, this California-based giant has gained more than 2% in February. This seasonal trend further boosts confidence in buying INTC ahead of its Q4 earnings next week.

Note that Intel’s relative strength index (14-day) sits at about 66 currently, reinforcing that the bullish momentum is not fully exhausted yet.

How Wall Street Recommends Playing Intel

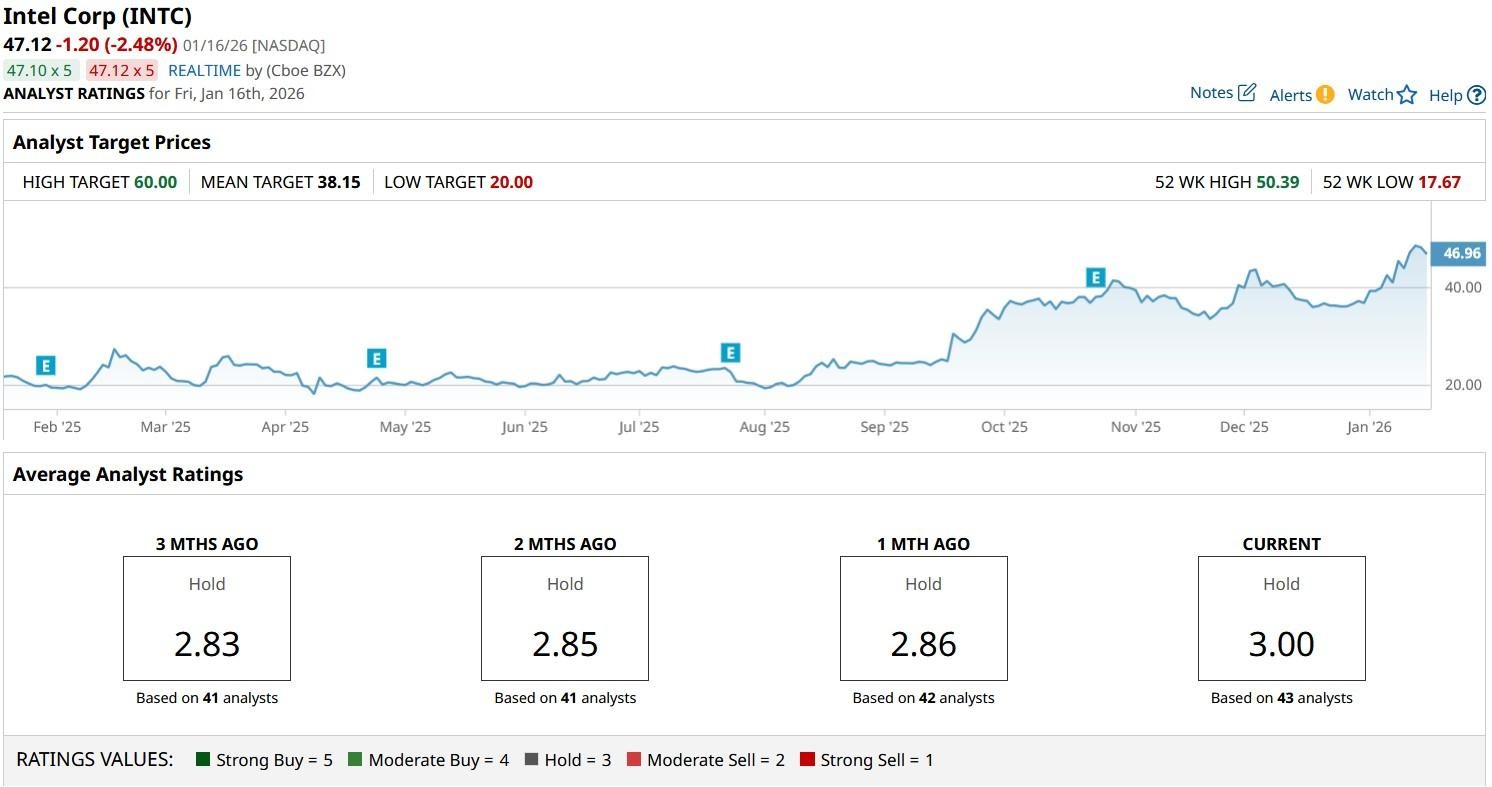

While INTC shares have already exploded higher in recent months, Wall Street remains adequately positive on them for the next 12 months.

The consensus rating on Intel stock sits at “Hold” only, but price objectives currently go as high as $60, indicating potential upside of roughly 30% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 2 Smart Stocks for Patient Long-Term Investors to Buy Now

- Super Micro Computer Is One of the Most Shorted Stocks. Could a Squeeze Take It Higher in 2026?

- Intel Reports Earnings on January 22. Here Is Where Options Data Says INTC Stock Could Be Trading Next.

- Trump Just Took Aim at Health Insurance ‘Middlemen.’ What Does That Mean for UnitedHealth Stock?