Michael Burry, the investor famous for predicting the 2008 housing crash and capitalizing on it, is now going after AI stocks. Burry has previously made several unsuccessful bets against AI stocks and failed to repeat his original success. However, his recent actions seem more aggressive, and Wall Street is all ears.

That's because, unlike last time, most investors are now doubting whether this AI rally can keep dragging on. Burry does not think so, and he launched a very public and scathing critique of Nvidia (NVDA) alongside other AI beneficiaries like Palantir (PLTR). And it seems like he has his money where his mouth is, with Scion Asset Management buying over $1 billion in put options on Nvidia and Palantir before he closed the fund to outside investors.

The magnitude of this bet has elicited a response from Nvidia itself.

Is Nvidia Enron or is it Cisco?

Nvidia released a secret seven-page memo to Wall Street analysts directly addressing Burry's allegations and pushing back on fraud accusations. In response, Burry clarified his position on Substack, saying, “I am not claiming Nvidia is Enron. It is clearly Cisco.”

He dismissed Nvidia's defense as containing "one straw man after another" and said the memo "almost reads like a hoax."

His argument is that Nvidia is facing a multitude of issues in the future. Depreciation comes first, as he claims AI hardware becomes commercially useless in two to three years. Cloud platforms are depreciating these assets over five to six years, which he believes is being used to artificially boost margins. Plus, he alleges Nvidia's stock compensation has cost shareholders $112.5 billion, “reducing owner's earnings by 50%.”

He compares the current AI boom to Cisco's role in the dot-com bubble, when telecom companies invested billions in fiber optic infrastructure based on overly optimistic projections about internet traffic. This time, he believes the same mistake is being repeated with Nvidia and GPUs.

"Fraudulent" Accounting?

Burry believes so. He claims that Big Tech is understating depreciation and that the problem goes beyond just Nvidia. Per Burry, between 2026 and 2028, Oracle (ORCL) could be overstating its earnings by 26%, Meta (META) by 20%, and Microsoft (MSFT) / Amazon (AMZN) / Alphabet (GOOG) (GOOGL) by ~$176 billion in unrecognized capital decay.

He also accuses AI companies of round-tripping to inflate their financials. There's some substance to this. For example, Microsoft invested approximately $13 billion in OpenAI across multiple rounds, with OpenAI then paying much of that back to Microsoft through heavy use of Azure cloud services. Likewise, Nvidia announced a $100 billion investment in OpenAI through non-voting shares, with the expectation that OpenAI would use that capital to purchase Nvidia's GPU hardware.

You can also look at Nvidia's investment in xAI, where the arrangement helps finance purchases of Nvidia's own hardware.

What Nvidia Says

Burry's claim that the stock buybacks cost shareholders $112.5 billion was corrected by Nvidia. The company said it cost $91 billion, saying that Burry incorrectly included RSU taxes.

As for depreciation, Nvidia claims that customers depreciate GPUs over four to six years based on actual longevity. Older A100s from 2020 were used as an example, as these GPUs are still running at high utilization and are in demand.

As for the "circular financing" claims, Nvidia said that its investments constituted a small fraction of revenue. This is a reasonable defense since AI startups do get most of their funding from external investors. However, there are still AI companies that derive a significant portion of their revenue from these "circular" investments.

Is the AI Bubble Risk Real for Nvidia?

Burry is likely right, considering the extreme amount of spending is not sustainable. For instance, Meta Platforms now has more debt than cash and can go deeper in the red if it continues.

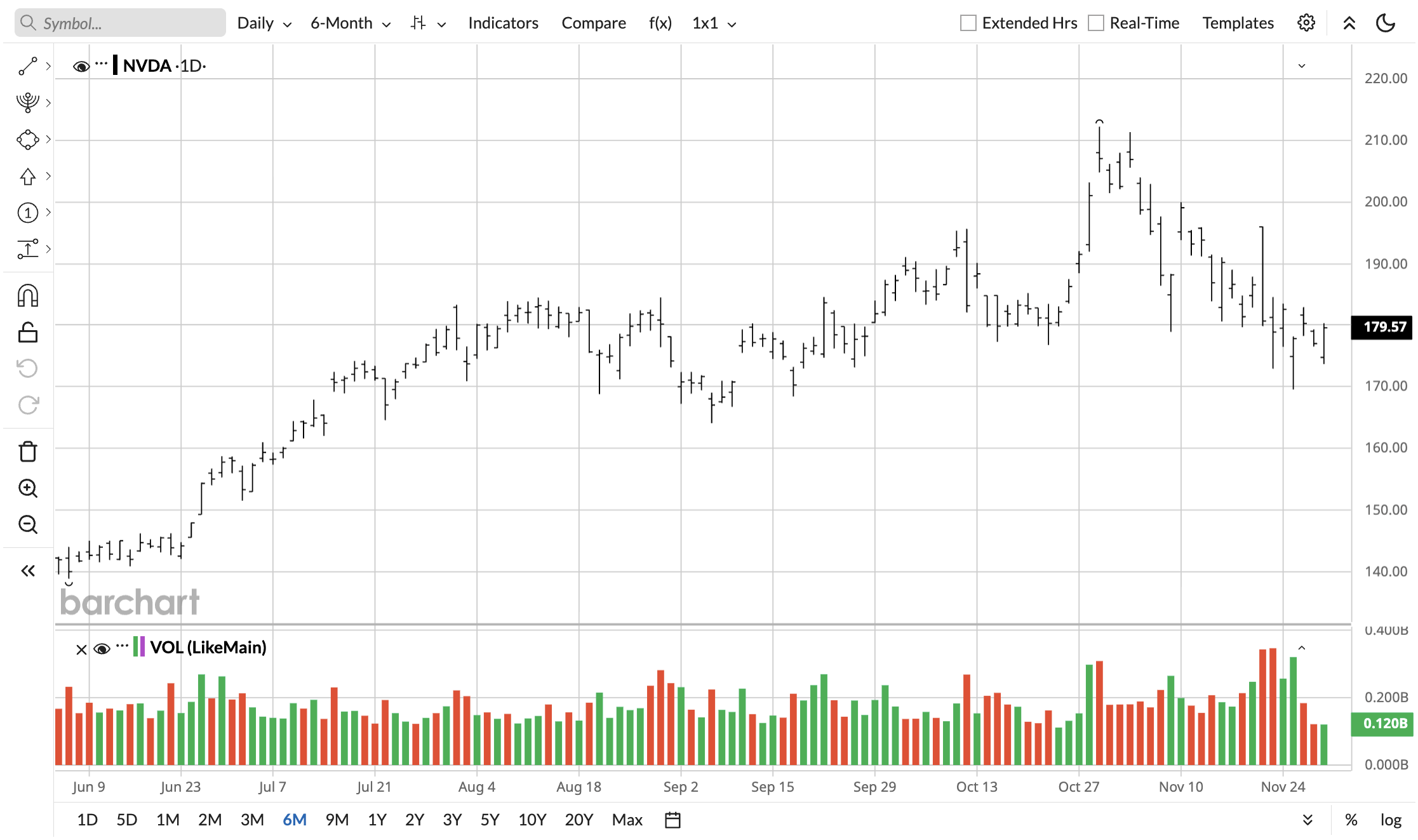

Hence, once these hyperscalers eventually start cutting back on the AI buildout, NVDA investors could be in for a reality check.

At the same time, no one knows exactly when that may happen. The current decline could be a head fake, with Burry being short too early once again. Only time will tell, but the AI bubble risk is certainly real.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart