It doesn’t look like it at first glance but coffee chain Dutch Bros (BROS) hides an informational arbitrage opportunity. By that, I’m referring to the mathematical divergence between expected outcomes for BROS stock and what is realistically likely to happen. However, it’s not a pure arbitrage but rather a difference in philosophy between American/western math (i.e. Black-Scholes-Merton or BSM) versus Russian axiomatic frameworks (i.e. Kolmogorov, Markov).

From a technical standpoint, BROS stock represents an intriguing source for speculation. Despite topping both sales and earnings estimates for the third quarter, the market’s response to the security has been relatively muted. While BROS did pop more than 2% in the after-hours session following Wednesday's close, it eventually ended negotiations with a modest lift.

If this circumstance continues to hold true for the remainder of this week, we might have a very compelling opportunity on our hands.

I’ll be straight up: my bullishness has nothing to do with the earnings results, as great as they were. Once the headline print has been revealed, the forward expectations have been priced into the security with the new information. It would be irrational to believe that some rando on the internet saw an insight in the financials that everyone else — including artificial-intelligence-powered chatbots — failed to see.

In addition, I’m finding analyst assessments to largely be a waste of time. Yes, we in the financial publication industry always mention these targets but that’s because it’s a simple way to beef up the word count. In reality, when you consider the high-low-price-target spread for BROS stock — which stands at over 46% — the wide discrepancy clues you in on an uncomfortable reality: what is considered fair value is contingent on the person making the claim.

We need to find a better way to make rational, epistemologically sound decisions — and that’s where the Russian axioms come into play.

Shining the Light on the BROS Stock Arbitrage Trade

One of the first tools that options traders often reach for is the expected move calculator. Pretty much every finance platform that specializes in options coverage features this calculator, which is based on the BSM model. Essentially, it’s a prescriptive model that incorporates the latest implied volatility readings for the stock at hand and spits out a stochastic high-low range for various options chains (expiration dates).

For example, the BSM model calculates that for the options chain expiring Dec. 19, BROS stock could reach a price between $46.12 and $65. That sounds insightful until you realize that’s a flippin’ 41% gap between the two outcomes. Moreover, because you don’t know the density of outcomes, you can’t tell on which side of the profit/loss table BROS is likely to fall on by expiration.

Many Americans attempt to solve this problem by recommending that you read more articles about BROS stock, a process known as fundamental analysis. Other Americans recommend that you stare at the chart until you start seeing some patterns, a process known as technical analysis. As great as these methodologies are, they don't answer the question.

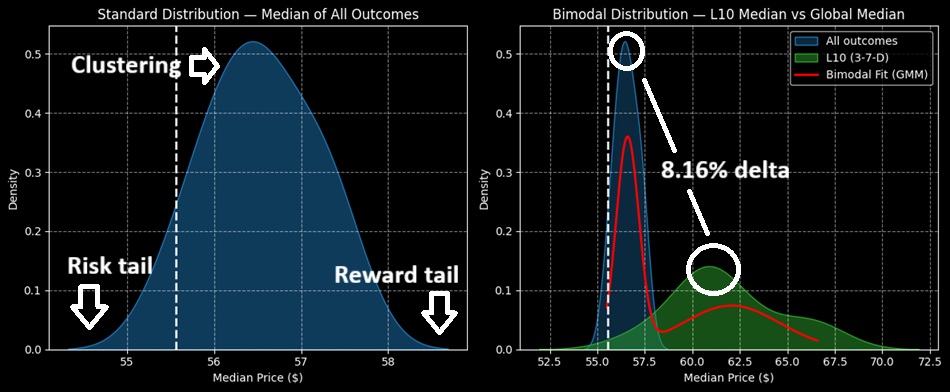

The Russian approach is categorically different. Rather than view price as a temporal narrative, we can use axioms to characterize price as a distribution of outcomes. For example, over the forward 10 weeks, BROS’ median nominal returns would be expected to land between $54.20 and $58.80 (assuming an anchor of $55.56, Wednesday’s close). Further, price clustering would likely be most prominent at $56.40.

With the axiomatic approach, we don’t have to clutter our analysis with indicators like RSI, MACD, Bollinger bands and Aroon oscillators. Personally, I find them useless and distracting. What you need to know is the likely distribution of prices between the baseline condition and the signal you are analyzing.

My argument for BROS stock is that the security is not in a homeostatic state. Rather, it’s in a heavily distributive state, with the equity poised to print a 3-7-D sequence: three up weeks, seven down weeks, with an overall downward slope. Under this condition, the forward 10-week distributional curve’s risk tail would fall to $52.50. However, the reward tail would rise to nearly $72.50.

Most significantly, price clustering would be expected to be predominant at around $61. That’s an 8.16% positive delta in density dynamics, which is a hidden informational arbitrage that no one is talking about.

Converting Arbitrage into Profit

So, with all things considered, arguably the most ideal trade is the 57.50/65.00 bull call spread expiring Dec. 19. This transaction will require BROS stock to rise through the second-leg strike ($65) at expiration to trigger the maximum payout, which stands at 150%. Granted, $65 is a stretch under normal circumstances. However, under 3-7-D conditions, it’s within the realm of previously observed outcomes.

What’s more, the breakeven price for the above spread is $60.50. That’s very much within reach based on price density dynamics. Also, what’s fascinating is that, per the BSM model, the probability of profit of reaching breakeven is listed at only 37%. But based on the Russian axioms above, this figure is in dispute.

It’s difficult to peg a hard probability on a specific price at a specific point in time, given the many exogenous factors that influence the equities market. That said, I would estimate the terminal median price at the Dec. 19 options chain to be around $62. As such, the odds of breakeven could possibly land between 48% to 53%.

Finally, it’s worth pointing out that we’ve seen this exact setup materialize before in late September — and the price more or less responded as expected. If you believe lightning can strike twice, BROS stock deserves to be on your radar.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart