San Diego, California-based DexCom, Inc. (DXCM) is a medical device company that designs, develops, and commercializes continuous glucose monitoring (CGM) systems. Valued at $24.8 billion by market cap, the company develops a small implantable device that continuously measures glucose levels in subcutaneous tissue just under the skin and a small external receiver to which the sensor transmits glucose levels at specified intervals.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and DXCM perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the medical devices industry. DexCom leads in diabetes care with its advanced CGM systems like G6 and G7, driving innovation and convenience. Strategic partnerships with insulin pump companies enhance its offerings and market reach, solidifying its position in the growing diabetes market.

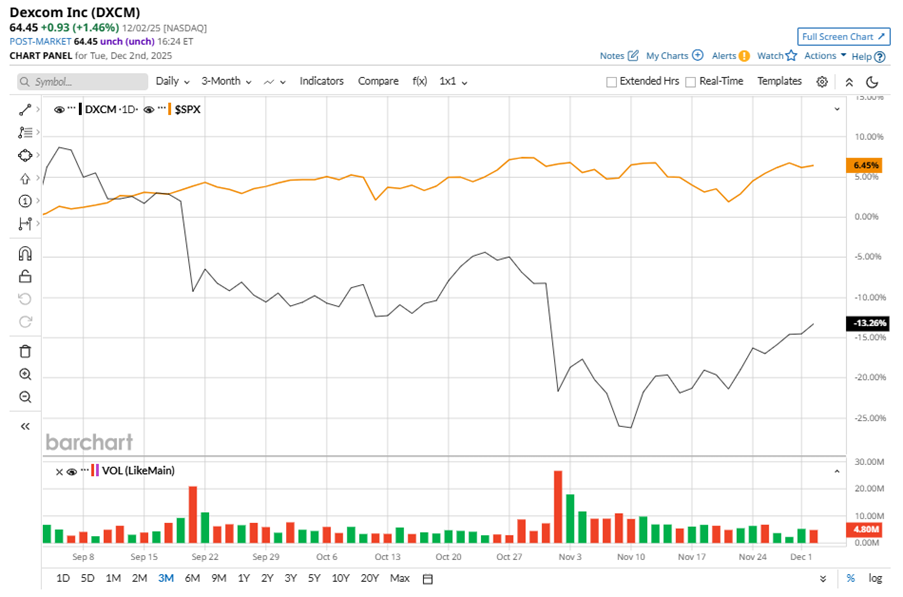

Despite its notable strength, DXCM slipped 30.9% from its 52-week high of $93.25, achieved on Feb. 18. Over the past three months, DXCM stock declined 13.3%, underperforming the S&P 500 Index’s ($SPX) 6.5% gains during the same time frame.

In the longer term, shares of DXCM fell 24.6% over the past six months and dipped 18.7% over the past 52 weeks, significantly underperforming SPX’s six-month gains of 15.1% and solid 12.9% returns over the last year.

To confirm the bearish trend, DXCM has been trading below its 200-day moving average since early August, with slight fluctuations. However, despite the negative price momentum, the stock began trading above the 50-day moving average recently.

DXCM's underperformance is due to the FDA warning letter over manufacturing issues and trade war worries with China, sparking supply chain concerns. Additionally, higher scrap rates and sensor deployment issues also weigh in, although management sees improvements with new quality controls and shipping methods.

On Oct. 30, DXCM reported its Q3 results, and its shares closed down by 14.6% in the following trading session. Its adjusted EPS of $0.61 surpassed Wall Street expectations of $0.57. The company’s revenue was $1.21 billion, exceeding Wall Street's $1.18 billion forecast. DXCM expects full-year revenue in the range of $4.6 billion to $4.7 billion.

In the competitive arena of medical devices, Insulet Corporation (PODD) has taken the lead over DXCM, showing resilience with a 4.9% downtick over the past six months and 16% gains over the past 52 weeks.

Wall Street analysts are bullish on DXCM’s prospects. The stock has a consensus “Strong Buy” rating from the 28 analysts covering it, and the mean price target of $85.92 suggests a notable potential upside of 33.3% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Down 41% From Its Highs, Should You Buy the Dip in MP Materials Stock?

- How to Use the Naked Put Options Strategy to Earn Income & Buy Stocks at a Discount

- Dan Ives Says AI Bubble Fears Are ‘Overblown’ and He’s Betting on This 1 Data Center Stock Now

- S&P Futures Tick Higher With U.S. Economic Data in Focus