In a November 7, 2025, Barchart article on natural gas, I concluded with the following:

The natural gas market is transitioning into the season when prices tend to rise as demand for the energy commodity increases during winter. In November, the injections to storage become withdrawals, and the uncertainty of temperatures across the United States often causes price appreciation. I am bullish on the prospects for natural gas prices over the coming weeks, but expect significant price variance. BOIL and KOLD are short-term trading tools that require constant attention to risk-reward dynamics, but they enable market participants to capitalize on the energy commodity’s numerous trading opportunities during the early stages of the peak demand season.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

Nearby natural gas futures for December delivery traded at $4.367 per MMBtu on November 7. Over the past months, the energy commodity reached a higher high with the nearby contract trading over $5 on December 3.

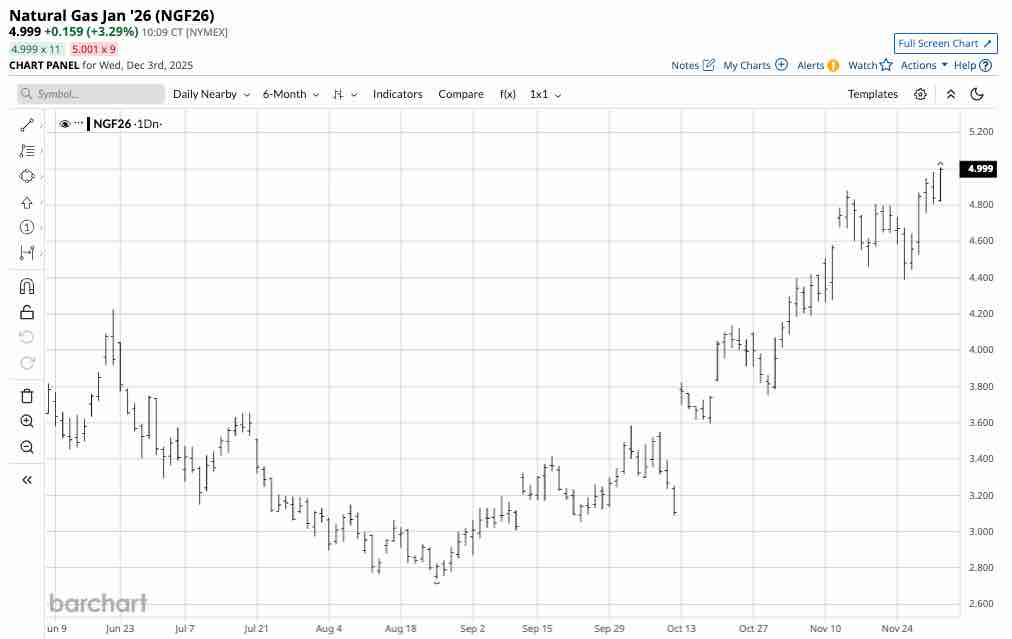

A bullish trend in the January NYMEX natural gas futures

The daily continuous NYMEX U.S. natural gas futures chart shows the bullish trend since late August.

After falling to an August 25, 2025, low of $2.738, the volatile energy commodity made higher lows and higher highs, reaching the latest December 3, 2025, high of over $5.00 per MMBtu. The over 82.9% rally took natural gas futures past the critical technical resistance level.

The November 2025 range was higher than the November 2024 range

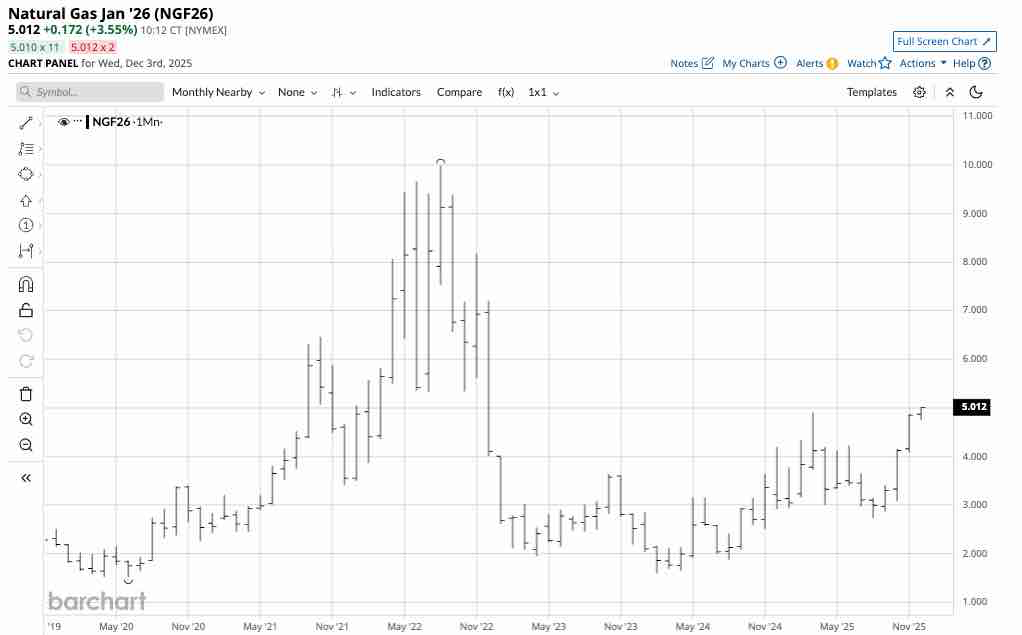

The monthly continuous contract chart highlights the first technical upside target.

The March 2025 high of $4.908 per MMBtu was the first technical resistance level, which gave way in early

December. As the winter and peak heating season is just getting underway, the odds favor a challenge of the March 2025 high, which could be a gateway to substantially higher prices.

Meanwhile, the monthly chart shows that continuous NYMEX natural gas futures traded in a $2.514 to $3.639 range in November 2024. In November 2025, the bottom of the $4.087 to $4.881 trading range was nearly 45 cents above the November 2024 peak. The price has already surpassed the high from December 2024 at $4.201 per MMBtu.

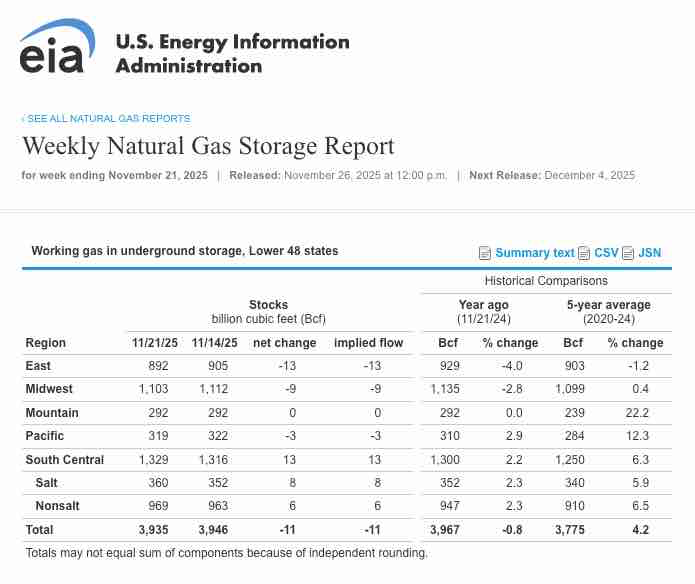

Natural gas inventories have entered the withdrawal season

During the week of November 7, 2025, natural gas inventories across the United States reached an annual high. Stockpiles rose to 3.960 trillion cubic feet (tcf) at the end of the 2025 injection season, slightly lower than the previous year when they peaked at 3.972 tcf.

As the chart illustrates, natural gas inventories were at 3.935 tcf for the week ending on November 21, 0.8% below the previous year and 4.2% over the five-year average for the period. Natural gas is now in the withdrawal season, where stocks decline. The weather over the coming weeks and months will determine heating demand and the rate of stockpile declines. The early signs point to a cold winter in many U.S. states.

LNG and the weather will determine the trend

While weather is the primary determinant for the path of least resistance for U.S. NYMEX natural gas futures, the ongoing war in Ukraine and U.S. and Western European sanctions on Russia could weigh on U.S. natural gas inventories and support prices. Western Europe has historically purchased Russian natural gas through Russia’s pipeline network. However, the current sanctions support more U.S. LNG shipments to the region.

Therefore, both U.S. and European weather conditions will impact U.S. natural gas stockpile drawdowns over the coming weeks and months. Natural gas futures began trading on the CME’s NYMEX division in 1990 when the distribution of U.S. production was limited to the North American pipeline network. Technological advances in liquefying natural gas into LNG have expanded the U.S. gas’s addressable market far beyond the pipeline network, as LNG travels the world by ocean vessel.

Expect lots of volatility in natural gas during the 2025/2026 peak season

When it comes to seasonality, natural gas is now entering the most volatile period during the coldest months when prices often reach annual highs. A colder-than-expected winter could send prices higher, well above $5 per MMBtu, while a warmer-than-expected winter could cause prices to decline below $4, or even $3, per MMBtu by March 2026.

The most direct route for risk positions is the CME’s NYMEX futures and futures options. The UNG ETF is a highly liquid, unleveraged ETF that tracks the NYMEX futures. Meanwhile, BOIL and KOLD are double-leveraged bullish and bearish ETF products that reflect the energy commodity’s price action. Given its very volatile nature, natural gas futures and the related ETFs are not appropriate for long-term investment risk positions. However, the price volatility makes it an exciting trading market for flexible traders with their fingers on the pulse of the changing price trends.

A cold winter could send natural gas futures prices significantly higher, considering the energy commodity reached almost $10 per MMBtu in 2022.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart