Legacy software stocks can seem boring to growth hunters, but their cash-rich businesses and strategic pivots often produce big payoff moments.

Wells Fargo just made that case for Oracle (ORCL), initiating coverage at “Overweight” after tallying nearly $500 billion in AI-related deals with partners such as OpenAI, xAI, Meta (META), and TikTok. The bank projects Oracle Cloud Infrastructure (OCI) could expand to roughly 16% of the cloud market by 2029, up from about 5% in 2025. The projection is driven by major AI compute commitments, including OpenAI’s reported 4.5GW, tied to an engagement valued at more than $300 billion.

Coupled with Oracle’s high-margin software franchise, Wells Fargo sees a pathway to roughly 40% upside, though investors should watch margin pressure and rising debt tied to the infrastructure buildout. Here’s a closer look at ORCL.

About ORCL Stock

Founded in 1977, Oracle is one of the world’s largest enterprise software and cloud companies. It offers integrated suites of applications and database management, along with a growing cloud platform. Oracle serves thousands of customers across every industry and sits in the tech mega-cap league, with a market cap of $573 billion.

Oracle’s stock has seen sharp swings in 2025. Fueled by AI hype and big cloud deals, the shares nearly doubled by mid-September. However, in late November, the stock pulled back sharply as investors took profits and questioned whether Oracle could convert all that backlog into revenue. After that volatility, ORCL currently trades 28% up year to date (YTD) and well above last year’s levels, but off its peak.

On valuation, Oracle now looks fullly priced. It trades around 47x trailing earnings, significantly higher than the tech sector average of 31x. Likewise, its EV/EBITDA is on the order of 27x today, roughly double the software industry median 13x. In short, Wall Street is assuming Oracle can deliver big growth to justify that rich valuation.

Oracle Cloud Business Drives Strong Growth

Oracle turned in a solid start to its fiscal 2026, posting strong top-line growth even though the results came in just a touch lighter than Wall Street hoped. Revenue for the August quarter landed at about $14.9 billion, up 12% from a year earlier and only slightly shy of the roughly $15 billion analysts were expecting.

Cloud continued to drive the story. Oracle pulled in around $7.2 billion in cloud revenue, up 28%. Its infrastructure business jumped 55%, while cloud applications grew 11%. The older on-premise software and support lines were mostly flat, as expected.

Profit held up as well. Oracle reported $2.9 billion in GAAP net income, while adjusted profit came in at roughly $4.3 billion, up 8%. That translated into $1.47 of adjusted earnings per share, up 6% but a hair below consensus estimates.

Cash generation remained a bright spot. Oracle generated more than $21 billion in operating cash flow over the past year and about $11.3 billion in free cash flow. It ended the quarter with just over $10 billion in cash and paid a $0.50 dividend while continuing to pour money into data center buildouts.

Former CEO Safra Catz described the quarter as “astonishing,” pointing to a $455 billion backlog and forecasting nearly $18 billion in cloud-infrastructure sales this year. Founder Larry Ellison said the upcoming Oracle AI Database will tie the company’s AI offerings together, noting that AI is reshaping the entire product roadmap.

Looking ahead, management offered earnings guidance of $1.27 to $1.31 for the November quarter. Analysts expect roughly $5 in earnings for the full fiscal year.

Analyst Views and Price Targets

Wall Street consensus has turned mostly bullish, with analysts racing to lift their targets. Goldman Sachs, for example, kept a “Neutral” rating but raised its target to $320.

Similarly, TD Cowen and Deutsche Bank remain outright bullish. Cowen’s very recent note pushes the target to $375, and Bank of America’s Cantor Fitzgerald put its target at $400.

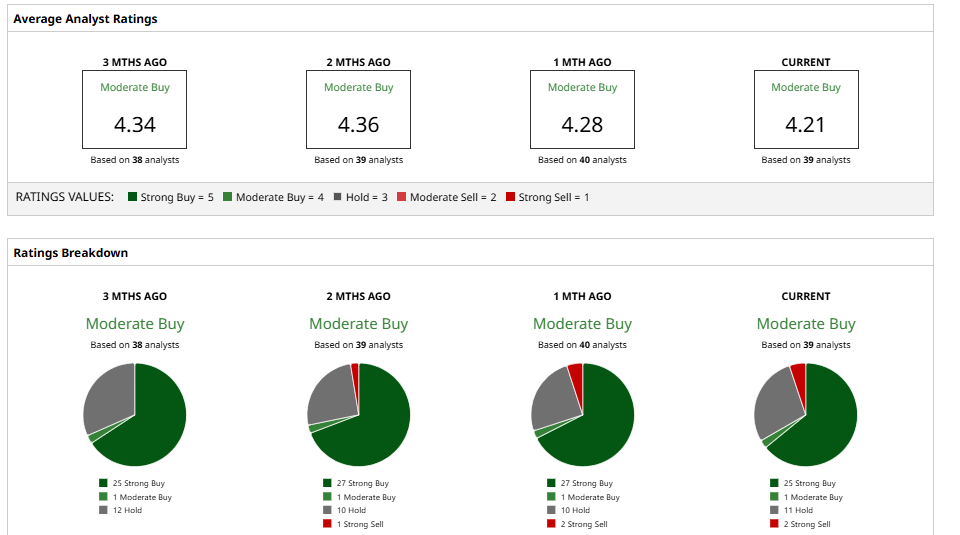

On average, analysts see Oracle’s 12-month price target $346, which suggests a massive 72% upside potential. The consensus rating among 39 analysts is “Moderate Buy.”

So, in my opinion, Oracle stands at an inflection point. Wells Fargo’s AI thesis adds fuel to the bull case. If Oracle can capture this AI market and fully leverage its nearly $500 billion backlog, its shares have plenty of room to run.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Stifel Says This 1 ‘Picks and Shovels’ AI Stock Is a Buy for Massive Growth in 2026

- As Trump Looks to Boost Robotics, This 1 Lesser-Known Stock Is a Strong Buy

- With Fears Swirling, IBM Says There Is No AI Bubble. Does That Make IBM Stock a Buy Here?

- This Semiconductor Stock Is Up 435% in the Past 6 Months and Can Gain Another 40% from Here