I asked if U.S. government long bond futures can rally in a September 11, 2025, Barchart article, when I concluded with the following:

Any unforeseen events that cause a flight to quality could lift bond prices and lower long-term yields if history repeats. The U.S. bond market and currency remain the most stable for global reserves, which favors the upside in turbulent times.

Join 200K+ Subscribers: Find out why the midday Barchart Brief newsletter is a must-read for thousands daily.

With long bonds and TLT below the midpoint of their trading range over the past two years, the odds favor a recovery if the technical support levels at 110 and 107-04 holds. U.S. bonds can rally, and risk-reward at the current support and resistance levels favors the upside, even if the range remains intact over the coming months and into 2026.

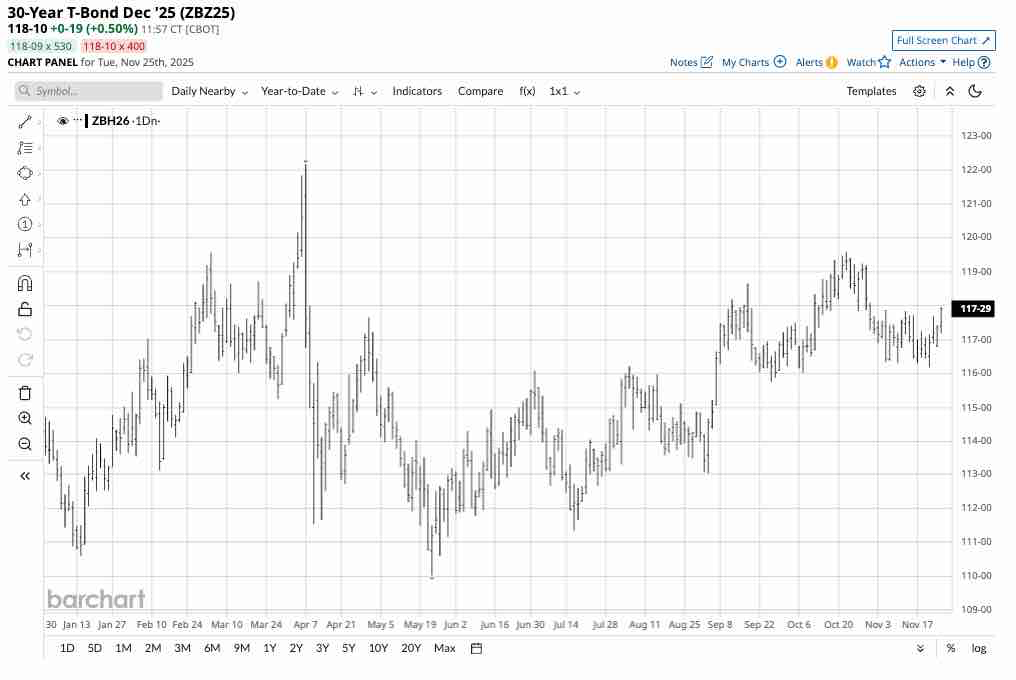

The long bond futures were at 117-10 on September 10, while the TLT ETF was at $89.40 per share. In late November, the bonds and TLT were marginally higher and still stuck within their trading ranges as the debt market prepares to move into 2026.

Bonds go nowhere fast

The bear market in the 30-Year U.S. Government Treasury Bond futures that began at the March 2020 high of 191-22 reached a low of 107-04 in October 2023. Since then, the long bond futures have traded in a sideways range closer to the 2023 low than to the 2020 high.

The monthly chart highlights the decline. However, since 2024, the bonds have traded in a narrow range of 110-01 to 127-22. Interest rates have remained elevated over the past two years, even though the Fed has reduced the short-term Fed Funds Rate to a midpoint of 3.875%. The Fed cut rates by 1% in 2024 and by 50 basis points so far in 2025. The bottom line is that while the Fed Funds Rate is trending lower, longer-term interest rates remain in a narrow sideways trend, going nowhere fast.

TLT is stuck in a range

The iShares 20+ Year Treasury Bond ETF (TLT) moves higher and lower with the long-term U.S. government bond futures.

As the monthly chart highlights, after falling over 54% from the 2020 high of $179.70 to the October 2023 low of $82.42, the highly liquid TLT ETF has traded in a $83.30 to $101.64 per share range in 2024 and 2025. At the $90.52 level in late November, TLT is just below the range’s midpoint as long-term U.S. interest rates remain elevated.

The bullish case for bonds in 2026

The bullish case for bonds and the TLT ETF in 2026 includes:

- The Trump administration favors lower interest rates. New appointments to the Fed and a new Chairman in 2026 will likely lower the short-term Fed Funds rate.

- While the long bond futures and TLT ETF remain near their lows, they have not challenged the October 2023 low, which is the critical technical support level.

- Recent volatility in the U.S. stock market or unforeseen events that heighten economic fears could trigger a wave of U.S. government bond buying, as the U.S. remains the leading economic power. The 2020 highs occurred as market participants reacted to the global pandemic.

- The daily long bond futures and TLT charts display a bullish trend of higher lows and higher highs since late May 2025.

The year-to-date chart of the continuous U.S. long bond futures market displays a bullish trend.

The year-to-date chart of the TLT ETF displays the same bullish trend.

The bearish case for bonds next year

- Inflation remains above the Fed’s 2% target, which increases downside pressure on long-term U.S. interest rates.

- Fed Funds Rate reductions do not guarantee lower long-term rates, as the Fed’s monetary policy tool only involves the yield curve’s short end, while market sentiment determines long-term rates and bond prices.

- U.S. debt, at over $38 trillion and rising, is bearish for bonds, as it lowers the United States’ credit rating and the demand for its sovereign debt.

- Moody’s, a leading credit agency, lowered its rating on U.S. debt in 2025.

- The long-term trend since the 2020 high remains bearish, despite the sideways trading action in 2024 and 2025. Technical resistance for the long bond and TLT is at the September 2024 highs of 127-22 and $101.64 per share, respectively. A move above those levels is necessary to negate the bearish trends since the 2020 highs.

Bullish and bearish factors are pulling long-term U.S. interest rates in opposite directions in late November 2025.

The longer the range remains intact, the greater the potential move

Markets can remain in sideways trends for long periods. However, long static trends tend to lead to significant eventual price moves when a market moves above technical resistance or below support levels. Consider the bond market a rubber band being pulled in opposite directions. When it reaches the snapping point, it can hurt! Therefore, a break below the October 2023 low or the September 2024 high could trigger a herd of selling or buying, causing substantial price volatility.

Time will tell if U.S. long-term interest rates are heading higher or lower in 2026, or if the sideways trading range will continue for a third year. One factor that could determine 2026 price action is the upcoming U.S. mid-term elections, which will determine majorities in the U.S. House and Senate, and will either aid or prevent the Trump administration’s initiatives for the final two years of the President’s second, nonconsecutive, term. The administration will do everything in its power to lower interest rates, but the path of least resistance will likely come from an exogenous event or events.

I favor lower interest rates in 2026, but in late 2025, the path of least resistance remains a coin flip that could land on its side, suggesting another year of sideways trading.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Where are U.S. Government Bonds Heading in 2026?

- Stock Index Futures Gain on Fed Rate-Cut Optimism, U.S. Economic Data on Tap

- Corporate Insiders Have Sold $25 Billion in Stock in Just 60 Days. Before You Panic and Sell Your Shares, Read This.

- Warren Buffett Warns to Stop Worrying About Market Volatility, ‘Short-Term Market Forecasts Are Poison’