IonQ (IONQ) was back in the limelight this week, having announced the formation of a strategic alliance with Heven Aerotech, a defense-oriented company that develops autonomous aerial systems. The deal would help Heven integrate IonQ's solutions in the areas of quantum networking, security, and sensing into its latest autonomous drones. The development caused the stock to rise over the course of last week's trading.

The announcement came at the right time when the momentum in the field of quantum computing continues to build. IonQ has secured four government contracts totaling about $100 million each from the U.S. Air Force Research Lab between 2022 and 2025. Besides the acquisitions and developments in the field, these contracts may help the company, particularly in the defense and related segments, when the industry is still in the development stage.

About IonQ Stock

IonQ is a prominent player in the field of quantum computing and has its headquarters in College Park, Maryland. The company deals in the development of trapped-ion quantum hardware, quantum networking, and the development of the entire technology stack on the quantum platform. The company has a market capitalization of approximately $16.35 billion.

In the last 52 weeks, the stock has touched a lower and higher price of $17.88 and $84.64, respectively, showcasing high volatility since the field of quantum computing has always dealt with long-duration and high-growth trends. The stock currently stands at $48, much lower than the annual high value, yet far better than the lowest points, when the S&P 500 ($SPX) was underperforming.

IonQ has a high price/sales ratio, exceeding 377, due in large part to their start-up revenues and the willingness of the markets to assign high multiples. The company has negative earnings, and therefore ratios such as the forward price/earnings multiple or the price/cash flow multiple are not appropriate.

Comparatively speaking, IonQ’s high valuation does reflect the company’s status and role in the advanced computing space, albeit one that has yet to achieve profitable returns.

IonQ Beats on Earnings

IonQ reported better-than-expected results in their Q3 2025 earnings, beating guidance by 37%, settling at $39.9 million, with a 222% increase on a YoY basis. The company also increased its yearly guidance range, setting the high end at $110 million. This, however, was accompanied by an increase in net loss to $1.1 billion, in addition to an adjusted EPS of -$0.17.

The company announced the reaffirmation of management's confidence in the long-range roadmap, recognizing the early achievement in the attainment of the milestone #AQ 64, which has the ability to extend the computational power beyond the leading superconducting systems. The company also achieved the world record in the 99.99% two-qubit gate fidelity.

In terms of other advancements, IonQ has completed the acquisition of firms like Oxford Ionics and Vector Atomic, boosting the company in the field of quantum control and precision sensing. The company closed the quarter with $3.5 billion in cash on a pro forma basis, after the company raised equity in the month of October.

IonQ has not announced the release date of its upcoming quarterly earnings, so there are no further timing announcements available here.

What Do Analysts Expect for IONQ Stock?

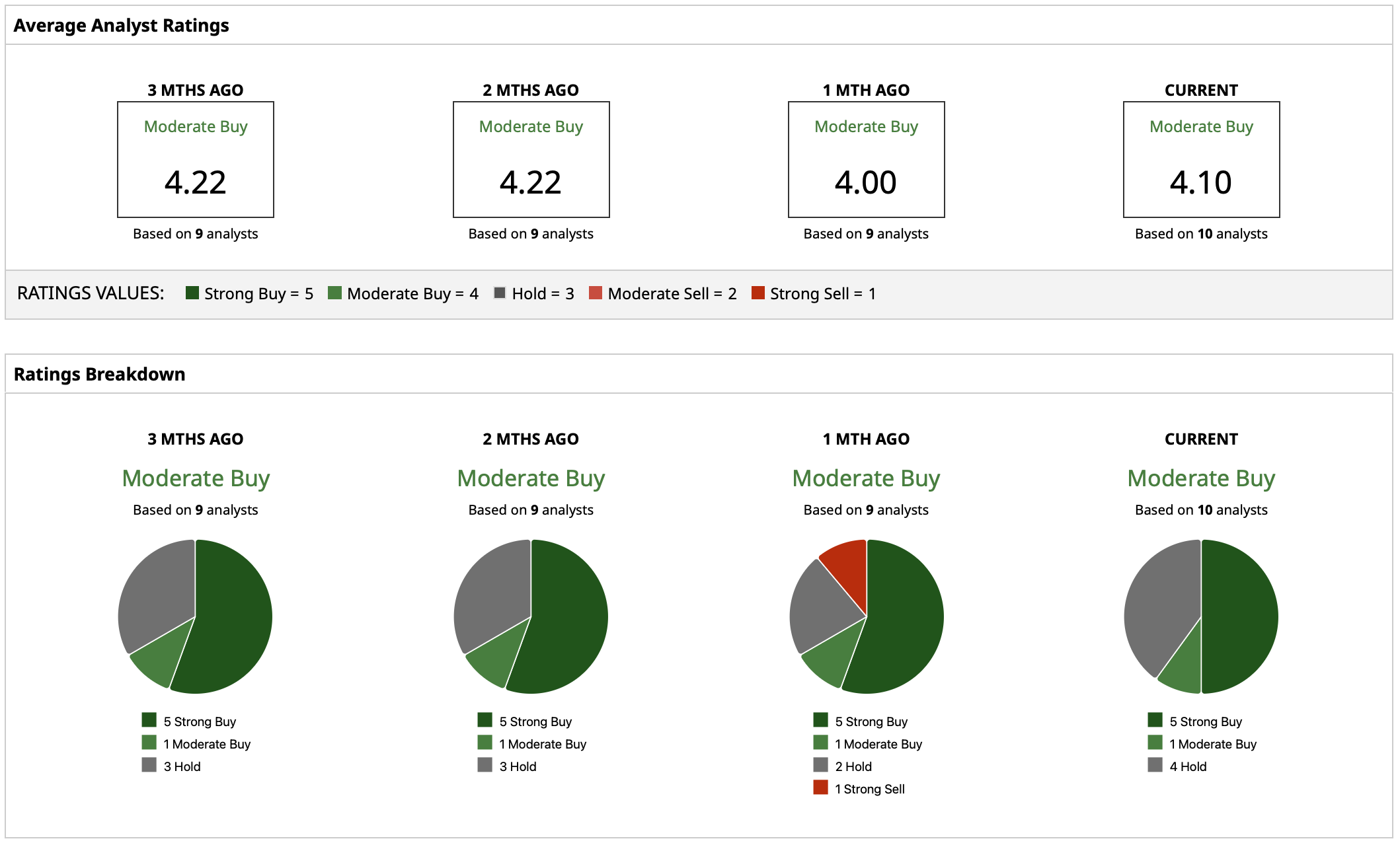

Analysts offer a mixed outlook on IONQ with an overall positive stance with a consensus “Moderate Buy” rating for the stock. The lowest price target ends at $47, and the highest price target touches $100. The average target price stands at $72.89. The average target price shows an upside potential of approximately 52% from the current price near $48.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Analysts Say Even the Bear Case for Oracle Stock Is Bullish. Should You Back Up the Truck on ORCL?

- With Apple Poised to Best Samsung in Smartphone Shipments, Should You Buy, Sell, or Hold AAPL Stock?

- Wedbush Says This 1 Tech Giant Is the Best AI Hyperscaler Stock to Own as 2025 Ends

- IonQ Just Locked In Another Defense Deal. Should You Buy the Quantum Computing Stock Here?