Happy Thanksgiving to all of my American readers. I hope you and your families have a wonderful holiday. Enjoy the conversation, football watching, and the opportunity to give thanks for all the blessings in your lives. There are many.

In my commentary on unusual options activity today, I thought I would discuss an options strategy that is an offshoot of the Covered Strangle, which I’ve covered a lot in recent weeks.

It’s called the “Wheel” strategy. It involves selling Cash-Secured Puts and covered calls to generate income. Although it involves income generation, it is also suitable for accumulating shares of the stocks you want to own over the long haul.

In this strategy, you first sell an OTM (out-of-the-money) cash-secured put to generate premium income. You continue this process over and over until you acquire shares of the desired stock at a better entry point. At that point, you do a Covered Call to generate premium income, then repeat the process until your shares are called away. You then return to selling cash-secured puts and start the cycle anew.

The strategy is ideal for patient investors seeking steady income and ownership of high-quality companies.

It differs from the Covered Strangle in two ways: First, you don’t own the stock when starting the strategy, and second, while you do combine two options strategies (cash-secured puts and covered calls), unlike the covered strangle, you don’t combine them at the same time.

If this were an English class, you might say it’s a semantics issue, because in the end, you’re trying to accomplish the same two things: generate income and take ownership of quality stocks.

The wheel strategy works best with expirations between 28 and 60 days. I’ve found three stocks to buy whose unusual put options activity from yesterday sets up nicely for their implementation.

Have an excellent holiday weekend!

Workday (WDAY)

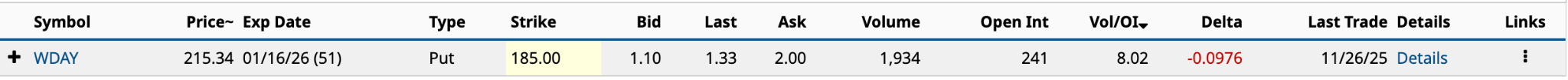

Workday (WDAY) had eight unusually active put options yesterday, with four expiring between 28 and 60 days. Three of the four were ITM (in the money), so I’ll go with the Jan. 16/2026 $185 put.

First, you’re not going to get rich on the income generated from selling the $185 put. On an annualized basis, your return would be 4.3% [$1.10 bid price / $185 strike price - $1.10 bid price * 365 / 51]. That’s about what a 30-year Treasury bill pays right now.

First, you’re not going to get rich on the income generated from selling the $185 put. On an annualized basis, your return would be 4.3% [$1.10 bid price / $185 strike price - $1.10 bid price * 365 / 51]. That’s about what a 30-year Treasury bill pays right now.

OTM by 14.1%, that’s a decent downside. The stock hasn’t traded around $185 since May 2023.

On the surface, Workday stock seems expensive. Its enterprise value of $54.45 billion is 38.9 times EBITDA (earnings before interest, taxes, depreciation and amortization), according to S&P Global Market Intelligence. Nvidia’s (NVDA) is about the same.

However, its free cash flow for the trailing 12 months ended Oct. 31 was $2.59 billion. That’s a free cash flow yield of 4.7%. Anything between 4% and 8% is considered fair value.

Analysts generally like it. Of the 39 that rate it, 28 give it a Buy (4.36 out of 5), with a target price of $282.18, well above its current share price.

Robinhood Markets (HOOD)

Robinhood Markets (HOOD) sees a ton of volume, both in shares and in options. Yesterday, it had an options volume of 581,878, about 1.6 times its 30-day average. That lends itself to significant unusual options activity. It had five calls and four puts with Vol/OI (volume-to-open-interest) ratios over 10.

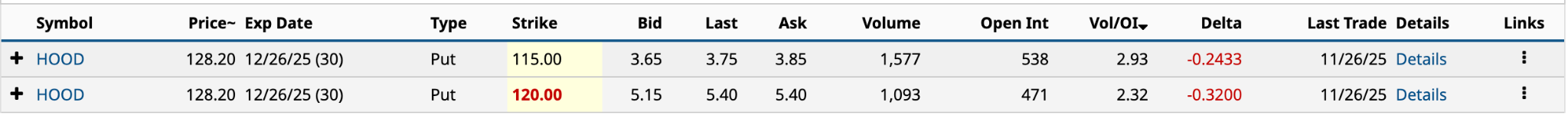

None of the four puts had DTEs between 28 and 60 days. However, two were expiring on Dec. 26 that fit the bill.

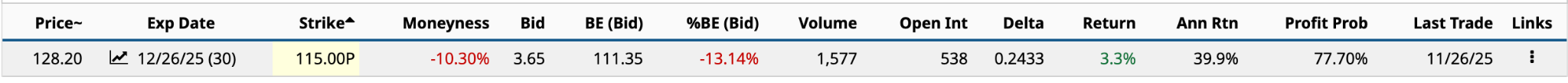

Of the two, the $115 strike would be my preference. Worst-case scenario, you’re buying shares at a net cost of $111.35, should you be asked to do so. That’s 13,1% OTM. The expected move, up or down, is 12.07%.

It has not had a good November, falling from a high of $150.47 on Halloween to a low of $102.10 on Nov. 21. It’s recovered some of those losses this week but is still trading well below its October 52-week high of $153.86.

Selling the $115 put would generate $365 in premium income. The annualized return would be 39.9%. With a 77.7% chance that the share price will be above $111.35 at expiration on Boxing Day (remember, I’m Canadian), I see this as an excellent risk/reward opportunity.

Honestly, I don’t spend much time thinking about Robinhood. However, many people do. There’s no question it’s a popular stock to own.

Over the next two years, its revenues are expected to grow by 33%, from $4.51 billion in 2025 to $6.02 billion in 2027. At the same time, EBITDA should increase by 48%, from $2.50 billion in 2025 to $3.69 billion in 2027. That’s an EBITDA margin of 61.2% in 2027 if it hits the analyst estimates.

Interestingly, analysts are only lukewarm about HOOD stock. Of the 22 that rate it, only 14 give it a Buy (4.09 out of 5), with a target price of $155.05, 21% above its current share price.

SoFi Technologies (SOFI)

SoFi Technologies' (SOFI) stock is on a tear in 2025, up 85% year to date. I’m not surprised its shares are trading higher. In July, as it hit a new 52-week high just shy of $20, I contemplated whether SOFI was a $20, $40 or $10 stock.

I concluded that, although fairly valued, I thought it would be a $40 stock in the long run. Fast forward four months, and it’s moved up another 43% to $28.49. The Barchart Technical Opinion is Strong Buy in the near term.

I continue to like what CEO Anthony Neto is doing with the business. Analysts aren’t so sure. Of the 24 analysts with a rating, only seven give it a Buy (3.17 out of 5), with a $27 target price, below its current share price.

Between 2026 and 2030, SoFi is expected to grow its earnings per share from an estimated $0.58 to $1.26. As I said in July, it traded at 155 times its normalized earnings per share for the next 12 months. According to S&P Global Market Intelligence, it now trades at 49.1 times its 2026 EPS and 22.6 times its 2030 EPS.

I expect that the multiple will continue to fall as it delivers better-than-expected earnings over the next 2-3 years. It appears the question now is whether it’s a $30, $60 or $15 stock.

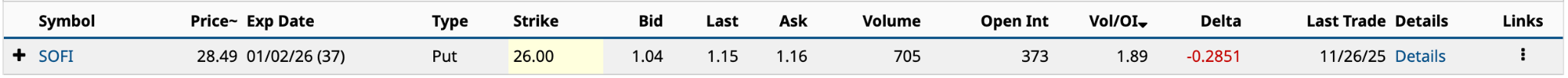

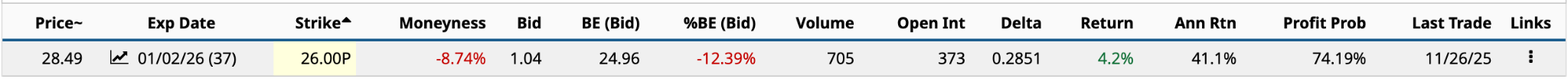

In yesterday’s unusual options activity, SOFI had four puts with Vol/OI ratios of 1.24 or higher. However, only the Jan. 2/2026 $26 put had a DTE of between 28 and 60 days.

This one is a little tight. It’s only 8.7% OTM. It might be better to go with a slightly lower strike price if you’re not risk-tolerant.

This one is a little tight. It’s only 8.7% OTM. It might be better to go with a slightly lower strike price if you’re not risk-tolerant.

Selling the $26 put would generate $104 in premium income. The annualized return would be 41.1%, with a 74.2% chance that the share price will be above $24.96 at expiration. The expected move is 13.2% in either direction. That’s $24.73, 23 cents below the breakeven.

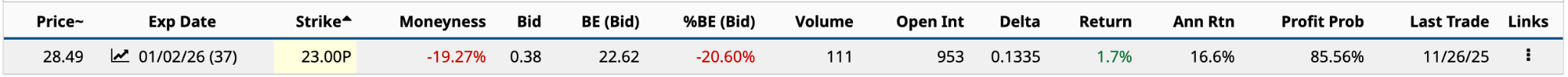

If you want to own SOFI for the long haul while implementing a wheel strategy, I see the $26 put as a reasonable bet. However, as I said, if you’re somewhat risk-intolerant, you might consider the $23 put. It has a 16.6% annualized return with an 85.56% chance of being above the $22.62 breakeven in early January.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Have You Heard of the ‘Wheel’ Strategy? These 3 Unusually Active Stocks to Buy Can Get You Started

- Using Probability Density to Extract a Huge Payout from Microchip’s Potential Breakout

- Eli Lilly’s Stock Price Has Fattened Up Like a Thanksgiving Turkey. Time to (Options) Collar That Green!

- Unusual Activity in Oracle Corp Put Options Highlights ORCL Stock's Value