I’m going to be upfront: I’m supposed to be specifically focusing on unusual options activity. As for whether NetApp (NTAP) is on the list or not, I don’t know nor do I care all that much. Generally speaking, options screeners — especially those for the retail market — contain a lot of noise and misdirection. Instead, I found something far more valuable and that’s a structural (informational) arbitrage.

Traditionally, arbitrage means to exploit pricing inefficiencies — usually by buying an asset on one exchange where it’s cheap and simultaneously selling it on another exchange where it’s priced higher, thus locking in a risk-free spread. This category of arbitrage is known as spatial or cross-exchange. However, such opportunities are limited to institutional hedge funds running ultra-low-latency pipelines.

That’s a complicated way of saying “not you.”

In contrast, I’m interested in the arbitrage that I can calculate — the structural variety where we attempt to profit from pricing constraints due to mathematical convergence. Stated differently, we’re looking for misalignment based on probability density.

That’s why I said earlier that I don’t care whether NTAP stock was listed among entities in the unusual options activity list. Such data tells me that a larger order was printed on a single strike on a single expiry. But while scanners show the leg of the derivative transaction, it does not reveal the intent.

You see, we have these heuristics that say that when volume greatly exceeds open interest, that indicates the trader has opened a position. Actually, we don’t know that for sure. Such dynamics could also mean that the trader is exiting the position. Since open interest is only updated overnight and not in real time, there’s a lot of ambiguity.

What’s far less ambiguous is structural arbitrage because this concept is built upon falsifiable mechanics whereas options data — no matter where you look — is opaque, ambiguous and prone to misinterpretation.

I’m not saying that options data is outright useless. It can be instructive when combined with other models and systems. However, we should disabuse ourselves of the idea that derivative market trading alone is predictive.

If it were, everybody would be watching the same indicators and constantly making money.

Using Math to Find the Favorable Mispricing in NTAP Stock

As one of the most complex systems in human history, the equities market is incredibly dynamic: it is stochastic, chaotic, non-linear, heteroskedastic, reflexive and non-ergodic, among many other characteristics. By logical deduction, any attempt to model its behaviors must be adequately complex, a principle known as Ashby's Law of Requisite Variety.

To meet the minimum threshold of Ashby's Law, I am adopting a Kolmogorov-Markov framework layered with kernel density estimations (KM-KDE). As well, we’re going to run a bespoke algorithm through a reified and iterated lens. This mathematical scaffolding enables us to treat probability as a physical object (reification), which has materialized thanks to multiple 10-week trials (iteration).

Fundamentally, the idea is to uncover the probability density or the price point where NTAP stock tends to cluster the most over the next 10 weeks. Then, under the principle of heteroskedasticity, we run trials specifically on the signal that NTAP has currently printed to reveal its conditional probabilistic structure. If a positive variance exists — and spoiler alert, there is — then we may have found a structural arbitrage.

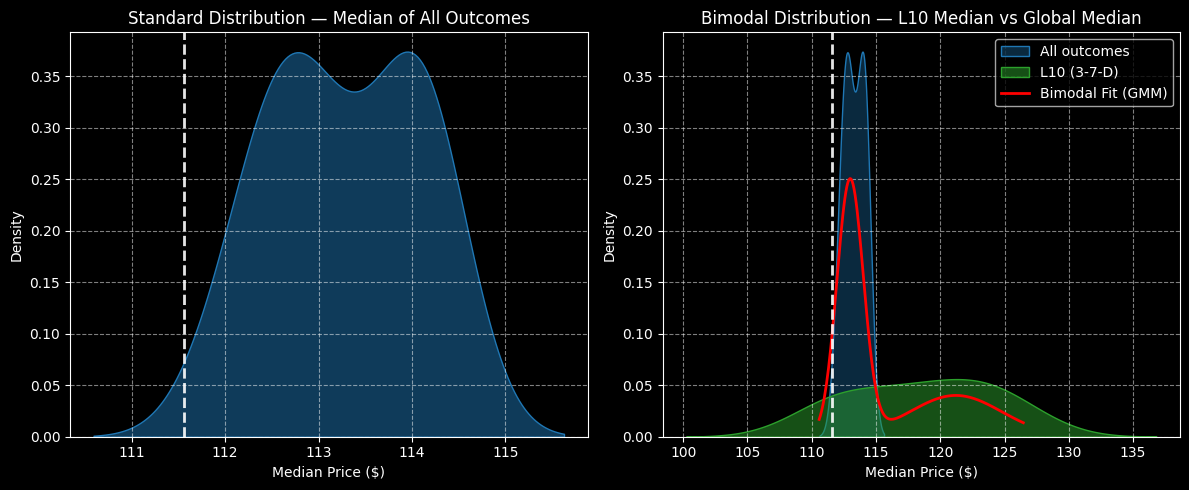

Using the process above, we can arrange the forward 10-week returns of NTAP stock as a distributional curve, with outcomes ranging between $110.50 and $115.80 (assuming an anchor price of $111.56, Friday’s close). Further, price clustering occurs in two spots: $112.75 and $114.

The above assessment aggregates all trials since January 2019. However, we’re interested in a specific signal, which is the 3-7-D sequence; that is, in the past 10 weeks, NTAP stock printed three up weeks and seven down weeks, with an overall downward slope.

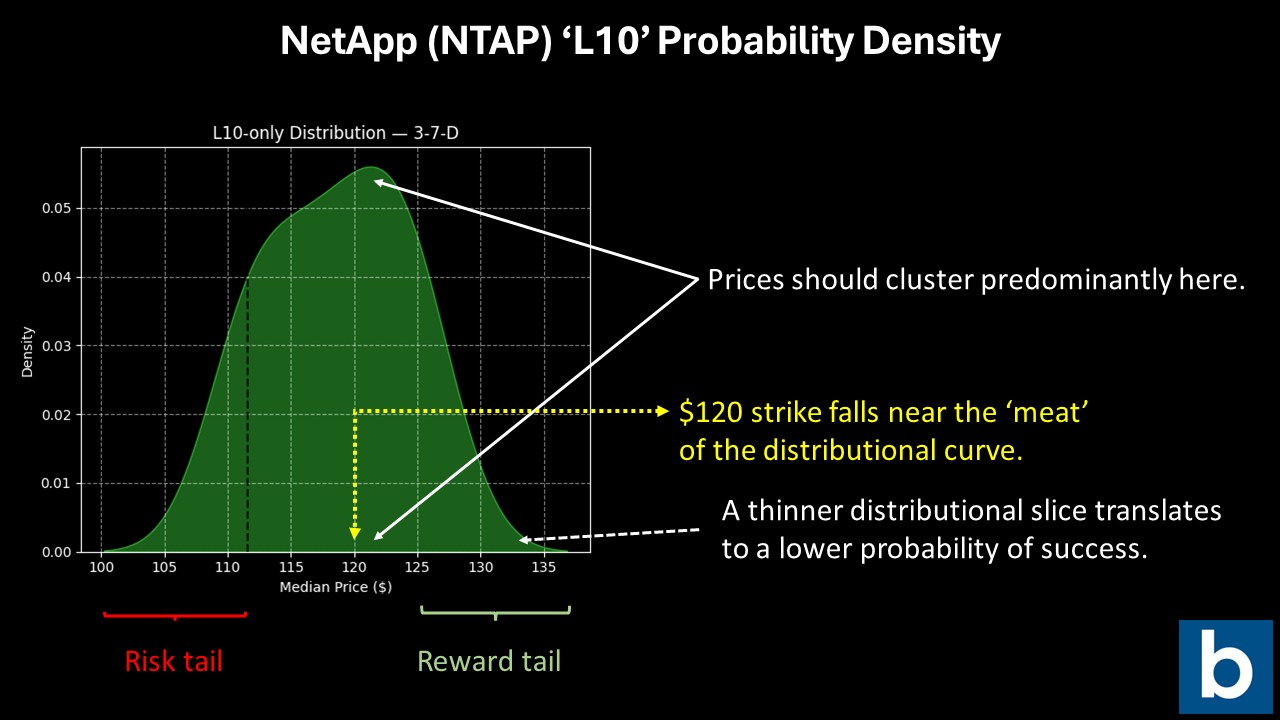

Under this setup, the forward returns of NTAP should mostly range between $100 and $137, with price clustering predominant at around $122. Therefore, a structural arbitrage between 7.02% and 8.2% may exist, which intrepid speculators could potentially exploit.

What makes this such an intriguing idea is that it’s impossible to extract this arbitrage from fundamental or technical analysis. In the former methodology’s case, the complex, multi-dimensional non-linearity of the market is collapsed into a linear, single-dimensional assumption. In the latter case, you would have to assume that merely eyeballing the chart is an equivalent methodology to advanced calculus in measuring probabilistic mass.

Going Where the Data Leads

Perhaps the biggest advantage of using the quantitative approach is trading clarity. If you accept the premise of the underlying logic, then trading becomes a matter of simply following the data. In this case, we know that under 3-7-D conditions, NTAP stock generally tends to cluster around $122 over the next 10 weeks.

Given this intelligence, arguably the most tempting idea is the 115/120 bull call spread expiring Jan. 16. Should NTAP stock rise through the second-leg strike ($120) at expiration, the maximum payout comes out to nearly 144%. Breakeven also sits at $117.05, which is a realistic proposition if we assume that the forward implications of the 3-7-D sequence hold true.

Those who really want to be gutsy may consider the 120/125 bull spread, also expiring Jan. 16. What entices speculators about this trade is the shape of the 3-7-D sequence’s probabilistic mass. Essentially, the probabilistic distribution is “heavier” on the right side as opposed to the left, which means that the bulls are more justified in taking upside risks.

You’re not getting that kind of insight when you’re using middle-school math (fundamental analysis) or no math at all (technical analysis). However, this collective obliviousness is also what breathes life into the concept of structural arbitrage.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Did Wall Street Accidentally Hide This Arbitrage Trade for NetApp (NTAP) Stock?

- Apple Stock Looks Cheap Here Based on Strong FCF - Shorting OTM Put Options Has Worked

- Copper Bull Case 2026: Fundamentals, Trend, Correlation, and a Proven Nov-Feb Seasonal Play

- Bitcoin Slump Hits Strategy Hard, But This MSTR Options Play Pays You