Nvidia (NVDA) continues to dominate headlines in the AI segment in 2025. However, TD Cowen believes investors should look elsewhere for the best opportunity in 2026. The investment firm has placed Advanced Micro Devices (AMD) on its coveted Best Ideas list, explaining that the chipmaker is being unfairly overlooked despite its widening AI moat.

TD’s bullish stance centers on AMD’s upcoming product launches, including the Helios rack-scale platform and the MI450 accelerator, both expected in mid-2026. These releases are estimated to help AMD double earnings by Q4 2026. The firm projects AMD’s AI accelerator business alone could reach $89 billion in sales by 2030, growing at a 67% annual rate.

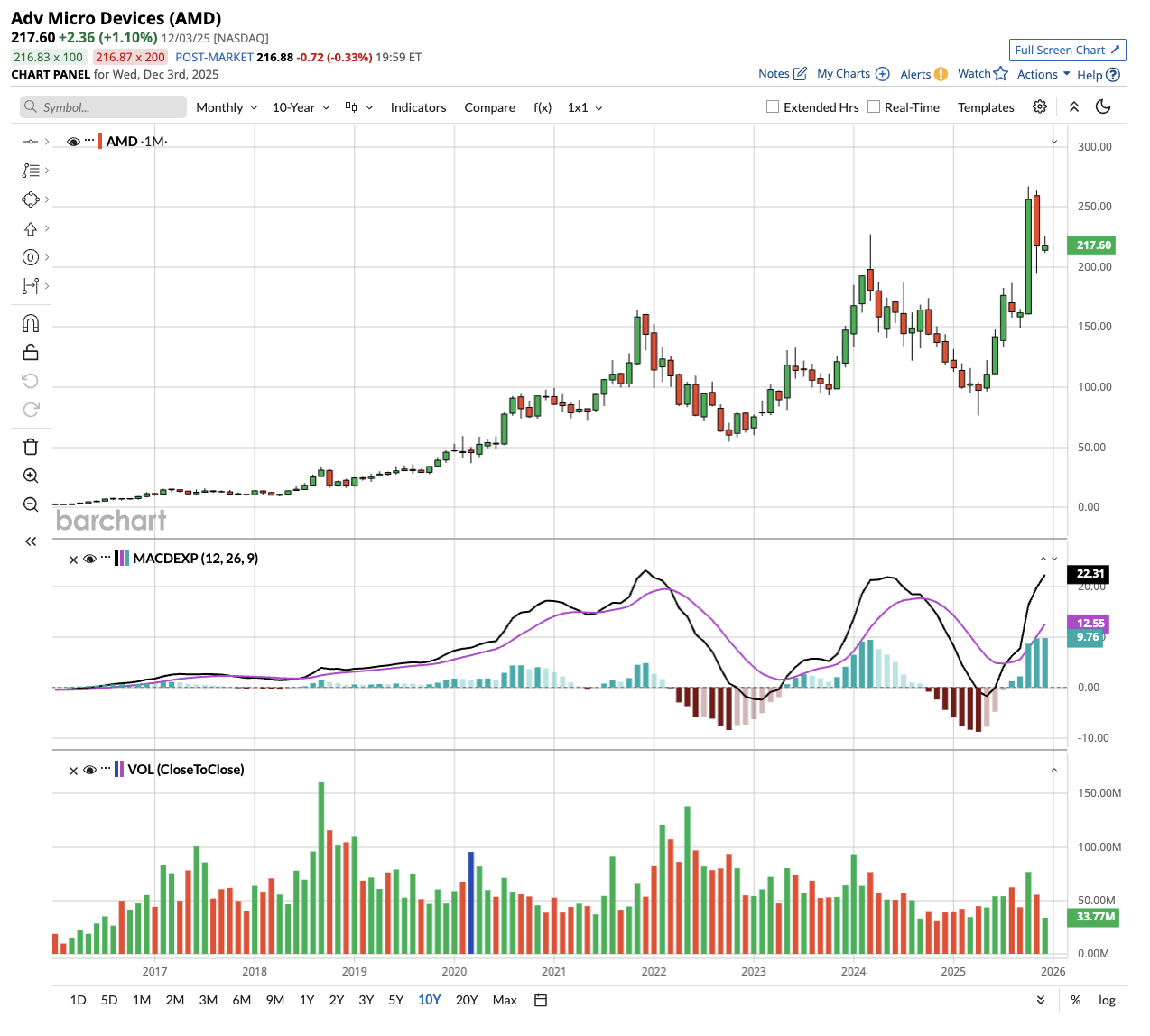

Valued at a market cap of $354 billion, AMD stock is down 18% from its all-time high. Despite the ongoing pullback, the chip stock has returned close to 8,000% over the past decade.

Today, investors are concerned about the sustainability of AI spending and the company's exposure to OpenAI. But TD Cowen believes these worries are overblown and that AMD is judged more harshly than competitors despite making steady progress in gaining customers and market share. TD maintains a “Buy” rating on AMD stock with a $290 price target and views the recent weakness as an entry point ahead of the anticipated product ramp.

Is AMD Stock a Good Buy Right Now?

Recently, Advanced Micro Devices unveiled plans to grow its data center business by 60% annually and to target double-digit market share in the lucrative AI accelerator space by 2030.

At the heart of AMD’s strategy sits the upcoming MI450 GPU series and Helios rack-scale system, set to launch in mid-2026. These products will help AMD gain traction in the data center chip market, which Nvidia dominates.

AMD’s confidence stems partly from a major partnership with OpenAI spanning six gigawatts of computing capacity over five years. But the company insists this deal represents just one piece of a broader puzzle. Management emphasized that the semiconductor behemoth is working on multiple gigawatt-scale deployments with different hyperscale customers. Each gigawatt translates to double-digit billions in revenue, making these partnerships potentially transformative for AMD's bottom line.

The data center story extends beyond just AI accelerators. AMD’s server CPU business continues to expand, ending Q3 with a market share of 40%. Notably, AI adoption is driving demand for traditional server processors. As AI agents and inference workloads proliferate, they need conventional computing power to function, reversing earlier concerns that GPUs might cannibalize the CPU market.

AMD projects the overall data center market will balloon from around $200 billion today to over $1 trillion by 2030. Within that massive expansion, the company expects its total data center revenue to climb past $100 billion annually within three to five years. That would represent a stunning transformation for a business that barely existed a decade ago and currently runs at about $16 billion in annual revenue.

What Is the AMD Stock Price Target?

AMD laid out an aggressive model targeting 35% annual revenue growth combined with operating margins above 35% through 2030. Management believes this combination can drive earnings per share beyond $20 in the forecast period.

Gross margins should expand to between 55% and 58% as the product mix shifts toward higher-value offerings, though the pace of AI accelerator adoption will influence exactly where margins land within that range.

Analysts tracking AMD stock forecast revenue to increase from $34 billion in 2025 to $96 billion in 2029. In this period, adjusted earnings are estimated to expand from $3.96 per share to $16.60 per share.

If we assume that AMD stock increases earnings to $20 per share in 2030 and trades at a 25x forward multiple, it should be priced around $500 in December 2029, indicating upside potential of 130% from current levels.

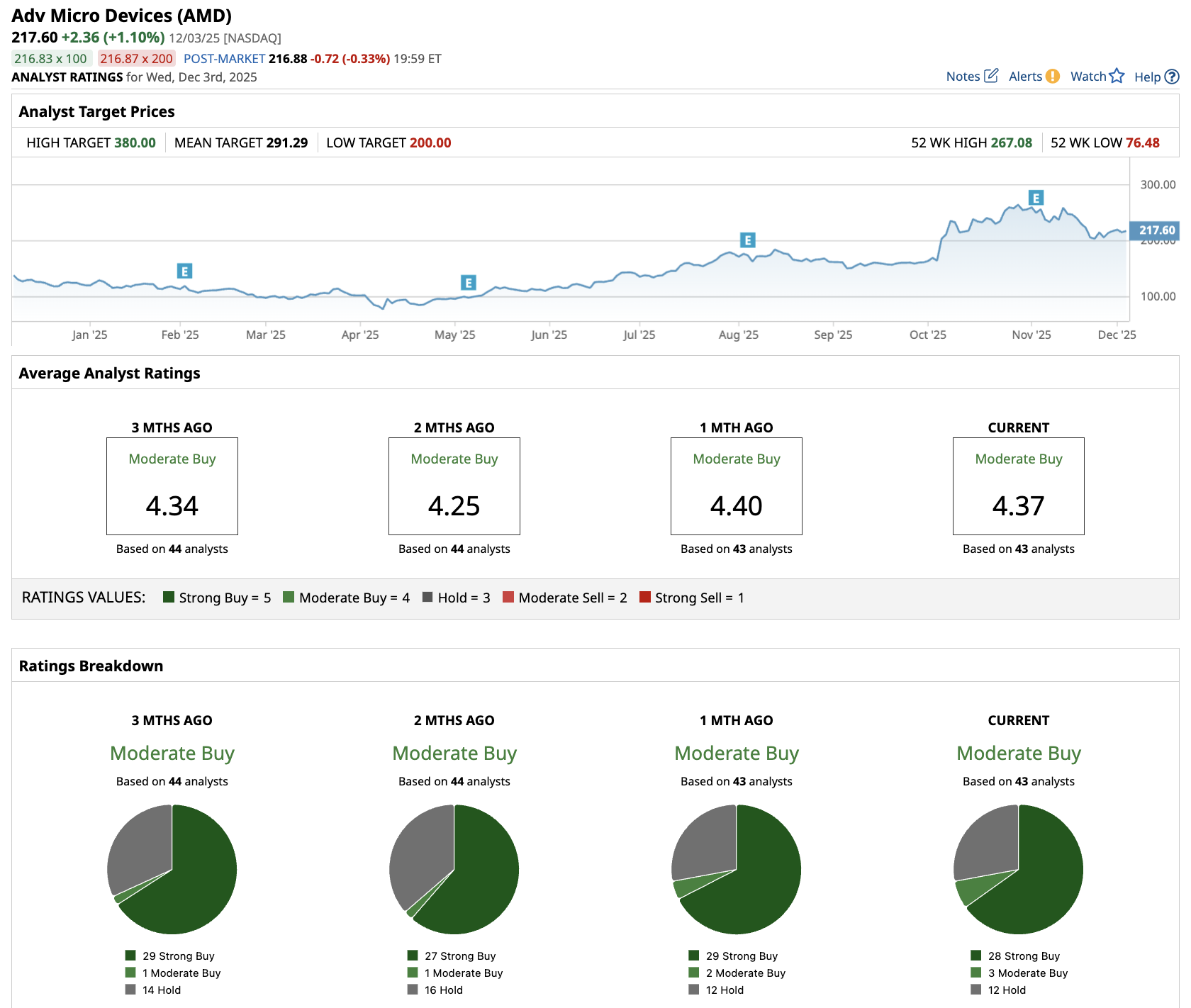

Out of the 43 analysts covering AMD stock, 28 recommend “Strong Buy,” three recommend “Moderate Buy,” and 12 recommend “Hold.” The average AMD stock price target is $291, above the current price of $218.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Archer Aviation Just Signed on a New Aerospace Partner. Should You Buy ACHR Stock Here?

- Stifel Says This 1 ‘Picks and Shovels’ AI Stock Is a Buy for Massive Growth in 2026

- As Trump Looks to Boost Robotics, This 1 Lesser-Known Stock Is a Strong Buy

- With Fears Swirling, IBM Says There Is No AI Bubble. Does That Make IBM Stock a Buy Here?