Shares of most companies in the artificial intelligence (AI) ecosystem have been on a solid run, driven by massive investments and surging demand for the infrastructure needed to train and deploy large AI models. Among these top performers is Western Digital (WDC), whose shares have soared 249.1% year-to-date.

The key catalyst behind Western Digital’s massive year-to-date rally is the booming AI-driven demand for its storage solutions. The company specializes in manufacturing high-capacity hard disk drives (HDDs), which are essential for storing the enormous volumes of data generated and processed by AI systems. As AI adoption expands globally, data centers and cloud service providers are racing to secure these high-capacity drives, creating a surge in demand that has pushed prices higher and boosted Western Digital's revenue and profits.

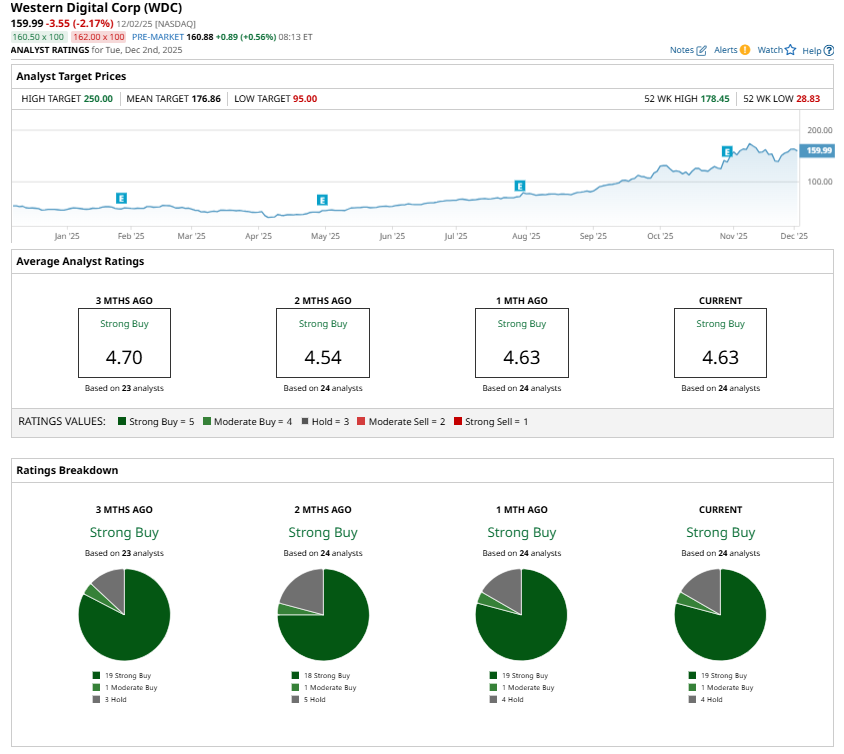

Despite WDC’s significant gains, Wall Street remains optimistic about the company’s prospects. Analysts continue to rate it a “Strong Buy,” with the highest price target set at $250, suggesting potential upside of around 56% from its recent close of $159.99. Let’s take a closer look.

Western Digital to Sustain Growth Momentum

With growing investment in AI infrastructure, Western Digital’s growth is unlikely to slow down soon. After a strong finish to fiscal 2025, WDC carried that strength into the first quarter of fiscal 2026.

During the first quarter of fiscal 2026, its revenue jumped 27% year over year, driven by soaring demand for its nearline hard drives used in data centers. Profitability scaled sharply with volume leverage. Its earnings per share (EPS) surged 137% year-over-year to $1.78. The company’s focus on innovation is playing a key role in its upward trajectory. The company’s new high-capacity ePMR drives are gaining significant traction, with more than 2.2 million units shipped during the latest quarter.

WDC’s management highlighted that storage deployments now require higher engineering collaboration and longer planning cycles. This is playing in the company’s favor. For instance, customers are locking in supply further in advance. Seven of the company’s largest buyers have already committed to orders extending into the first half of 2026, most covering the full fiscal year, and a major hyperscaler has secured product through 2027. Such multi-year agreements strengthen the outlook for future growth.

A key growth catalyst for Western Digital is the transition to Heat-Assisted Magnetic Recording (HAMR) technology. Western Digital plans to begin HAMR qualifications with a major cloud customer in early 2026 and expand testing to additional partners by year-end. Volume production is targeted for the first half of 2027. In parallel, continued enhancements to ePMR technology ensure the company does not sacrifice near-term competitiveness as it transitions to HAMR. Investments in automation and AI-driven manufacturing efficiencies are further positioning the business for cost-effective scale.

Western Digital’s platforms business is also seeing strong adoption as enterprises blend on-premise data solutions with cloud storage architectures.

The company’s dual growth engines across drives and platforms create a more balanced revenue profile and expand margin opportunities.

Western Digital Stock Is Too Cheap to Ignore

Despite the significant rally and solid AI-driven demand for its data storage solutions, Western Digital stock still looks undervalued. WDC stock trades at a forward price-earnings ratio of just 22.8x, a low multiple considering its strong earnings growth potential. Analysts expect its EPS to jump 58.3% in fiscal 2026 and increase by 40.9% in 2027. Its low valuation and strong growth prospects make it an attractive investment.

The Bottom Line

Western Digital is set to benefit from solid demand for high-capacity HDDs and improving pricing. Moreover, its focus on next-generation technologies like ePMR and HAMR, along with supply agreements, augurs well for future revenue and earnings growth.

Western Digital’s valuation remains attractive relative to its growth trajectory. At the same time, Wall Street is bullish about its prospects. In short, WDC is a compelling stock to buy now.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Heavy Volume in Home Depot Call Options - Investors are Bullish on HD Stock

- Which AI ETF Should You Buy? Perhaps None of Them.

- Cathie Wood Is Buying Up Google Stock at Record Highs. Should You?

- MicroStrategy Is Turning to a U.S. Dollar Reserve Amid Bitcoin Volatility. Should You Buy, Sell, or Hold MSTR Stock Here?