Nvidia (NVDA) posted another stellar quarterly report, boosting the bull case for scores of other names that stand to benefit from increasing data center spending. The chipmaker’s data center revenue went up 66% year over year, prompting investors to flock to server OEMs, including Dell (DELL) and HP (HP).

Nvidia’s earnings call attempted to put AI bubble fears to rest as CEO Jensen Huang explained the company’s increasing role in AI data center infrastructure. The chipmaker is helping OpenAI set up at least 10 gigawatts of data centers, while a recent announcement with Anthropic signaled further bullish sentiment. For the first time, Anthropic will use Nvidia for its infrastructure. Nvidia continues to invest in companies like OpenAI, Mistral, and Anthropic to help spur their growth.

These developments only point to one thing: AI is still not in bubble territory, and there is still a lot of infrastructure to be set up, not just for existing companies that are switching to AI, but also for companies that have sprung up due to AI itself. For data center stocks like Dell and Hewlett-Packard, there is significant growth to come.

About HPE Stock

Hewlett-Packard delivers enterprise-class IT infrastructure, server solutions, cloud solutions, and offerings in associated domains like networking, switches, Wi-Fi, etc. The company is based in Spring, Texas.

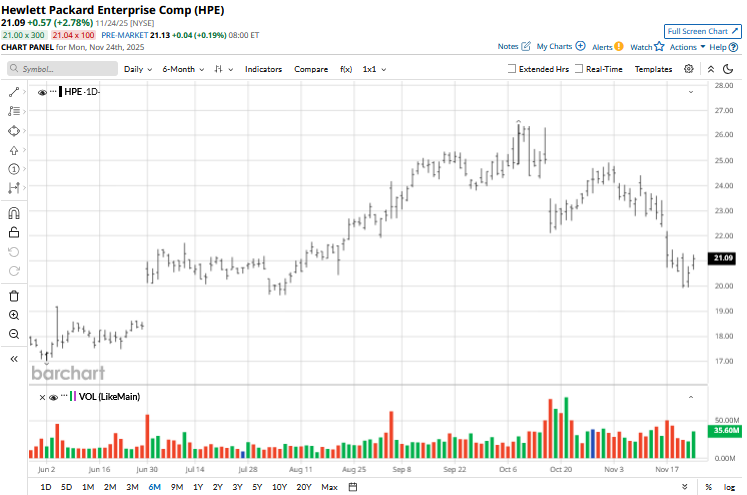

HPE stock is up nearly 80% from its tariff-induced April lows. However, over the last year, it has had a rather disappointing performance of -4%. Well below the S&P 500 Index’s ($SPX) 12% returns. DELL, on the other hand, has given an even worse performance of -12.7% in the last 12 months.

Looking at various valuation metrics, HPE comes out as a clear winner. The company’s FY26 PE of 11.11x beats DELL’s 13.33x. For FY27 and FY28, the story isn’t much different. HPE only slightly manages to beat DELL on price per cash flow and price per sales. Its forward EV/EBITDA of 8.41x also looks slightly more attractive than DELL’s 8.94x.

HPE’s forward revenue growth of 11.84% beats DELL’s 10.33%. Even though HPE’s 29.88% gross margins look better than DELL’s 21.26%, it loses out on net margins. At the end of the day, investors need to decide whether they want to pay the premium for DELL. However, based on valuation metrics, HPE is clearly the cheaper stock. Its dividend yield of 2.43% also helps soothe investors' nerves with talk of an AI bubble. DELL’s yield is significantly lower at 1.67%. HPE is scheduled to announce its Q4 2025 earnings on Dec. 4.

HPE Stock Misses EPS Estimates

HPE reported its Q3 2025 earnings on Sept. 3, bringing in $9.1 billion in sales during the quarter. This was 18% YoY growth. The company’s annualized recurring revenue run rate has now reached $3.1 billion. During the quarter, HPE also finalized its Juniper Networks acquisition. The networking revenue stood at $1.7 billion for the quarter, up 54% YoY. The EPS of $0.35 fell short of the expectations of $0.36.

On the earnings call, the management raised FY25 non-GAAP EPS estimates to $1.90 at the midpoint, while the GAAP EPS estimate was revised to $0.44 at the midpoint. Since Q4 will be the first full quarter since the Juniper acquisition, the networking revenue is likely to go up by 60% QoQ. Going forward, the company is likely to face short-term obstacles in the form of tariffs and increased integration costs due to its Juniper acquisition. This could also explain its lower valuation compared to DELL. However, management is keeping a close eye on cash flow generation and debt reduction, targeting a net leverage ratio of 3x by FY27.

What Are Analysts Saying About HPE Stock?

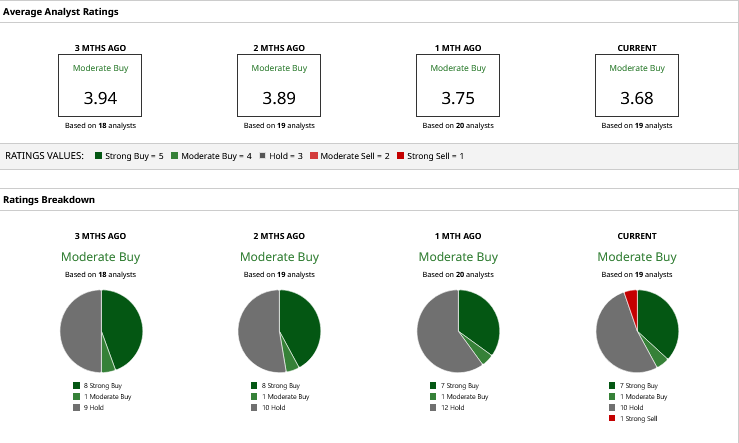

19 analysts cover HPE stock on Wall Street, and 10 of them have a “Hold” rating on the stock, with 7 “Strong Buy” ratings. In the last month, one “Strong Sell” rating has emerged, which is consistent with a -9.4% performance in that period.

The mean target price of $26.44 offers 24% upside from current levels, while the higher price target of $31 would see the stock go up nearly 50% from here.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Argus Just Slashed Its Earnings Estimates for Coinbase. Should You Dump COIN Stock Here?

- Big Money is Betting on Natural Gas Prices to Break Out. Here’s the Setup.

- Is This Under-the-Radar High-Yield AI Stock a Buy Now?

- Wall Street Likes Server Stocks After Nvidia’s Q3. Is DELL or HPE Stock a Better Buy Here?