NXP Semiconductors N.V. (NXPI), headquartered in Eindhoven, the Netherlands, designs, manufactures, and supplies high-performance mixed-signal and standard product solutions. Valued at $49.1 billion by market cap, the company's innovative products and solutions are used in a wide range of applications, including automotive, industrial, IoT, mobile, and communication infrastructure.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and NXPI perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the semiconductors industry. NXPI is a key player in the automotive market, leveraging its portfolio of microcontrollers and analog chips for clusters, powertrains, infotainment, and radars. With substantial R&D investments, the company drives innovation, positioning itself for growth in electrification and autonomous driving trends.

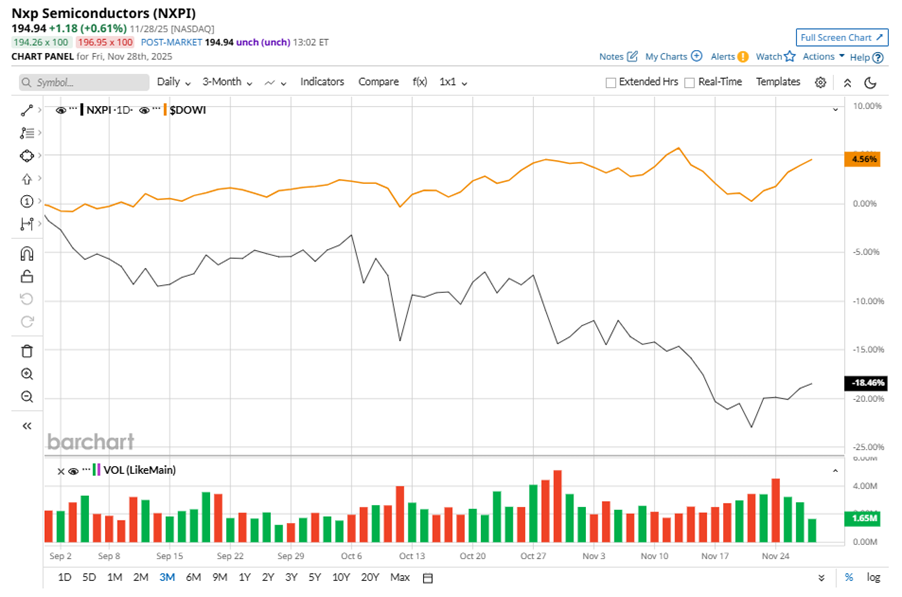

Despite its notable strength, NXPI slipped 23.7% from its 52-week high of $255.45, achieved on Feb. 20. Over the past three months, NXPI stock declined 18.5%, underperforming the Dow Jones Industrials Average’s ($DOWI) 4.6% gains during the same time frame.

In the longer term, shares of NXPI fell 6.2% on a YTD basis and dipped 14% over the past 52 weeks, underperforming DOWI’s YTD gains of 12.2% and 6.7% returns over the last year.

To confirm the bearish trend, NXPI has been trading below its 200-day moving average since late October. The stock has been trading below its 50-day moving average since early October.

On Oct. 27, NXPI shares closed up more than 1% after reporting its Q3 results. Its adjusted EPS of $3.11 met Wall Street expectations. The company’s revenue was $3.17 billion, beating Wall Street forecasts of $3.15 billion. For Q4, NXPI expects its adjusted EPS to be between $3.07 and $3.49.

In the competitive arena of semiconductors, Monolithic Power Systems, Inc. (MPWR) has taken the lead over the stock, showing resilience with a 56.9% gain on a YTD basis and a 65.7% uptick over the past 52 weeks.

Wall Street analysts are bullish on NXPI’s prospects. The stock has a consensus “Strong Buy” rating from the 30 analysts covering it, and the mean price target of $257.51 suggests a notable potential upside of 32.1% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart