Meta Platforms (META) shares are extending gains today following reports that CEO Mark Zuckerberg plans significant cost cuts to the company’s metaverse division.

The billionaire will redirect capital and resources instead to the firm’s artificial intelligence (AI)-focused initiatives, anonymous sources told Bloomberg on Thursday morning.

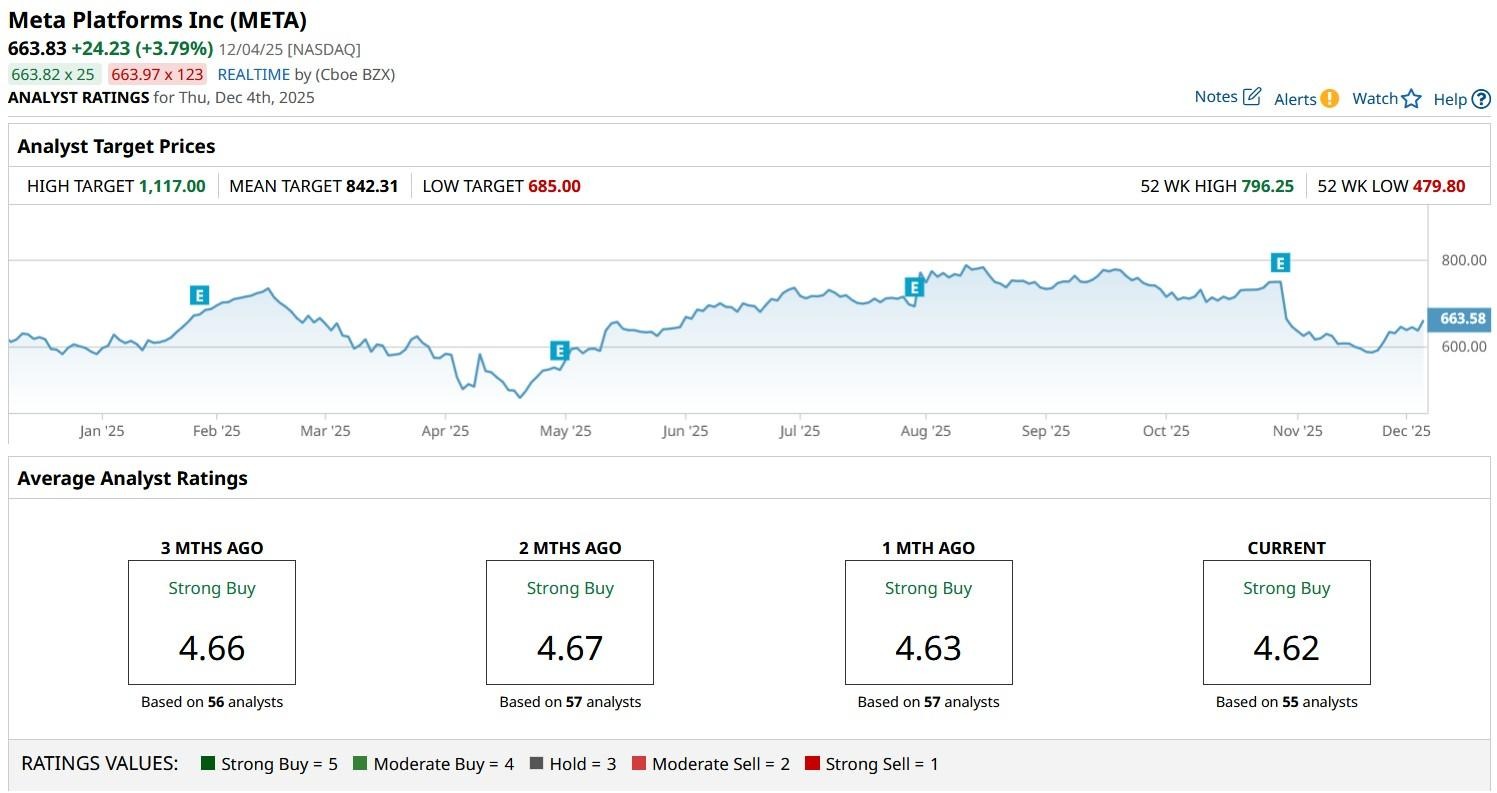

Despite today’s gains, Meta stock is down more than 15% versus its year-to-date high in August.

Why Does It Matter for Meta Stock?

Investors are cheering the metaverse news as “Reality Labs” has been a costly bet for the Nasdaq-listed firm, losing tens of billions of dollars since 2021.

According to Bloomberg, Zuckerberg could trim metaverse spending by up to 30%, which signals a pivot toward profitability and capital discipline.

Investors have long criticized the company’s metaverse unit as a cash drain. So, the expected cuts are being interpreted as a sign that Meta Platforms is listening to shareholders concerns.

All in all, such a seismic shift could boost the titan’s earnings, which may unlock significant further upside in META shares over time.

Cramer Recommends Buying META Shares

Former hedge fund manager Jim Cramer also agrees that redirecting resources from the metaverse to artificial intelligence would be a major win for Meta Platforms’ shareholders.

In a segment of CNBC today, Cramer recommended owning META stock heading into 2026 also because the company remains a frontrunner in advertising.

“[Zuckerberg] can destroy OpenAI because he’s still the best place to advertise,” he argued.

Note that Meta Platforms is currently trading at a forward price-earnings (P/E) ratio of about 22x only. That’s compelling for a name strongly positioned to benefit from AI tailwinds.

Meta Platforms Remains a ‘Buy’

Wall Street analysts share Cramer’s optimism on Meta shares as well.

According to Barchart, the consensus rating on META stock currently sits at “Strong Buy” with the mean target of about $842 indicating potential upside of more than 25% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Stifel Says This 1 ‘Picks and Shovels’ AI Stock Is a Buy for Massive Growth in 2026

- As Trump Looks to Boost Robotics, This 1 Lesser-Known Stock Is a Strong Buy

- With Fears Swirling, IBM Says There Is No AI Bubble. Does That Make IBM Stock a Buy Here?

- This Semiconductor Stock Is Up 435% in the Past 6 Months and Can Gain Another 40% from Here